Philadelphia Pennsylvania Agreement to Partners to Incorporate Partnership is a legally binding document that outlines the terms and conditions for establishing a partnership incorporating business entities in Philadelphia, Pennsylvania. This agreement is crucial for partners entering into a formal partnership structure and plays a significant role in ensuring transparency, clarity, and protection of rights for all involved parties. The Philadelphia Pennsylvania Agreement to Partners to Incorporate Partnership entails various essential elements that need to be addressed for a successful incorporation. These include the names, addresses, and roles of each partner involved, as well as their respective contributions to the partnership (financial, intellectual, or other forms of capital). Additionally, the agreement outlines the purpose and objectives of the partnership, detailing the scope of business activities to be pursued. It also includes provisions regarding the distribution of profits and losses among the partners, thereby ensuring a fair and equitable sharing of financial returns and responsibilities. The agreement sets forth the duration of the partnership, specifying whether it is a fixed-term or perpetual partnership. It also addresses procedures for the admission or withdrawal of partners, to accommodate changes in ownership or the inclusion of new partners in the future. Furthermore, the agreement includes provisions regarding the management and decision-making processes of the partnership. It defines the authority and responsibilities of partners, as well as the mechanisms for resolving disputes, potentially through mediation or arbitration. Different types of Philadelphia Pennsylvania Agreement to Partners to Incorporate Partnership may include General Partnerships, Limited Partnerships, and Limited Liability Partnerships. General partnerships involve all partners equally sharing the profits, liabilities, and management responsibilities. Limited partnerships consist of general partners who manage the business and limited partners who primarily contribute capital, with limited liability. Limited Liability Partnerships provide liability protection to partners, where they are not personally responsible for the partnership's debts or actions beyond their own misconduct or negligence. In conclusion, the Philadelphia Pennsylvania Agreement to Partners to Incorporate Partnership is a comprehensive legal document that sets forth the terms and conditions for establishing a partnership incorporating business entities in Philadelphia, Pennsylvania. It addresses crucial aspects such as partner roles, contributions, profit sharing, dispute resolution, and management. By providing a clear and formal framework, this agreement ensures a smooth and transparent partnership incorporation process, fostering trust and cooperation among partners.

Philadelphia Pennsylvania Agreement to Partners to Incorporate Partnership

Description

How to fill out Philadelphia Pennsylvania Agreement To Partners To Incorporate Partnership?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Philadelphia Agreement to Partners to Incorporate Partnership, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Philadelphia Agreement to Partners to Incorporate Partnership from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Philadelphia Agreement to Partners to Incorporate Partnership:

