Travis Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax: The Travis Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax is a legally binding agreement between a lessee and a lessor for the use of equipment in the state of Texas. This lease is specifically designed to address the tax implications related to the investment into equipment. This comprehensive lease includes various provisions that ensure both parties understand their rights and obligations. The lease agreement outlines details such as the identification of the lessor and lessee, a detailed description of the equipment being leased, the lease term, and the amount of rent or payment to be made. The provision regarding investment tax is a crucial aspect of this lease. It addresses the tax implications associated with the purchase and usage of equipment. Under this provision, the lessor may include investment tax credits or deductions for the lessee, providing financial benefits to offset the costs of the equipment lease. One of the variations of the Travis Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax is the short-term lease. This type of lease is suitable for lessees who only require equipment for a limited period, such as a few weeks or months. It offers flexibility and cost-effectiveness for short-term projects or seasonal needs. Another type of this lease is the long-term lease. This lease is suitable for lessees who require equipment for an extended period, typically several years. It provides stability and predictability for businesses that rely on equipment for their operations. The Travis Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax is designed to protect both parties' interests and ensure compliance with Texas state laws. It is essential for lessees to consult with legal and tax professionals to fully understand the investment tax provisions and their implications. In conclusion, the Travis Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax is a detailed, comprehensive agreement that addresses the tax implications associated with leasing equipment in Texas. It offers flexibility, financial benefits, and compliance with state laws for both lessees and lessors.

Travis Texas Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

How to fill out Travis Texas Comprehensive Equipment Lease With Provision Regarding Investment Tax?

How much time does it typically take you to draw up a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Travis Comprehensive Equipment Lease with Provision Regarding Investment Tax suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often expensive. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. In addition to the Travis Comprehensive Equipment Lease with Provision Regarding Investment Tax, here you can find any specific form to run your business or personal deeds, complying with your regional requirements. Specialists check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Travis Comprehensive Equipment Lease with Provision Regarding Investment Tax:

- Examine the content of the page you’re on.

