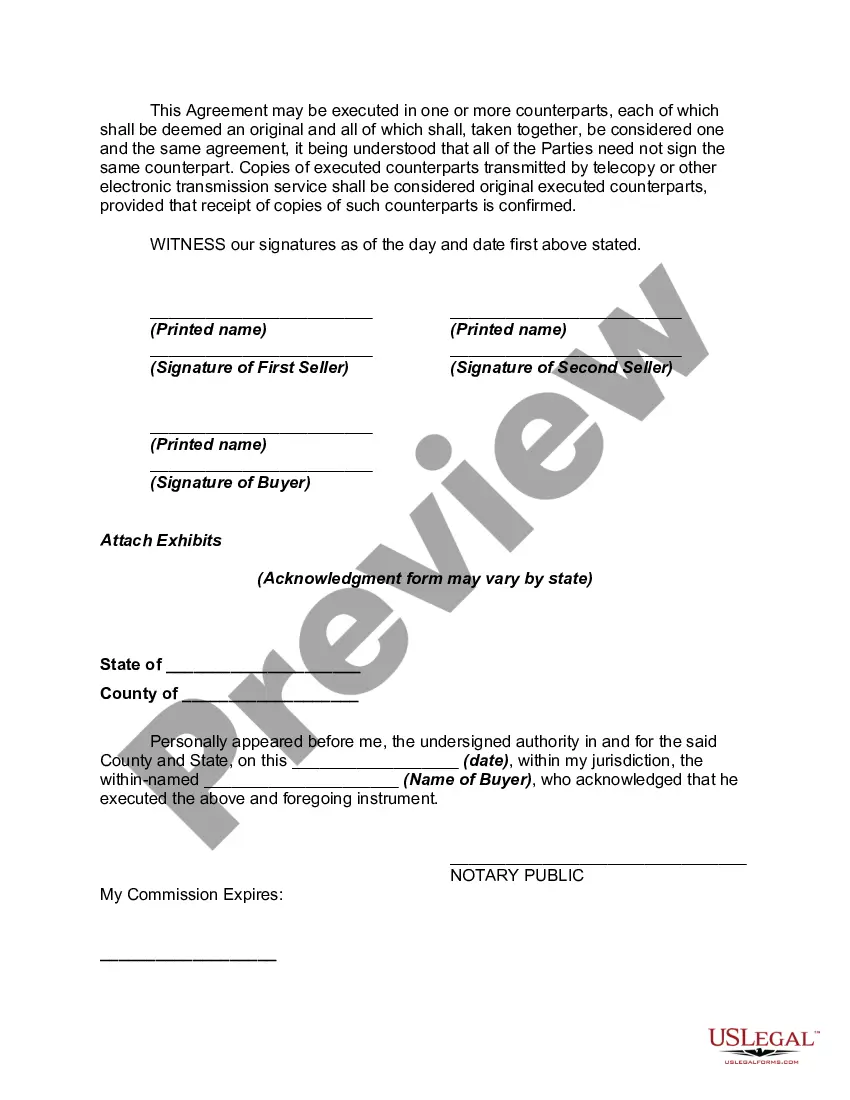

Title: Understanding the Phoenix Arizona Stock Purchase Agreement: A Comprehensive Guide Introduction: The Phoenix Arizona Stock Purchase Agreement (SPA) between Two Sellers and One Investor, with Transfer of Title Concurrent with Execution of the Agreement, is a legally binding contract concerning the sale of stock shares. This agreement outlines the terms, conditions, and respective obligations of the sellers and the investor involved in the transaction. In this article, we will delve into the various aspects of the SPA, its importance, and explore any potential variations of this agreement. Key Elements of the Phoenix Arizona Stock Purchase Agreement: 1. Parties Involved: The SPA typically involves two sellers, who own the stock shares, and one investor, who wishes to purchase those shares. The agreement clearly identifies all parties, their roles, and their respective responsibilities throughout the process. 2. Transfer of Title Concurrent with Execution of Agreement: One distinguishing feature of this agreement is that the transfer of stock shares' title occurs simultaneously with the execution of the agreement. This ensures a swift and seamless transfer of ownership, minimizing any potential risks or delays. 3. Purchase Price and Payment Terms: The SPA specifies the purchase price per share or the total consideration for the transaction. Additionally, it outlines the agreed-upon payment terms, such as upfront payments, installments, or any other mutually agreed arrangements. 4. Representations and Warranties: Both sellers and the investor provide statements, warranties, and guarantees regarding the stock shares being sold. These representations ensure transparency and protect the parties involved from any misrepresentation or undisclosed information concerning the shares. 5. Conditions Precedent: The SPA may include specific conditions that need to be met before the agreement becomes effective. Such conditions might include regulatory approvals, due diligence, or any relevant legal requirements for the transaction to proceed. 