Miami-Dade Florida Buy-Sell Agreement between Shareholders of Closely Held Corporation A Miami-Dade Florida Buy-Sell Agreement between Shareholders of a Closely Held Corporation is a legally binding contract that outlines the terms and conditions for the buying and selling of shares in a closely held corporation in Miami-Dade County, Florida. In a closely held corporation, the ownership is limited and typically held by a few shareholders. This type of agreement is essential to establish a clear framework for the transfer of shares and the protection of shareholders' interests in case of certain triggering events, such as death, disability, retirement, or voluntary departure of a shareholder. Key provisions that should be included in a Miami-Dade Florida Buy-Sell Agreement are: 1. Purchase Price: The agreement defines the method of valuing the shares, such as using an agreed-upon formula, independent appraisal, or other mutually acceptable methods. 2. Triggering Events: The agreement identifies the events that will trigger a buyout, such as death, disability, retirement, or voluntary departure, and specifies the procedures to be followed in each case. 3. Right of First Refusal: This provision grants the remaining shareholders the first opportunity to purchase the shares from the departing or deceased shareholder before they are sold to a third party. 4. Mandatory Buyout: In some cases, the agreement may require the mandatory buyout of shares from a shareholder who has triggered a specific triggering event. This ensures an orderly transition of shares and protects the corporation from having unwanted or incompatible shareholders. 5. Funding Mechanism: The agreement may establish a funding mechanism, such as life insurance, installment payments, or a sinking fund, to ensure that the necessary funds are available to execute the buyout without putting a financial burden on the corporation or remaining shareholders. Different types of Miami-Dade Florida Buy-Sell Agreements between Shareholders of Closely Held Corporations may include: 1. Cross-Purchase Buy-Sell Agreement: In this type of agreement, each shareholder agrees to purchase the shares of the departing shareholder directly. This can be advantageous when there are only a few shareholders and the ownership structure is not too complex. 2. Stock Redemption Buy-Sell Agreement: In this type of agreement, the corporation agrees to purchase the shares of the departing shareholder. The advantage is that the corporation can use its own funds to execute the buyout, eliminating the need for individual shareholders to come up with the purchase price. 3. Hybrid Buy-Sell Agreement: This type of agreement combines elements of both the cross-purchase and stock redemption agreements. It provides flexibility by allowing shareholders to choose whether they want to buy shares individually or have the corporation buy them. By having a Miami-Dade Florida Buy-Sell Agreement between Shareholders of a Closely Held Corporation, shareholders can ensure a smooth transition of ownership, protect their investments, and avoid potential disputes or unwanted third-party ownership. Consulting with a knowledgeable attorney is advised to draft an agreement tailored to the specific needs and circumstances of the corporation and its shareholders in Miami-Dade County, Florida.

Miami-Dade Florida Buy-Sell Agreement between Shareholders of Closely Held Corporation

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-02462BG

Format:

Word;

PDF;

