Fairfax Virginia Promissory Note in Connection with a Sale and Purchase of a Mobile Home A Fairfax Virginia Promissory Note in connection with the sale and purchase of a mobile home is a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and a seller involved in the sale of a mobile home property in Fairfax, Virginia. This note serves as evidence of a debt owed by the buyer to the seller and specifies the repayment terms and other important details of the transaction. The contents of a Fairfax Virginia Promissory Note may vary depending on the specific agreement between the parties involved. However, typical elements found in such documents include: 1. Parties Involved: The note clearly identifies the buyer (also referred to as the borrower) and the seller (also referred to as the lender) by their legal names and addresses. 2. Mobile Home Details: The specific details of the mobile home being sold are included in the note, such as the make, model, year, and serial number. This information helps ensure accurate identification of the property being purchased. 3. Loan Amount and Repayment Terms: The note states the total amount of the loan provided by the seller to the buyer for the purchase of the mobile home. It outlines the agreed-upon interest rate, the length of the repayment period, and whether the interest is fixed or variable. 4. Payment Schedule: The note specifies the agreed-upon payment schedule, including the due dates, frequency (monthly, bi-weekly, etc.), and the amount of each installment payment. It may also mention any penalties for late or missed payments. 5. Security Agreement: In some cases, the note may include a security agreement that grants the seller a security interest in the mobile home as collateral until the loan is fully repaid. This allows the seller to repossess the mobile home in case of default. 6. Default and Remedies: The note outlines the consequences of default, such as late payment or non-payment, and the remedies available to the seller, including the right to enforce the security agreement, seek legal action, or potentially repossess the mobile home. Different types of Fairfax Virginia Promissory Notes in connection with the sale and purchase of a mobile home may include variations in the terms and conditions, interest rates, payment schedules, and other specific details based on the negotiated agreement between the buyer and the seller. Examples of specific types may include: 1. Fixed-Rate Promissory Note: This type of promissory note has a set interest rate that remains constant throughout the term of the loan. 2. Adjustable-Rate Promissory Note: This note includes an interest rate that is subject to change periodically, usually based on an index such as the prime rate. 3. Balloon Promissory Note: This type of note involves making lower monthly payments over the term of the loan, with a larger "balloon" payment due at the end. 4. Installment Promissory Note: This note breaks down the loan amount into equal installments, due at regular intervals until the debt is fully repaid. In summary, a Fairfax Virginia Promissory Note in connection with the sale and purchase of a mobile home is a crucial legal document that protects the interests of both the buyer and the seller throughout the loan agreement. It ensures clarity and transparency in the financial transaction and outlines the rights and obligations of each party involved.