6. Closing Mechanism: The SPA outlines the process known as the "closing," which is the final step where the transaction is completed. It includes the transfer of funds, the issuance of share certificates, and any other necessary documentation required to conclude the agreement. Types of Phoenix Arizona Stock Purchase Agreements: 1. Sole Proprietorship Stock Purchase Agreement: This type of SPA specifically caters to the sale of stock shares in a single-owner business entity, where one investor purchases the shares from one seller. 2. Partnership Stock Purchase Agreement: Designed for partnerships, this agreement facilitates the sale of stock shares between sellers who own shares or interests in a partnership and an investor interested in acquiring those shares. 3. Limited Liability Company (LLC) Stock Purchase Agreement: For LCS, this agreement governs the sale and transfer of stock shares or member interests from two sellers to one investor involved in the transaction. In conclusion, the Phoenix Arizona Stock Purchase Agreement between Two Sellers and One Investor, with Transfer of Title Concurrent with Execution of Agreement, is a vital legal document that outlines the terms of the stock share sale. Understanding its core elements and potential variations depending on the type of business entity involved can help parties navigate through the transaction process effectively.

Phoenix Arizona Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement

Description

How to fill out Phoenix Arizona Stock Purchase Agreement Between Two Sellers And One Investor With Transfer Of Title Concurrent With Execution Of Agreement?

Laws and regulations in every sphere vary from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Phoenix Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Phoenix Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Phoenix Stock Purchase Agreement between Two Sellers and One Investor with Transfer of Title Concurrent with Execution of Agreement:

