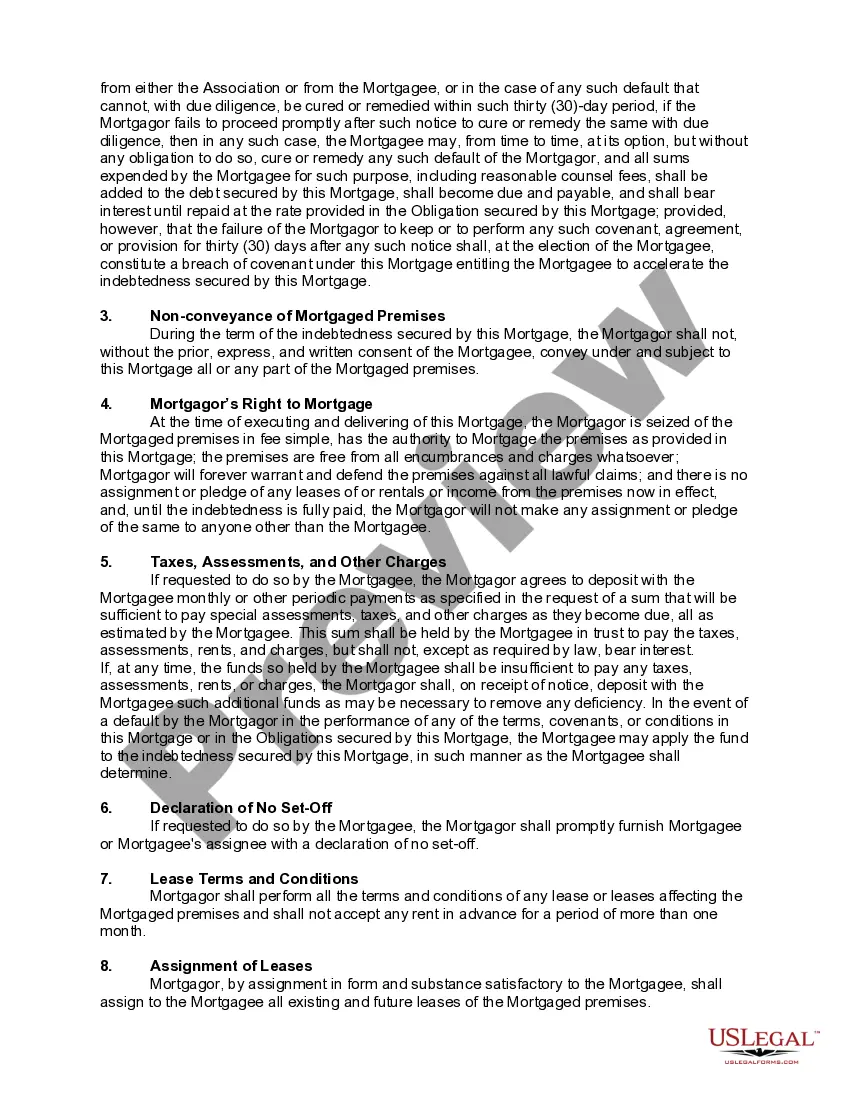

An agreement that creates an interest in real property as security for an obligation, such as the payment of a note, and that is to cease upon the performance of the obligation, is called a mortgage. The person whose interest in the property is given as security is the mortgagor. The person who receives the security is the mortgagee (lender). Two characteristics of a mortgage are (a) the mortgagee's interest terminates upon the performance of the obligation secured by the mortgage such as payment of the note secured by the mortgage; and (b) the mortgagee has the right to enforce the mortgage by foreclosure if the mortgagor fails to perform the obligation (such as defaulting on the note payments).

A condominium is a combination of co-ownership and individual ownership. Those who own an apartment house or buy a condominium are co-owners of the land and of the halls, lobby, and other common areas, but each apartment in the building is individually owned by its occupant. In some States, the owners of the various units in the condominium have equal voice in the management and share an equal part of the expenses. In other States, control and liability for expenses are shared by a unit owner in the same ratio as the value of the unit bears to the value of the entire condominium project. The bigger condominium owners would have more say-so than the smaller condominium owners.

