Maricopa, Arizona Buy-Sell Agreement between Shareholders of a Closely Held Corporation is a legally binding contract that regulates the transfer of shares in a corporation between its shareholders. This agreement is crucial for establishing clear guidelines and protecting the interests of all parties involved in the ownership and management of the corporation. A Maricopa Arizona Buy-Sell Agreement outlines the terms and conditions under which shareholders can buy or sell their shares, ensuring a fair and orderly process that minimizes friction and potential conflicts. By addressing specific scenarios such as death, disability, retirement, or voluntary exit, this agreement provides a comprehensive framework for handling the transfer of ownership. There are different types of Maricopa Arizona Buy-Sell Agreements between Shareholders of a Closely Held Corporation that cater to varying circumstances and objectives. Some of these types include: 1. Cross-Purchase Agreement: In this type of agreement, individual shareholders agree to buy the shares of a departing shareholder. Each remaining shareholder has the right and obligation to purchase a proportionate share of the departing shareholder's stake in the corporation. The purchase price is usually determined by a predetermined formula or through independent valuation. 2. Stock Redemption Agreement: Under this arrangement, the corporation itself buys back the shares of a departing shareholder. The corporation is obligated to redeem the shares at a predetermined price, ensuring a seamless transition while maintaining control within the company. 3. Hybrid Buy-Sell Agreement: This agreement combines elements of both cross-purchase and stock redemption agreements. Typically, the decision of whether the remaining shareholders or the corporation will purchase the departing shareholder's shares depends on certain triggering events, such as retirement, disability, or termination of employment. To make the Maricopa Arizona Buy-Sell Agreement effective, shareholders should carefully consider and include various key provisions, such as: — Purchase price determination: Clearly define how the purchase price will be determined or the valuation method to be used, whether through a formula, third-party appraisal, or fixed value. — Restrictions on transfers: Set forth any limitations regarding the sale or transfer of shares to parties outside the existing shareholders or the corporation, protecting the integrity and stability of the closely held corporation. — Option exercise and notice period: Establish the method by which shareholders must exercise their right to buy or sell their shares within a specified timeframe, ensuring prompt action and a smooth transaction process. — Funding mechanisms: Detail the means by which the purchase price will be funded, such as through cash, installment payments, or life insurance policies. — Dispute resolution: Include provisions for resolving any disputes that may arise during the implementation of the agreement, such as through mediation, arbitration, or litigation. A well-drafted Maricopa Arizona Buy-Sell Agreement between Shareholders of a Closely Held Corporation is essential for preserving the stability and continuity of the corporation in the face of ownership changes. Seeking legal advice from experienced professionals in Maricopa, Arizona is crucial to ensure that the agreement fully reflects the specific needs and goals of the closely held corporation and its shareholders.

Maricopa Arizona Buy-Sell Agreement between Shareholders of Closely Held Corporation

Description

How to fill out Maricopa Arizona Buy-Sell Agreement Between Shareholders Of Closely Held Corporation?

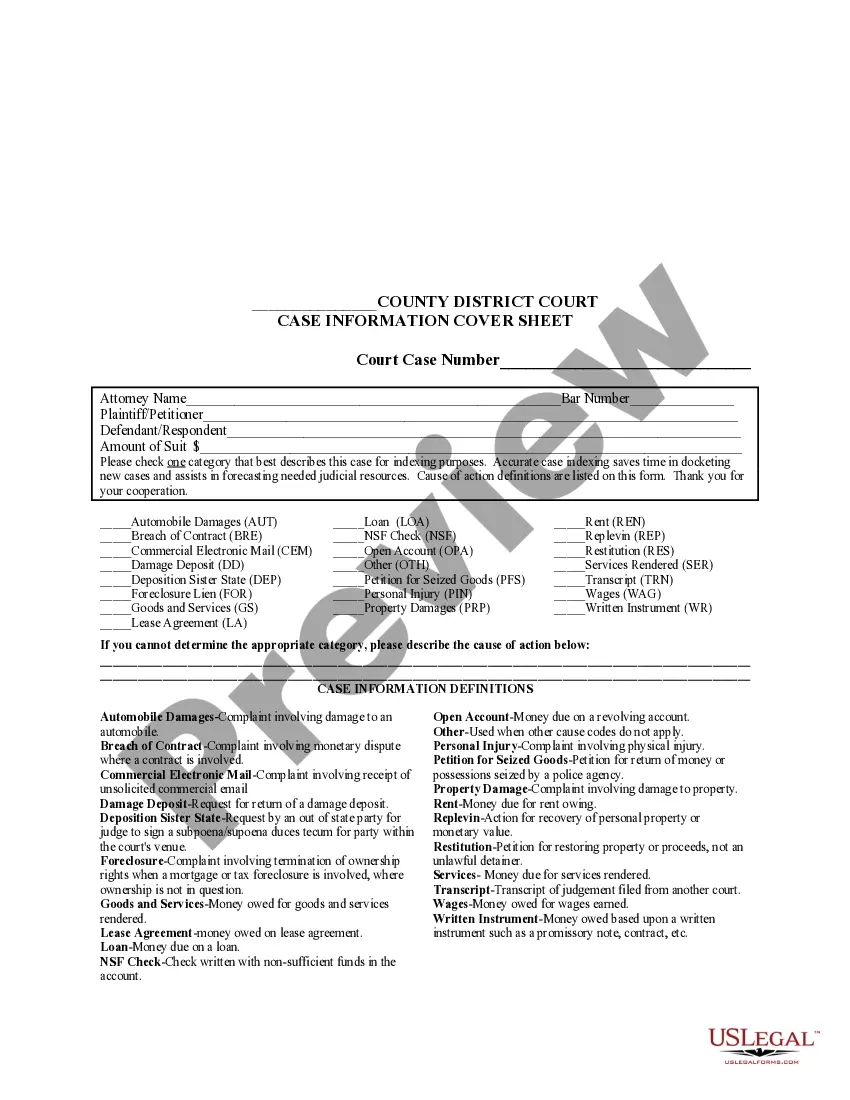

If you need to find a trustworthy legal document provider to get the Maricopa Buy-Sell Agreement between Shareholders of Closely Held Corporation, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can search from over 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support team make it simple to locate and execute various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply select to search or browse Maricopa Buy-Sell Agreement between Shareholders of Closely Held Corporation, either by a keyword or by the state/county the document is intended for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Maricopa Buy-Sell Agreement between Shareholders of Closely Held Corporation template and take a look at the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be immediately ready for download once the payment is completed. Now you can execute the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes these tasks less pricey and more affordable. Set up your first company, organize your advance care planning, draft a real estate agreement, or execute the Maricopa Buy-Sell Agreement between Shareholders of Closely Held Corporation - all from the convenience of your sofa.

Sign up for US Legal Forms now!