Dear [Insured], We hope this message finds you well. We are writing to inform you of an important update regarding your insurance rate increase. As an esteemed policyholder with our company, it is our duty to provide you with a detailed explanation for this change, so you understand the factors influencing the new premium. Insurance rates are determined based on various elements, including the location of the insured property. In this case, your policy pertains to Palm Beach, Florida—a vibrant and sought-after coastal destination. Palm Beach, Florida, often referred to as the "jewel of South Florida," is a captivating and scenic area beloved by residents and tourists alike. Nestled on a barrier island, Palm Beach mesmerizes visitors with its pristine white-sand beaches, lush greenery, and crystal-clear waters. It boasts a rich history, luxurious estates, and a vibrant cultural scene, attracting individuals from all walks of life. The genuine charm of Palm Beach, Florida does come with its own set of unique risks and insurance considerations. Factors such as the region's climate, proximity to the coast, exposure to severe weather events, and occasional natural disasters impact the insurance industry's overall risk assessment. To effectively protect your property, we invest significant resources, conduct extensive research, and analyze historical data to accurately calculate insurance premiums. The specific type of Palm Beach, Florida Sample Letter for Explanation of Insurance Rate Increase categories may vary based on your policy type and coverage. Examples of policy types include: 1. Homeowners Insurance: If you possess a Palm Beach, Florida homeowners insurance policy, factors like the property's location, construction material, coverage limits, claim history, and any recent improvements may contribute to changes in the premium. 2. Flood Insurance: Given Palm Beach's coastal location, flood insurance may be a critical component of your coverage. Premium adjustments for flood insurance are typically influenced by factors such as elevation, proximity to water bodies, and flood zone classifications. 3. Windstorm Insurance: The vulnerability of coastal regions to hurricanes and tropical storms necessitates windstorm insurance. Premium adjustments in this category may be impacted by the dwelling's construction, roof type, and protection measures against storms. Please note that this list is not exhaustive, and other specific policy types might be relevant to your coverage. It is essential to remember that our objective as an insurance provider is to ensure your property and possessions are adequately protected against the potential risks associated with living in Palm Beach, Florida. Our priority is to diligently assess risk factors and accurately price policies, facilitating your peace of mind. We understand that rate increases may impose unexpected financial burdens. Therefore, we encourage you to reach out to our dedicated team of professionals, who will gladly assist you in exploring available options to help manage insurance costs without compromising your coverage. Thank you for entrusting us with your insurance needs. Should you have any questions or require further clarification regarding the insurance rate increase, please do not hesitate to contact our customer service department. We greatly value your continued confidence in our company and look forward to serving your insurance needs for years to come. Warm regards, [Your Name] [Your Title] [Insurance Company Name]

Palm Beach Florida Sample Letter for Explanation of Insurance Rate Increase

Description

How to fill out Palm Beach Florida Sample Letter For Explanation Of Insurance Rate Increase?

