Orange California Demand for Payment of an Open Account by Creditor is a legal document typically used by creditors to demand payment for an unpaid open account from debtors residing in Orange, California. This document serves as a formal notification to debtors to settle their outstanding balances promptly. Keywords: Orange California, Demand for Payment, Open Account, Creditor Types of Orange California Demand for Payment of an Open Account by Creditor: 1. Orange California Demand for Payment of an Open Account by Creditor for Services: This type of demand letter is used when a creditor provides services to a debtor, such as professional services, repairs, or maintenance, and the debtor has not made the agreed-upon payments. 2. Orange California Demand for Payment of an Open Account by Creditor for Goods: When a debtor fails to pay for goods purchased from a creditor in Orange, California, this type of demand letter can be issued. It typically applies to scenarios where the creditor has supplied tangible products but has not received payment. 3. Orange California Demand for Payment of an Open Account by Creditor for Unpaid Invoices: This type of demand letter is sent when a debtor has overdue invoices with a creditor in Orange, California. It serves as a formal request for payment of the outstanding invoice amounts. 4. Orange California Demand for Payment of an Open Account by Creditor for Loans: When a creditor lends money to a debtor based on an open account arrangement, this type of demand letter can be used if the debtor fails to repay the borrowed funds according to the agreed terms. 5. Orange California Demand for Payment of an Open Account by Creditor for Professional Fees: This specific type of demand letter is applicable when a debtor has not made the required payments for professional services rendered by the creditor, such as legal or accounting services, consulting, or advisory work. Each type of demand for payment of an open account by the creditor is personalized based on the specific financial arrangement between the creditor and debtor and must comply with the applicable local and state laws governing debt collection practices. It is essential for the creditor to include relevant details, such as the outstanding balance, the due date, and any interest or late payment charges in the demand letter to assert their rights and urge the debtor to settle the debt promptly.

Orange California Demand for Payment of an Open Account by Creditor

Description

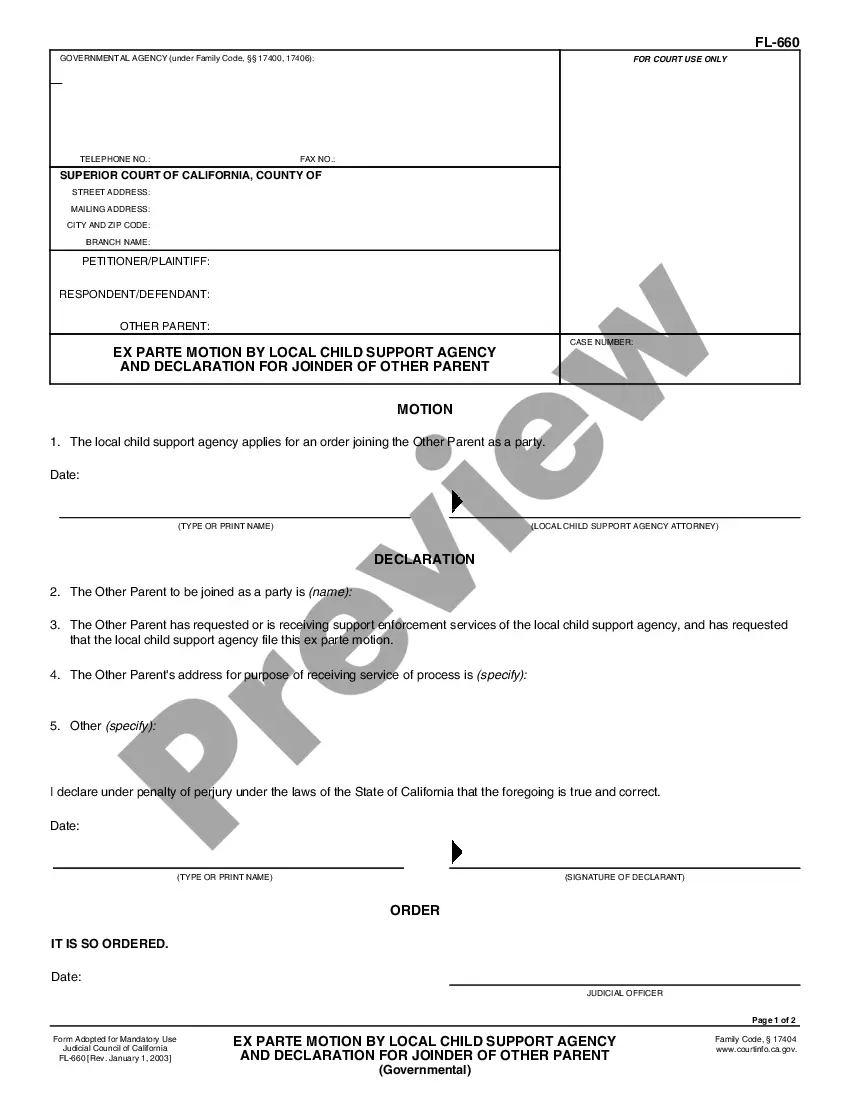

How to fill out Orange California Demand For Payment Of An Open Account By Creditor?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Orange Demand for Payment of an Open Account by Creditor, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various categories ranging from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find detailed resources and guides on the website to make any activities related to paperwork completion simple.

Here's how you can find and download Orange Demand for Payment of an Open Account by Creditor.

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can impact the legality of some records.

- Check the similar document templates or start the search over to locate the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and buy Orange Demand for Payment of an Open Account by Creditor.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Orange Demand for Payment of an Open Account by Creditor, log in to your account, and download it. Of course, our platform can’t replace a legal professional completely. If you have to cope with an extremely challenging situation, we recommend getting a lawyer to check your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-compliant documents with ease!