Title: Understanding Fulton, Georgia: A Comprehensive Guide to Ad Valor em Tax Exemption Introduction: Welcome to Fulton, Georgia, a vibrant county known for its bustling city of Atlanta and diverse communities. If you are a property owner in Fulton County seeking a tax exemption, this guide will provide you with detailed insights into the Ad Valor em Tax Exemption process. In this article, we will explore the different types of exemptions offered by Fulton County, Georgia. 1. Homestead Exemption: The Homestead Exemption is one of the most common and important forms of tax relief available to Fulton County homeowners. Under this exemption, eligible residents can receive a reduction in their property's assessed value, resulting in lower annual property taxes. To apply for this exemption, residents must submit a properly filled out Fulton Georgia Sample Letter for Ad Valor em Tax Exemption focusing on the Homestead Exemption. 2. Senior Citizen Exemption: Fulton County also provides an additional tax relief for senior citizens aged 65 and older. Similar to the Homestead Exemption, this senior citizen exemption aims to help elderly homeowners by reducing their property tax burden. Qualified individuals can apply for this exemption by submitting a Fulton Georgia Sample Letter for Ad Valor em Tax Exemption, specifically designed for the Senior Citizen Exemption. 3. Disabled Veterans Exemption: Fulton County acknowledges the sacrifices made by disabled veterans and offers them special tax exemptions. Disabled veterans who meet the eligibility criteria, including proof of disability, can apply for this exemption. The Fulton Georgia Sample Letter for Ad Valor em Tax Exemption for Disabled Veterans will help guide them through the application process. 4. Conservation Use Assessment Exemption: The Conservation Use Assessment Exemption encourages landowners to preserve their properties for conservation purposes by offering reduced property tax rates. If you own a large tract of land primarily used for farming, timber, or conservation activities, you may qualify for this exemption. Utilize the dedicated Fulton Georgia Sample Letter for Ad Valor em Tax Exemption for Conservation Use Assessment to apply. 5. Industrial Property Exemption: Fulton County provides tax incentives to businesses investing in industrial properties within the county. The Industrial Property Exemption exempts eligible properties from certain property taxes to promote economic growth and job creation. The Fulton Georgia Sample Letter for Ad Valor em Tax Exemption for Industrial Property Exemption will assist business owners throughout the application process. Conclusion: In conclusion, Fulton, Georgia supports various Ad Valor em Tax Exemptions to ease the tax burden on property owners. Whether you are a homeowner, senior citizen, disabled veteran, or business owner, understanding the available exemptions is crucial. By utilizing the appropriate Fulton Georgia Sample Letter for Ad Valor em Tax Exemption, you can ensure a smooth application process and potentially reduce your property tax obligations.

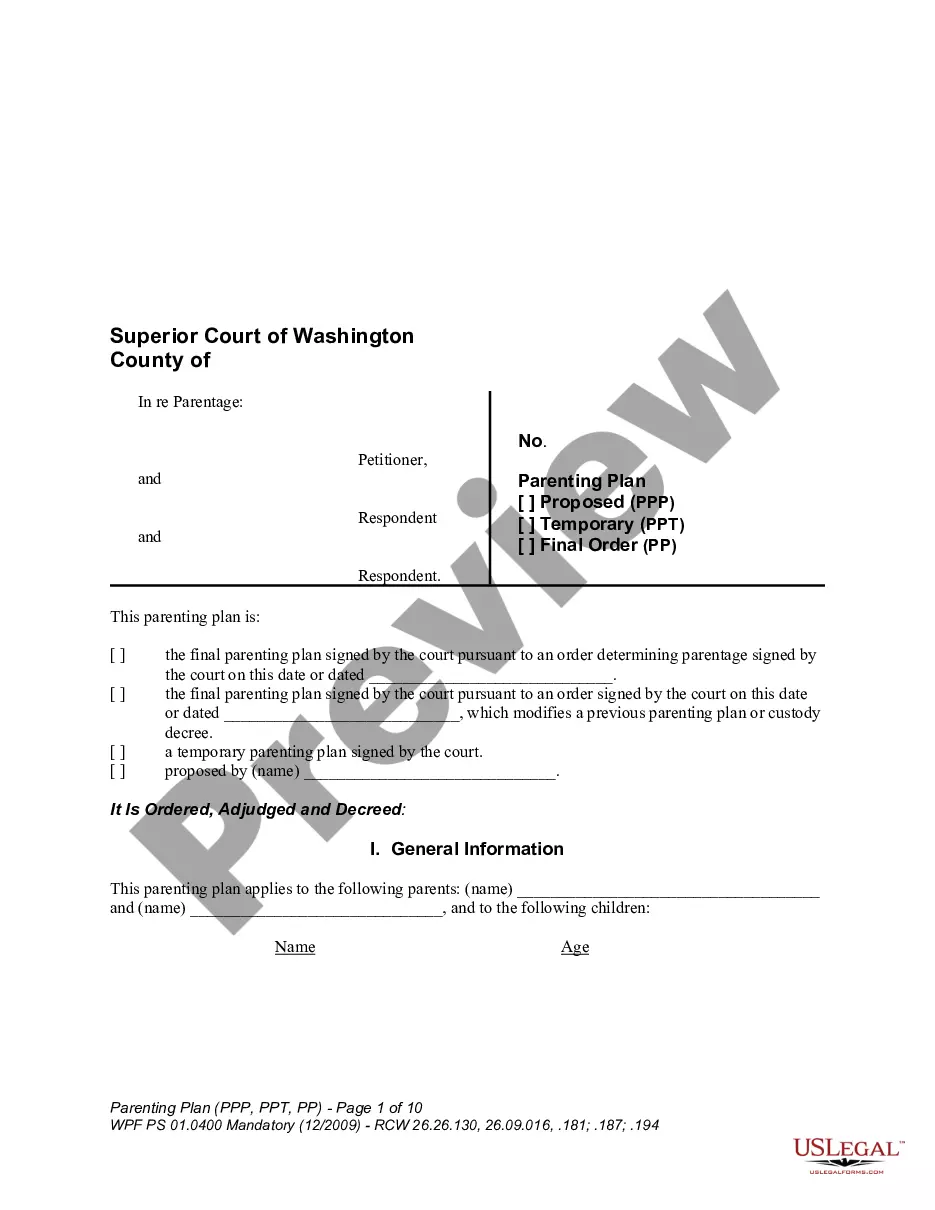

Fulton Georgia Sample Letter for Ad Valorem Tax Exemption

Description

How to fill out Fulton Georgia Sample Letter For Ad Valorem Tax Exemption?

If you need to get a trustworthy legal paperwork provider to obtain the Fulton Sample Letter for Ad Valorem Tax Exemption, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can select from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support team make it simple to locate and execute different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply select to look for or browse Fulton Sample Letter for Ad Valorem Tax Exemption, either by a keyword or by the state/county the document is intended for. After locating required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Fulton Sample Letter for Ad Valorem Tax Exemption template and check the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Register an account and select a subscription option. The template will be instantly ready for download as soon as the payment is processed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes this experience less costly and more affordable. Set up your first business, organize your advance care planning, draft a real estate contract, or execute the Fulton Sample Letter for Ad Valorem Tax Exemption - all from the comfort of your home.

Join US Legal Forms now!