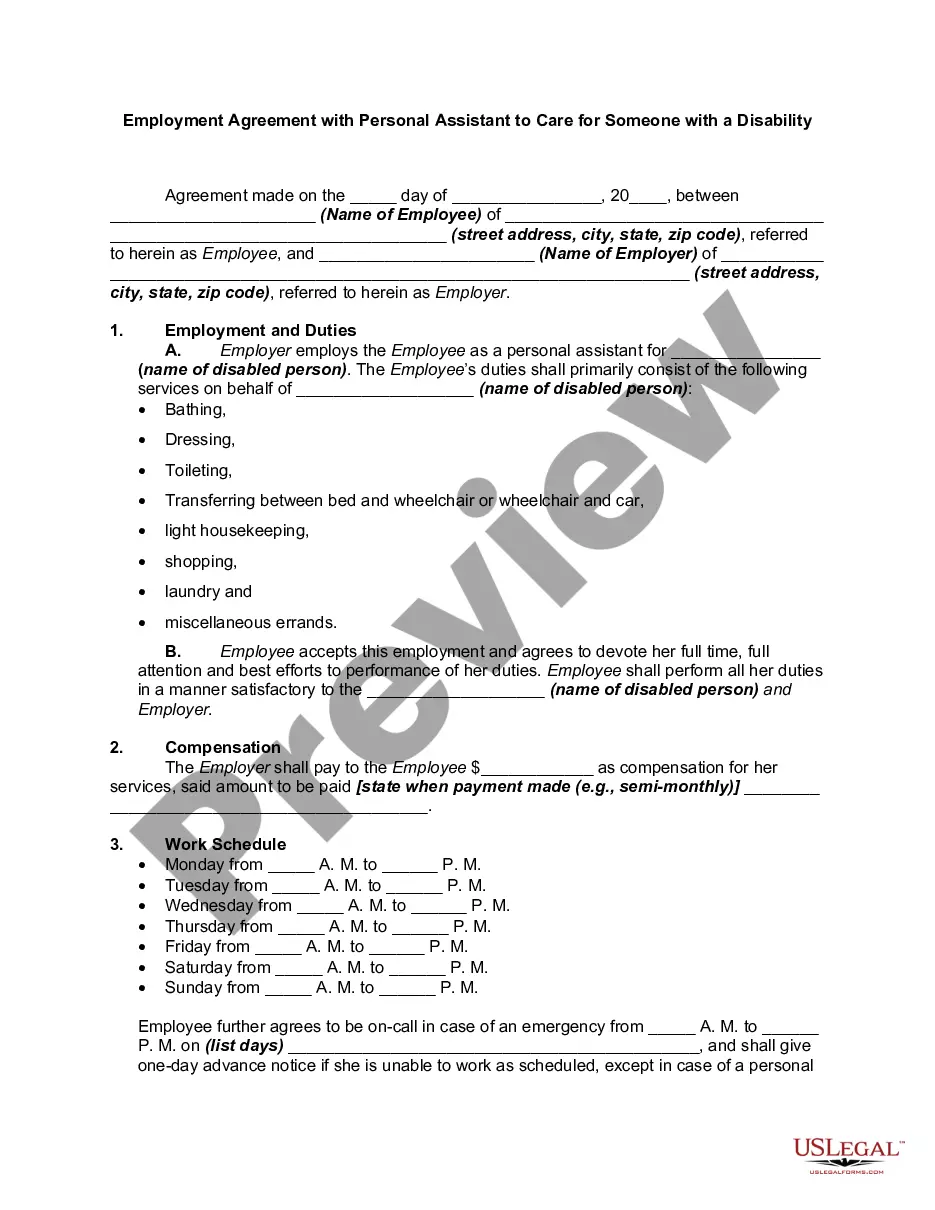

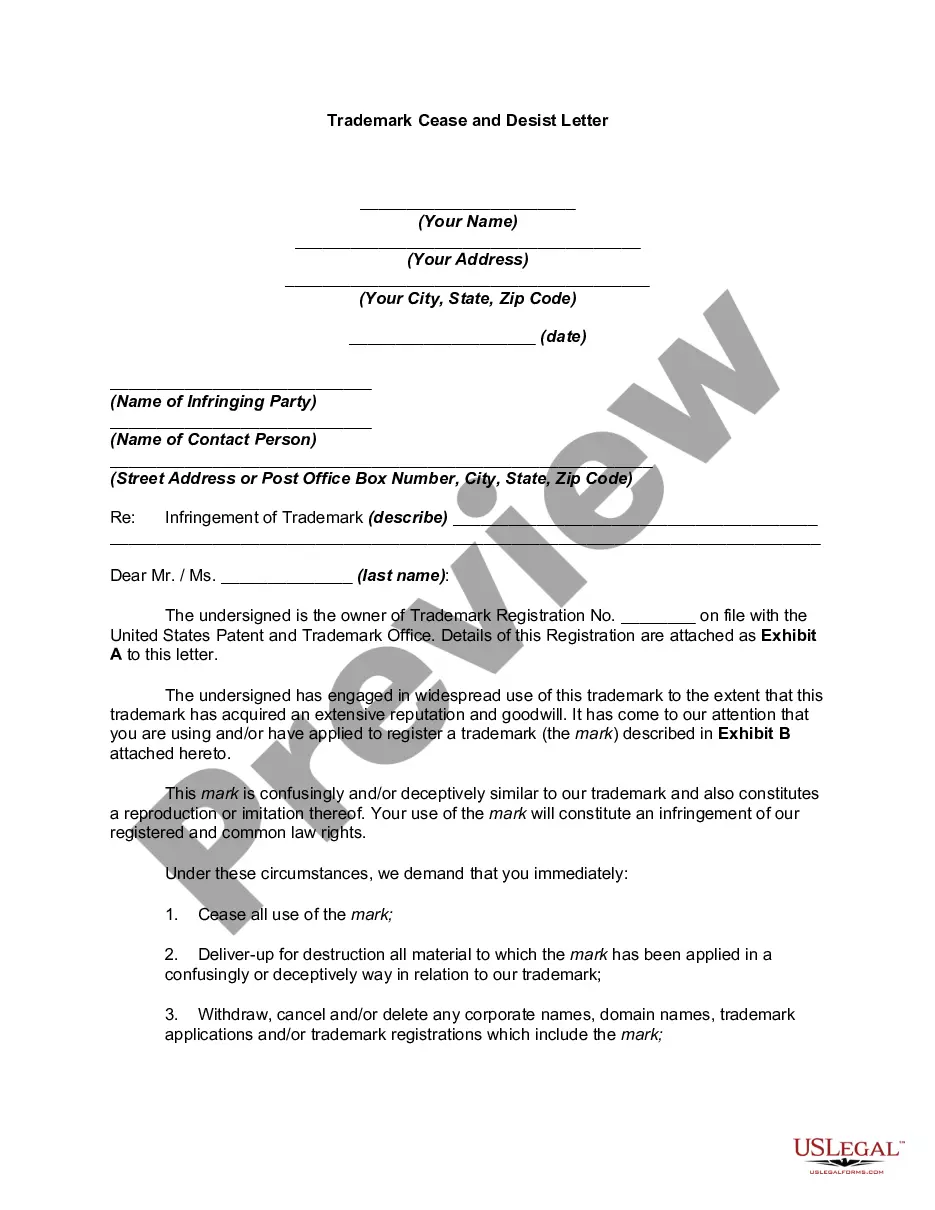

How much time does it usually take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, finding a Palm Beach Sample Letter for Explanation of Insurance Rate Increase meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often pricey. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. In addition to the Palm Beach Sample Letter for Explanation of Insurance Rate Increase, here you can get any specific form to run your business or individual affairs, complying with your county requirements. Specialists check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can retain the document in your profile at any time later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Palm Beach Sample Letter for Explanation of Insurance Rate Increase:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Palm Beach Sample Letter for Explanation of Insurance Rate Increase.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!