Maricopa Arizona Credit Card Holder's Inquiry Concerning Billing Error refers to a process through which credit card holders in Maricopa, Arizona can address concerns and dispute unauthorized or incorrect charges on their credit card bills. This inquiry process enables credit card holders to reach out to their credit card companies to rectify any billing errors and ensure accurate and fair transactions. Credit card holders in Maricopa, Arizona who notice discrepancies, unauthorized charges, or mistakes on their monthly credit card statements can initiate a billing error inquiry. By contacting their credit card company's customer service department, either through phone, email, or an online portal, they can express their concerns and provide specific details regarding the billing error experienced. The purpose of the Maricopa Arizona Credit Card Holder's Inquiry Concerning Billing Error is to resolve issues associated with incorrect charges promptly. Credit card companies are legally obligated to investigate reported billing errors within a specified timeframe, typically 30 days, and subsequently take appropriate action to rectify the error. There can be various types of billing errors that Maricopa Arizona credit card holders may encounter, including: 1. Unauthorized Charges: These are charges made without the cardholder's knowledge or consent. It could be a result of stolen card information, online fraud, or identity theft. In such cases, the credit card holder should promptly inform their credit card company to dispute and reverse these unauthorized charges. 2. Incorrect Amount Charged: This type of billing error occurs when the credit card statement reflects an amount that is different from what the cardholder expected or authorized. It could be a result of human error, technical glitches, or miscommunication during transactions. The credit card holder can dispute this error and request a correction. 3. Duplicate Charges: Duplicate charges refer to instances where the same transaction appears multiple times on the credit card statement. This can happen due to technical errors, system malfunctions, or merchant mistakes. The credit card holder should notify their credit card company and provide evidence of the duplicate charges for resolution. 4. Goods or Services Not Received: This type of billing error typically arises when a credit card holder has been charged for goods or services that were never received or rendered. Whether it's a result of non-delivery or poor service quality, the credit card holder can initiate the inquiry process to request a refund or credit for the undelivered items or services. It's important for Maricopa Arizona credit card holders to carefully review their credit card statements each month and report any billing errors promptly. By being vigilant and proactive, credit card holders can protect their financial interests, maintain accurate records, and ensure fair transactions.

Maricopa Arizona Credit Card Holder's Inquiry Concerning Billing Error

Description

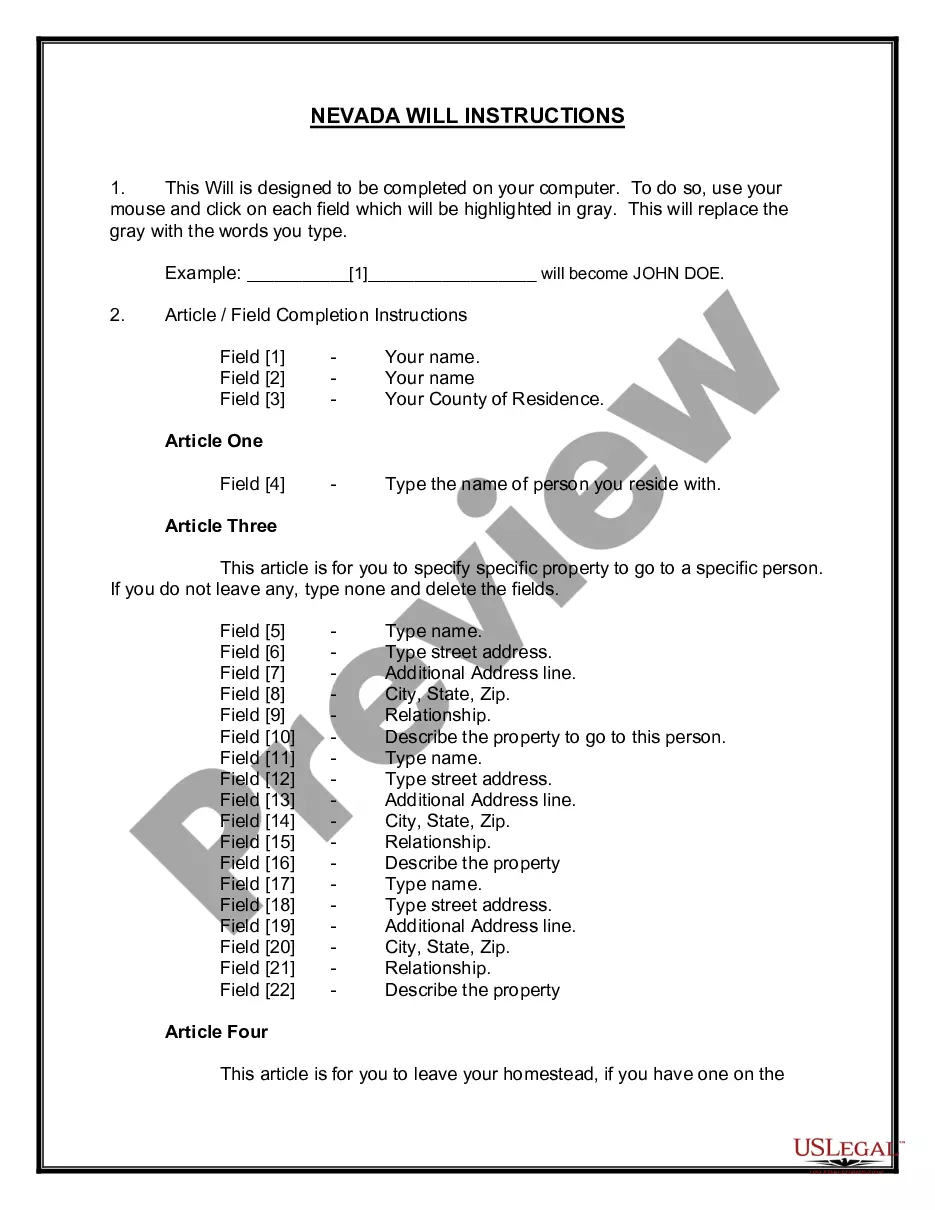

How to fill out Maricopa Arizona Credit Card Holder's Inquiry Concerning Billing Error?

Are you looking to quickly create a legally-binding Maricopa Credit Card Holder's Inquiry Concerning Billing Error or probably any other form to manage your own or business matters? You can go with two options: contact a professional to write a legal paper for you or draft it entirely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you receive neatly written legal papers without paying unreasonable prices for legal services.

US Legal Forms offers a rich collection of over 85,000 state-compliant form templates, including Maricopa Credit Card Holder's Inquiry Concerning Billing Error and form packages. We provide documents for an array of use cases: from divorce papers to real estate documents. We've been on the market for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary document without extra troubles.

- To start with, double-check if the Maricopa Credit Card Holder's Inquiry Concerning Billing Error is tailored to your state's or county's regulations.

- In case the form includes a desciption, make sure to verify what it's intended for.

- Start the search over if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Select the plan that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Maricopa Credit Card Holder's Inquiry Concerning Billing Error template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the documents we offer are reviewed by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!