Nassau New York Comprehensive Equipment Lease with Provision Regarding Investment Tax The Nassau New York Comprehensive Equipment Lease with Provision Regarding Investment Tax is a legally binding agreement designed to provide businesses in Nassau County, New York with an efficient and cost-effective solution for acquiring essential equipment for their operations while taking advantage of tax benefits. This lease agreement offers businesses the opportunity to lease a wide range of equipment required for various industries, including manufacturing, construction, healthcare, technology, and more. From heavy machinery and vehicles to office equipment and technology devices, this lease allows businesses to access the necessary tools without the burden of purchasing them outright. One of the notable features of this lease is the provision regarding investment tax. This provision ensures that businesses leasing equipment benefit from tax advantages related to their investment. By incorporating tax incentives, businesses in Nassau County can potentially deduct lease payments as operating expenses, reducing their taxable income and ultimately lowering their tax liability. This provision aims to incentivize businesses to invest in equipment leasing, thus supporting economic growth and development within the region. There may be different types or variations of the Nassau New York Comprehensive Equipment Lease with Provision Regarding Investment Tax, tailored to suit specific industries or equipment types. For instance, there could be variations for healthcare equipment leases, construction equipment leases, or technology equipment leases, each with provisions targeted towards the particular needs and tax implications of those industries. Overall, the Nassau New York Comprehensive Equipment Lease with Provision Regarding Investment Tax offers businesses a flexible and advantageous option to obtain necessary equipment while considering tax benefits. By entering into this lease agreement, businesses can streamline their operations, reduce upfront costs, and maximize their tax savings, enabling them to allocate resources more efficiently.

Nassau New York Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out Nassau New York Comprehensive Equipment Lease With Provision Regarding Investment Tax?

