A Maricopa Arizona Promissory Note is a legal document that outlines the terms and conditions of a loan arrangement between parties involved in the sale and purchase of a mobile home. This document serves as evidence of the borrower's promise to repay the lender a specific amount of money borrowed for the mobile home's purchase. There are different types of Maricopa Arizona Promissory Notes in connection with the sale and purchase of a mobile home that buyers and sellers can consider. These notes may vary in terms of the payment schedule, interest rate, and other specific details. Here are a few noteworthy types: 1. Fixed-Interest Promissory Note: This type of promissory note sets a fixed interest rate for the duration of the loan. The interest rate remains constant, ensuring stability in monthly payments throughout the repayment period. 2. Adjustable-Rate Promissory Note: Unlike the fixed-interest note, an adjustable-rate promissory note has an interest rate that can fluctuate over time. The interest rate typically follows a specific financial index, such as the prime rate, and can adjust periodically, causing changes in monthly payments. 3. Balloon Payment Promissory Note: A balloon payment note is structured to have lower monthly payments initially, followed by a large final payment called a "balloon payment." This type of note may be beneficial for borrowers who expect a significant influx of money or plan to refinance the loan in the future. 4. Installment Promissory Note: An installment note divides the total loan amount into equal payments (installments) over a specified period, usually monthly. Each installment includes both principal and interest portions. This type of note can provide clarity and predictability for both parties, ensuring steady repayment progress. When drafting a Maricopa Arizona Promissory Note for a mobile home sale and purchase, it is crucial to include essential information such as the names of the parties involved, loan amount, interest rate, repayment terms, payment schedule, late fees, and any specific conditions agreed upon. Having a well-defined and comprehensive promissory note promotes transparency and reduces the chances of disputes between the buyer and seller. Remember, the content above provides a general understanding of Maricopa Arizona Promissory Notes related to the sale and purchase of mobile homes. Consultation with legal professionals is advised to tailor the promissory note to specific circumstances and ensure compliance with applicable laws and regulations.

Maricopa Arizona Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

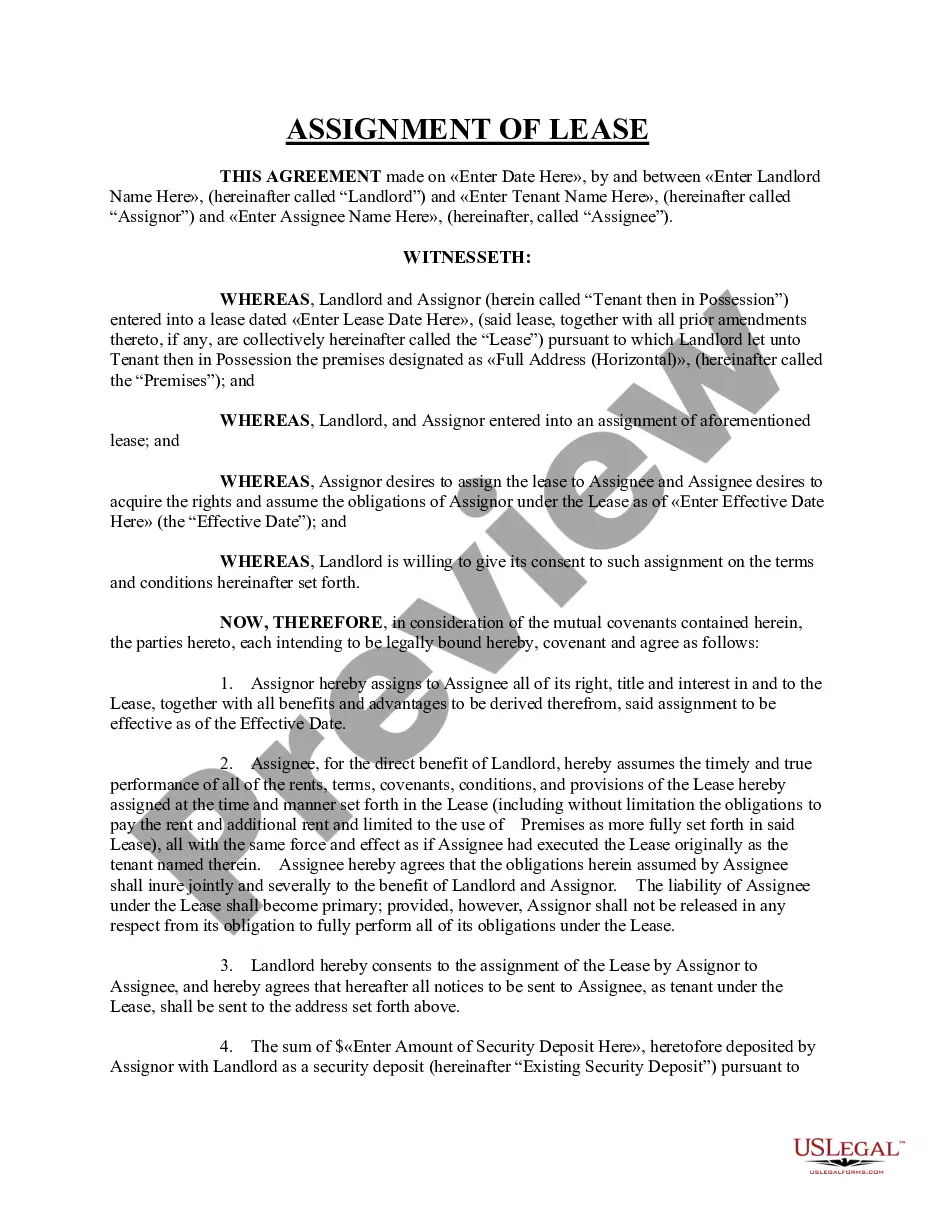

How to fill out Maricopa Arizona Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

If you need to find a reliable legal paperwork supplier to find the Maricopa Promissory Note in Connection with a Sale and Purchase of a Mobile Home, consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can browse from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting resources, and dedicated support make it simple to find and complete various papers.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply select to search or browse Maricopa Promissory Note in Connection with a Sale and Purchase of a Mobile Home, either by a keyword or by the state/county the document is intended for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Maricopa Promissory Note in Connection with a Sale and Purchase of a Mobile Home template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be instantly ready for download once the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less expensive and more reasonably priced. Create your first company, organize your advance care planning, create a real estate contract, or complete the Maricopa Promissory Note in Connection with a Sale and Purchase of a Mobile Home - all from the convenience of your home.

Sign up for US Legal Forms now!