Subject: Understanding the Insurance Rate Increase in Cuyahoga, Ohio: A Detailed Explanation Dear [Policyholder's Name], We hope this letter finds you in good health. We are writing to provide you with a comprehensive explanation of the recent insurance rate increase affecting your policy in Cuyahoga, Ohio. We understand that any change in your insurance premiums can raise concerns, and we want to ensure your complete understanding of the factors contributing to this adjustment. Cuyahoga, Ohio, nestled in the northeastern part of the state, is known for its diverse communities, rich heritage, and thriving economy. Unfortunately, this area, like many others, has experienced significant changes that have influenced insurance rates across the board. Throughout recent years, we have witnessed various elements that have directly impacted insurance premiums in our region. One of the key factors is the evolving risk landscape. Natural calamities such as severe storms, hailstones, and flooding have become more frequent and intense, leading to higher property damage claims. These incidents have compelled us to reassess our risk exposure and adjust premiums accordingly to maintain financial stability and continue offering quality coverage. Moreover, Cuyahoga, Ohio, has witnessed an increase in instances of auto accidents and theft. These incidents not only result in higher claim payouts but also necessitate enhanced safety measures and investments in security systems and personnel. Consequently, insurance providers are bound to increase premiums to compensate for these financial implications and ensure prompt claim settlements. As a responsible insurer, prioritizing your safety and well-being remains our utmost concern. To ensure our ability to promptly respond to claims and provide exceptional service, we must adapt to these evolving circumstances through the necessary rate adjustments. By implementing these changes, we can continue to protect your assets and fulfill our commitment to offering comprehensive coverage tailored to your specific needs. We understand that insurance costs are an essential part of your financial planning, and we strive to maintain affordability to the greatest extent possible. While it is challenging to avoid rate fluctuations altogether, we continually analyze our pricing policies, explore cost-saving opportunities, and negotiate with our network of providers to minimize the impact on your premiums without compromising on coverage quality. We are striving to provide you access to various resources and tools that can assist you in managing your insurance costs effectively. Our dedicated team of agents remains available to review your policy, identify potential discounts, and explore alternative coverage options that might better suit your requirements. Rest assured that we value your continued trust in us and remain committed to transparent communication. Please do not hesitate to reach out to our customer service department at [phone number] or visit our website for personalized assistance tailored to your circumstances, concerns, and needs. Thank you for your ongoing support and understanding as we work together to navigate the changing dynamics of insurance in Cuyahoga, Ohio. We appreciate your partnership and look forward to serving you for years to come. Wishing you the best of health and safety. Yours sincerely, [Your Name] [Your Title] [Insurance Company Name]

Cuyahoga Ohio Sample Letter for Explanation of Insurance Rate Increase

Description

How to fill out Cuyahoga Ohio Sample Letter For Explanation Of Insurance Rate Increase?