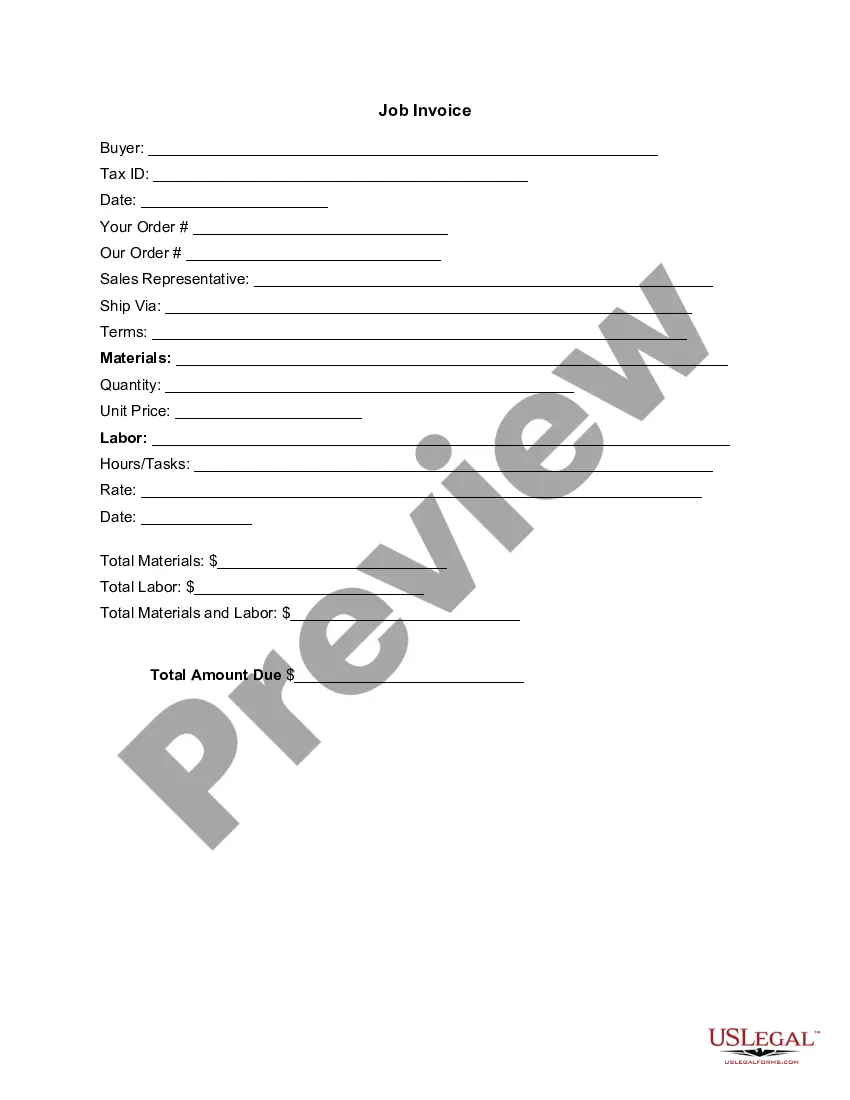

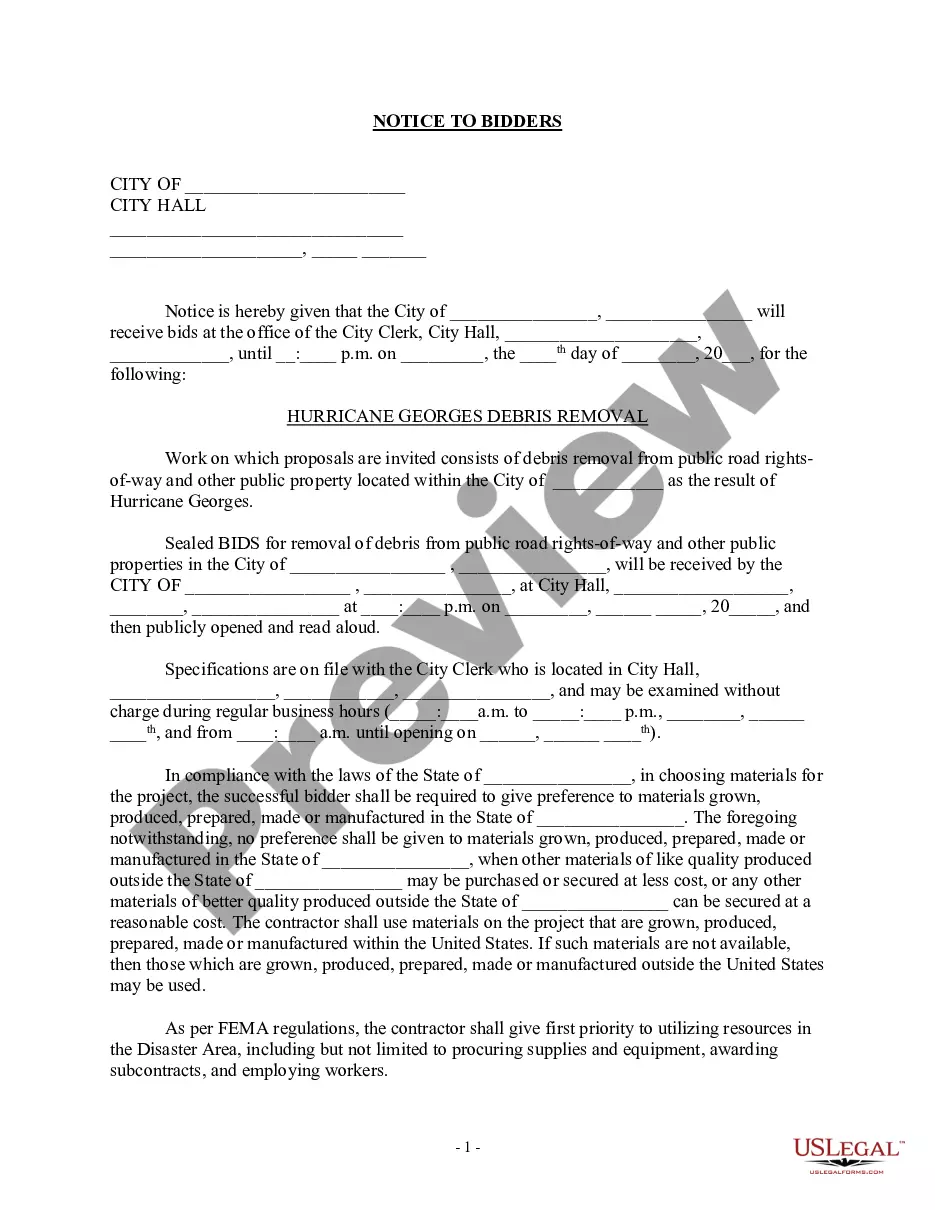