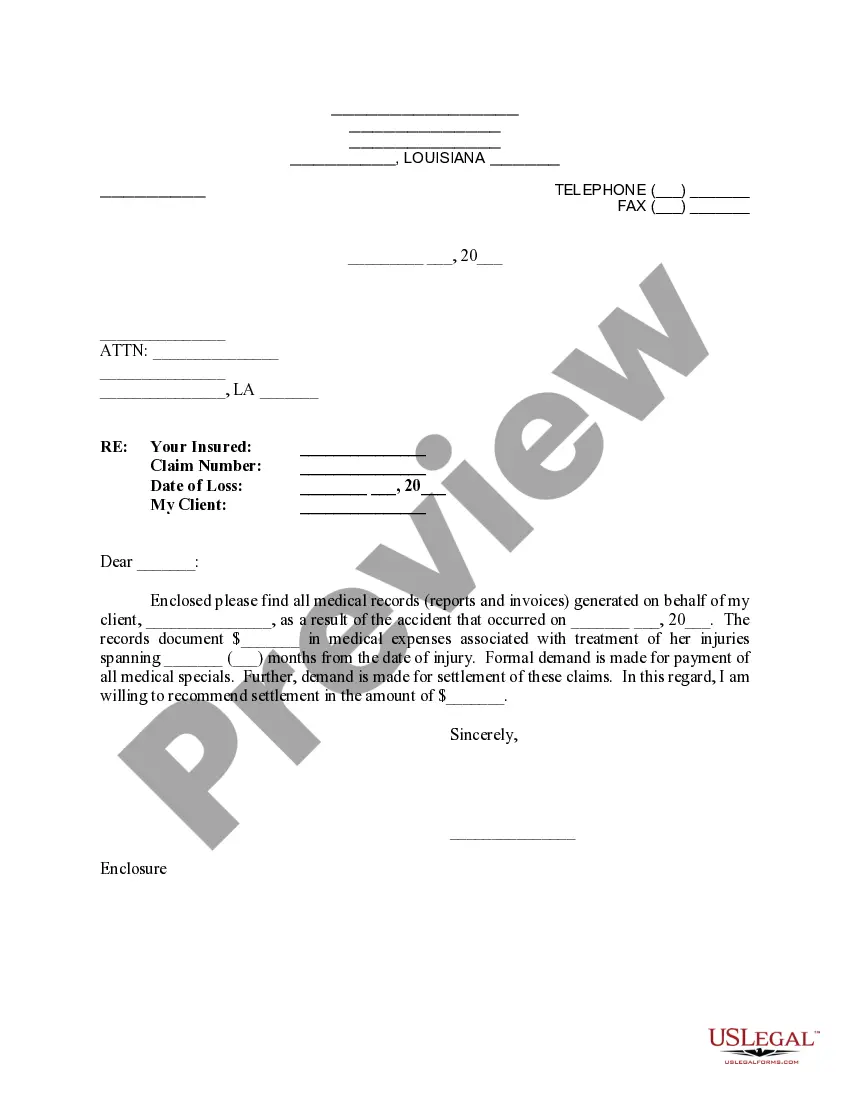

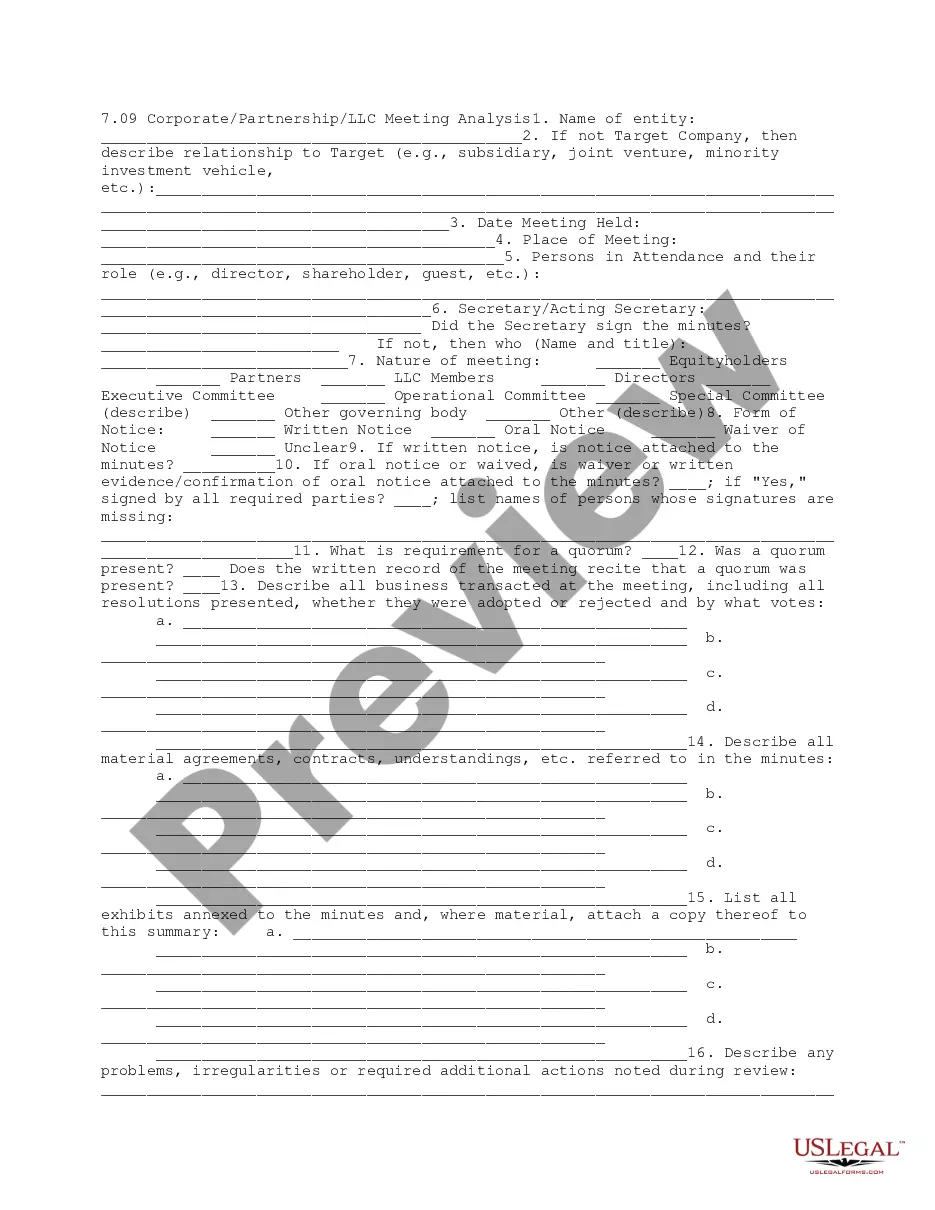

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Travis Comprehensive Equipment Lease with Provision Regarding Investment Tax.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

If you lease equipment for the purpose of renting it someone else, you may need to charge a sales and use tax in Texas. However, if you are renting the equipment to someone, but you will operate the equipment, you do not need to pay sales and use tax on the rental. Only the service is charged tax.

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services.

(1) If a contract for the lease or rental of real property includes the lease or rental of tangible personal property (such as furniture) as part of the agreement, no sales tax is due on the amount charged the tenant for the lease or rental of the tangible personal property.

Sec. 11.11. PUBLIC PROPERTY. (a) Except as provided by Subsections (b) and (c) of this section, property owned by this state or a political subdivision of this state is exempt from taxation if the property is used for public purposes.

(1) Leases subject to sales tax. (A) An operating lease executed while the property is within the state is subject to sales tax. Tax will be due on the total lease amount for the entire term of the lease regardless of where the property is used if the lessee takes delivery in the state.

No tax is due on the lease payments made by the lessee under a lease agreement. Also, no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas.

Texas sales and use tax exempts tangible personal property that becomes an ingredient or component of an item manufactured for sale, as well as taxable services performed on a manufactured product to make it more marketable.

Tax must be collected from the lessee on all charges contained in the lease unless the charge is separately stated and is nontaxable as provided by this section. See subsection (f) of this section for imposition of tax and time for reporting.

Texas generally does charge sales tax on the rental and lease of tangible personal property unless a specific exemption applies.