Fairfax Virginia Demand for Payment of an Open Account by Creditor is a legal document issued by a creditor in Fairfax, Virginia, ordering the debtor to pay an outstanding balance on an open account. This document serves as a formal request for payment and highlights the creditor’s intent to take legal action if the debt remains unpaid. Keywords: Fairfax Virginia, Demand for Payment, Open Account, Creditor, Legal document, Outstanding balance, Formal request, Legal action. There are different types of Fairfax Virginia Demand for Payment of an Open Account by Creditor, namely: 1. Standard Fairfax Virginia Demand for Payment: This is the most common type of demand, used when a debtor fails to make timely payments on an open account. It outlines the amount owed, due dates, and instructs the debtor to remit payment immediately. 2. Final Fairfax Virginia Demand for Payment: This type of demand serves as a final notice before legal action is taken. It warns the debtor of potential consequences, such as damaging their credit score or initiating a lawsuit if the outstanding balance is not settled promptly. 3. Fairfax Virginia Demand for Payment by Certified Mail: When a creditor wants to ensure a documented proof of delivery, they can send the demand for payment via certified mail. This method gives the creditor an additional level of evidence if further legal action is necessary. 4. Fairfax Virginia Demand for Payment with Intent to Sue: If the debtor continues to ignore previous demands for payment, the creditor may issue a demand letter with a clear statement of intent to initiate a lawsuit if the debt remains unpaid. It emphasizes the creditor's preparedness to go to court to recover the owed amount. 5. Fairfax Virginia Demand for Payment with Offer of Settlement: In some cases, a creditor may be open to negotiating a settlement or a payment plan to resolve the debt. This type of demand acknowledges the debtor's financial difficulties but emphasizes the need for immediate action to address the outstanding balance. It is important for both creditors and debtors in Fairfax, Virginia, to familiarize themselves with the specific regulations and legal requirements when it comes to demanding payment for open accounts. Seeking professional legal advice is recommended to ensure compliance and protect one's rights during the debt collection process.

Fairfax Virginia Demand for Payment of an Open Account by Creditor

Description

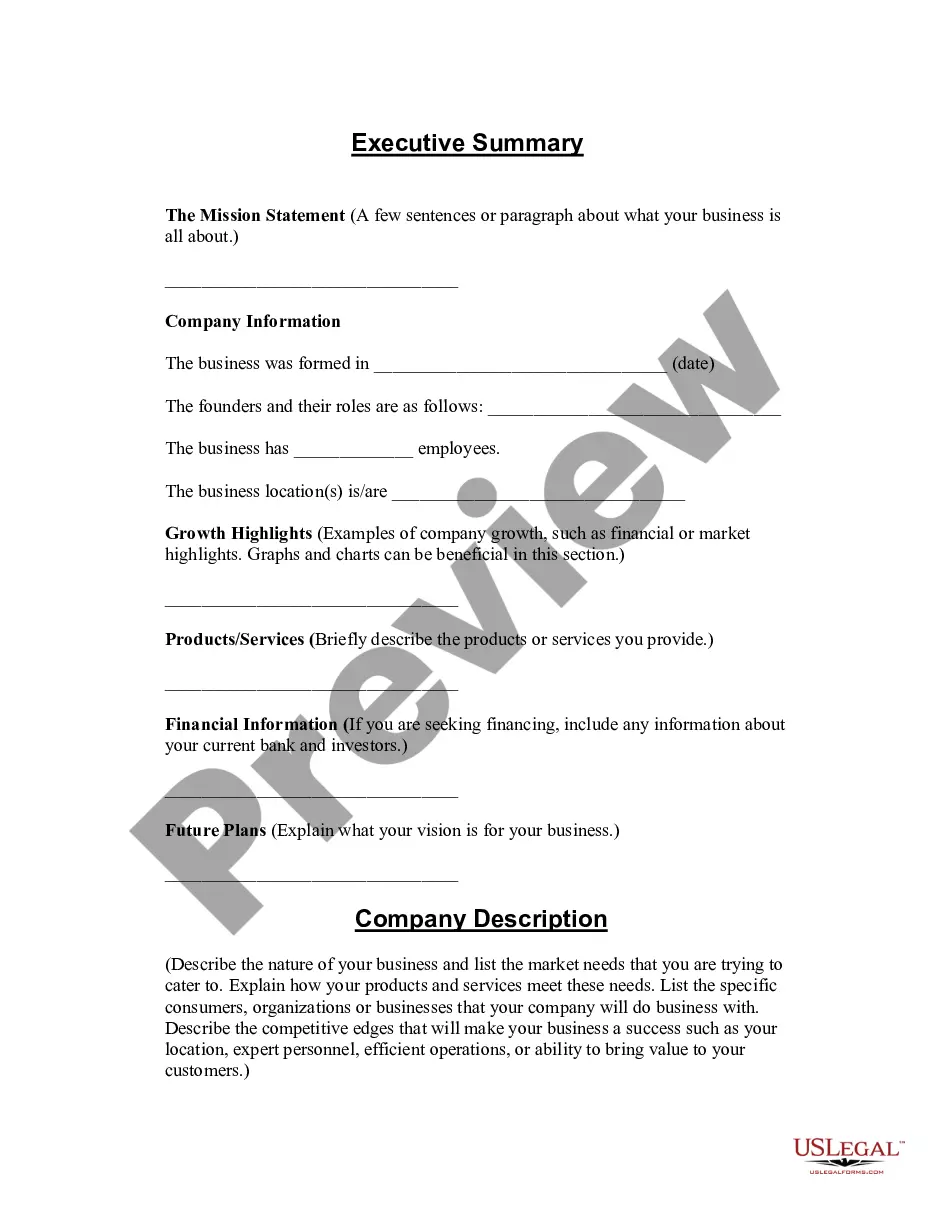

How to fill out Fairfax Virginia Demand For Payment Of An Open Account By Creditor?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a lawyer to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Fairfax Demand for Payment of an Open Account by Creditor, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case accumulated all in one place. Therefore, if you need the current version of the Fairfax Demand for Payment of an Open Account by Creditor, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Fairfax Demand for Payment of an Open Account by Creditor:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Fairfax Demand for Payment of an Open Account by Creditor and save it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!