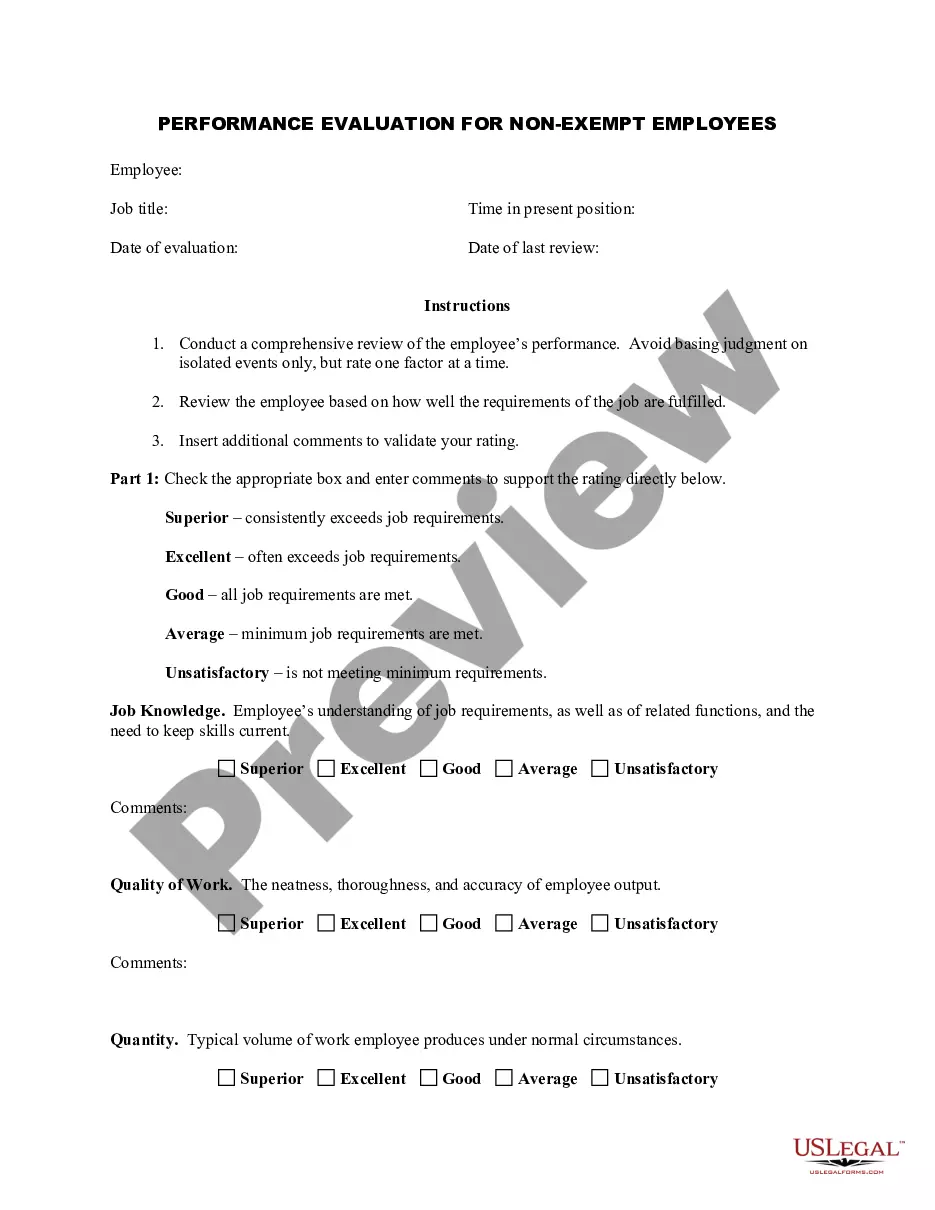

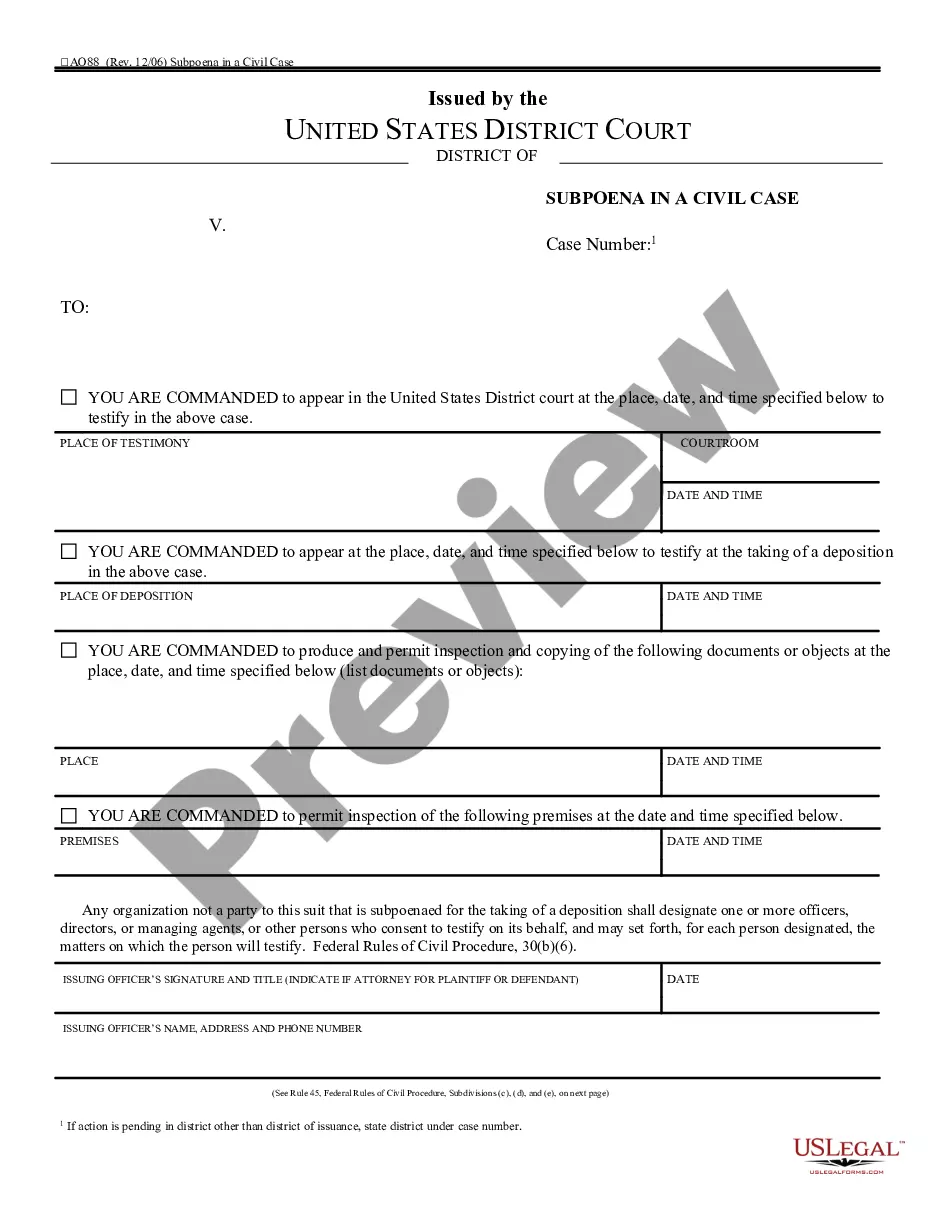

- Take a look at the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!