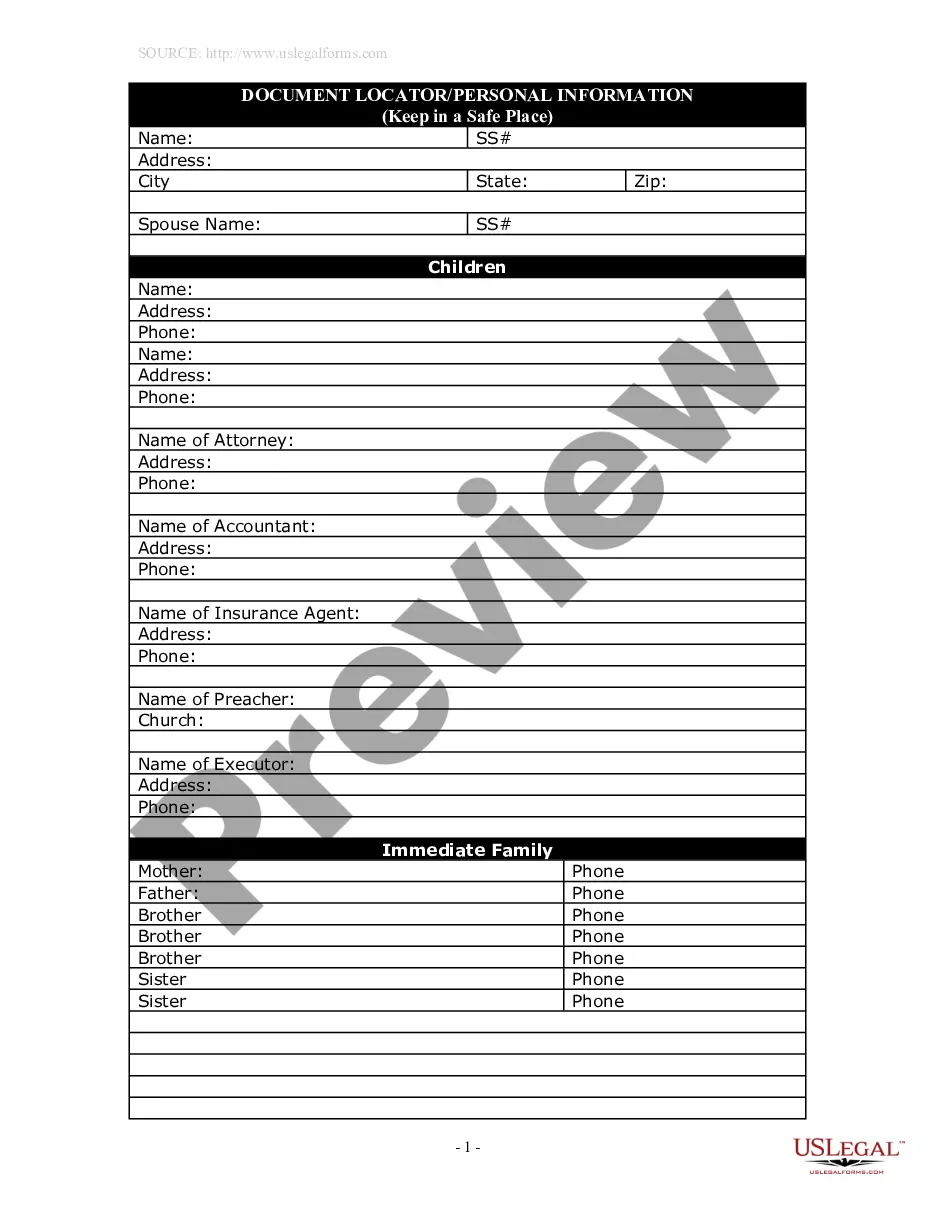

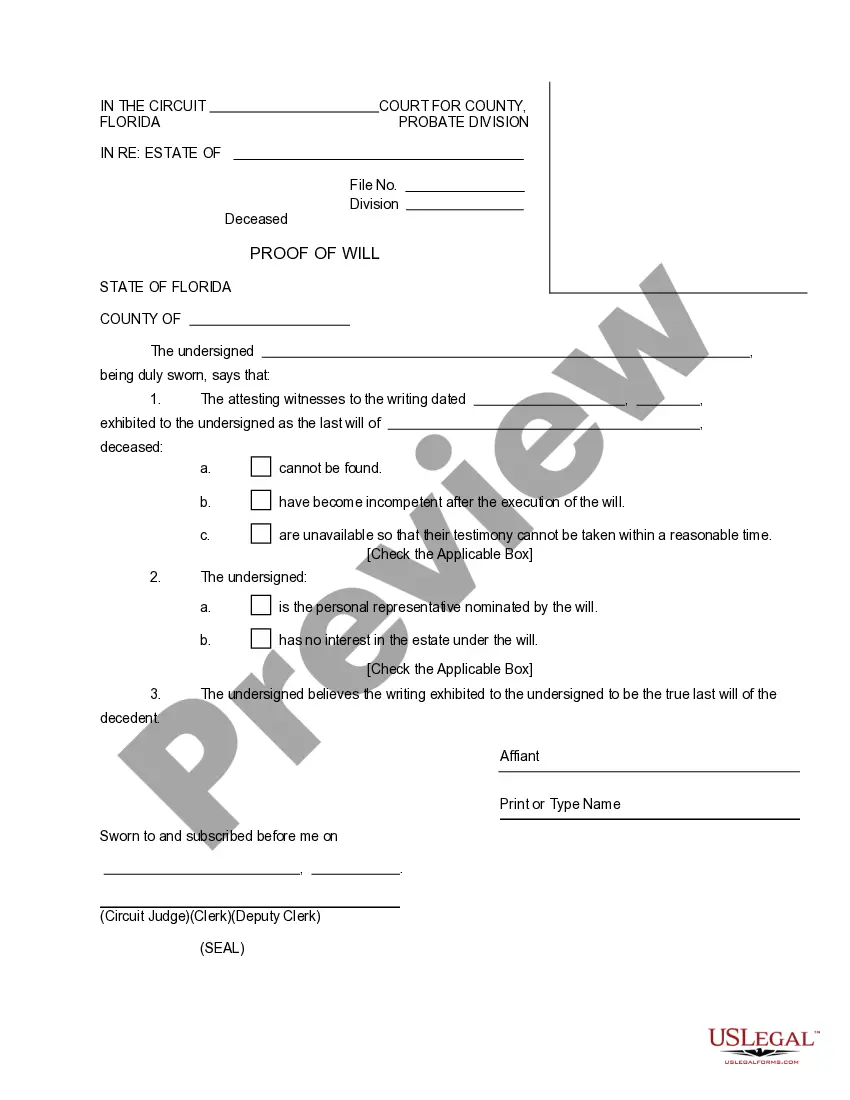

- Analyze the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!