Title: A Comprehensive Guide to Harris Texas Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees Introduction: In Harris County, Texas, businesses are required to pay their corporate income and franchise taxes, as well as file an annual report. This article aims to provide you with a detailed description of the Harris Texas Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees, while highlighting any pertinent variations that may exist. 1. Importance of Paying Corporate Income and Franchise Taxes: Corporate income and franchise taxes are crucial obligations for businesses operating in Harris County, Texas. These taxes contribute to the funding of various public services and infrastructure developments, benefiting both businesses and communities. 2. Understanding Annual Report Filing Requirements: Apart from tax payments, businesses must also file an annual report with the appropriate department in Harris County. This report provides crucial financial and operational information about the company, ensuring transparency and compliance with regulatory requirements. 3. Harris Texas Sample Letter for Payment of Corporate Income and Franchise Taxes: To simplify the payment process, Harris County has developed a standard Sample Letter for businesses to remit their corporate income and franchise taxes. This letter may include the following key elements: a. Description of the company: Provide detailed information about the business, including its legal name, address, and tax identification number (TIN). b. Tax period and amounts: Clearly state the applicable tax period and calculate the amount to be paid for each tax. This involves calculating the corporate income tax and franchise tax based on the company's net income or margin. c. Payment options: Inform the business about the available payment methods, such as electronic funds transfer, check, or money order. Include the necessary details to facilitate a smooth and accurate transaction. d. Deadline and penalties: Emphasize the due date for tax payments and highlight the potential consequences of late submission, such as penalty fees or a loss of good standing. 4. Potential Variations in the Sample Letter: While the Harris Texas Sample Letter generally covers the key components mentioned above, it's important to note that specific variations might exist based on individual circumstances or legal changes. These variations may include: a. Different tax periods: Depending on the nature of the business, the tax period may vary. For example, for newly incorporated businesses, the first tax period may differ from subsequent periods. b. Additional taxes and fees: In some cases, businesses may be subject to additional local taxes or filing fees determined by the county or city. These should be clearly addressed within the letter to ensure comprehensive compliance. Conclusion: Adhering to the corporate income and franchise tax obligations and filing annual reports in Harris County, Texas, is essential for businesses to operate lawfully and maintain good standing. By utilizing the Harris Texas Sample Letter for Payment and staying aware of any potential variations, companies can streamline their tax filing process, avoid punitive measures, and contribute to the community's growth and development.

Harris Texas Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees

Description

How to fill out Harris Texas Sample Letter For Payment Of Corporate Income And Franchise Taxes And Annual Report Filing Fees?

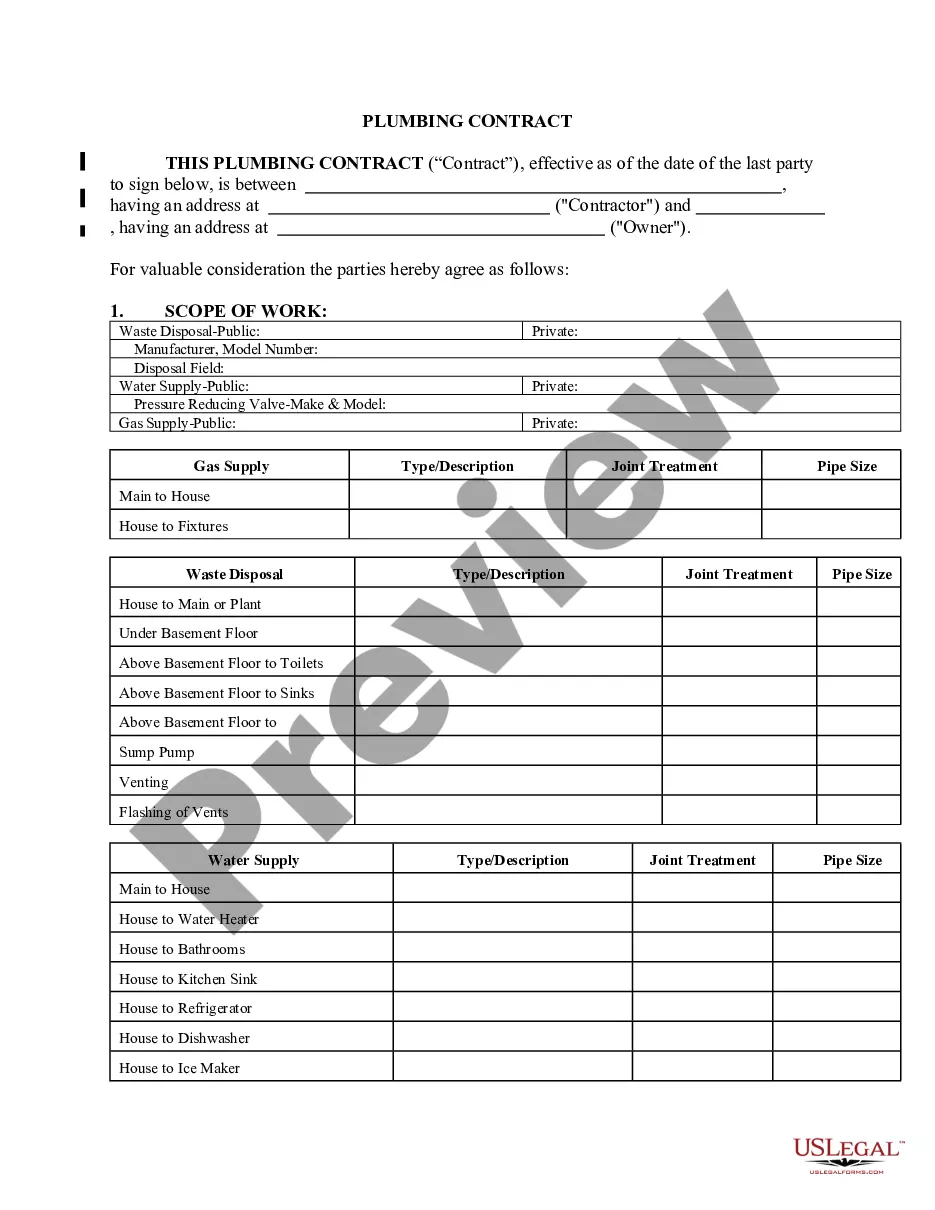

Draftwing documents, like Harris Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees, to manage your legal matters is a tough and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can consider your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents created for various cases and life situations. We ensure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Harris Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees template. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as straightforward! Here’s what you need to do before getting Harris Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees:

- Ensure that your form is compliant with your state/county since the regulations for creating legal papers may differ from one state another.

- Discover more information about the form by previewing it or going through a quick description. If the Harris Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin utilizing our website and download the document.

- Everything looks good on your side? Click the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment details.

- Your form is ready to go. You can try and download it.

It’s an easy task to locate and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!