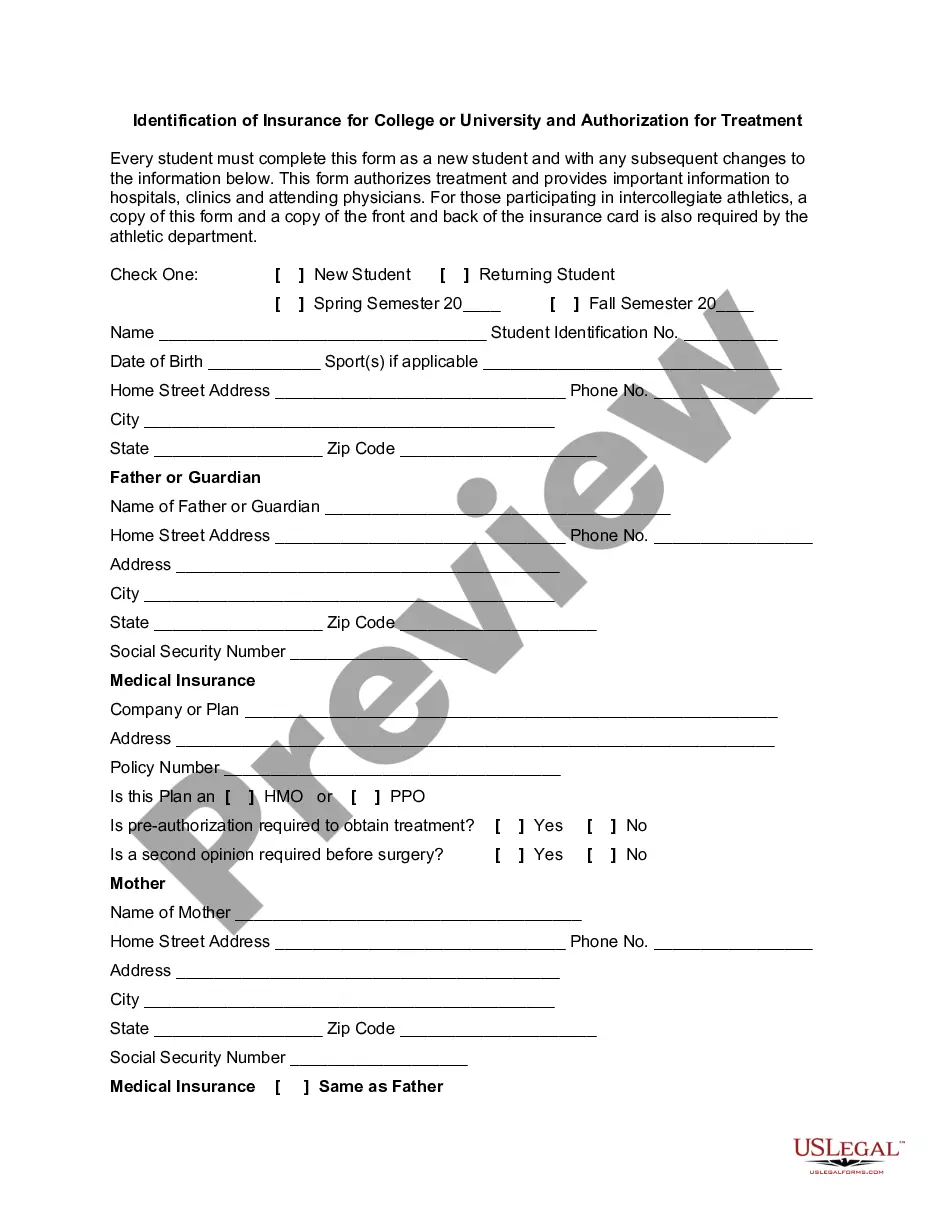

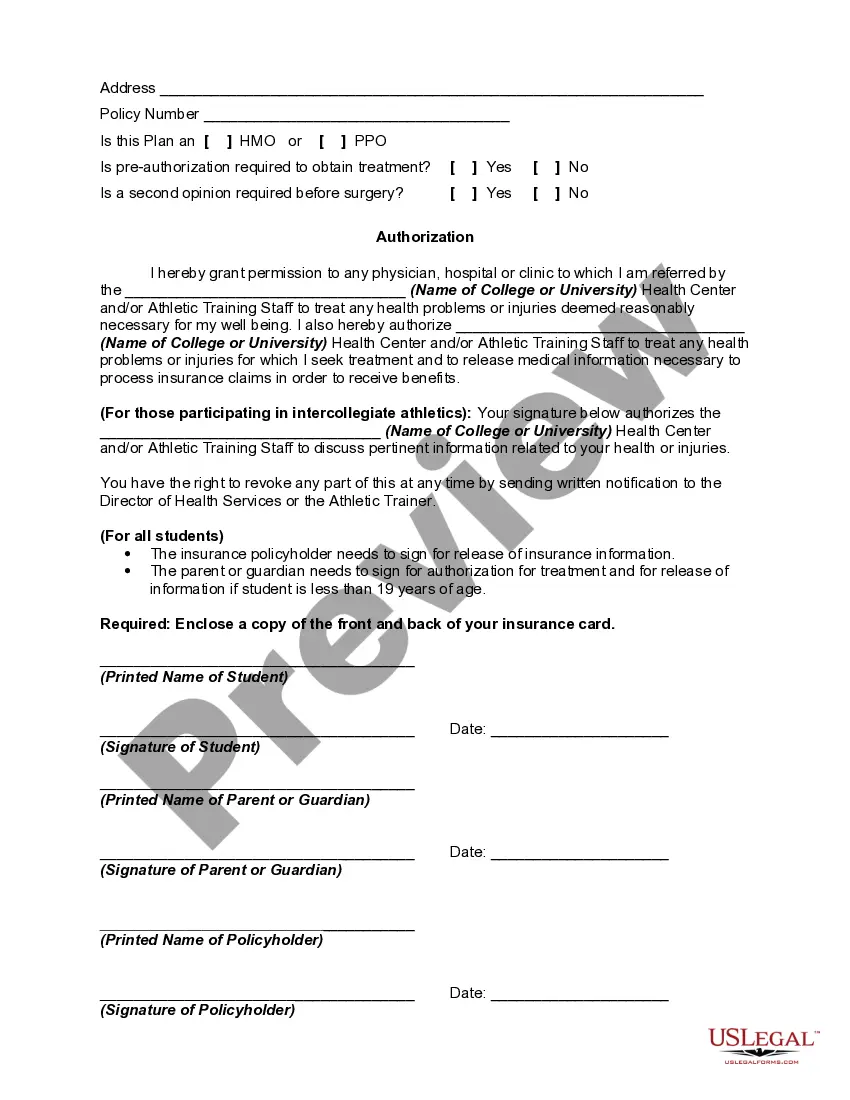

This form authorizes treatment for athletes and students of a college and university and provides important information to hospitals, clinics and attending physicians. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Jose, California, is a bustling city located in the heart of Silicon Valley. Renowned for its thriving tech industry and diverse cultural scene, it is home to several prestigious colleges and universities. In order to ensure the well-being and safety of students, various types of insurance coverage are available for colleges and universities in San Jose. Let's delve into some important types of insurance specifically designed for educational institutions in this city. 1. General Liability Insurance: This type of insurance provides coverage for claims arising from bodily injury, property damage, personal injury, or advertising injury. It safeguards colleges and universities against lawsuits related to accidents, slip and falls, and other unforeseen events that may occur on their premises. 2. Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, professional liability insurance protects educational institutions and their personnel against claims alleging professional negligence, errors, or omissions. It covers legal expenses and settlements related to claims of educational malpractice, improper guidance or advice, and other professional misconduct allegations. 3. Property Insurance: Property insurance is crucial for colleges and universities in San Jose, as it safeguards against the financial loss of buildings, equipment, and facilities due to fire, theft, vandalism, or natural disasters. This coverage helps educational institutions quickly recover and rebuild, ensuring minimal disruption to their academic activities. 4. Workers' Compensation Insurance: This insurance is a legal requirement for any college or university in San Jose that employs staff. Workers' compensation insurance provides coverage for medical costs and lost wages for employees who suffer work-related injuries or illnesses. It also protects the educational institution from potential lawsuits arising from such incidents. 5. Cyber Liability Insurance: As technology plays a central role in education, cyber liability insurance is essential to safeguard colleges and universities against data breaches, hacking attempts, and other cyber threats. This coverage helps cover expenses related to data recovery, legal settlements, customer notification, and public relations efforts to mitigate reputational damage. 