A Suffolk New York Notice of Default under Security Agreement in the Purchase of a Mobile Home is a legal document that is issued when a borrower fails to meet their obligations outlined in a security agreement for the purchase of a mobile home in Suffolk County, New York. This notice serves as a formal notification to the borrower that they are in default and must take immediate action to rectify the situation. The Notice of Default under Security Agreement is an important step in the foreclosure process, which allows the lender or financing institution to pursue legal remedies to recover the outstanding debt owed by the borrower. It is crucial for both parties involved to understand the implications and consequences of this notice. Some common types of Suffolk New York Notice of Default under Security Agreement in Purchase of Mobile Home include: 1. Payment Default: This occurs when the borrower fails to make timely payments as agreed upon in the security agreement. The lender will issue a notice of default, specifying the missed payments and the outstanding amount due. 2. Insurance Default: By defaulting on insurance payments or failing to maintain adequate insurance coverage for the mobile home, the borrower breaches the security agreement. The lender may issue a notice of default to address this violation. 3. Maintenance Default: Any failure by the borrower to properly maintain the mobile home, resulting in significant damage or depreciation, can be considered a default under the security agreement. The lender has the right to issue a notice of default if the borrower neglects their responsibility in this regard. 4. Tax Default: Failure to pay property taxes on the mobile home can also result in a notice of default. The lender may take action to protect their interests when the borrower breaches their obligations related to property tax payments. When served with a Suffolk New York Notice of Default under Security Agreement in Purchase of Mobile Home, the borrower should seek legal advice immediately. They must understand their rights and options for resolving the default, such as repayment plans, loan modifications, or other alternatives to foreclosure. Failure to address the default may ultimately lead to the lender initiating legal proceedings to repossess the mobile home. In conclusion, a Suffolk New York Notice of Default under Security Agreement in Purchase of Mobile Home is a critical document serving as a formal notification to a borrower who has defaulted on their mobile home purchase agreement. It is essential for both the lender and borrower to comprehend the implications and seek legal guidance to navigate this situation effectively.

Suffolk New York Notice of Default under Security Agreement in Purchase of Mobile Home

