Queens New York Debt Agreement is a legal arrangement made between a debtor and creditor residing in Queens, New York, to resolve outstanding debts. It is important to understand the various types of debt agreements available to residents in Queens to find the most suitable option for their financial situation. Here are a few types of debt agreements commonly practiced in Queens, New York: 1. Debt Settlement Agreement: This type of debt agreement involves negotiating with creditors to reduce the total amount owed on the debt. The debtor and the creditor agree upon an affordable lump-sum payment, usually lower than the original debt, allowing the debtor to pay off the debt in a single installment. 2. Debt Consolidation Agreement: A debt consolidation agreement allows individuals with multiple debts to combine them into a single loan. By doing so, the debtor can simplify their repayment process as they only have to make one monthly payment. This type of agreement often involves securing the debt with collateral, such as a home or car. 3. Debt Management Agreement: In a debt management agreement, individuals work with a credit counseling agency to create a personalized debt repayment plan. The agency negotiates with creditors to reduce interest rates, eliminate penalties, and establish an affordable monthly payment. This arrangement aims to help debtors regain control over their finances and repay their debts efficiently. 4. Chapter 13 Bankruptcy: While bankruptcy is generally considered a last resort, Chapter 13 bankruptcy allows debtors to establish a court-approved repayment plan to repay all or a portion of their debts over a designated period, typically three to five years. This type of debt agreement provides individuals an opportunity to retain their assets and avoid liquidation. 5. Informal Agreements: Not all debt agreements in Queens, New York, are formalized in legal documents. Many debtors negotiate informal agreements with their creditors, discussing revised payment terms, interest rates, or forgiving a portion of the debt. These informal arrangements can help debtors alleviate some financial burden without involving legal procedures. It is vital for individuals facing debt issues in Queens, New York, to understand the different debt agreement options available to them. Seeking professional advice from a debt counselor, lawyer, or credit counseling agency can greatly assist in selecting the most appropriate Queens New York Debt Agreement tailored to one's specific financial circumstances and goals.

Queens New York Debt Agreement

Description

How to fill out Queens New York Debt Agreement?

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life scenario, finding a Queens Debt Agreement suiting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, grouped by states and areas of use. In addition to the Queens Debt Agreement, here you can get any specific form to run your business or individual affairs, complying with your county requirements. Specialists check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can retain the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Queens Debt Agreement:

- Examine the content of the page you’re on.

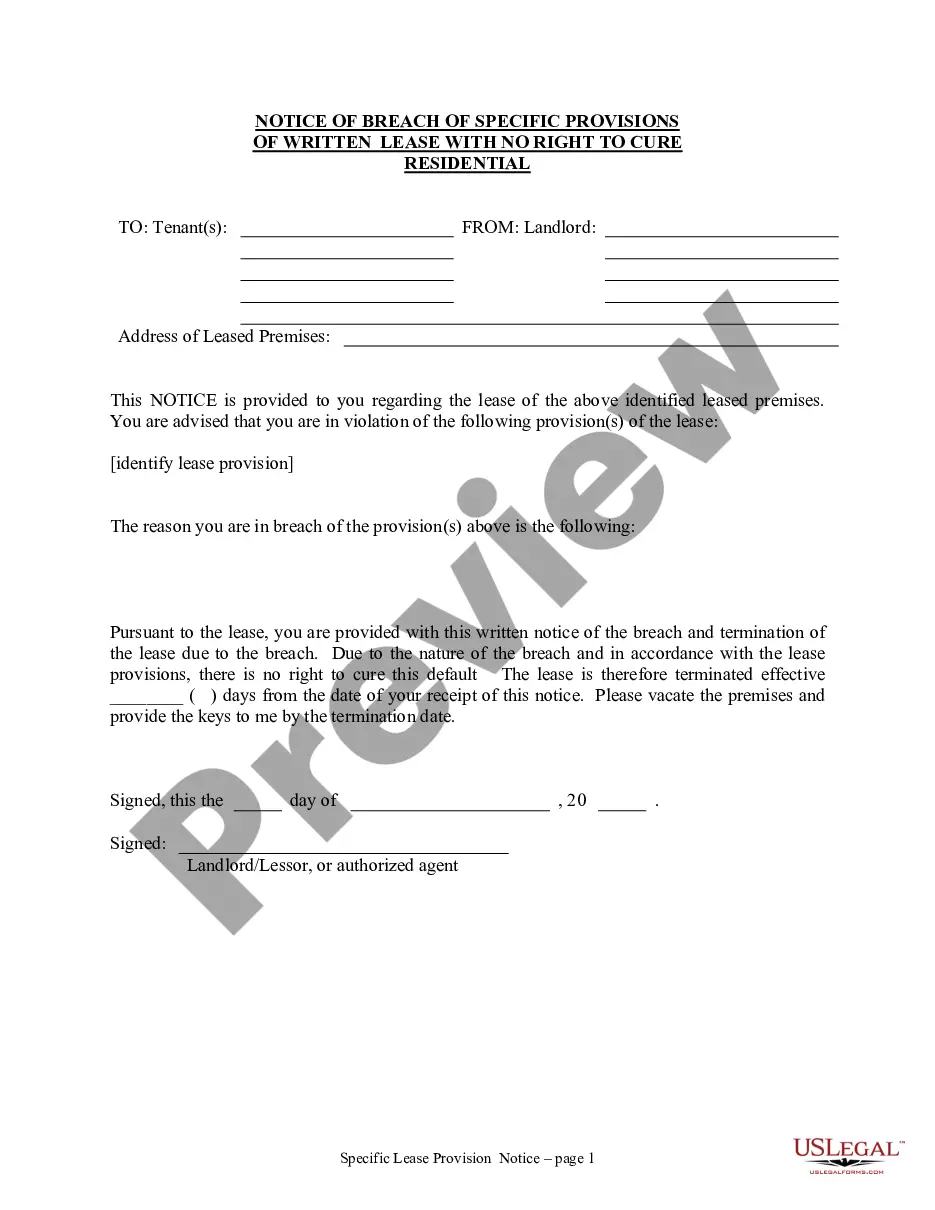

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Queens Debt Agreement.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!