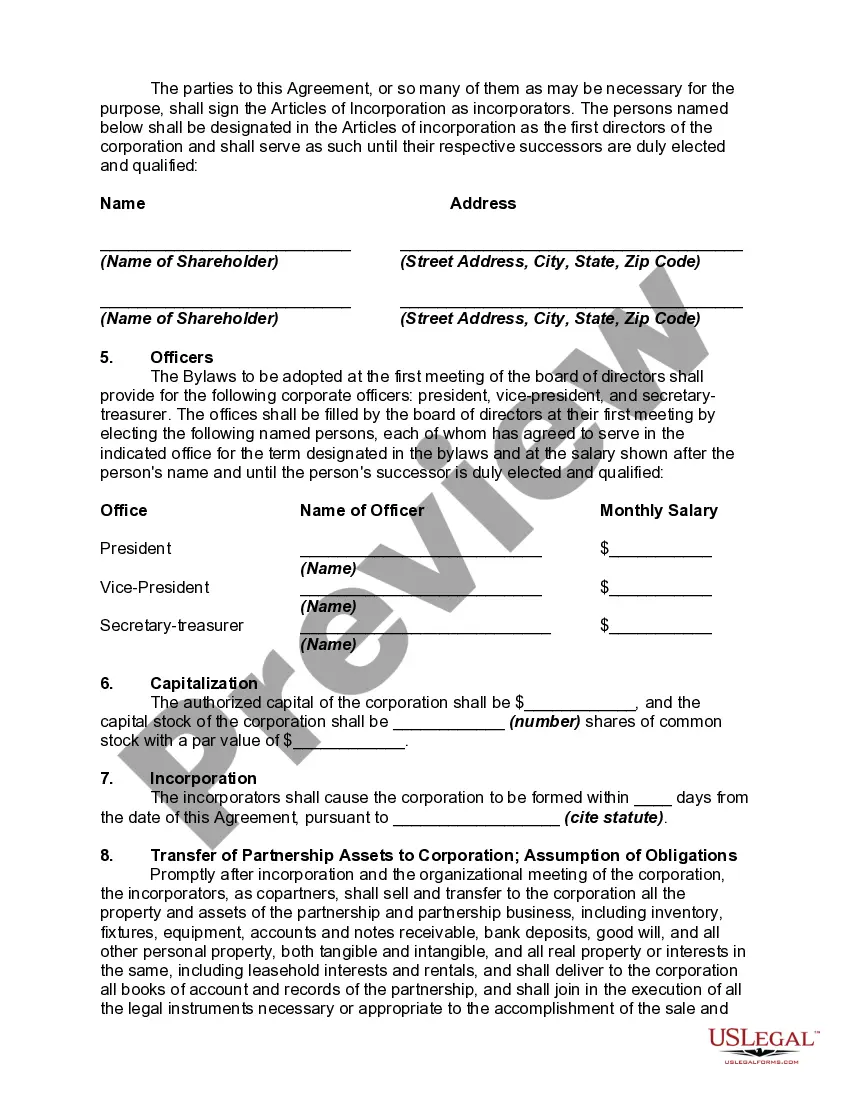

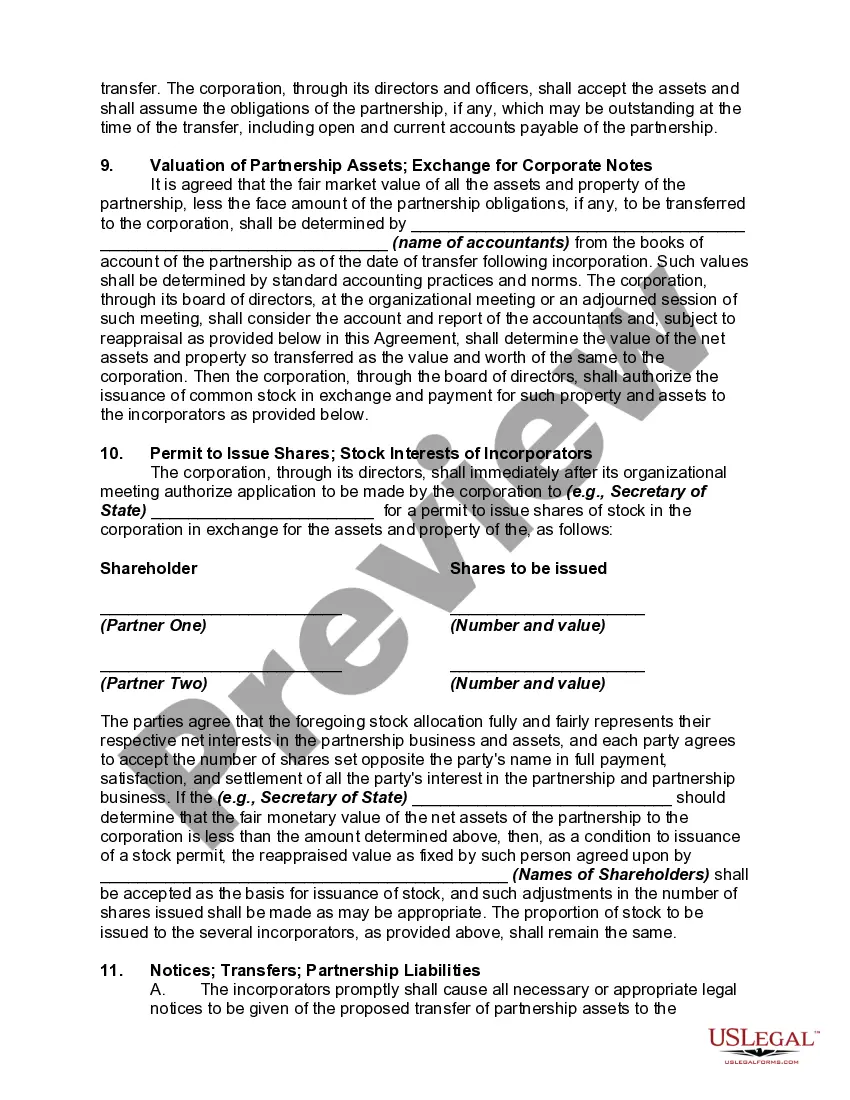

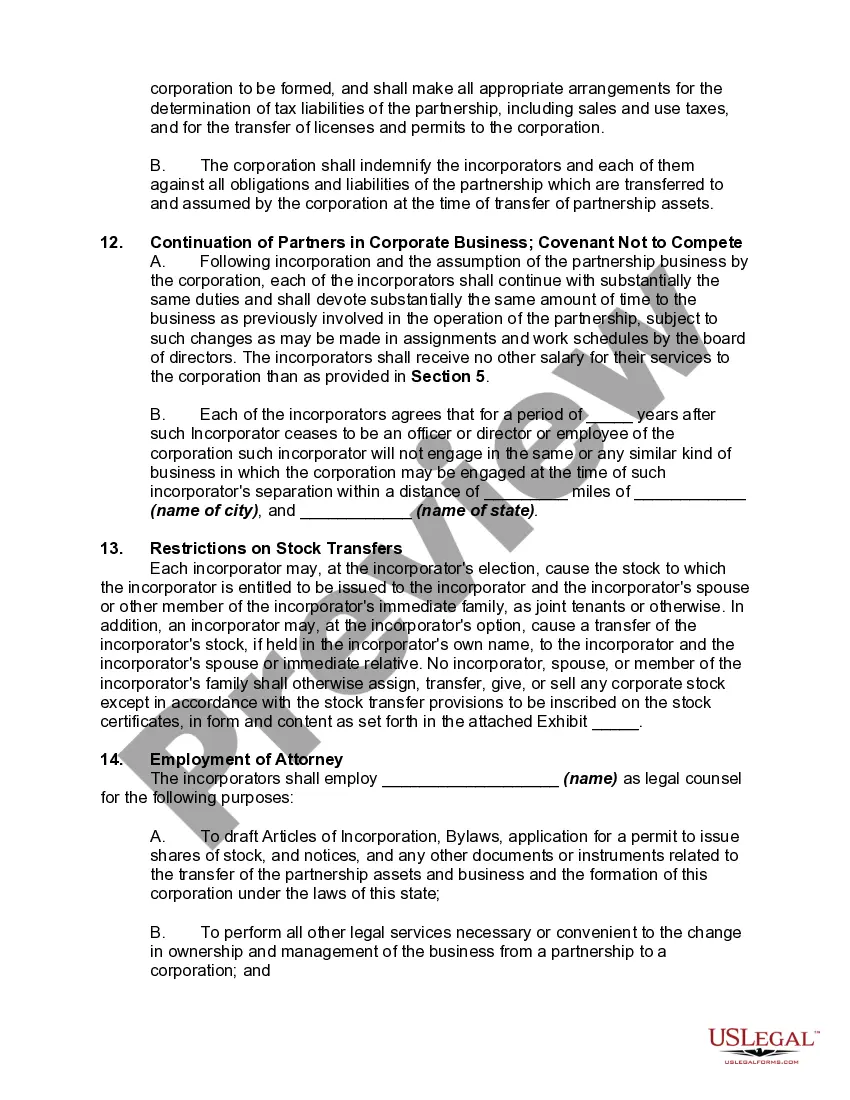

Clark Nevada Agreement to Partners to Incorporate Partnership is a legal document that outlines the terms and conditions for forming a partnership in the state of Nevada. This agreement is essential for partners who wish to establish a business entity and want to clearly define their roles, responsibilities, and rights. The Clark Nevada Agreement to Partners to Incorporate Partnership covers various elements including the purpose of the partnership, the capital contributions of each partner, profit and loss allocation, management and decision-making authority, dispute resolution mechanisms, and the process for adding or removing partners. The agreement starts by stating the name of the partnership and the address of its principal place of business. It also specifies the type of partnership, such as general partnership or limited partnership. The general partnership involves partners who have equal management authority and share equal liability for the partnership's debts and obligations. On the other hand, a limited partnership comprises general partners who have management authority and unlimited liability and limited partners who have no management authority and limited liability. The capital contributions section of the agreement lays out the initial investment or assets that each