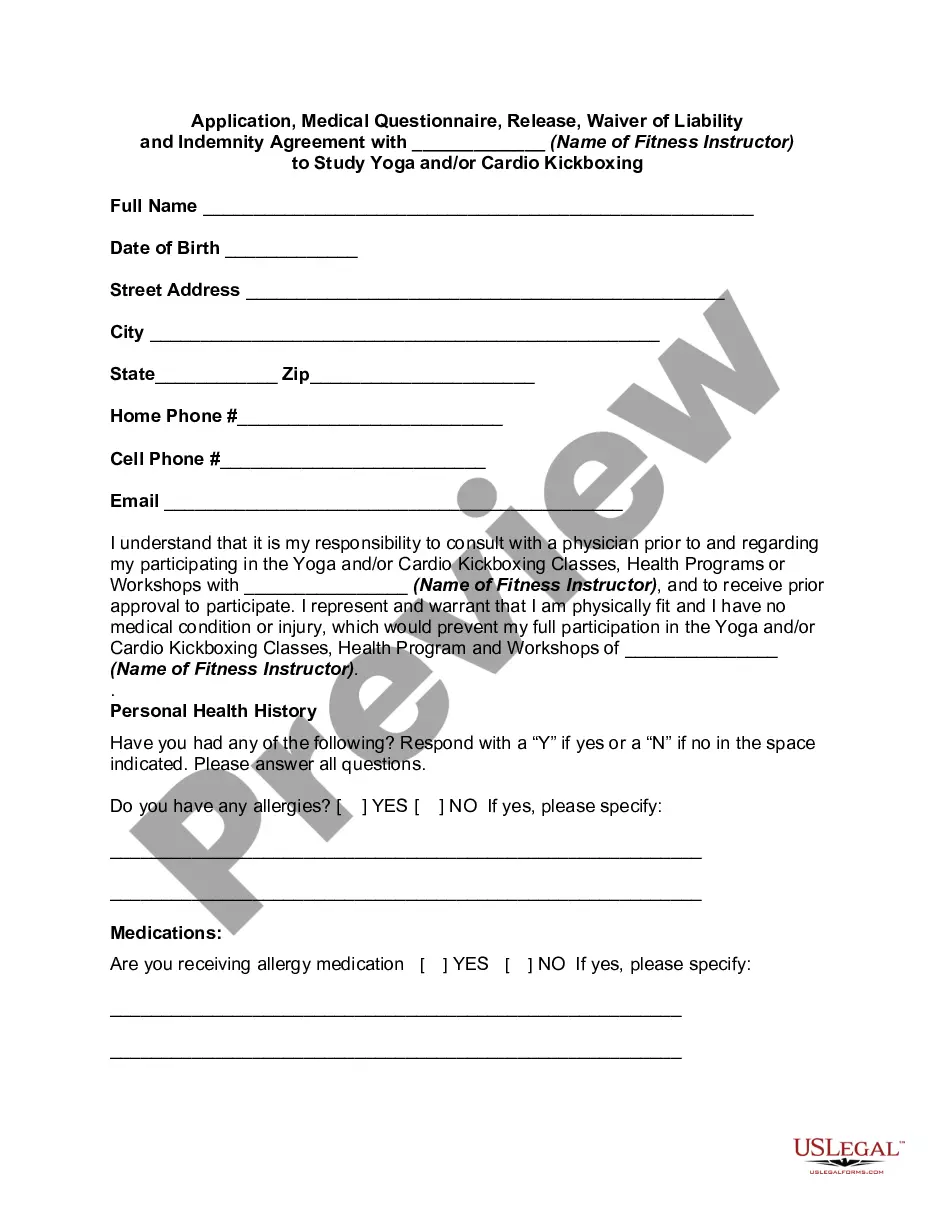

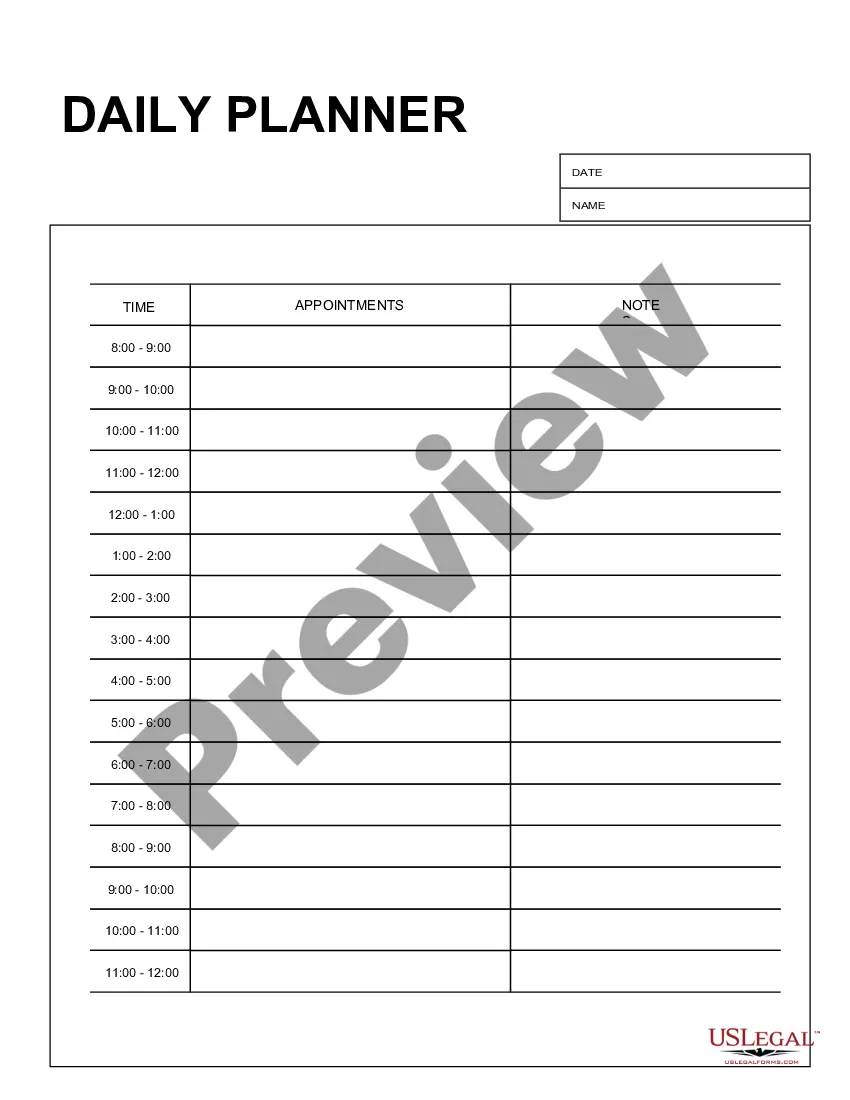

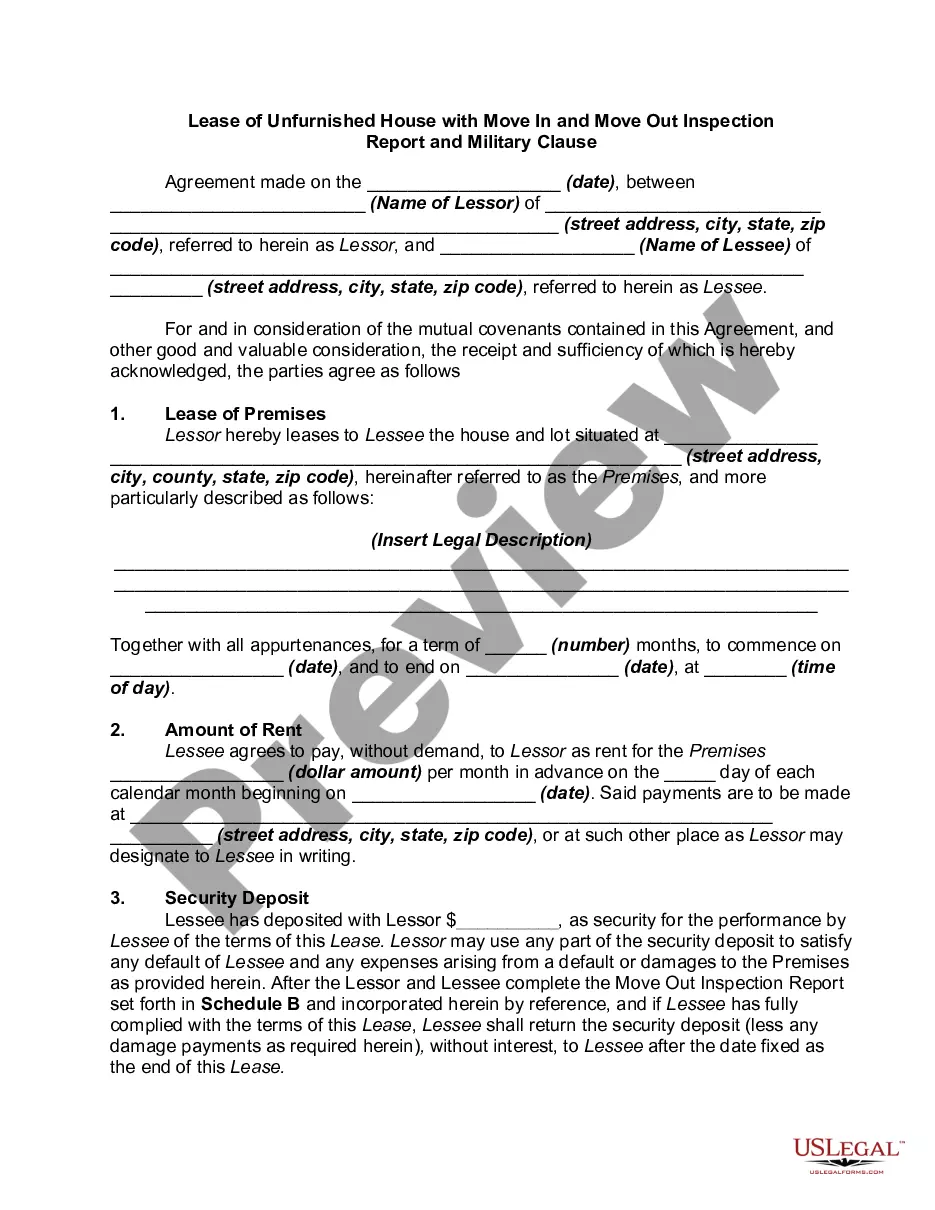

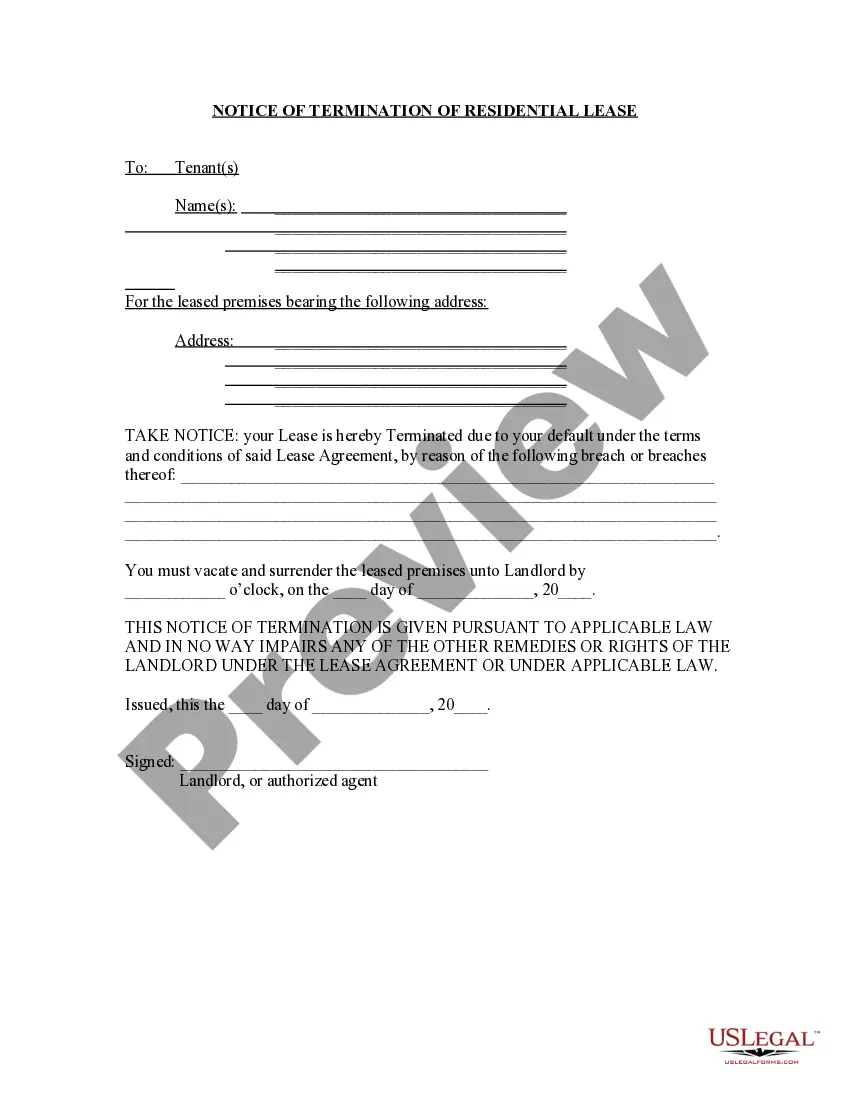

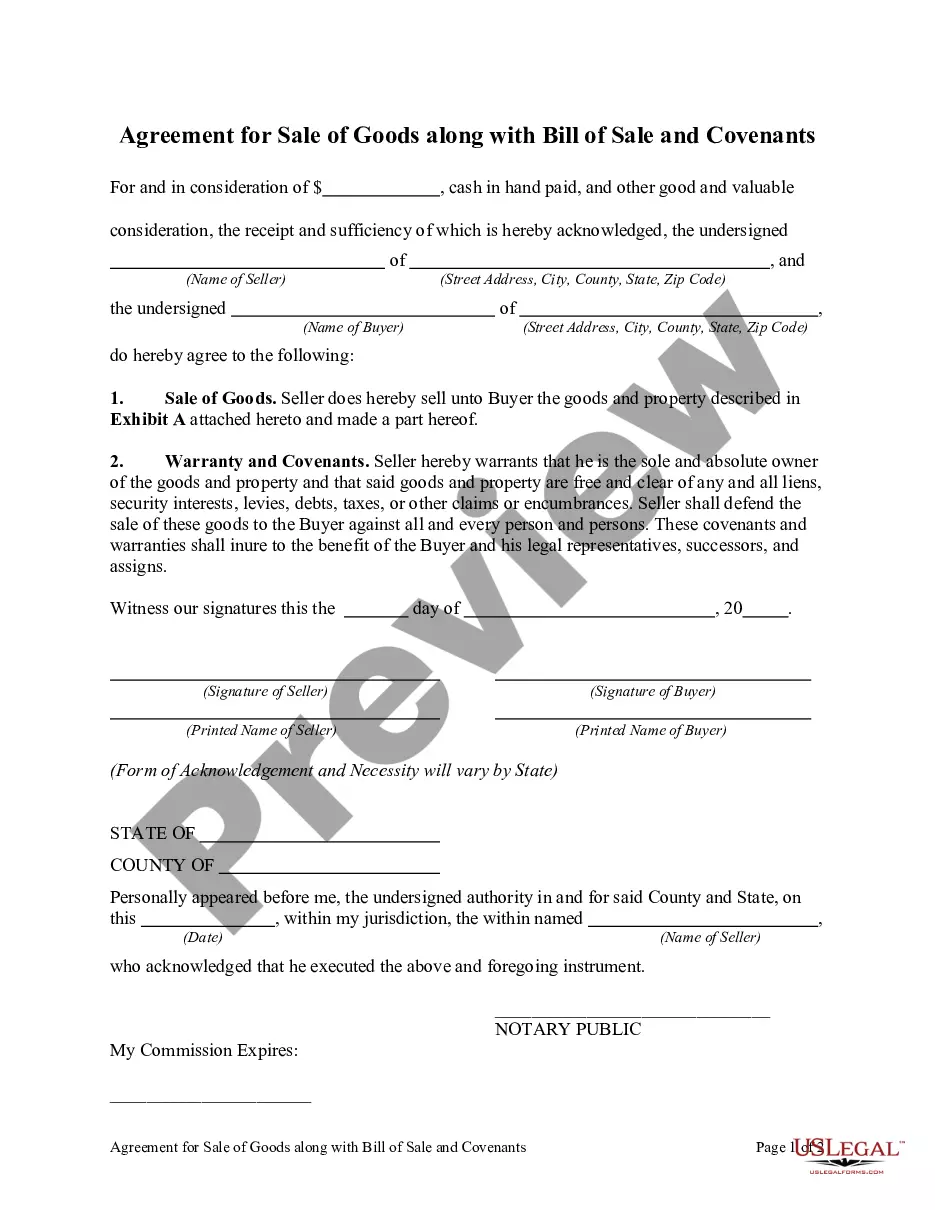

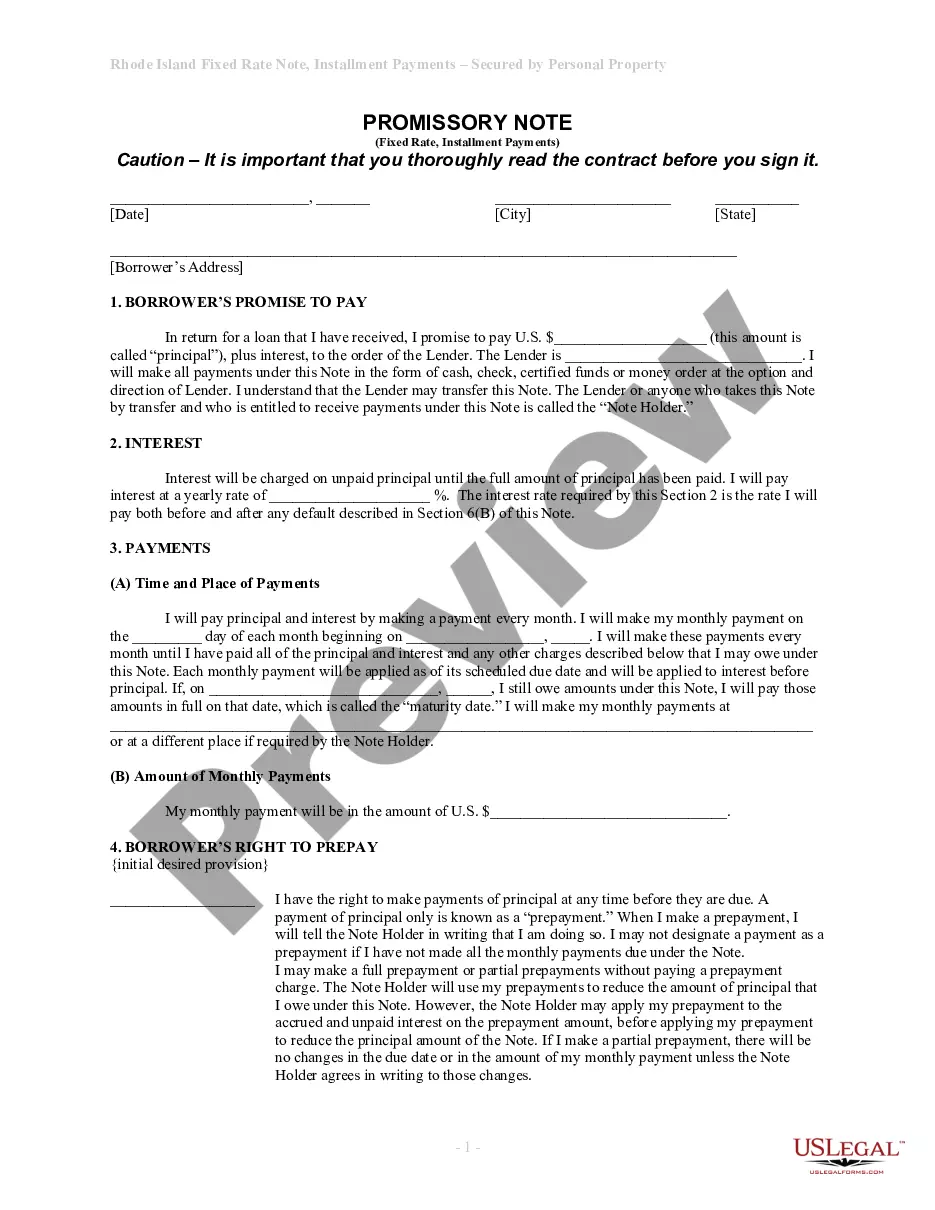

Are you looking to quickly draft a legally-binding Cuyahoga Sample Letter for Explanation of Insurance Rate Increase or probably any other form to take control of your personal or corporate affairs? You can go with two options: hire a professional to write a legal paper for you or draft it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you get professionally written legal papers without having to pay unreasonable prices for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-specific form templates, including Cuyahoga Sample Letter for Explanation of Insurance Rate Increase