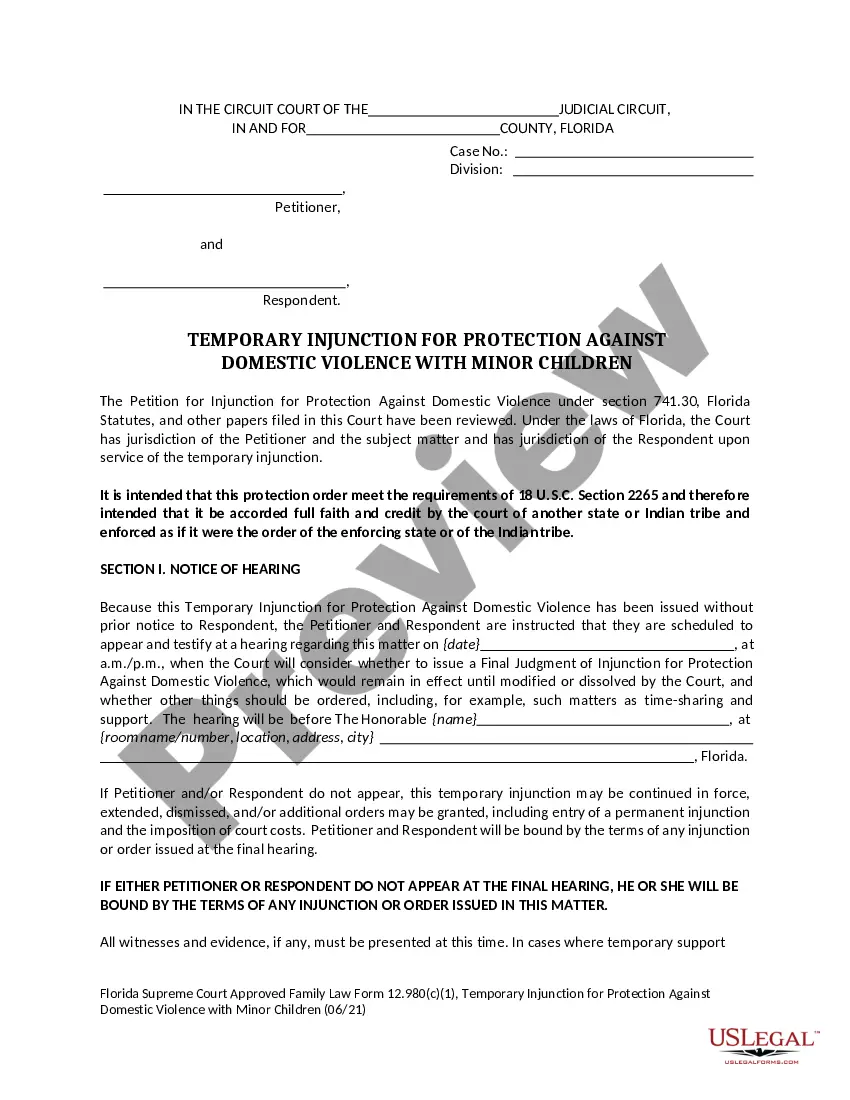

Dallas Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax is a specific type of lease agreement tailored for businesses and organizations in Dallas, Texas. This lease agreement encompasses comprehensive terms and conditions related to the leasing of equipment, while also addressing the specific provisions regarding investment tax. The purpose of a Dallas Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax is to provide a legally binding agreement between the lessor (owner of the equipment) and the lessee (the business or organization renting the equipment) in order to facilitate the temporary use of equipment for the lessee's operational needs while ensuring compliance with investment tax regulations. This lease agreement typically includes key provisions such as lease duration, rental payment terms, maintenance responsibilities, insurance requirements, and indemnification clauses. It also elaborates on the provisions related to investment tax, which may cover areas such as depreciation, tax credits, deductions, and other financial benefits associated with leasing equipment. Different types of Dallas Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax may vary depending on the specific industry or equipment being leased. For instance, there could be different lease agreements for construction equipment, medical equipment, office equipment, or manufacturing machinery. Each agreement will have tailored provisions based on industry-specific requirements and investment tax regulations. When preparing or negotiating a Dallas Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax, it is important for both parties to carefully review and understand all terms and conditions to ensure compliance with local, state, and federal laws, as well as tax regulations. Seeking legal advice is recommended to ensure the lease agreement adequately protects the rights and interests of both the lessor and lessee. Overall, a Dallas Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax serves as a valuable tool for businesses and organizations in Dallas, Texas, allowing them to efficiently lease equipment while considering the financial benefits and obligations associated with investment tax.

Dallas Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out Dallas Texas Comprehensive Equipment Lease With Provision Regarding Investment Tax?

How much time does it normally take you to draft a legal document? Since every state has its laws and regulations for every life scenario, finding a Dallas Comprehensive Equipment Lease with Provision Regarding Investment Tax meeting all local requirements can be tiring, and ordering it from a professional attorney is often costly. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. In addition to the Dallas Comprehensive Equipment Lease with Provision Regarding Investment Tax, here you can find any specific form to run your business or personal deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can retain the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Dallas Comprehensive Equipment Lease with Provision Regarding Investment Tax:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Dallas Comprehensive Equipment Lease with Provision Regarding Investment Tax.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!