partner will bring into the partnership. It details which partner contributes cash, property, or any other resources and assigns a specific value to those contributions. The profit and loss sharing provisions define how profits and losses will be allocated among the partners. This section establishes the percentage or ratio in which the partners will share profits or bear losses, ensuring fairness and transparency. Management and decision-making authority are critical aspects of any partnership. The Clark Nevada Agreement to Partners to Incorporate Partnership outlines how decisions will be made, whether by unanimous consent, majority vote, or delegation to one or more partners. It sets the framework for handling day-to-day operations, decision-making, and important matters such as entering into contracts, hiring employees, or making financial investments. Dispute resolution mechanisms play a crucial role in partnerships. The agreement may include clauses for mediation, arbitration, or litigation to resolve disputes that may arise among the partners. This helps to avoid costly and time-consuming legal battles and encourages amicable resolution. Lastly, the agreement outlines the process for adding or removing partners from the partnership. It explains how new partners can be admitted, whether through contribution of capital or by following a specified procedure. Similarly, it discusses the circumstances under which a partner can be expelled or decide to withdraw voluntarily. In conclusion, the Clark Nevada Agreement to Partners to Incorporate Partnership provides a comprehensive framework for establishing and managing a partnership in Nevada. It addresses crucial aspects of the partnership, including capital contributions, profit and loss sharing, decision-making authority, dispute resolution, and partner admission and withdrawal. By clearly defining these terms, the agreement ensures a fair and structured partnership that minimizes misunderstandings and conflicts.

Clark Nevada Agreement to Partners to Incorporate Partnership

Description

How to fill out Clark Nevada Agreement To Partners To Incorporate Partnership?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official documentation that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business objective utilized in your county, including the Clark Agreement to Partners to Incorporate Partnership.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Clark Agreement to Partners to Incorporate Partnership will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to obtain the Clark Agreement to Partners to Incorporate Partnership:

- Make sure you have opened the proper page with your local form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Clark Agreement to Partners to Incorporate Partnership on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!