Description

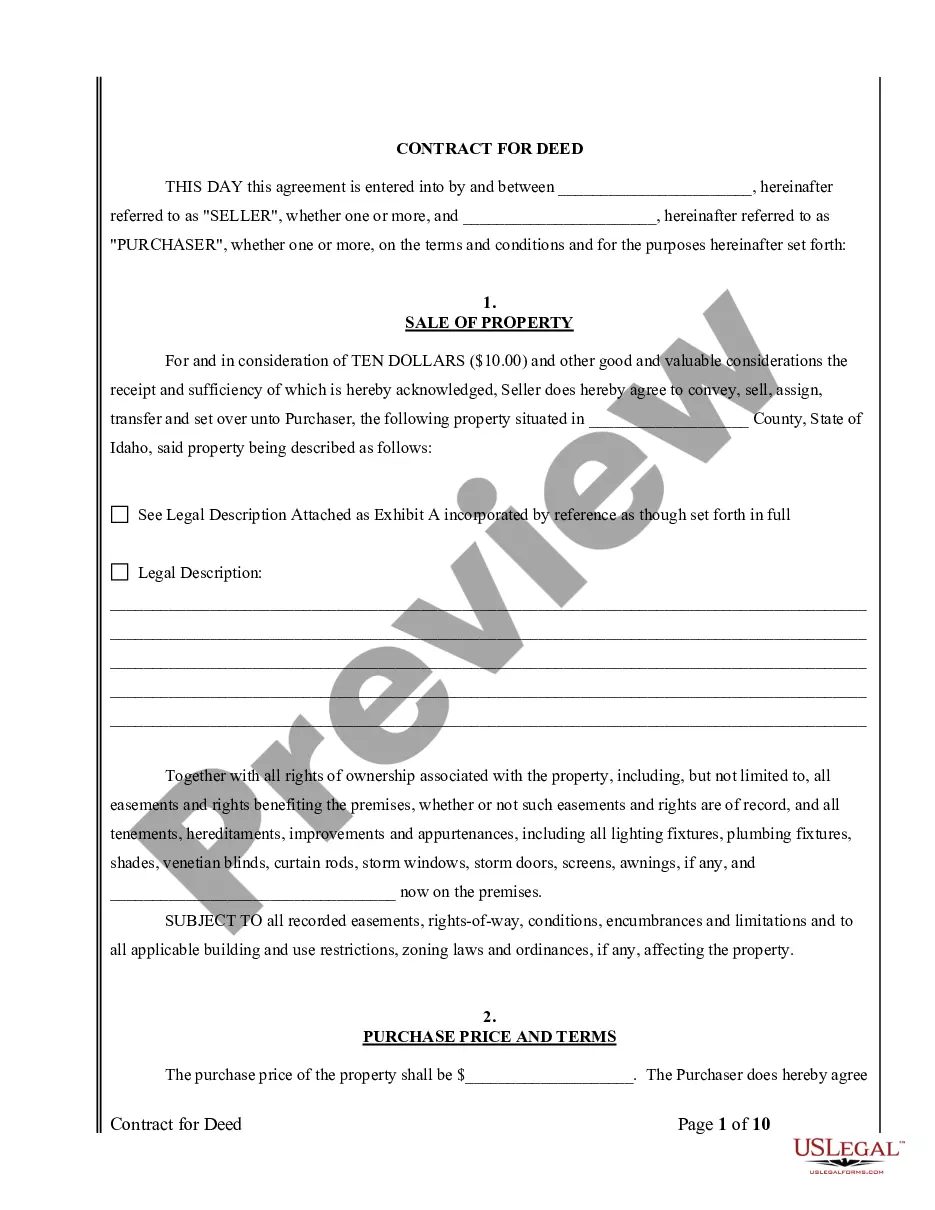

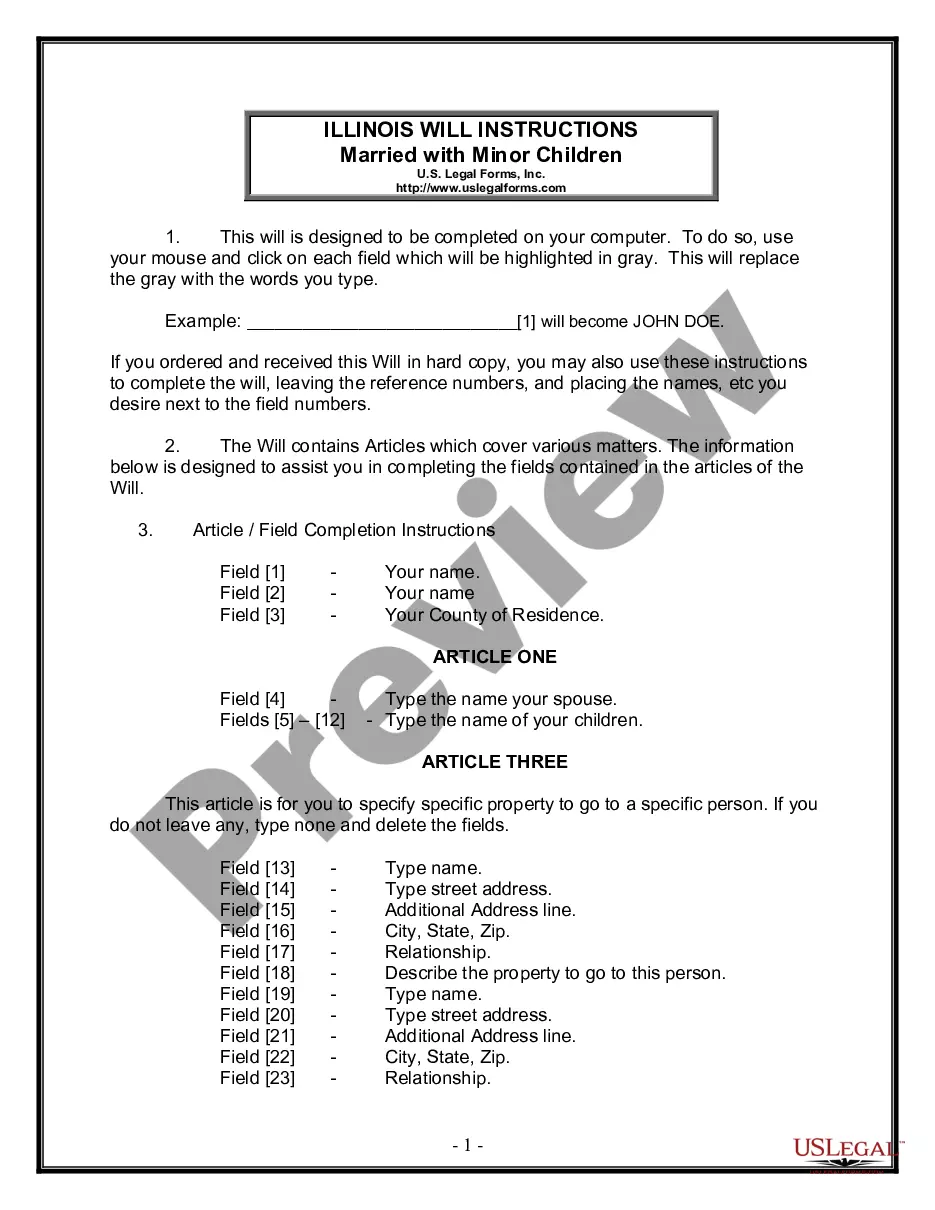

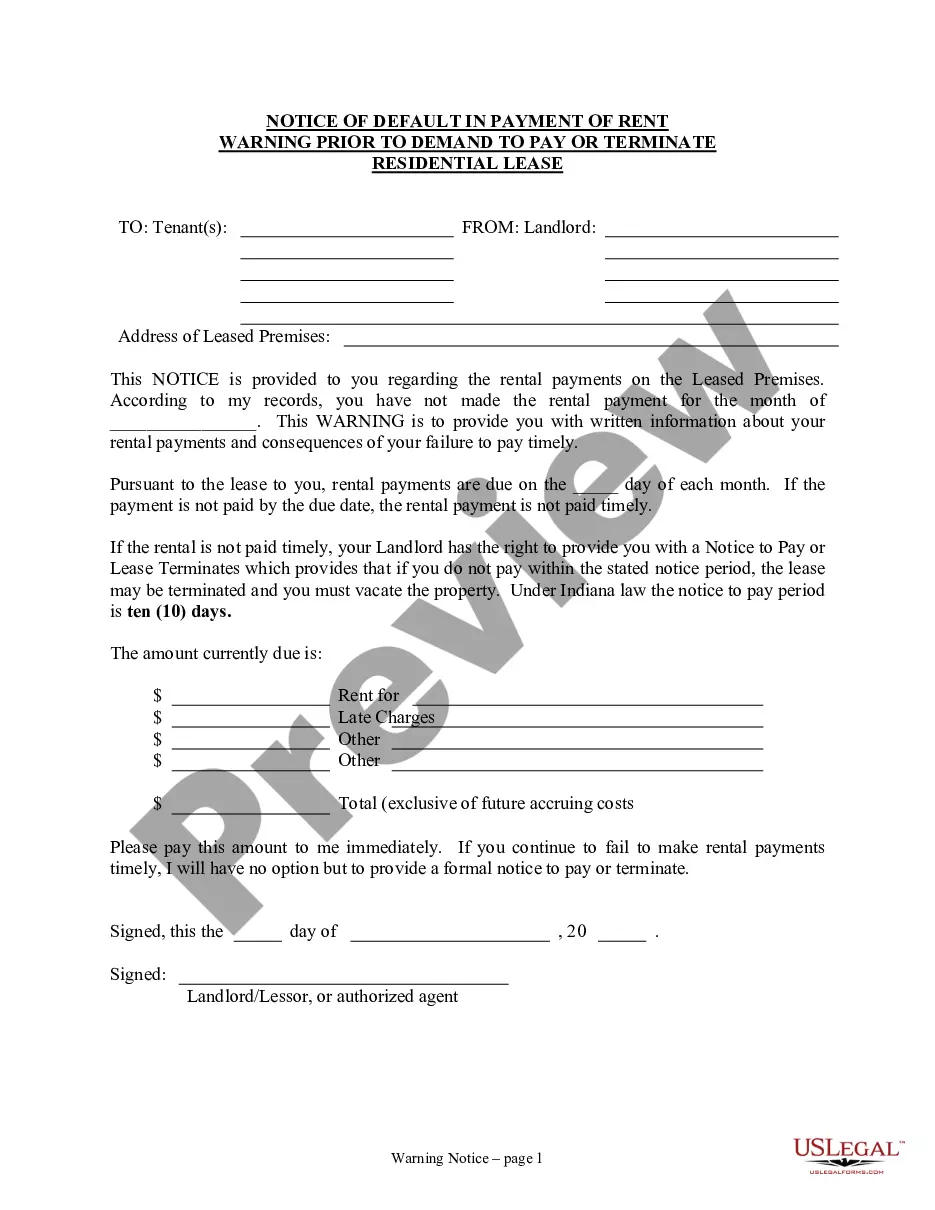

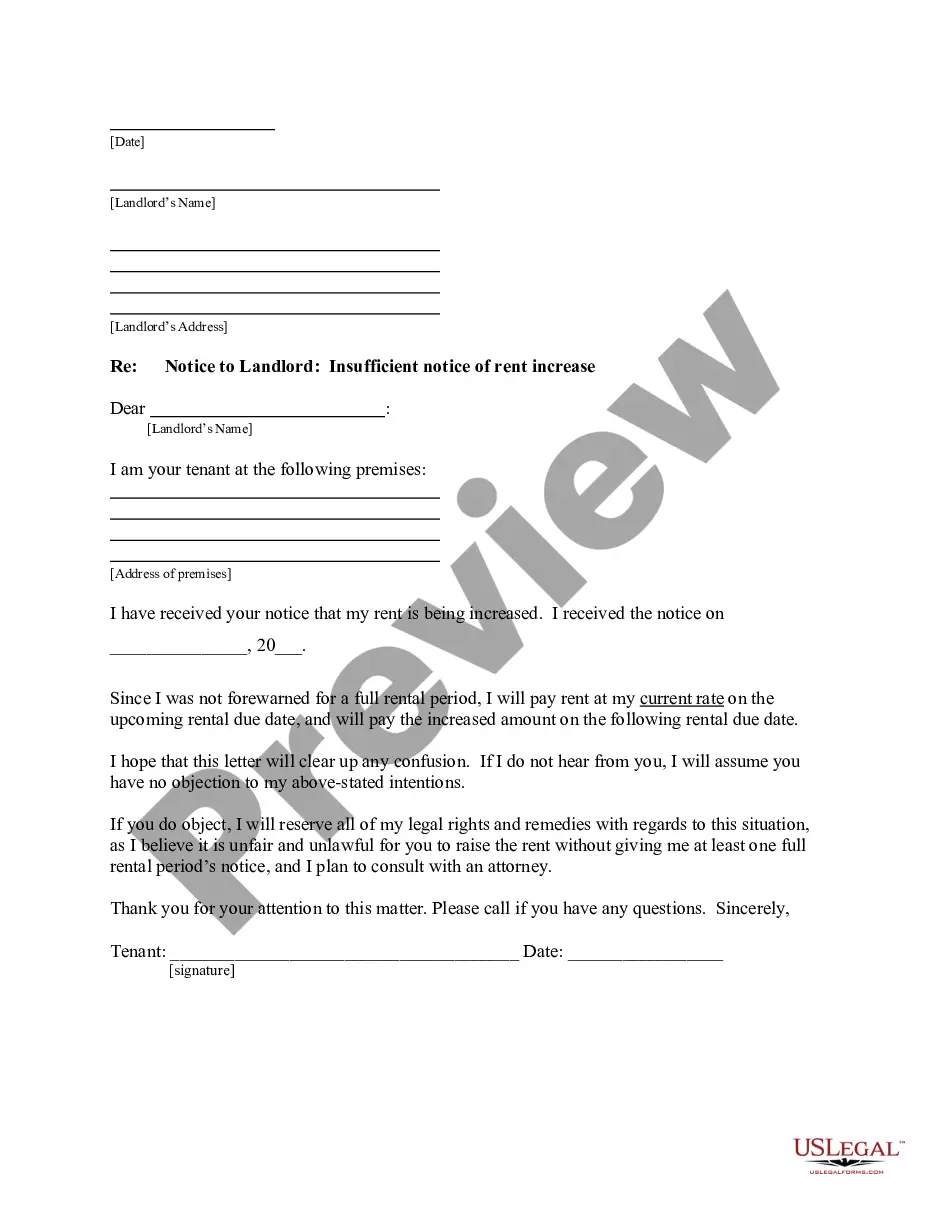

How to fill out Suffolk New York Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

Whether you plan to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business case. All files are grouped by state and area of use, so picking a copy like Suffolk Notice of Default under Security Agreement in Purchase of Mobile Home is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Suffolk Notice of Default under Security Agreement in Purchase of Mobile Home. Adhere to the instructions below:

- Make sure the sample meets your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Notice of Default under Security Agreement in Purchase of Mobile Home in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!