Fairfax Virginia Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

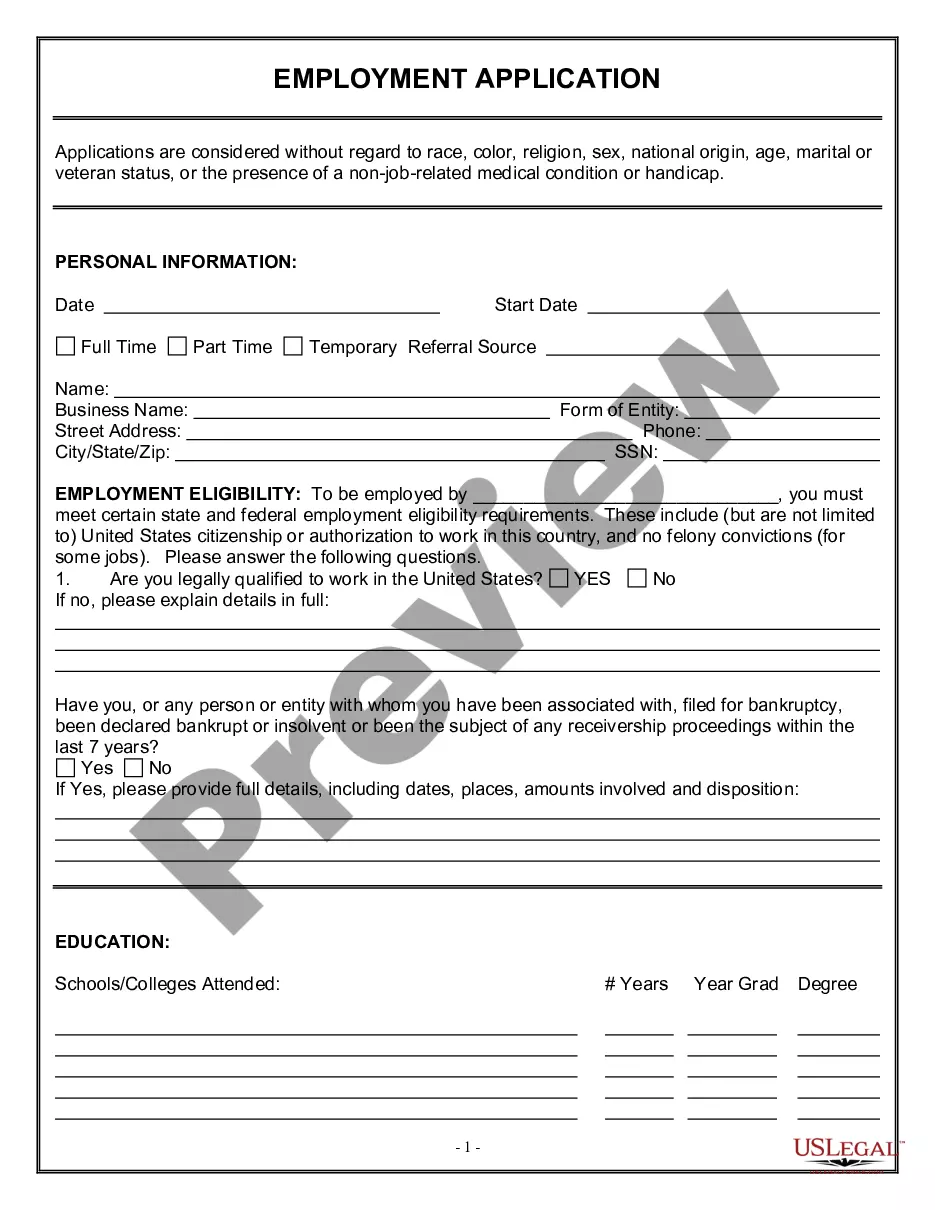

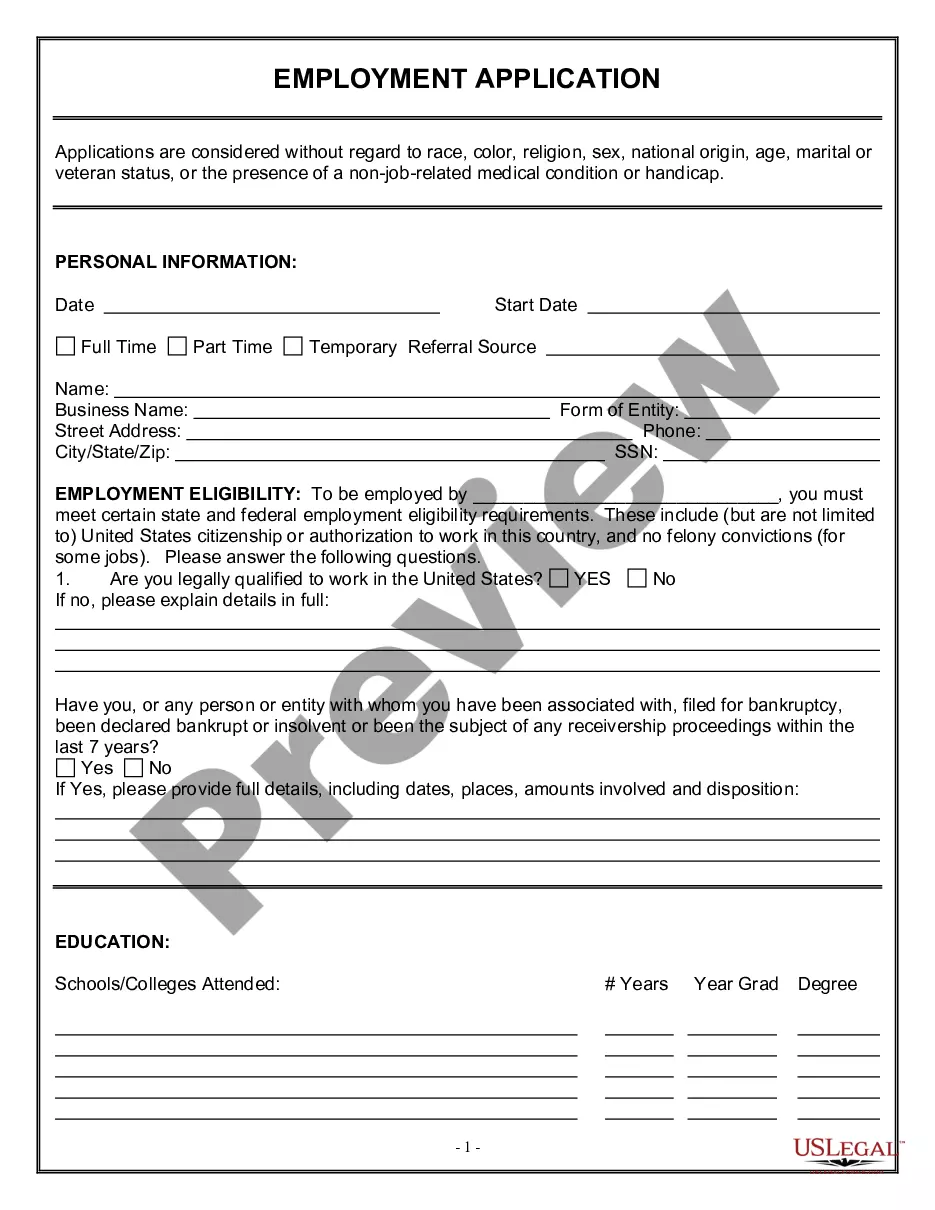

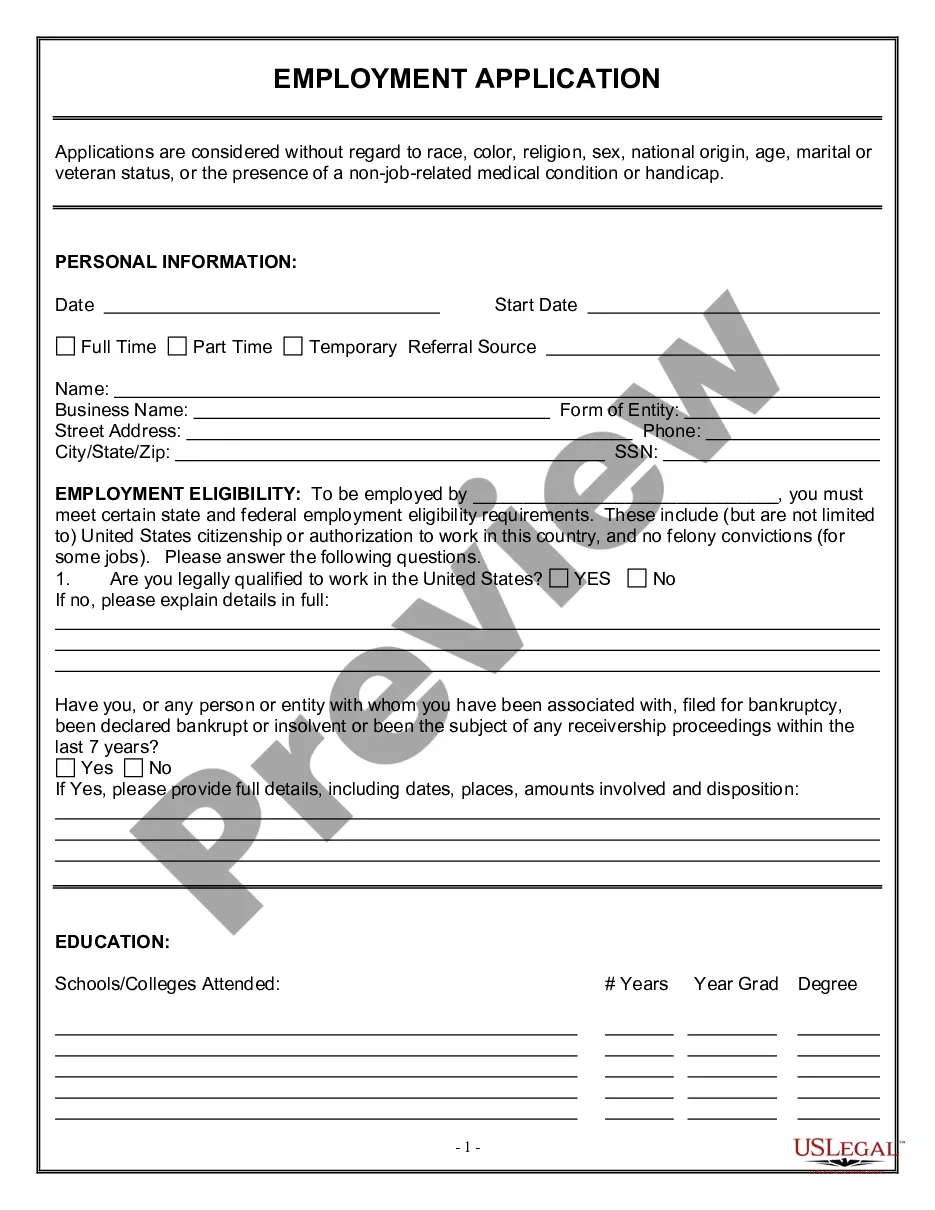

How to fill out Fairfax Virginia Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Fairfax Promissory Note in Connection with a Sale and Purchase of a Mobile Home, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to pick from in different types varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching process less challenging. You can also find information resources and tutorials on the website to make any tasks related to paperwork completion simple.

Here's how to locate and download Fairfax Promissory Note in Connection with a Sale and Purchase of a Mobile Home.

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state laws can affect the validity of some documents.

- Check the related forms or start the search over to locate the appropriate file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment gateway, and purchase Fairfax Promissory Note in Connection with a Sale and Purchase of a Mobile Home.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Fairfax Promissory Note in Connection with a Sale and Purchase of a Mobile Home, log in to your account, and download it. Needless to say, our platform can’t take the place of a lawyer completely. If you need to cope with an extremely difficult situation, we recommend using the services of a lawyer to examine your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of customers. Join them today and purchase your state-compliant paperwork with ease!