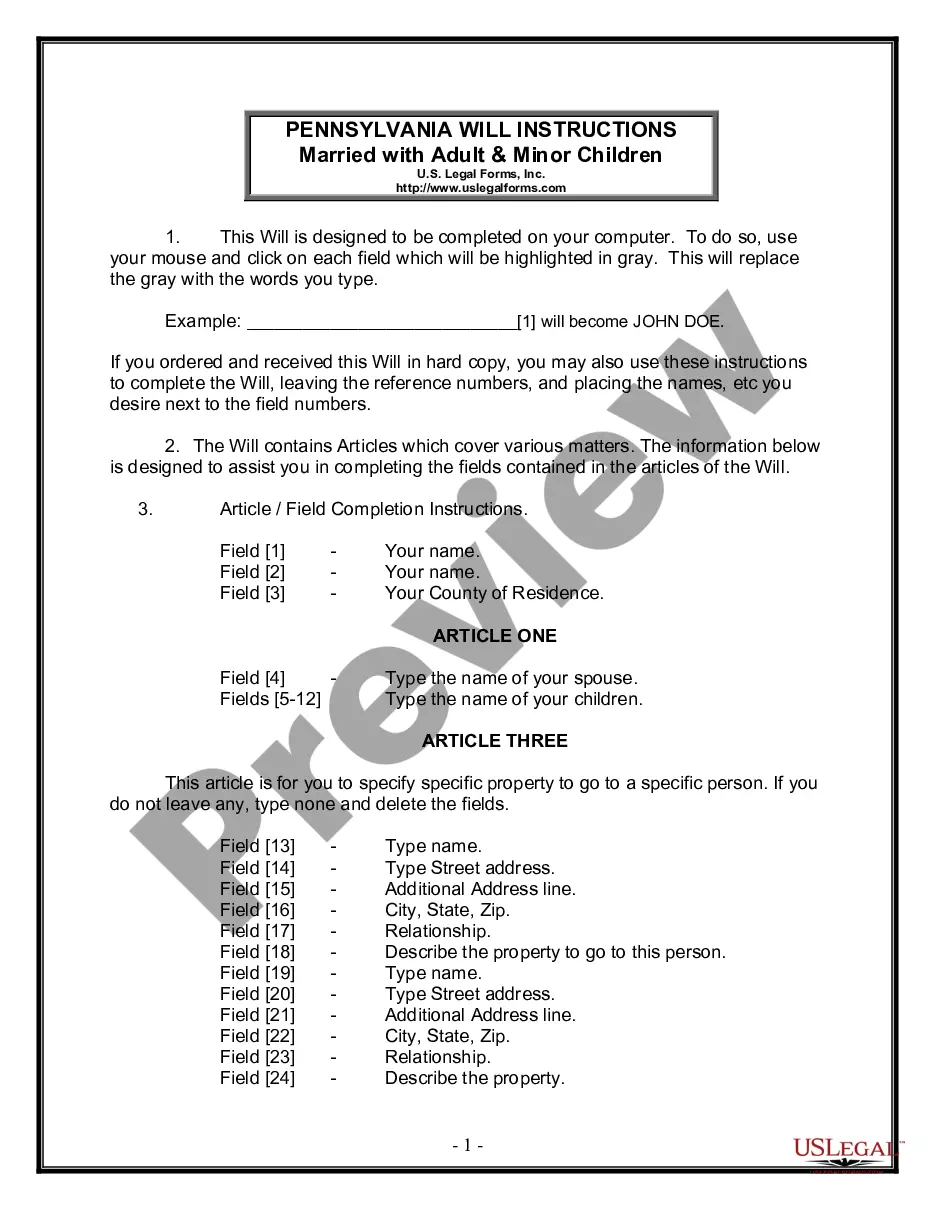

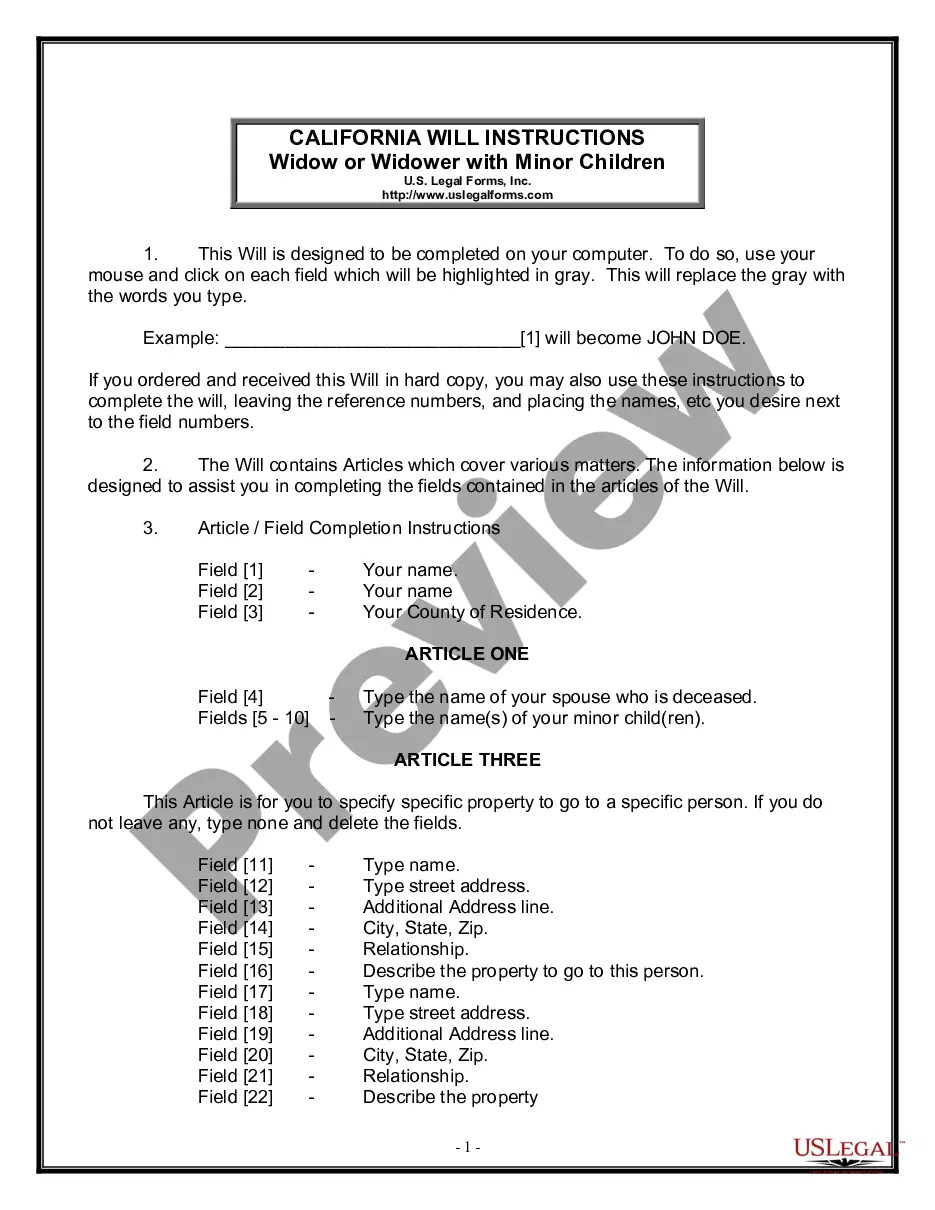

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Nassau Comprehensive Equipment Lease with Provision Regarding Investment Tax, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Nassau Comprehensive Equipment Lease with Provision Regarding Investment Tax from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Nassau Comprehensive Equipment Lease with Provision Regarding Investment Tax:

- Take a look at the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!