Chicago Illinois Comprehensive Equipment Lease with Provision Regarding Investment Tax is a legal document that outlines the terms and conditions surrounding the rental of equipment in Chicago, Illinois. This lease agreement is specifically designed to include a provision regarding the investment tax related to the leased equipment. It establishes a comprehensive framework for both parties, ensuring clear communication and legal protection throughout the leasing process. Keyword: Chicago Illinois Comprehensive Equipment Lease In Chicago, Illinois, a comprehensive equipment lease is an essential agreement for businesses and individuals looking to rent equipment for various purposes, such as construction, manufacturing, or transportation. This lease provides the lessee with the right to use specified equipment owned by the lessor in exchange for periodic payments. Keyword: Provision Regarding Investment Tax The provision regarding investment tax in the Chicago Illinois Comprehensive Equipment Lease covers the tax implications and responsibilities associated with the leased equipment. It defines the rights and obligations of both parties regarding investment tax credits, deductions, or incentives related to the leased equipment. Different types of Chicago Illinois Comprehensive Equipment Leases with Provision Regarding Investment Tax may include: 1. Short-term Equipment Lease: This type of lease agreement is generally used for equipment rentals lasting for a shorter duration, typically less than a year. It may be suitable for businesses with temporary or seasonal equipment needs. 2. Long-term Equipment Lease: This lease agreement is suitable for businesses requiring equipment for an extended period, typically over a year. It provides stability and predictability for both parties involved. 3. Operating Lease: In an operating lease, the lessor retains ownership of the equipment, and the lessee uses it for a specific period. This type of lease may be beneficial for businesses that require equipment temporarily without the intention of ownership. 4. Capital Lease: A capital lease is similar to a loan, where the lessee takes ownership of the equipment after the lease term. This lease is suitable for businesses that intend to use the equipment for an extended duration and eventually want to own it. Overall, the Chicago Illinois Comprehensive Equipment Lease with Provision Regarding Investment Tax is a crucial legal agreement that ensures both parties understand their rights and obligations when it comes to leasing equipment while accounting for investment tax implications. The tailored provisions within this agreement help protect the interests of both the lessor and the lessee, fostering a transparent and efficient equipment rental process in the vibrant city of Chicago, Illinois.

Chicago Illinois Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out Chicago Illinois Comprehensive Equipment Lease With Provision Regarding Investment Tax?

How much time does it normally take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Chicago Comprehensive Equipment Lease with Provision Regarding Investment Tax suiting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. Apart from the Chicago Comprehensive Equipment Lease with Provision Regarding Investment Tax, here you can find any specific form to run your business or individual affairs, complying with your regional requirements. Professionals check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can retain the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Chicago Comprehensive Equipment Lease with Provision Regarding Investment Tax:

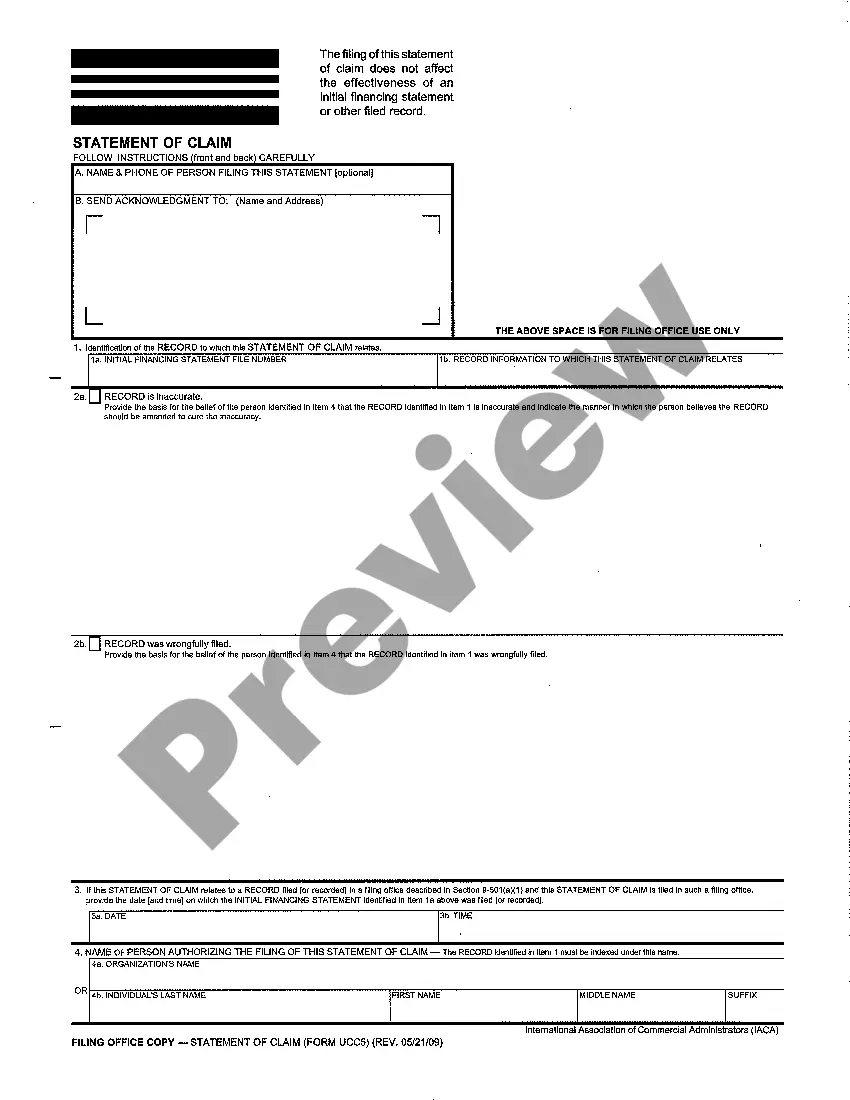

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Chicago Comprehensive Equipment Lease with Provision Regarding Investment Tax.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!