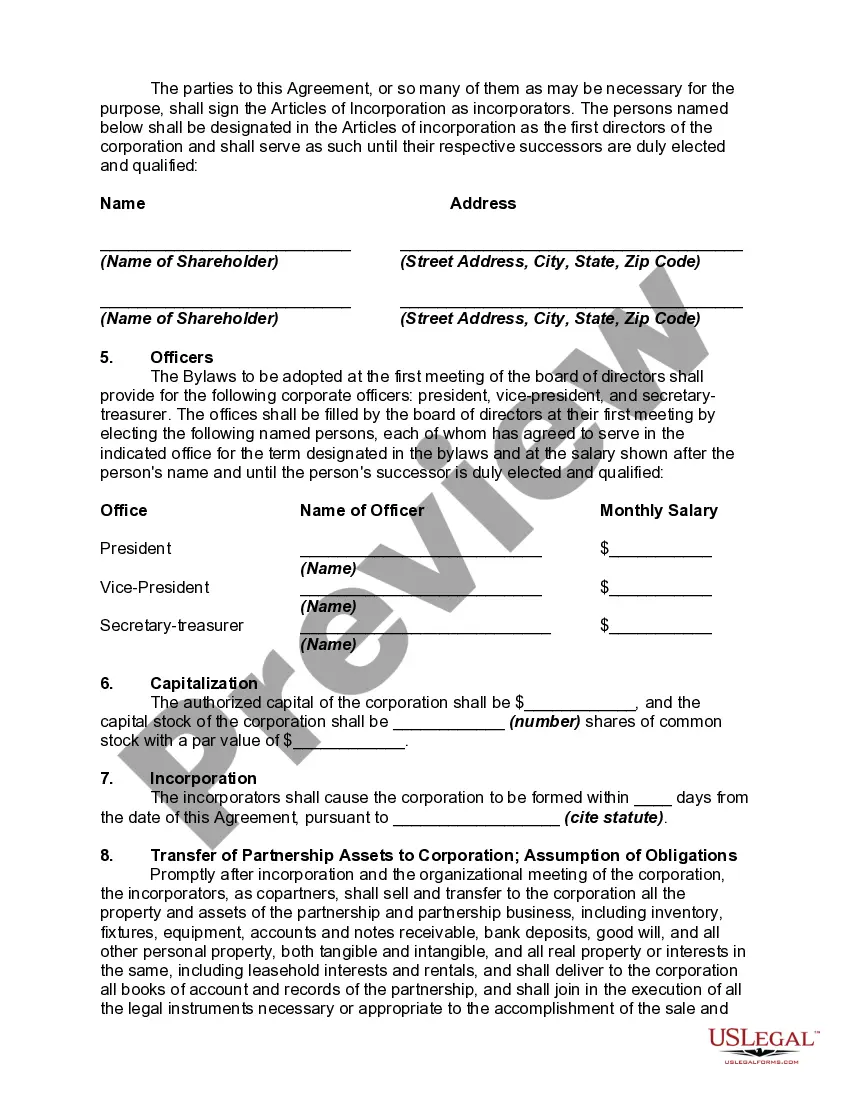

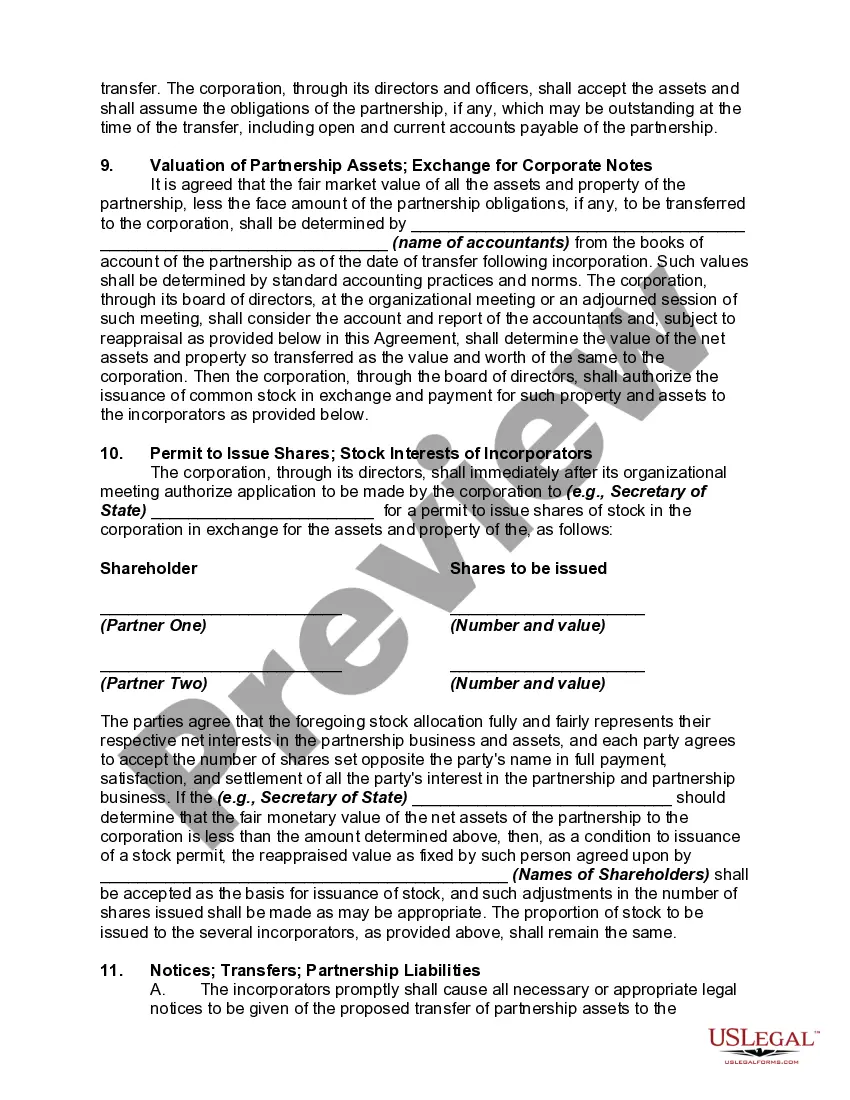

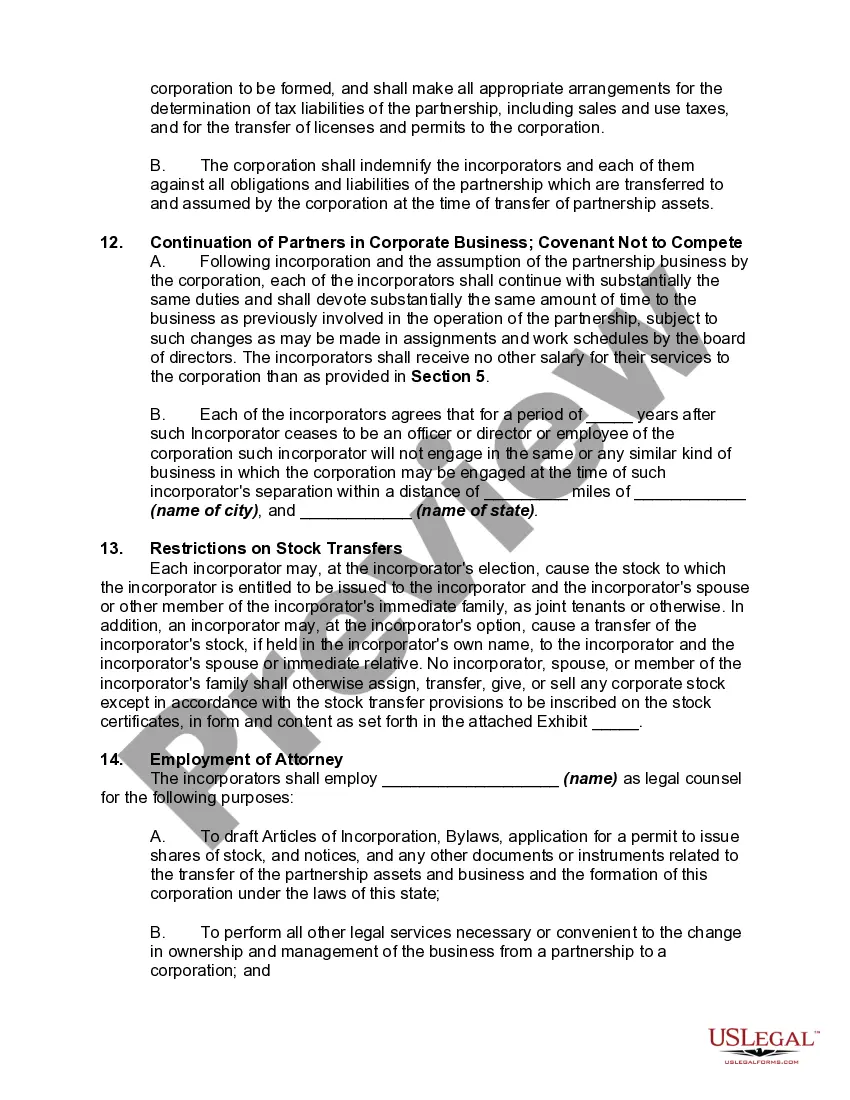

Title: Understanding the Harris Texas Agreement to Partners to Incorporate Partnership: A Comprehensive Guide Introduction: The Harris Texas Agreement to Partners to Incorporate Partnership is a legal document that outlines the terms and conditions for the formation and operation of a partnership within the state of Texas. This agreement is crucial as it defines the roles, responsibilities, and obligations of each partner, highlighting the framework under which the partnership will be incorporated. In this article, we will delve into the details of the Harris Texas Agreement to Partners to Incorporate Partnership, exploring its significance and various types that exist. Key Details of the Agreement: 1. Purpose: The agreement establishes the purpose of the partnership, providing a clear statement of its objectives and the business activities it intends to engage in. 2. Partnership Structure: It defines the desired structure of the partnership, where partners unite their resources, skills, and efforts to achieve common goals. This section typically includes details about the partnership's duration, the number of partners involved, and their respective contributions. 3. Partner Roles and Responsibilities: The agreement extensively outlines the rights, duties, and obligations of each partner within the partnership. It ensures proper allocation of responsibilities and enables efficient decision-making processes. 