Rich Text

Instant download

Description

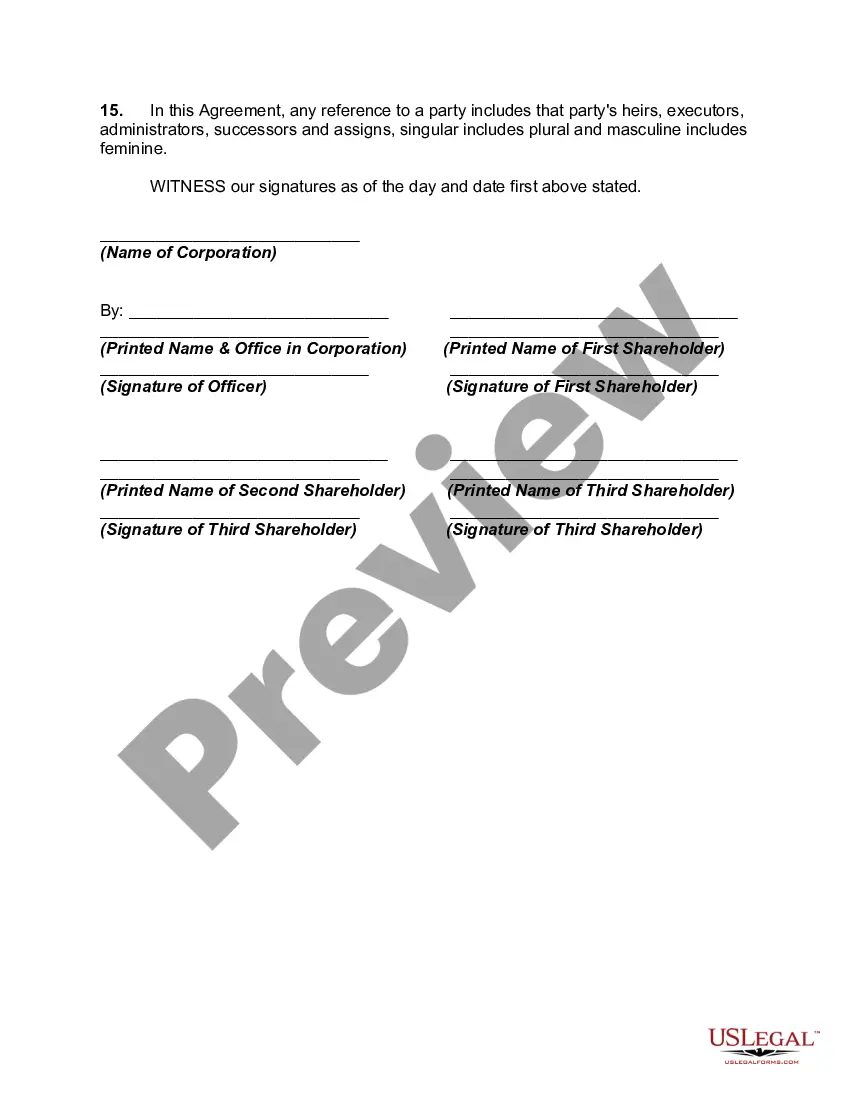

A corporation whose shares are held by a single shareholder or a closely-knit group of shareholders (such as a family) is known as a close corporation. The shares of stock are not traded publicly. Many of these types of corporations are small firms that in the past would have been operated as a sole proprietorship or partnership, but have been incorporated in order to obtain the advantages of limited liability or a tax benefit or both.

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights.

Miami-Dade Florida Buy-Sell Agreement between Shareholders of Closely Held Corporation A Miami-Dade Florida Buy-Sell Agreement between Shareholders of a Closely Held Corporation is a legally binding contract that outlines the terms and conditions for the buying and selling of shares in a closely held corporation in Miami-Dade County, Florida. In a closely held corporation, the ownership is limited and typically held by a few shareholders. This type of agreement is essential to establish a clear framework for the transfer of shares and the protection of shareholders' interests in case of certain triggering events, such as death, disability, retirement, or voluntary departure of a shareholder. Key provisions that should be included in a Miami-Dade Florida Buy-Sell Agreement are: 1. Purchase Price: The agreement defines the method of valuing the shares, such as using an agreed-upon formula, independent appraisal, or other mutually acceptable methods. 2. Triggering Events: The agreement identifies the events that will trigger a buyout, such as death, disability, retirement, or voluntary departure, and specifies the procedures to be followed in each case. 3. Right of First Refusal: This provision grants the remaining shareholders the first opportunity to purchase the shares from the departing or deceased shareholder before they are sold to a third party. 4. Mandatory Buyout: In some cases, the agreement may require the mandatory buyout of shares from a shareholder who has triggered a specific triggering event. This ensures an orderly transition of shares and protects the corporation from having unwanted or incompatible shareholders. 5. Funding Mechanism: The agreement may establish a funding mechanism, such as life insurance, installment payments, or a sinking fund, to ensure that the necessary funds are available to execute the buyout without putting a financial burden on the corporation or remaining shareholders. Different types of Miami-Dade Florida Buy-Sell Agreements between Shareholders of Closely Held Corporations may include: 1. Cross-Purchase Buy-Sell Agreement: In this type of agreement, each shareholder agrees to purchase the shares of the departing shareholder directly. This can be advantageous when there are only a few shareholders and the ownership structure is not too complex. 2. Stock Redemption Buy-Sell Agreement: In this type of agreement, the corporation agrees to purchase the shares of the departing shareholder. The advantage is that the corporation can use its own funds to execute the buyout, eliminating the need for individual shareholders to come up with the purchase price. 3. Hybrid Buy-Sell Agreement: This type of agreement combines elements of both the cross-purchase and stock redemption agreements. It provides flexibility by allowing shareholders to choose whether they want to buy shares individually or have the corporation buy them. By having a Miami-Dade Florida Buy-Sell Agreement between Shareholders of a Closely Held Corporation, shareholders can ensure a smooth transition of ownership, protect their investments, and avoid potential disputes or unwanted third-party ownership. Consulting with a knowledgeable attorney is advised to draft an agreement tailored to the specific needs and circumstances of the corporation and its shareholders in Miami-Dade County, Florida.

Free preview