Maricopa, Arizona Demand for Payment of an Open Account by Creditor: A Comprehensive Overview In Maricopa, Arizona, a demand for payment of an open account by a creditor is a legal document that asserts a creditor's right to receive payment from a debtor for goods or services provided. This written notice calls upon the debtor to repay the outstanding debt in a specified time frame to avoid further legal action. Keywords: Maricopa, Arizona, demand for payment, open account, creditor, legal document, debtor, outstanding debt, specified time frame, legal action. Types of Maricopa, Arizona Demand for Payment of an Open Account by Creditor: 1. Simple Demand for Payment: This type of demand is a straightforward notice that informs the debtor of the outstanding debt and requests immediate repayment. It outlines the amount owed, the due date, and provides payment instructions. 2. Final Demand for Payment: A final demand for payment is typically sent after previous requests have been ignored or when the creditor believes the debtor has no valid reason for non-payment. This notice emphasizes that failure to settle the debt within a specified period may result in legal action. 3. Demand for Payment with Interest: Some creditors may add interest charges to the outstanding debt if the debtor fails to pay within the specified time frame. This type of demand for payment includes details about the interest rate, calculation method, and any applicable penalties for non-payment. 4. Demand for Payment with Late Payment Fees: In certain cases, creditors may also include late payment fees in their demand for payment. These fees are applied when the debtor fails to adhere to the agreed-upon payment terms and can be specified in the demand notice. 5. Final Legal Notice: If the debtor continues to neglect their payment obligations even after receiving previous demands, a final legal notice may be sent. This notice warns the debtor about potential legal consequences, such as litigation, credit damage, or asset seizure if the debt remains unpaid. It's important for both debtors and creditors to understand the implications and legal aspects surrounding the demand for payment of an open account. Seeking professional advice from an attorney or a debt collection agency specializing in Maricopa, Arizona, can ensure compliance with local laws and increase the chances of successful debt recovery.

Maricopa Arizona Demand for Payment of an Open Account by Creditor

Description

How to fill out Maricopa Arizona Demand For Payment Of An Open Account By Creditor?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Maricopa Demand for Payment of an Open Account by Creditor, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Maricopa Demand for Payment of an Open Account by Creditor from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Maricopa Demand for Payment of an Open Account by Creditor:

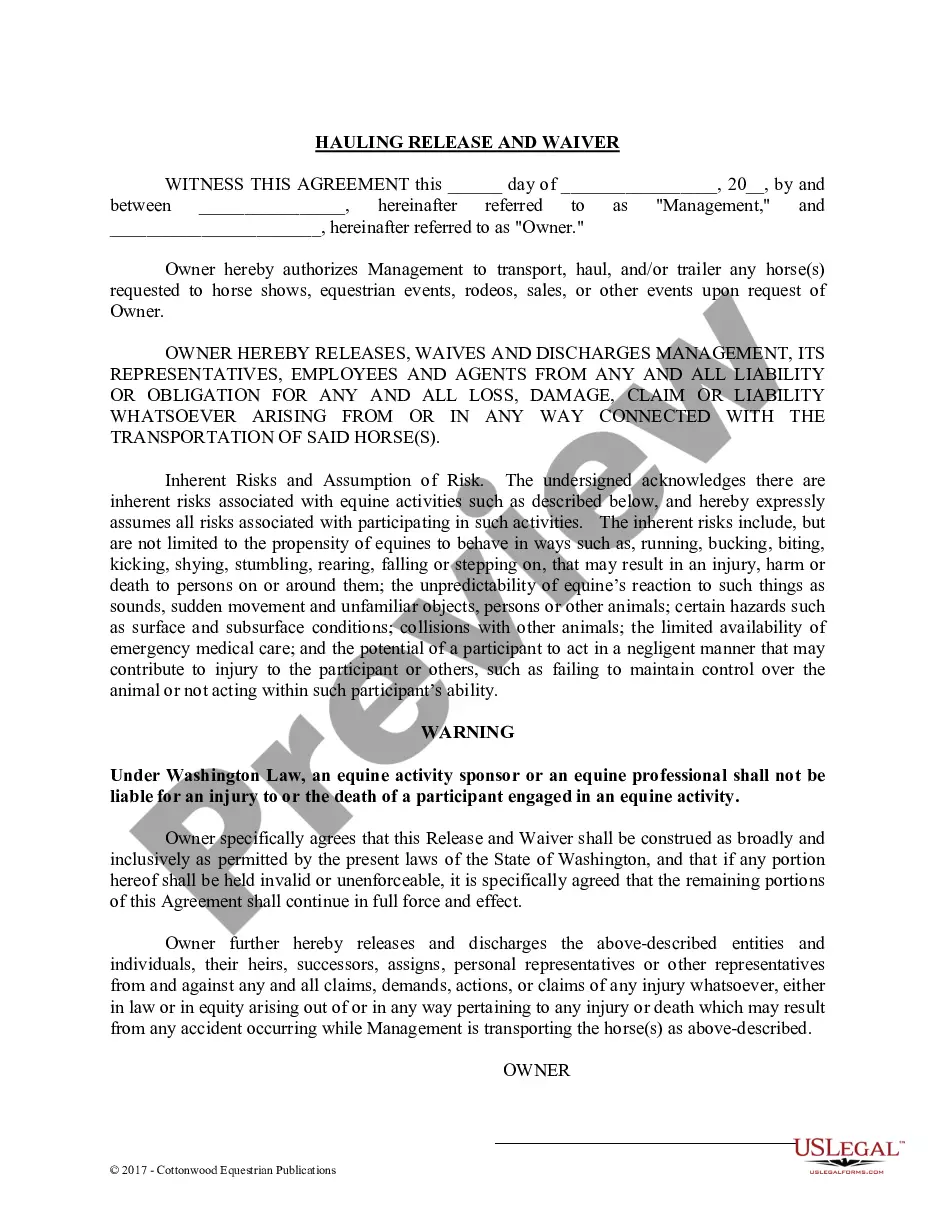

- Analyze the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!