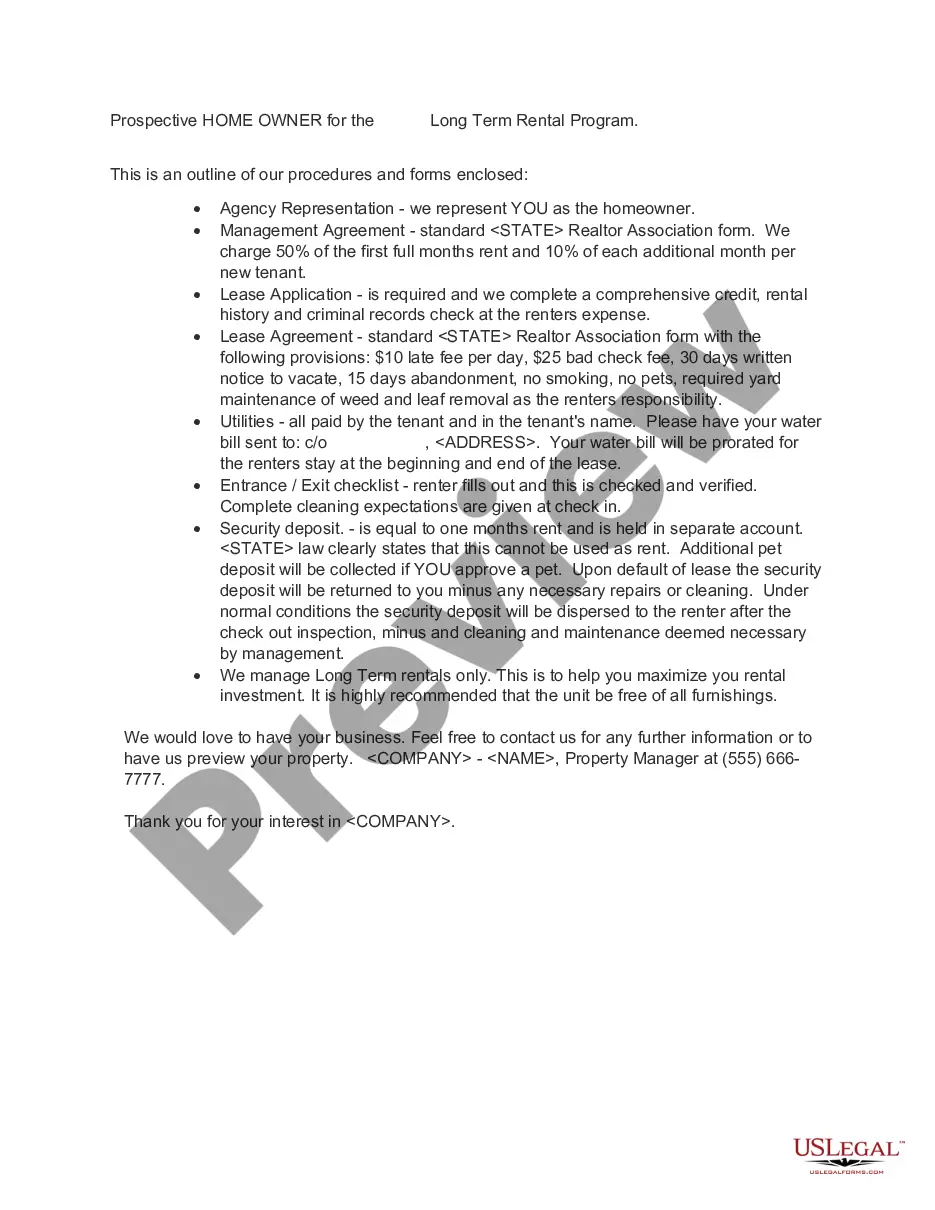

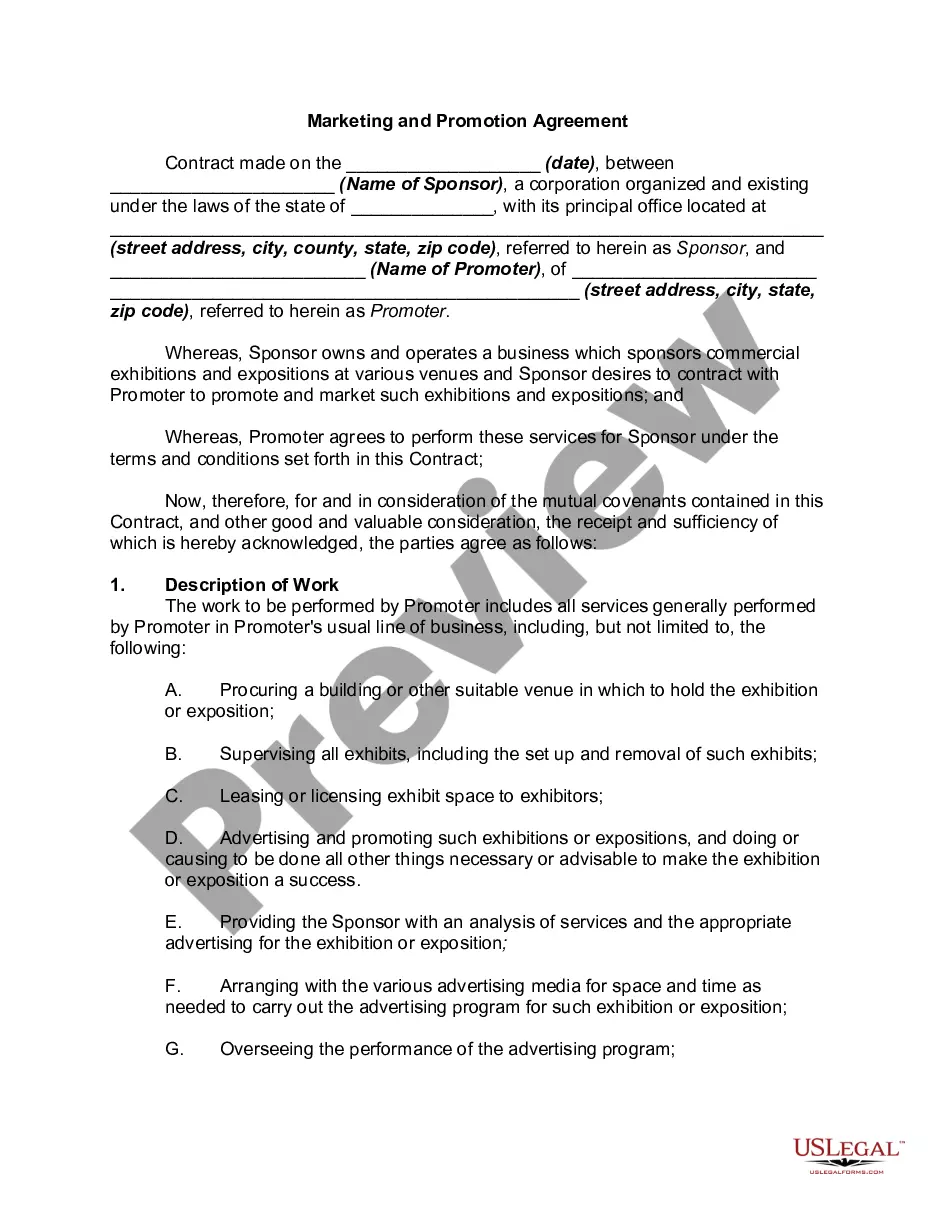

Wayne Michigan Comprehensive Equipment Lease with Provision Regarding Investment Tax is a legal agreement designed to facilitate businesses in Wayne, Michigan, to lease equipment while also taking advantage of investment tax provisions. This comprehensive lease structure ensures that both the lessor and lessee benefit from this financial arrangement. Here is a detailed description of what this lease entails, along with relevant keywords: 1. Wayne Michigan Comprehensive Equipment Lease: This lease encompasses a wide range of equipment leasing arrangements available in Wayne, Michigan. It is a legally binding contract between the lessor (equipment owner) and the lessee (business entity). This lease allows businesses to obtain necessary equipment without the need for upfront capital investment, fostering growth, and operational efficiency. 2. Provision Regarding Investment Tax: The Provision Regarding Investment Tax included in this lease agreement enables lessees in Wayne, Michigan, to take advantage of tax benefits associated with equipment investments. This provision allows businesses to deduct a portion or the full value of lease payments as operating expenses, potentially reducing their taxable