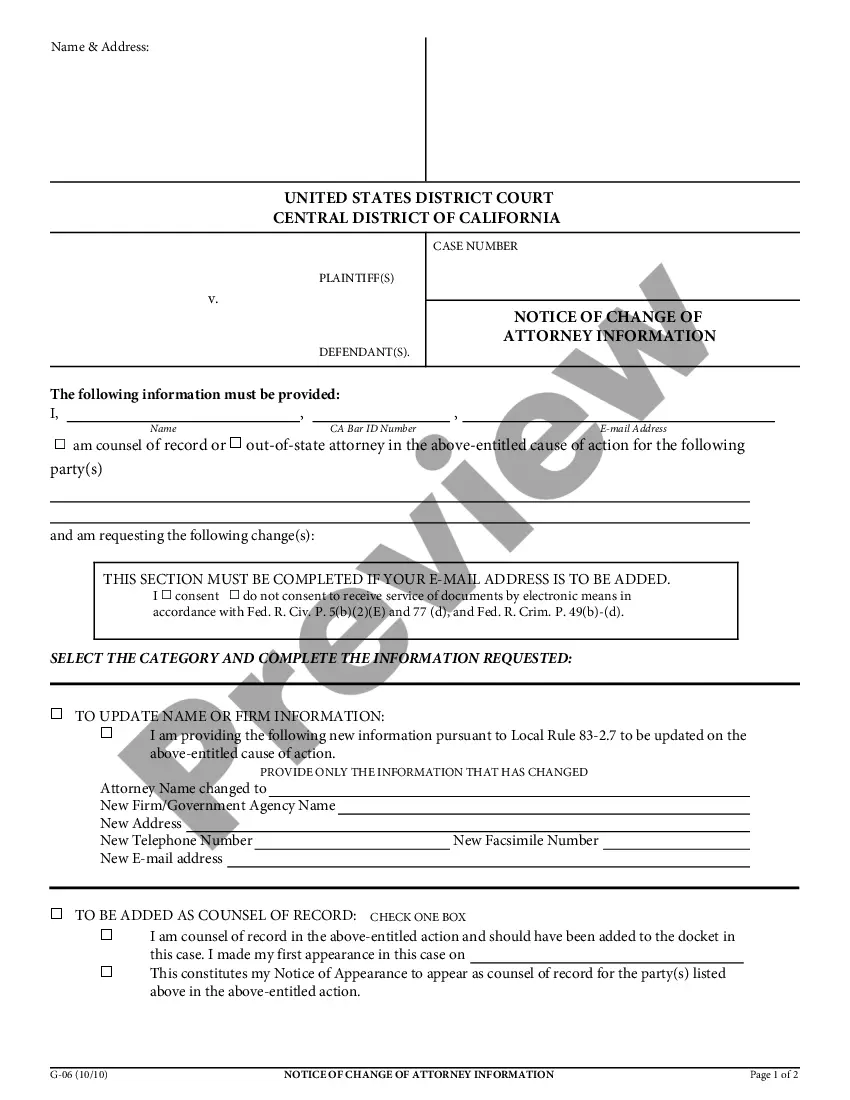

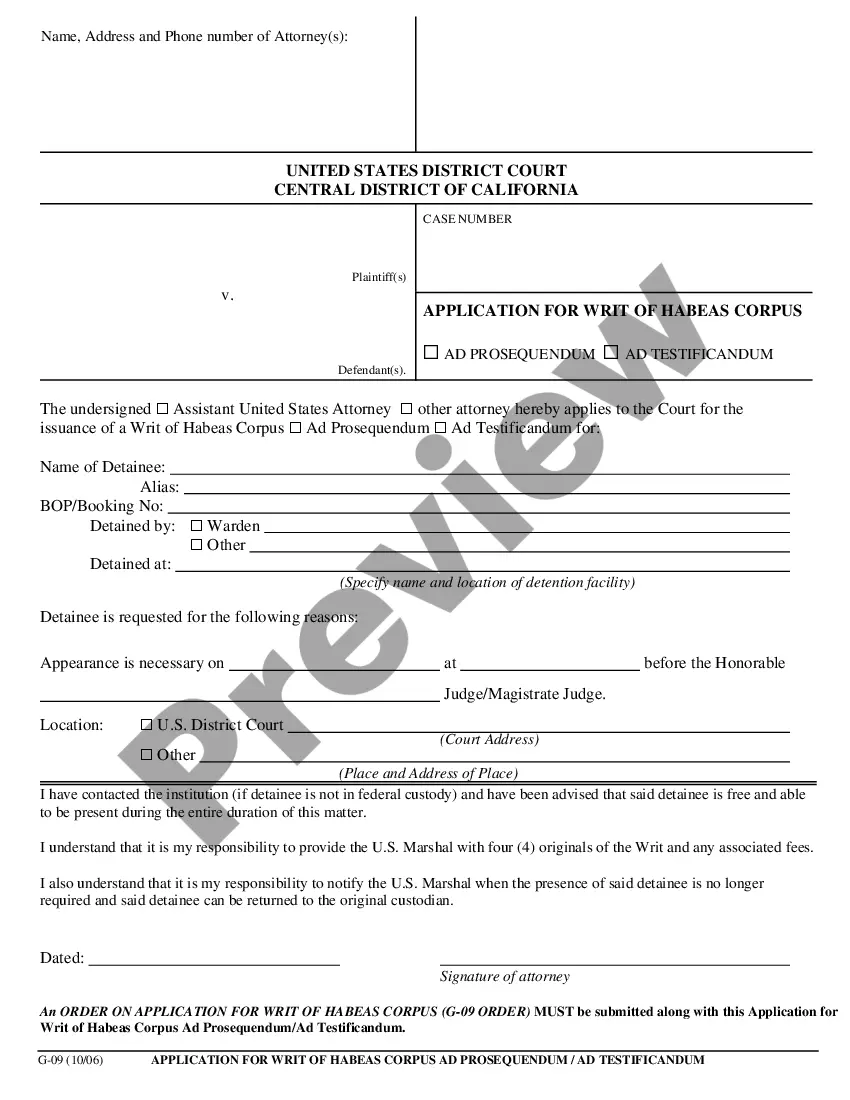

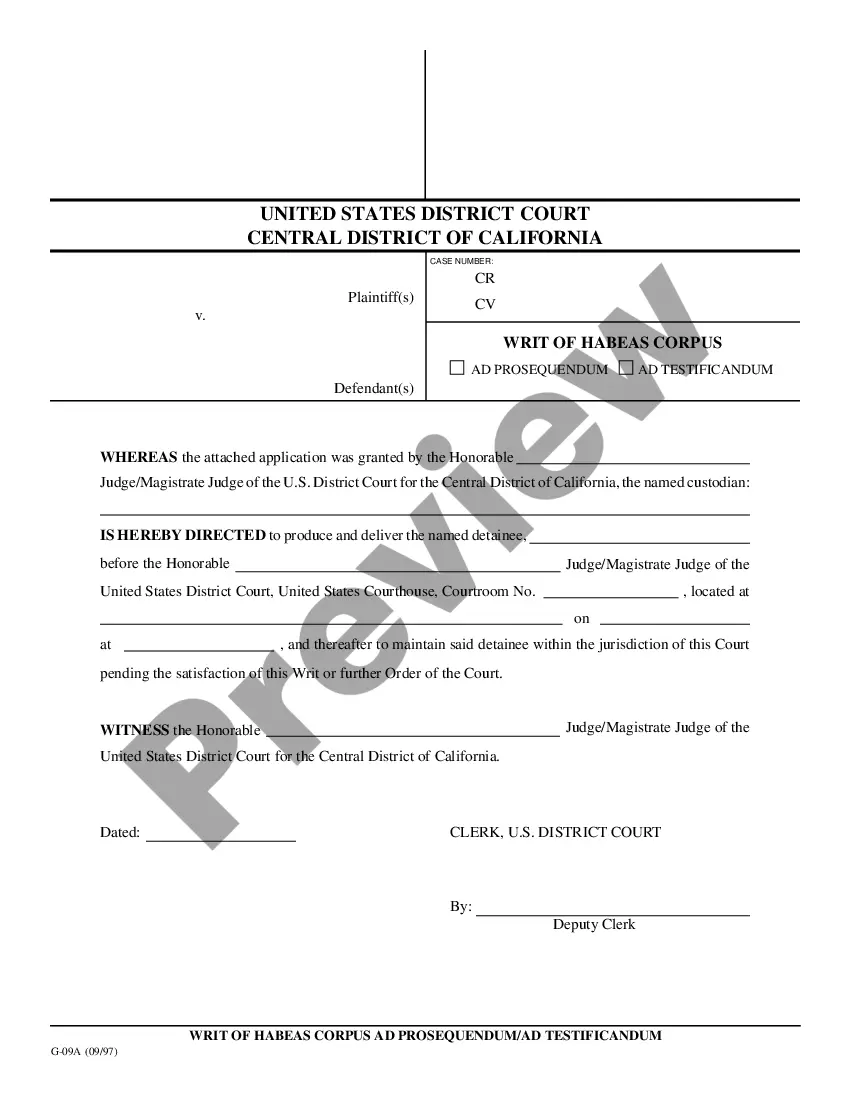

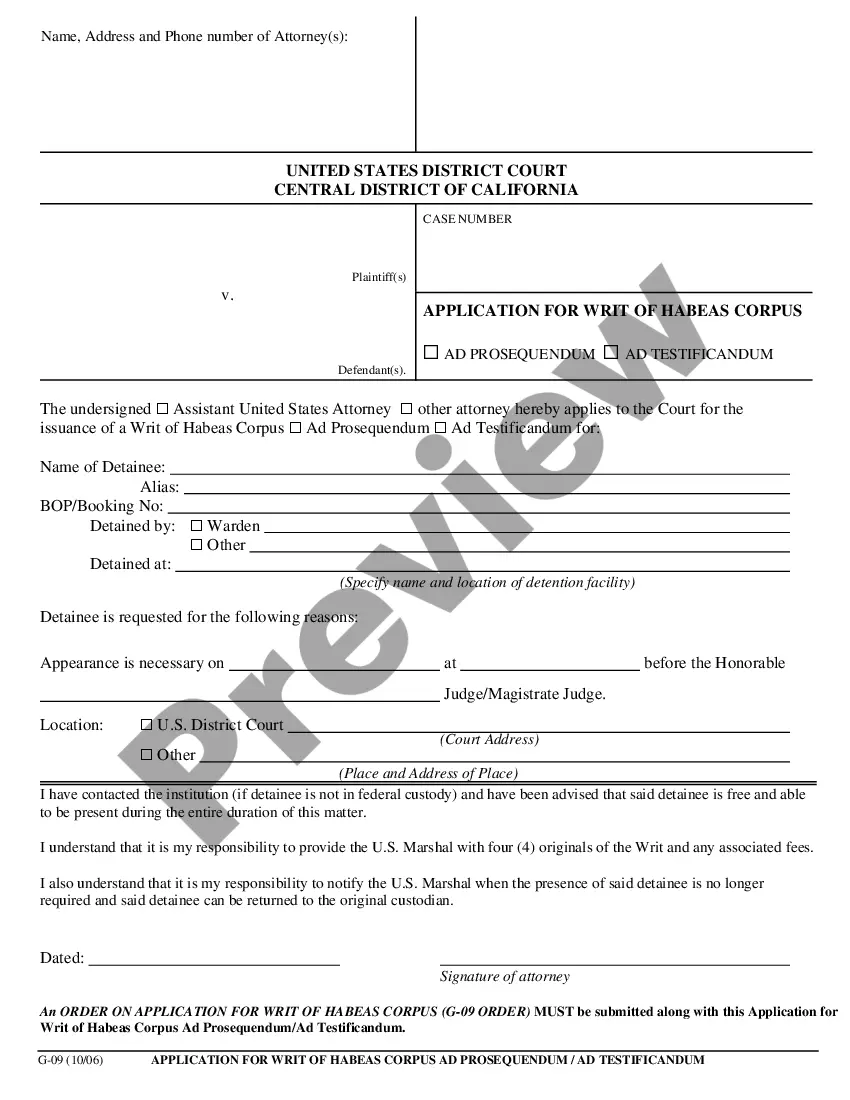

Kings New York Debt Agreement is a legal arrangement designed to help individuals or businesses in Kings County, New York, resolve their financial obligations. It provides a structured approach to managing and eliminating debt, offering various benefits to debtors and creditors alike. Under the Kings New York Debt Agreement, a debtor negotiates with their creditors to establish a plan to repay their outstanding debts over a specific period of time. This agreement aims to reduce the overall debt burden while ensuring that creditors receive a portion of what they are owed. There are different types of Kings New York Debt Agreements available, tailored to the specific needs and circumstances of debtors. These may include: 1. Debt Settlement Agreement: This type of agreement involves negotiating with creditors to settle outstanding debts for a lower amount than what is originally owed. Debtors may make a lump-sum payment or structured payments to fulfill the settlement agreement. 2. Debt Consolidation Agreement: With this agreement, multiple debts are consolidated into a single loan or repayment plan. Debtors can benefit from lower interest rates and a simplified repayment process. 3. Debt Management Agreement: This agreement is designed to help debtors regain control over their finances. A debt management company works with the debtor and their creditors to establish a manageable repayment plan with lower interest rates, fees, or waived penalties. 4. Debt Repayment Agreement: It involves developing a structured repayment plan that allows debtors to pay off their debts gradually. This agreement may involve negotiating lower interest rates or extending the repayment period to make monthly payments more affordable. Regardless of the type, Kings New York Debt Agreements aim to provide debtors with a clear path towards financial recovery. It helps them alleviate the stress associated with overwhelming debts and works towards a more stable financial future. It is important for individuals considering a Kings New York Debt Agreement to consult with a reputable debt relief agency or seek legal advice. These professionals can guide debtors through the agreement process, ensuring their rights and interests are protected while maximizing the benefits of the agreement.