6. Auto Insurance: Educational institutions in San Jose often operate a fleet of vehicles for transportation purposes, such as shuttles or for student-teacher field trips. Auto insurance provides coverage for vehicle accidents, property damage, and bodily injury caused by vehicles owned and operated by the college or university. In order to obtain necessary insurance coverage, colleges and universities in San Jose need to go through an authorization process, which ensures compliance with legal and regulatory requirements. The authorization may include submitting various documentation, such as proof of financial stability, adherence to safety protocols, and compliance with educational standards. In summary, San Jose, California, offers a range of insurance coverage specifically tailored for colleges and universities. These include general liability insurance, professional liability insurance, property insurance, workers' compensation insurance, cyber liability insurance, and auto insurance. By obtaining the right insurance coverage and completing the authorization process, educational institutions can protect their campus, faculty, students, and reputation, allowing them to focus on their primary mission of providing quality education.San Jose, California, is a bustling city located in the heart of Silicon Valley. Renowned for its thriving tech industry and diverse cultural scene, it is home to several prestigious colleges and universities. In order to ensure the well-being and safety of students, various types of insurance coverage are available for colleges and universities in San Jose. Let's delve into some important types of insurance specifically designed for educational institutions in this city. 1. General Liability Insurance: This type of insurance provides coverage for claims arising from bodily injury, property damage, personal injury, or advertising injury. It safeguards colleges and universities against lawsuits related to accidents, slip and falls, and other unforeseen events that may occur on their premises. 2. Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, professional liability insurance protects educational institutions and their personnel against claims alleging professional negligence, errors, or omissions. It covers legal expenses and settlements related to claims of educational malpractice, improper guidance or advice, and other professional misconduct allegations. 