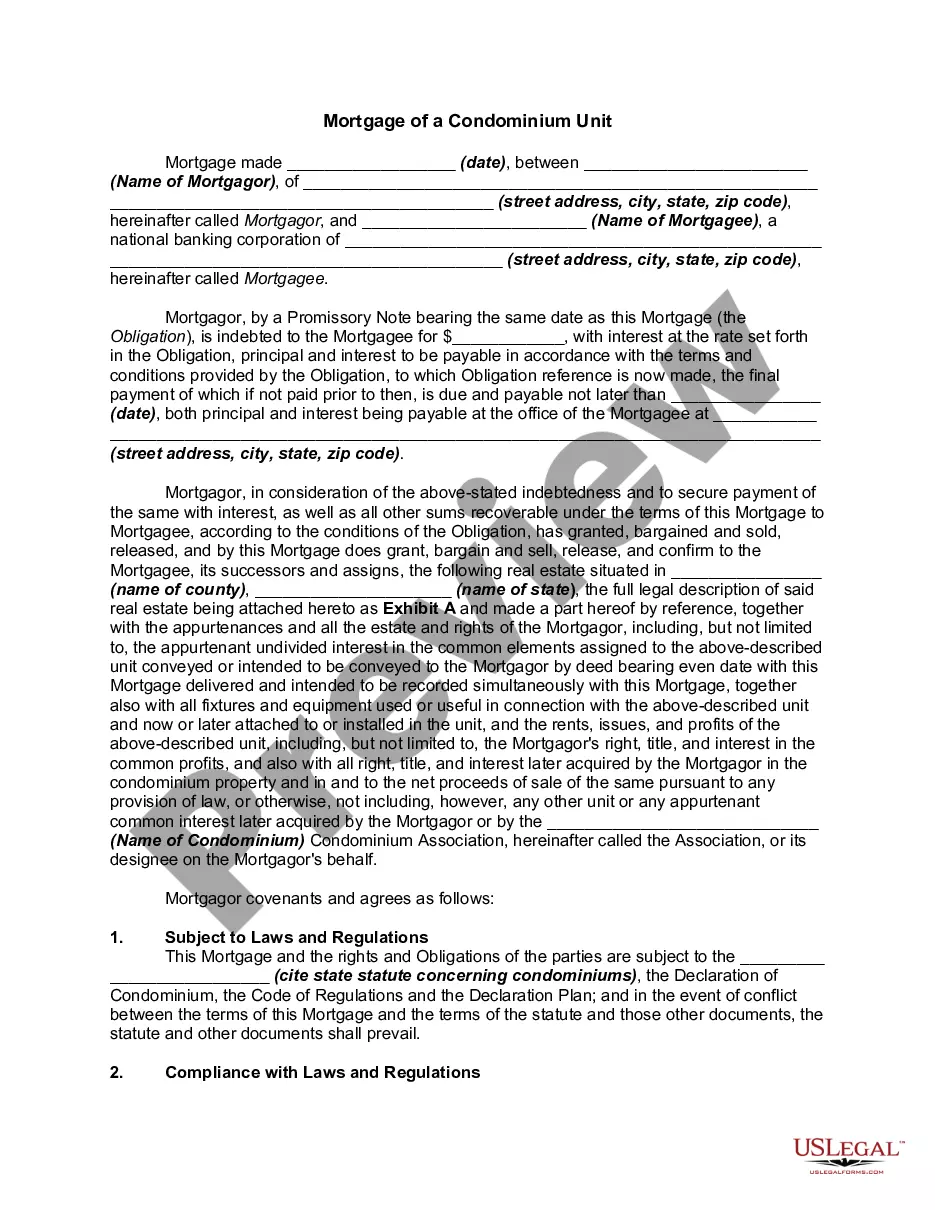

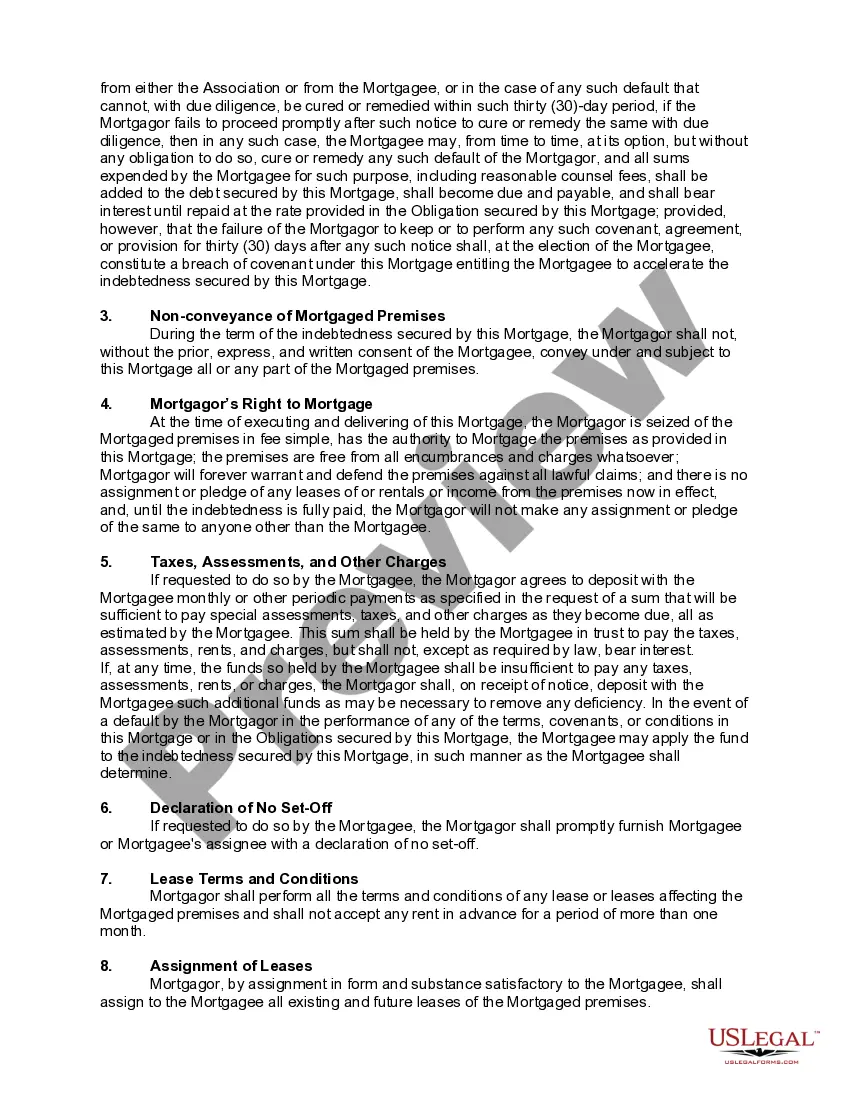

An agreement that creates an interest in real property as security for an obligation, such as the payment of a note, and that is to cease upon the performance of the obligation, is called a mortgage. The person whose interest in the property is given as security is the mortgagor. The person who receives the security is the mortgagee (lender). Two characteristics of a mortgage are (a) the mortgagee's interest terminates upon the performance of the obligation secured by the mortgage such as payment of the note secured by the mortgage; and (b) the mortgagee has the right to enforce the mortgage by foreclosure if the mortgagor fails to perform the obligation (such as defaulting on the note payments).

A condominium is a combination of co-ownership and individual ownership. Those who own an apartment house or buy a condominium are co-owners of the land and of the halls, lobby, and other common areas, but each apartment in the building is individually owned by its occupant. In some States, the owners of the various units in the condominium have equal voice in the management and share an equal part of the expenses. In other States, control and liability for expenses are shared by a unit owner in the same ratio as the value of the unit bears to the value of the entire condominium project. The bigger condominium owners would have more say-so than the smaller condominium owners.

A Lima Arizona Mortgage of a Condominium Unit refers to a specific type of home loan that is obtained when purchasing or refinancing a condominium unit in Lima, Arizona. This mortgage is designed to cater to individuals who are interested in owning a condominium unit within the area and require financial assistance. Lima Arizona Mortgage offers different types of loans