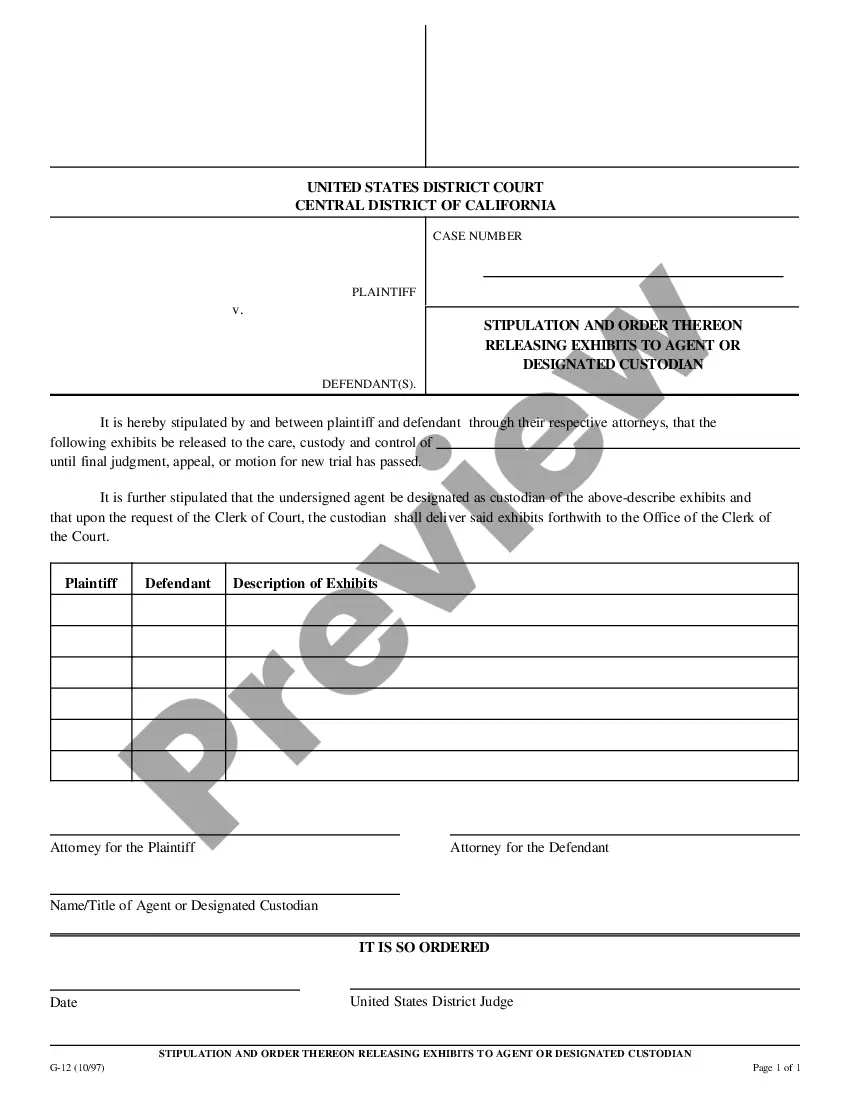

Kings New York Debt Agreement

Description

How to fill out Kings New York Debt Agreement?

If you need to find a trustworthy legal form provider to get the Kings Debt Agreement, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate template.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support team make it easy to get and complete different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply select to look for or browse Kings Debt Agreement, either by a keyword or by the state/county the document is created for. After finding the necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Kings Debt Agreement template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and choose a subscription option. The template will be instantly ready for download once the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less expensive and more reasonably priced. Create your first company, arrange your advance care planning, create a real estate contract, or execute the Kings Debt Agreement - all from the comfort of your home.

Sign up for US Legal Forms now!