3. Property Insurance: Property insurance is crucial for colleges and universities in San Jose, as it safeguards against the financial loss of buildings, equipment, and facilities due to fire, theft, vandalism, or natural disasters. This coverage helps educational institutions quickly recover and rebuild, ensuring minimal disruption to their academic activities. 4. Workers' Compensation Insurance: This insurance is a legal requirement for any college or university in San Jose that employs staff. Workers' compensation insurance provides coverage for medical costs and lost wages for employees who suffer work-related injuries or illnesses. It also protects the educational institution from potential lawsuits arising from such incidents. 5. Cyber Liability Insurance: As technology plays a central role in education, cyber liability insurance is essential to safeguard colleges and universities against data breaches, hacking attempts, and other cyber threats. This coverage helps cover expenses related to data recovery, legal settlements, customer notification, and public relations efforts to mitigate reputational damage. 6. Auto Insurance: Educational institutions in San Jose often operate a fleet of vehicles for transportation purposes, such as shuttles or for student-teacher field trips. Auto insurance provides coverage for vehicle accidents, property damage, and bodily injury caused by vehicles owned and operated by the college or university. In order to obtain necessary insurance coverage, colleges and universities in San Jose need to go through an authorization process, which ensures compliance with legal and regulatory requirements. The authorization may include submitting various documentation, such as proof of financial stability, adherence to safety protocols, and compliance with educational standards. In summary, San Jose, California, offers a range of insurance coverage specifically tailored for colleges and universities. These include general liability insurance, professional liability insurance, property insurance, workers' compensation insurance, cyber liability insurance, and auto insurance. By obtaining the right insurance coverage and completing the authorization process, educational institutions can protect their campus, faculty, students, and reputation, allowing them to focus on their primary mission of providing quality education.