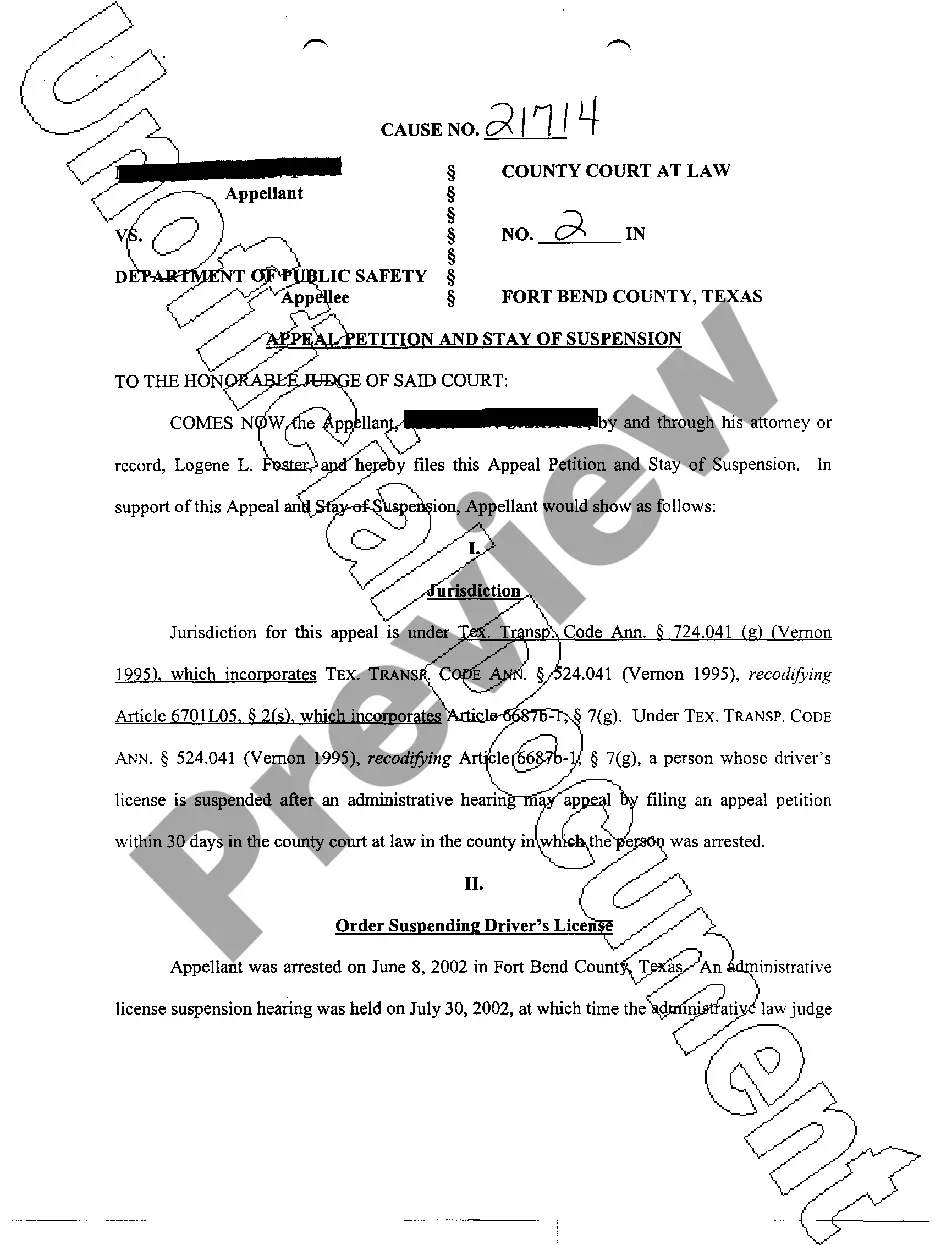

A Salt Lake Utah Buy-Sell Agreement between Shareholders of a Closely Held Corporation is a legally binding contract that outlines the terms and conditions for the buying and selling of shares in the corporation. This agreement serves to protect the interests of shareholders and provides a clear framework for the transfer of ownership. The primary purpose of a Buy-Sell Agreement is to ensure a smooth transition of ownership in the event of certain triggering events, such as the death, disability, retirement, or voluntary resignation of a shareholder. By defining the process and price for the purchase or sale of shares, this agreement minimizes disputes and potential disruptions to the corporation's operations. In Salt Lake City, Utah, there are different types of Buy-Sell Agreements that shareholders of closely held corporations can consider, depending on their specific needs and objectives. Some common types include: 1. Cross-Purchase Agreement: In this type of agreement, each shareholder agrees to buy the shares of a departing shareholder directly. This often works well in smaller corporations with a limited number of shareholders. 2. Entity Purchase Agreement: Also known as a stock redemption agreement, this type involves the corporation itself agreeing to buy the shares of a departing shareholder. The corporation then becomes the sole owner of the redeemed shares. 3. Hybrid Agreement: This is a combination of the cross-purchase and entity purchase agreements. It allows some shareholders to buy the shares of the departing shareholder, while the remaining shares are repurchased by the corporation. This type provides flexibility and can accommodate varying needs and financial capabilities of the shareholders. When drafting a Salt Lake Utah Buy-Sell Agreement between Shareholders of a Closely Held Corporation, several crucial elements should be included. These often consist of the following: — Triggering Events: Clearly define the specific events that will activate the buy-sell provisions, such as death, disability, retirement, or resignation. — Purchase Price: Describe the method for determining the fair market value of the shares and establish a pricing mechanism for buying and selling the shares. — Funding: Explain how the purchase will be funded, whether through cash, installment payments, insurance proceeds, or a combination. — Rights and Obligations: Outline the rights and obligations of the shareholders involved and specify any restrictions on the transfer of shares to third parties. — Dispute Resolution: Include provisions for resolving disputes, such as through mediation or arbitration, to avoid costly litigation. In summary, a Salt Lake Utah Buy-Sell Agreement between Shareholders of a Closely Held Corporation is a vital tool for protecting the interests of shareholders in the event of a triggering event. By considering the different types of agreements available and addressing key elements, shareholders can ensure a smooth transition and continuity for their closely held corporation in Salt Lake City, Utah.

Salt Lake Utah Buy-Sell Agreement between Shareholders of Closely Held Corporation

Description

How to fill out Salt Lake Utah Buy-Sell Agreement Between Shareholders Of Closely Held Corporation?

Draftwing documents, like Salt Lake Buy-Sell Agreement between Shareholders of Closely Held Corporation, to take care of your legal affairs is a tough and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can consider your legal matters into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms crafted for a variety of cases and life circumstances. We make sure each form is compliant with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Salt Lake Buy-Sell Agreement between Shareholders of Closely Held Corporation form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly easy! Here’s what you need to do before downloading Salt Lake Buy-Sell Agreement between Shareholders of Closely Held Corporation:

- Make sure that your template is specific to your state/county since the rules for creating legal papers may differ from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Salt Lake Buy-Sell Agreement between Shareholders of Closely Held Corporation isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin using our service and download the form.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!