Miami-Dade County is located in the southeastern part of Florida and is known for its vibrant culture, beautiful beaches, and bustling urban areas. When it comes to drafting a lease for a commercial building in Miami-Dade, there are several matters that both landlords and tenants need to consider. 1. Property Description: Start by providing a detailed description of the commercial building, including its address, size, layout, and any specific features or amenities. 2. Lease Term: Specify the length of the lease term, whether it's for a fixed period or a month-to-month basis, and include any provisions for renewal or termination. 3. Rent and Payment Terms: Define the base rent amount and any additional charges, such as common area maintenance fees or utilities. Clearly outline the payment schedule, method of payment, and any penalties for late payments. 4. Security Deposit: Determine the amount of the security deposit required and describe the conditions for its return or potential forfeiture. 5. Permitted Use: Specify the permitted use or business activities allowed within the commercial building. This could include any restrictions or limitations on certain types of businesses. 6. Maintenance and Repairs: Outline the responsibilities of both the landlord and tenant regarding maintenance, repairs, and improvements to the building. Clarify who will be responsible for major repairs or structural issues. 7. Alterations and Improvements: Discuss any limitations or requirements for making alterations or improvements to the premises, such as obtaining prior written consent from the landlord. 8. Insurance: Specify the types and amounts of insurance coverage required for the commercial building. This may include general liability insurance, property insurance, or worker's compensation coverage. 9. Indemnification: Include a provision that requires the tenant to indemnify and hold the landlord harmless from any claims, damages, or liabilities arising from the tenant's use of the premises. 10. Default and Termination: Define the conditions under which the lease can be terminated, either by the landlord or tenant, in the event of a default or breach of the lease agreement. Additional factors that may be relevant to consider when drafting a lease for a commercial building in Miami-Dade include zoning regulations, parking provisions, signage restrictions, environmental compliance, and compliance with the Americans with Disabilities Act (ADA) requirements. Different types of commercial building leases can also be categorized based on the purpose or usage, such as retail leases, office leases, industrial leases, and restaurant leases. Each type may have specific considerations and requirements that need to be addressed in the lease agreement.

Miami-Dade Florida Checklist of Matters to be Considered in Drafting a Lease of a Commercial Building

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-02414BG

Format:

Word;

PDF;

Rich Text

Instant download

Description

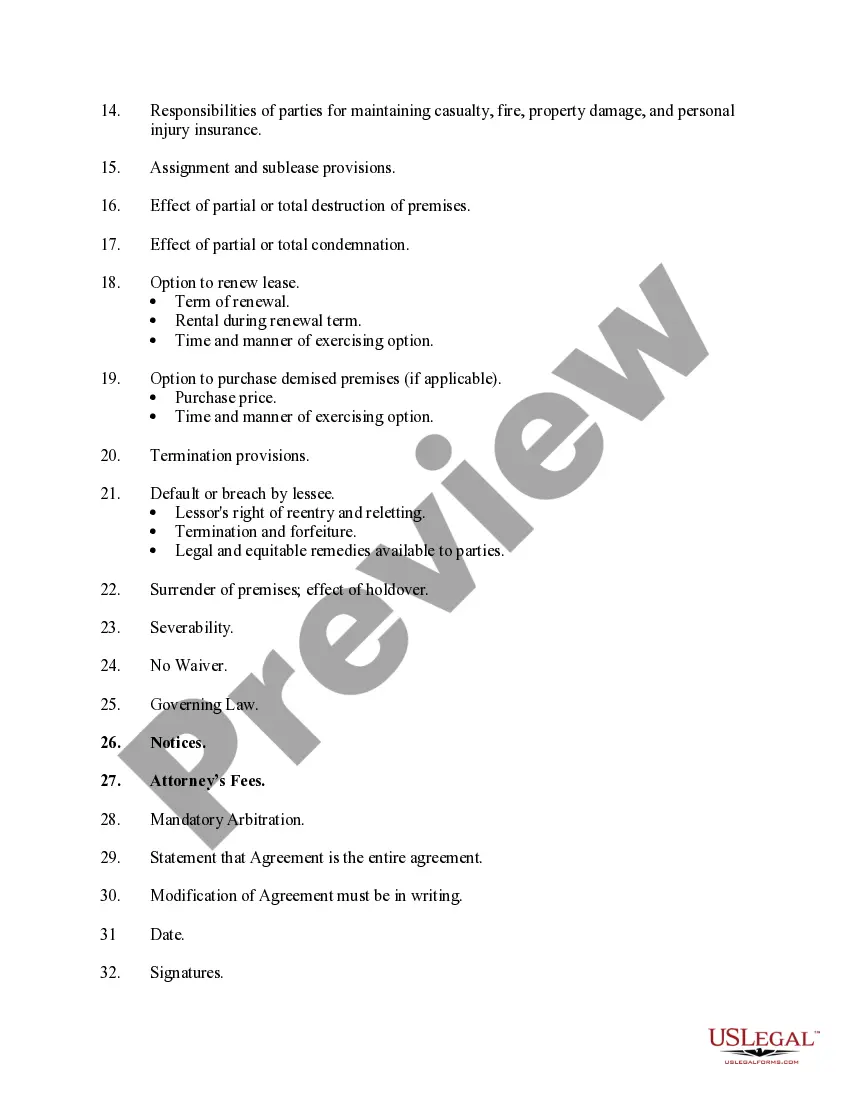

Checklist of Matters to be Considered in Drafting a Lease of a Commercial Building

Miami-Dade County is located in the southeastern part of Florida and is known for its vibrant culture, beautiful beaches, and bustling urban areas. When it comes to drafting a lease for a commercial building in Miami-Dade, there are several matters that both landlords and tenants need to consider. 1. Property Description: Start by providing a detailed description of the commercial building, including its address, size, layout, and any specific features or amenities. 2. Lease Term: Specify the length of the lease term, whether it's for a fixed period or a month-to-month basis, and include any provisions for renewal or termination. 3. Rent and Payment Terms: Define the base rent amount and any additional charges, such as common area maintenance fees or utilities. Clearly outline the payment schedule, method of payment, and any penalties for late payments. 4. Security Deposit: Determine the amount of the security deposit required and describe the conditions for its return or potential forfeiture. 5. Permitted Use: Specify the permitted use or business activities allowed within the commercial building. This could include any restrictions or limitations on certain types of businesses. 6. Maintenance and Repairs: Outline the responsibilities of both the landlord and tenant regarding maintenance, repairs, and improvements to the building. Clarify who will be responsible for major repairs or structural issues. 7. Alterations and Improvements: Discuss any limitations or requirements for making alterations or improvements to the premises, such as obtaining prior written consent from the landlord. 8. Insurance: Specify the types and amounts of insurance coverage required for the commercial building. This may include general liability insurance, property insurance, or worker's compensation coverage. 9. Indemnification: Include a provision that requires the tenant to indemnify and hold the landlord harmless from any claims, damages, or liabilities arising from the tenant's use of the premises. 10. Default and Termination: Define the conditions under which the lease can be terminated, either by the landlord or tenant, in the event of a default or breach of the lease agreement. Additional factors that may be relevant to consider when drafting a lease for a commercial building in Miami-Dade include zoning regulations, parking provisions, signage restrictions, environmental compliance, and compliance with the Americans with Disabilities Act (ADA) requirements. Different types of commercial building leases can also be categorized based on the purpose or usage, such as retail leases, office leases, industrial leases, and restaurant leases. Each type may have specific considerations and requirements that need to be addressed in the lease agreement.

Free preview