4. Capital Contributions: This section elaborates on the financial aspects of the partnership, detailing the expected capital contributions from each partner. It may outline the initial contribution, subsequent investments, and procedures for additional contributions as the partnership grows. 5. Profits, Losses, and Distributions: The agreement defines how profits and losses will be distributed among the partners, depending on their respective ownership interests. It also outlines the procedures for withdrawing funds, distributing dividends, or reinvesting profits back into the partnership. 6. Decision-Making Processes: This component addresses the decision-making procedures within the partnership, outlining how major or strategic decisions are made, including voting rights, quorum requirements, and the involvement of managing or general partners. 7. Partner Withdrawal or Dissolution: The partnership agreement specifies the circumstances under which a partner can withdraw from the partnership. It may outline exit strategies, buyout provisions, and restrictions on partner transfers. Additionally, the agreement may detail the dissolution process and the distribution of partnership assets in the event of termination. Types of Harris Texas Agreement to Partners to Incorporate Partnership: 1. General Partnership Agreement: This agreement establishes a partnership where all partners have unlimited personal liability, and their decision-making roles and responsibilities are fairly distributed. 2. Limited Partnership Agreement: In a limited partnership, one or more partners have limited liability, while others have unlimited liability. This agreement clarifies the roles of both general and limited partners, ensuring smooth operation and clear expectations. 3. Limited Liability Partnership Agreement: This agreement provides partners with limited personal liability, generally applicable to certain professions like law or accounting. It specifies the conditions for obtaining and maintaining LLP status, including compliance with state and professional regulations. Conclusion: The Harris Texas Agreement to Partners to Incorporate Partnership plays a crucial role in establishing a partnership's foundation and governing its operation. With this detailed guide, you now have a comprehensive understanding of its significance, key components, and the various types of partnerships encompassed by this agreement. It is essential to consult legal professionals to ensure the agreement aligns with specific business goals, protecting the interests of all partners involved.

Harris Texas Agreement to Partners to Incorporate Partnership

Description

How to fill out Harris Texas Agreement To Partners To Incorporate Partnership?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Harris Agreement to Partners to Incorporate Partnership, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Harris Agreement to Partners to Incorporate Partnership from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Harris Agreement to Partners to Incorporate Partnership:

- Take a look at the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!