income. Benefits of Wayne Michigan Comprehensive Equipment Lease with Provision Regarding Investment Tax: 1. No upfront capital investment: Lessees can acquire essential equipment without tying up significant capital resources. This lease structure allows businesses to redirect funds toward other operational needs or growth initiatives. 2. Flexibility: The lease terms can be tailored to the specific needs of the lessee. This includes choosing the equipment type, lease duration, and payment structure that aligns with the lessee's business objectives. 3. Tax advantages: The provision regarding investment tax offers tax benefits to lessees. By deducting lease payments as operating expenses, businesses may reduce their tax liability, potentially freeing up more funds for growth and investment. 4. Updated equipment: Leasing equipment under this agreement ensures access to the latest technology and machinery, improving operational efficiency and competitiveness. Types of Wayne Michigan Comprehensive Equipment Lease with Provision Regarding Investment Tax: 1. Equipment-specific leases: This type of lease focuses on leasing specific equipment required for a particular industry or business function. Examples include machinery, vehicles, medical equipment, or IT infrastructure. 2. Operating leases: These leases allow lessees to utilize equipment for a specific period without assuming ownership. Under this arrangement, the lessor retains the equipment title, and the lessee returns the equipment at lease end or chooses to purchase it at a predetermined price. 3. Capital leases: Capital leases provide lessees with the option to acquire the equipment's ownership rights at the end of the lease term. This type of lease is suitable when long-term equipment ownership is anticipated. In summary, the Wayne Michigan Comprehensive Equipment Lease with Provision Regarding Investment Tax is a beneficial agreement that allows businesses in Wayne, Michigan, to lease equipment without the need for large upfront investments. By taking advantage of investment tax provisions, lessees can potentially reduce their taxable income. The lease structure offers flexibility, tax advantages, and access to updated equipment. Various types of leases, such as equipment-specific leases, operating leases, and capital leases, cater to different business needs.

Wayne Michigan Comprehensive Equipment Lease with Provision Regarding Investment Tax

Description

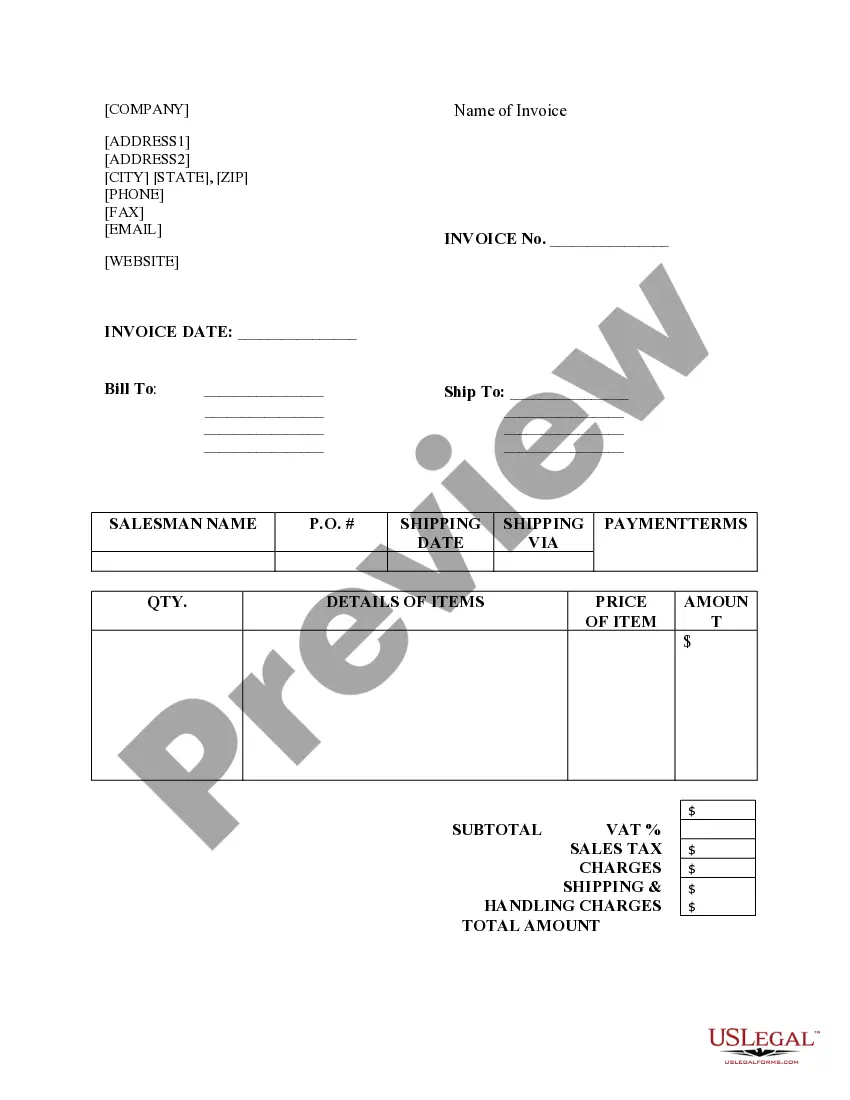

How to fill out Wayne Michigan Comprehensive Equipment Lease With Provision Regarding Investment Tax?