A San Diego California mortgage of a condominium unit refers to a loan specifically tailored for purchasing or refinancing a condominium property located in San Diego, California. This type of mortgage enables potential homebuyers or existing condominium owners to obtain the necessary funds to finance their property while adhering to the legal guidelines and regulations specific to condominium units in the area. Condominium mortgages in San Diego offer various types of loans to meet the diverse needs of borrowers. Some common San Diego California mortgage options for a condominium unit include: 1. Conventional Condominium Mortgage: This type of mortgage is offered by conventional lenders, such as banks or mortgage companies. It typically requires a down payment of at least 3% (or more depending on the lender), and borrowers must meet certain credit and income requirements. 2. Federal Housing Administration (FHA) Condominium Mortgage: The FHA provides mortgage insurance on loans made by FHA-approved lenders, which enables borrowers to qualify for a mortgage with a smaller down payment, typically around 3.5% of the purchase price. FHA loans also have more flexible credit requirements, making them attractive to borrowers with lower credit scores. 3. Department of Veterans Affairs (VA) Condominium Mortgage: Available exclusively to eligible veterans, active-duty service members, and their spouses, VA loans offer several advantages, including no down payment requirements, reduced closing costs, and competitive interest rates. This type of mortgage is insured by the Department of Veterans Affairs. 4. Jumbo Loans for Luxury Condominiums: In cases where the condominium unit exceeds the loan limits set by conventional mortgage programs, borrowers may need to apply for a jumbo loan. These loans allow borrowers to finance higher-priced properties, such as luxury condominium units, but typically come with stricter eligibility criteria and higher interest rates. When applying for a San Diego California mortgage of a condominium unit, lenders may require the borrower to provide certain documents, including income verification, asset statements, credit reports, and the condominium's bylaws or association documents. Additionally, the borrower may need to pay for an appraisal to determine the value of the condominium unit. It's important for borrowers to shop around and compare mortgage rates and terms from different lenders to find the best mortgage option that suits their financial situation and goals. Additionally, consulting with a local real estate agent or mortgage broker experienced in San Diego's condominium market can provide valuable insights and guidance throughout the mortgage application process. Overall, securing a San Diego California mortgage of a condominium unit is an essential step in purchasing or refinancing a condominium property in this vibrant Southern California city.A San Diego California mortgage of a condominium unit refers to a loan specifically tailored for purchasing or refinancing a condominium property located in San Diego, California. This type of mortgage enables potential homebuyers or existing condominium owners to obtain the necessary funds to finance their property while adhering to the legal guidelines and regulations specific to condominium units in the area. Condominium mortgages in San Diego offer various types of loans to meet the diverse needs of borrowers. Some common San Diego California mortgage options for a condominium unit include: 1. Conventional Condominium Mortgage: This type of mortgage is offered by conventional lenders, such as banks or mortgage companies. It typically requires a down payment of at least 3% (or more depending on the lender), and borrowers must meet certain credit and income requirements. 2. Federal Housing Administration (FHA) Condominium Mortgage: The FHA provides mortgage insurance on loans made by FHA-approved lenders, which enables borrowers to qualify for a mortgage with a smaller down payment, typically around 3.5% of the purchase price. FHA loans also have more flexible credit requirements, making them attractive to borrowers with lower credit scores. 3. Department of Veterans Affairs (VA) Condominium Mortgage: Available exclusively to eligible veterans, active-duty service members, and their spouses, VA loans offer several advantages, including no down payment requirements, reduced closing costs, and competitive interest rates. This type of mortgage is insured by the Department of Veterans Affairs. 4. Jumbo Loans for Luxury Condominiums: In cases where the condominium unit exceeds the loan limits set by conventional mortgage programs, borrowers may need to apply for a jumbo loan. These loans allow borrowers to finance higher-priced properties, such as luxury condominium units, but typically come with stricter eligibility criteria and higher interest rates. When applying for a San Diego California mortgage of a condominium unit, lenders may require the borrower to provide certain documents, including income verification, asset statements, credit reports, and the condominium's bylaws or association documents. Additionally, the borrower may need to pay for an appraisal to determine the value of the condominium unit. It's important for borrowers to shop around and compare mortgage rates and terms from different lenders to find the best mortgage option that suits their financial situation and goals. Additionally, consulting with a local real estate agent or mortgage broker experienced in San Diego's condominium market can provide valuable insights and guidance throughout the mortgage application process. Overall, securing a San Diego California mortgage of a condominium unit is an essential step in purchasing or refinancing a condominium property in this vibrant Southern California city.