Dear [Recipient's Name], I hope this letter finds you in good health and high spirits. I am writing to provide detailed information about the procedure and requirements for obtaining an Ad Valor em Tax Exemption in Fairfax, Virginia. Our organization, [Organization's Name], is seeking exemption for our property located at [Property Address] in Fairfax, Virginia. We believe that our work aligns with the criteria established by the Fairfax County Tax Assessment Office for tax exemption eligibility. Fairfax, Virginia is a vibrant and prosperous community nestled in Northern Virginia. It is home to a diverse population and offers a multitude of opportunities for individuals, businesses, and organizations to thrive. The county has a robust economy, exceptional educational institutions, and a rich cultural heritage. From historical landmarks to modern developments, Fairfax offers a high quality of life to its residents. When it comes to property taxes, Fairfax County follows the ad valor em taxation system. Ad valor em tax is based on the value of the property in question, typically real estate or personal property. However, in certain instances, exemptions can be granted to organizations that meet specific requirements. There are several types of Ad Valor em Tax Exemptions available in Fairfax, Virginia. Here are some of the most common categories: 1. Religious Organizations: Religious institutions such as churches, mosques, synagogues, and temples may be eligible for tax exemption if they meet the criteria established by Virginia law and the Fairfax County Tax Assessment Office. 2. Charitable Organizations: Nonprofit organizations that operate exclusively for charitable, educational, or scientific purposes may be eligible for tax exemption. These organizations must prove that their activities and services primarily benefit the community. 3. Exemptions for Disabled Veterans: Fairfax County extends tax exemptions to qualifying disabled veterans and their immediate family members as a token of appreciation for their service to our country. 4. Government and Public Institutions: Government buildings, schools, and public parks may be exempt from Ad Valor em taxes. To initiate the process of obtaining an Ad Valor em Tax Exemption, we have enclosed all the necessary documents as outlined by the Fairfax County Tax Assessment Office. These documents include [list of relevant documents]. Additionally, we have completed the Fairfax Virginia Sample Letter for Ad Valor em Tax Exemption, which details our organization's mission, activities, financial information, and how we meet the required criteria for exemption. We kindly request that you review our application diligently and reach out to us if any further information or clarification is required. We understand that the process might be complex, and we greatly appreciate your assistance in navigating the application procedure. Thank you for your attention to this matter, and we look forward to a favorable response. Sincerely, [Your Name] [Organization's Name] [Contact Information]

Fairfax Virginia Sample Letter for Ad Valorem Tax Exemption

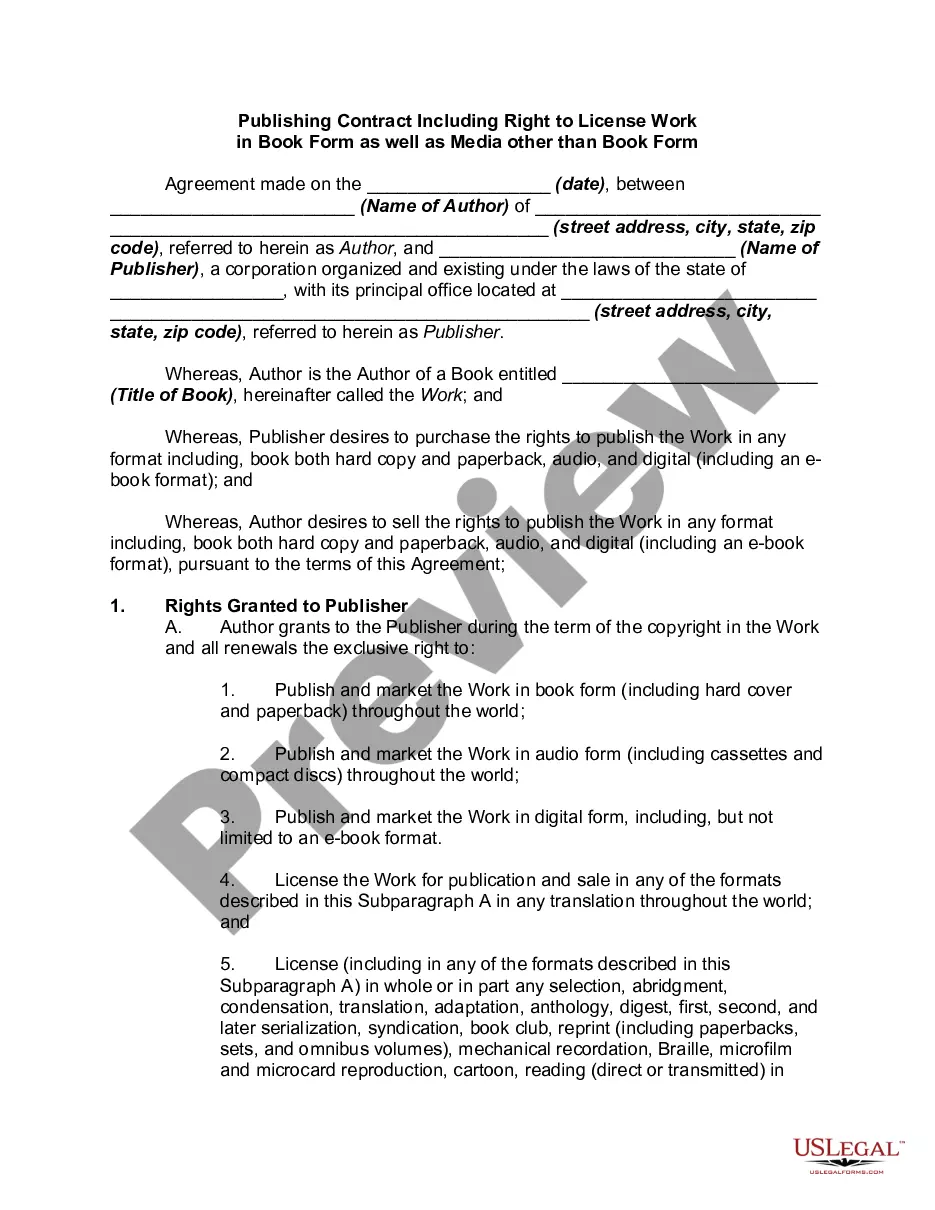

Description

How to fill out Fairfax Virginia Sample Letter For Ad Valorem Tax Exemption?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business purpose utilized in your region, including the Fairfax Sample Letter for Ad Valorem Tax Exemption.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Fairfax Sample Letter for Ad Valorem Tax Exemption will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to get the Fairfax Sample Letter for Ad Valorem Tax Exemption:

- Ensure you have opened the correct page with your local form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Fairfax Sample Letter for Ad Valorem Tax Exemption on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!