Title: Simplify your Tax Exemption Process with Maricopa Arizona Sample Letter for Ad Valor em Tax Exemption Introduction: Ad Valor em tax exemption is a boon for property owners in Maricopa, Arizona. By understanding and leveraging this benefit, individuals can significantly reduce their tax burdens. To facilitate this process, below are detailed descriptions of Maricopa Arizona Sample Letters for Ad Valor em Tax Exemption, which you can easily customize to suit your specific needs. 1. Maricopa Arizona Sample Letter for New Homeowners: If you have recently purchased a property in Maricopa, Arizona, you may qualify for Ad Valor em tax exemption as a new homeowner. This sample letter provides a clear structure and language to request tax exemption based on your recent property purchase. 2. Maricopa Arizona Sample Letter for Age-Based Exemption: Age-based exemption is available for individuals who meet certain age criteria and own property in Maricopa, Arizona. This sample letter is designed for property owners who qualify for the age-based exemption, allowing them to request tax exemption based on their age. 3. Maricopa Arizona Sample Letter for Disabled Veterans: Arizona provides Ad Valor em tax exemption for disabled veterans who have suffered permanent service-connected disabilities. This sample letter caters to disabled veterans residing in Maricopa, helping them initiate the process for tax exemption by providing essential details and documentation requirements. 4. Maricopa Arizona Sample Letter for Senior Citizens: Senior citizens who are 65 years or older are eligible for an additional tax exemption. Property owners in Maricopa, Arizona, falling under this category can make use of this sample letter to request tax exemption, providing necessary evidence of their age and property ownership. 5. Maricopa Arizona Sample Letter for Charitable Organizations: Non-profit charitable organizations registered in Maricopa, Arizona, can apply for Ad Valor em tax exemption. This sample letter assists these organizations in making a formal request for tax exemption, showcasing their philanthropic work and providing the required documentation. 6. Maricopa Arizona Sample Letter for Religious Institutions: Religious institutions within Maricopa County can also apply for Ad Valor em tax exemption. This sample letter guides religious leaders or administrators in seeking tax exemption status while emphasizing the community services provided, along with relevant legal documentation. Conclusion: Understanding the Ad Valor em tax exemption process is crucial for property owners in Maricopa, Arizona, keen on reducing their tax obligations. These Maricopa Arizona Sample Letters for Ad Valor em Tax Exemption offer pre-drafted templates to assist different groups, such as new homeowners, senior citizens, disabled veterans, charities, and religious organizations, in initiating the tax exemption process effectively. Customize these sample letters with your specific details and evidence to simplify your tax exemption journey and optimize your financial resources.

Maricopa Arizona Sample Letter for Ad Valorem Tax Exemption

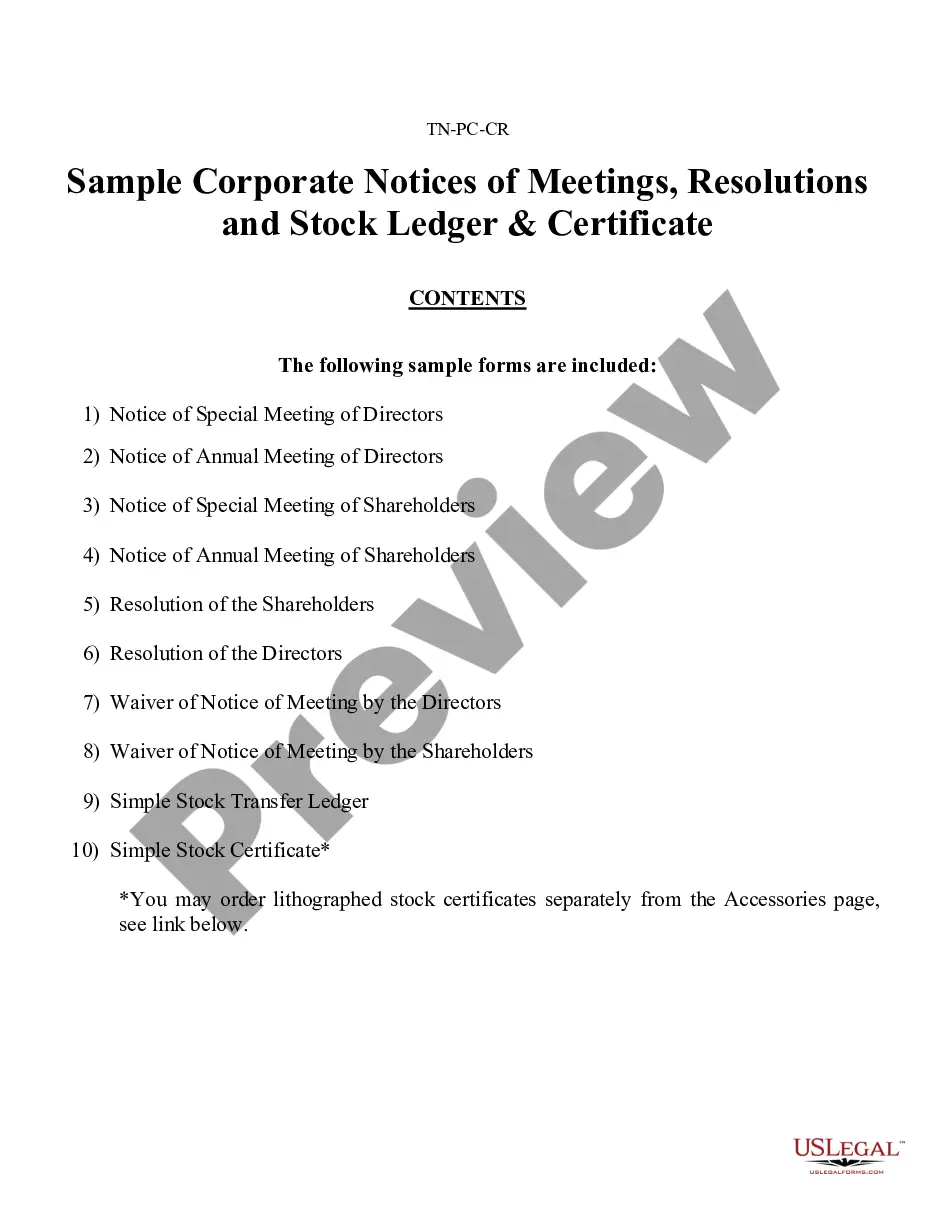

Description

How to fill out Maricopa Arizona Sample Letter For Ad Valorem Tax Exemption?

Creating forms, like Maricopa Sample Letter for Ad Valorem Tax Exemption, to manage your legal matters is a challenging and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal matters into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms crafted for various cases and life situations. We ensure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Maricopa Sample Letter for Ad Valorem Tax Exemption template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before downloading Maricopa Sample Letter for Ad Valorem Tax Exemption:

- Make sure that your form is specific to your state/county since the rules for writing legal paperwork may differ from one state another.

- Find out more about the form by previewing it or reading a quick description. If the Maricopa Sample Letter for Ad Valorem Tax Exemption isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to begin using our website and download the form.

- Everything looks great on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is ready to go. You can try and download it.

It’s an easy task to locate and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!