and form packages. We offer templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the needed template without extra troubles.

- To start with, double-check if the Cuyahoga Sample Letter for Explanation of Insurance Rate Increase is adapted to your state's or county's regulations.

- In case the form comes with a desciption, make sure to verify what it's intended for.

- Start the search again if the template isn’t what you were seeking by using the search bar in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Cuyahoga Sample Letter for Explanation of Insurance Rate Increase template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Additionally, the documents we offer are reviewed by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

7 Tips for Writing a Demand Letter To the Insurance Company Organize your expenses.Establish the facts.Share your perspective.Detail your road to recovery.Acknowledge and emphasize your pain and suffering.Request a reasonable settlement amount.Review your letter and send it!

A coverage position letter is a letter communicating a coverage position to the insured. There are three basic types: Those letters that inform the insured there is a question of coverage. Those letters that inform the insured there is no coverage. Those letters that inform the insured there is no question of coverage.

If you are asked to provide a letter as proof of insurance, you should contact your insurance company (or employer, if applicable) directly and request such a document.

How to Write a Grievance to an Insurance Company Know Your Rights. Go through your policy handbook and read up on your rights as a policy holder.Be Specific. Be specific about everything you put in writing.Stick to Guidelines.Include Attachments.Make it Easy.

All you need to do is request the letter from your insurance company. Only the insurer that provided you with a policy can give you a letter of experience. You cannot get it from your insurance broker. However, they may be able to help you get the letter from your insurer.

Things to Include in Your Appeal Letter Patient name, policy number, and policy holder name. Accurate contact information for patient and policy holder. Date of denial letter, specifics on what was denied, and cited reason for denial. Doctor or medical provider's name and contact information.

In most cases, your letter should contain: Your name. Your contact information. Insurance policy number. Details of the accident. Any injuries or damages. Any medical bills or repair estimates. Any information connected to a police report. Contact information for anyone else involved in the accident.

Confirmation of Coverage means the accompanying document that outlines Your benefits and Maximum Benefit amounts.

I am writing this letter in regards with the insurance claim for my car. My car insurance policy number is . The details of the car accident are mentioned below: On (incidence date) , I parked my car in front of my office, in the parking area.

A coverage position letter is a letter communicating a coverage position to the insured. There are three basic types: Those letters that inform the insured there is a question of coverage. Those letters that inform the insured there is no coverage. Those letters that inform the insured there is no question of coverage.