A Palm Beach Florida Promissory Note in Connection with a Sale and Purchase of a Mobile Home is a legal document that outlines the terms and conditions of a loan agreement between the buyer and the seller in a mobile home transaction. It serves as a binding agreement that sets forth the repayment terms, interest rate, and penalties involved in the mobile home purchase. There are several types of Palm Beach Florida Promissory Notes that could pertain to the sale and purchase of a mobile home. These variations include: 1. Fixed-Rate Promissory Note: This type of promissory note establishes a fixed interest rate for the loan amount, ensuring that the buyer's repayment amount remains consistent over the loan term. It may also specify the duration of the loan, typically ranging from 5 to 30 years. 2. Adjustable-Rate Promissory Note: With an adjustable-rate promissory note, the interest rate is subject to change based on market conditions or a predetermined timeframe. The note may contain provisions specifying how often the rate can be adjusted as well as information on interest rate caps to protect the buyer from excessively high rates. 3. Balloon Promissory Note: A balloon promissory note involves the buyer making regular payments for a fixed period, typically shorter than the loan term. At the end of the specified period, a lump sum payment, commonly known as a "balloon payment," is required to settle the remaining balance. This type of note allows for lower monthly payments but requires the buyer to secure financing or establish savings to cover the balloon payment. 4. Installment Promissory Note: An installment promissory note lays out a repayment schedule dividing the loan amount into equal monthly payments over an agreed-upon term. Each payment consists of both principal and interest and ensures the full repayment of the loan by the end of the term. Regardless of the type of Palm Beach Florida Promissory Note used in connection with a sale and purchase of a mobile home, it is crucial to include specific details such as the names and contact information of both parties, the agreed-upon sales price, the amount of the loan, the payment schedule and due dates, interest terms, late payment penalties, and any necessary disclosures or conditions. It is recommended to consult with a legal professional to draft or review the promissory note to ensure compliance with applicable laws and to protect both the buyer's and seller's interests.

Palm Beach Florida Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

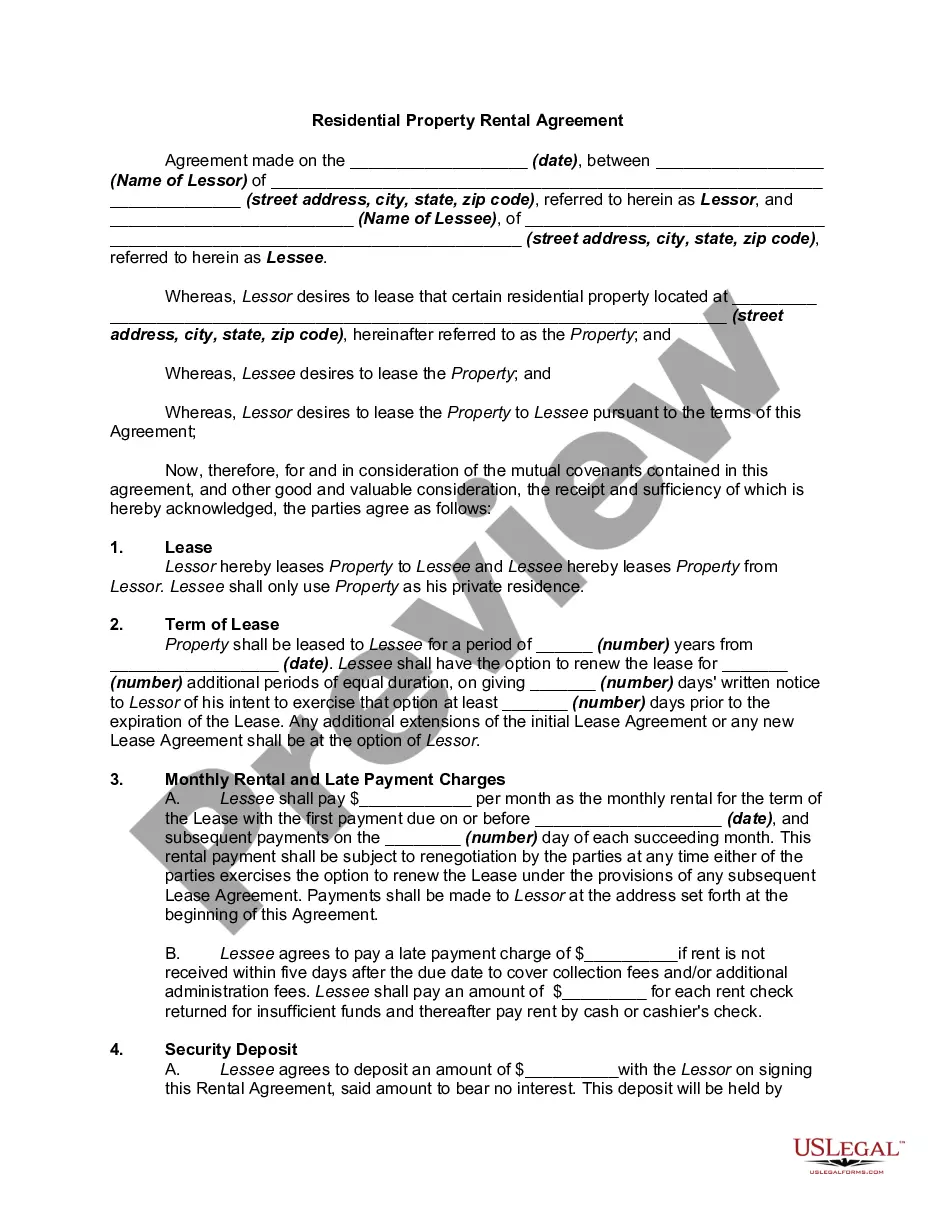

How to fill out Palm Beach Florida Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Palm Beach Promissory Note in Connection with a Sale and Purchase of a Mobile Home, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find detailed materials and guides on the website to make any activities associated with paperwork completion straightforward.

Here's how to find and download Palm Beach Promissory Note in Connection with a Sale and Purchase of a Mobile Home.

- Go over the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can affect the validity of some documents.

- Check the similar forms or start the search over to find the right file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and buy Palm Beach Promissory Note in Connection with a Sale and Purchase of a Mobile Home.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Palm Beach Promissory Note in Connection with a Sale and Purchase of a Mobile Home, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you need to deal with an exceptionally challenging case, we advise getting an attorney to examine your document before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-specific documents effortlessly!