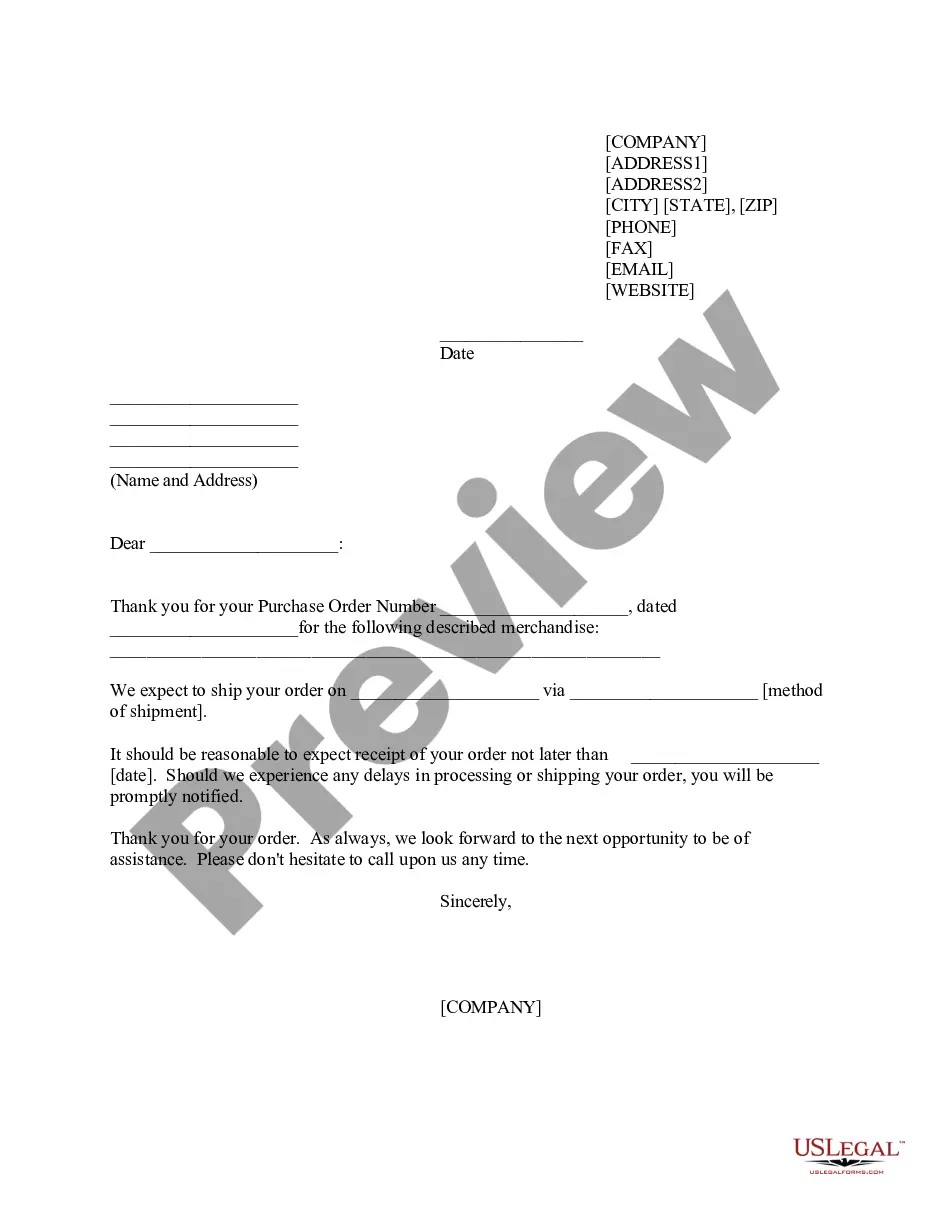

Whether you intend to open your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any personal or business case. All files are grouped by state and area of use, so picking a copy like Wayne Comprehensive Equipment Lease with Provision Regarding Investment Tax is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to get the Wayne Comprehensive Equipment Lease with Provision Regarding Investment Tax. Follow the instructions below:

- Make certain the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Wayne Comprehensive Equipment Lease with Provision Regarding Investment Tax in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!