for a condominium unit to suit the varying needs of potential buyers. These types of mortgages may include: 1. Conventional Condominium Mortgage: Conventional mortgages are not insured or guaranteed by any government agency. Buyers with a good credit score and a stable financial background often opt for this type of mortgage. It usually requires a down payment ranging from 3% to 20% of the purchase price, depending on various factors. 2. FHA (Federal Housing Administration) Condominium Mortgage: This type of mortgage is insured by the Federal Housing Administration, which allows buyers to secure financing with a lower down payment requirement, typically around 3.5%. FHA mortgages are often favored by first-time buyers or those with limited funds for a down payment. 3. VA (Veterans Affairs) Condominium Mortgage: Exclusive to qualified military veterans, active-duty service members, and eligible surviving spouses, VA mortgages offer favorable terms and benefits. These loans typically require no down payment, no private mortgage insurance (PMI), and lower interest rates compared to conventional mortgages. 4. USDA (United States Department of Agriculture) Condominium Mortgage: USDA mortgages are primarily designed for low to moderate-income buyers looking to purchase a condominium unit in rural or agricultural areas. These loans usually offer low-income requirements, zero down payment options, and favorable interest rates. When obtaining a Lima Arizona Mortgage of a Condominium Unit, potential buyers should consider factors such as the interest rate, loan term, down payment, credit score requirements, and closing costs. It is advisable to consult with a mortgage expert or a trusted lender to explore the available options and evaluate the most suitable mortgage choice based on individual financial circumstances and goals.