Tarrant Texas Promissory Note in Connection with a Sale and Purchase of a Mobile Home is a legal document that outlines the terms and conditions of a financial agreement between a buyer and a seller. It serves as a written record of the loan agreement, providing security for the seller's interest in the mobile home while enabling the buyer to make payments over a specified period. The Tarrant Texas Promissory Note includes essential details such as the names and contact information of both parties involved, the date of the agreement, the mobile home's description, and the purchase price. It also outlines the agreed-upon interest rate, payment schedule, and consequences for defaulting on payments. Different types of Tarrant Texas Promissory Notes in Connection with a Sale and Purchase of a Mobile Home include: 1. Fixed-rate Promissory Note: This type of promissory note outlines a fixed interest rate, which remains unchanged for the duration of the loan. Both parties agree upon the fixed interest rate before signing the agreement. 2. Adjustable-rate Promissory Note: Unlike a fixed-rate promissory note, an adjustable-rate note allows the interest rate to fluctuate over time. The interest rate is usually tied to an index such as the prime rate or the Treasury bill rate, with periodic adjustments within predetermined limits. 3. Installment Promissory Note: An installment note divides the total amount owed into equal, regular payments over a specified period. Typically, this note includes interest payments along with principal repayment in each installment. 4. Balloon Promissory Note: With a balloon note, the buyer makes regular payments for a specific period, usually a few years, followed by a large lump-sum payment (balloon payment) at the end. These types of notes often have lower monthly installments initially but require a significant final payment. 5. Secured Promissory Note: A secured note includes an additional security arrangement, such as the mobile home serving as collateral for the loan. If the buyer fails to fulfill their payment obligations, the seller can repossess the mobile home to recover their investment. In summary, Tarrant Texas Promissory Notes in Connection with a Sale and Purchase of a Mobile Home are legal contracts that establish a financial agreement between a buyer and a seller. Whether it's a fixed-rate note, adjustable-rate note, installment note, balloon note, or secured note, it is crucial to have a comprehensive understanding of the terms outlined in the promissory note before entering into such an agreement.

Tarrant Texas Promissory Note in Connection with a Sale and Purchase of a Mobile Home

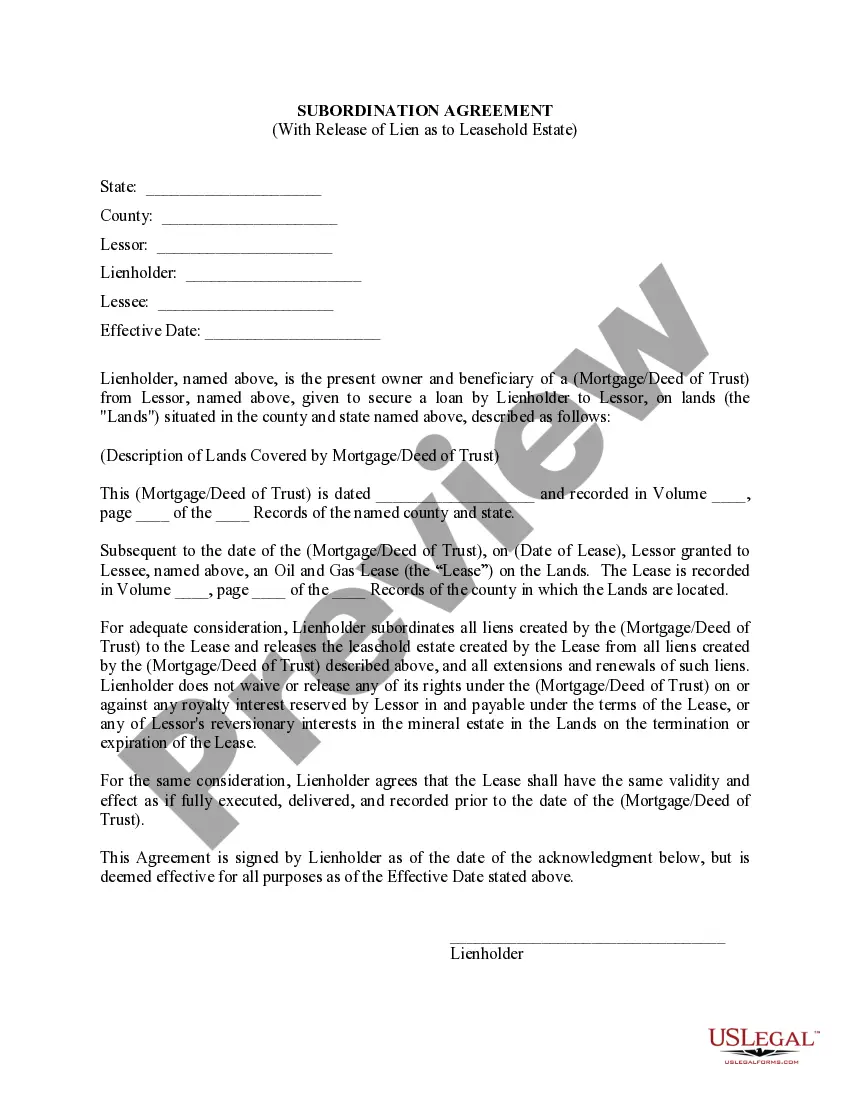

Description

How to fill out Tarrant Texas Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

Drafting documents for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to generate Tarrant Promissory Note in Connection with a Sale and Purchase of a Mobile Home without expert help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Tarrant Promissory Note in Connection with a Sale and Purchase of a Mobile Home by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Tarrant Promissory Note in Connection with a Sale and Purchase of a Mobile Home:

- Examine the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any situation with just a couple of clicks!