A blind trust is a trust in which the beneficiaries are unaware of the trust's specific assets, and in which a fiduciary third party has discretion over all management of the trust assets. For example, politicians may use a blind trust to hold their assets while they're in office to avoid conflict of interest accusations. Blind trusts are set up with grantor and beneficiary being the same, and a trust company as trustee. The trust company holds stocks, bonds, real estate, and other income-generating property in trust for the beneficiary, but the beneficiary lacks knowledge of what stocks or bonds or real estate or other investments are in the trust.

This trust is not meant for a politician but for a person in private life who desires a blind trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

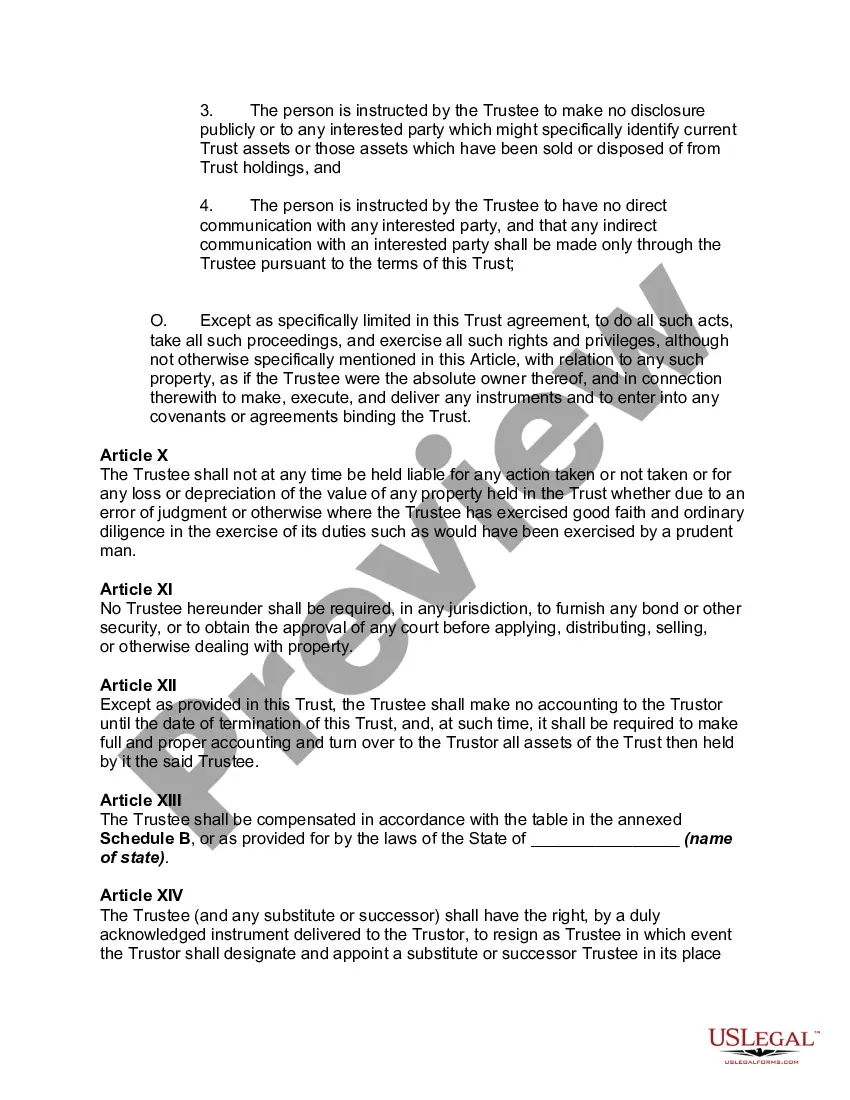

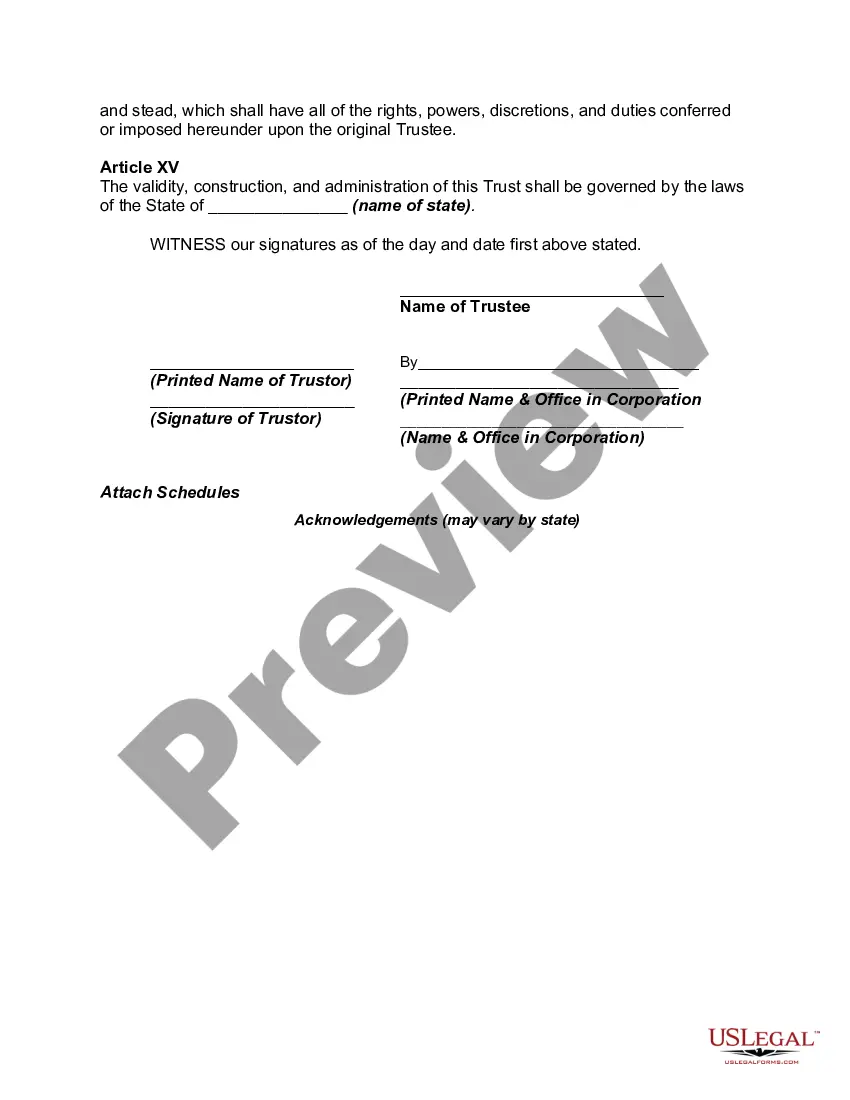

A Dallas Texas Blind Trust Agreement for Private Individual, as opposed to the government, is a legal document that allows individuals to create a trust to manage their assets and investments while ensuring their financial affairs remain confidential. This type of agreement is particularly relevant for high-profile individuals, business owners, or anyone seeking privacy in their financial matters. The purpose of a Dallas Texas Blind Trust Agreement for Private Individual is to remove any conflict of interest that could arise when the individual has a significant financial stake in certain businesses or industries. By transferring their assets to a blind trust, the individual relinquishes control and knowledge of their investments, allowing an independent trustee to manage them on their behalf. Key components of a Dallas Texas Blind Trust Agreement for Private Individual include: 1. Confidentiality: The agreement ensures utmost privacy and confidentiality in the management of the individual's assets, shielded from public scrutiny. This is crucial for private individuals who want to maintain anonymity and avoid potential conflicts of interest. 2. Trustee Selection: The individual appoints a trustee who will oversee the blind trust's operations. It is important to select a trustee who is reliable, experienced, and independent, ensuring they act in the best interest of the beneficiary. 3. Investment Authority: The agreement outlines the trustee's investment authority, including which assets can be acquired, sold, or held within the trust. The trustee makes these decisions prudently and without direct input from the individual to prevent any bias or knowledge that may influence investment choices. 4. Reporting Requirements: The agreement defines the trustee's reporting obligations, ensuring regular updates and transparency on the trust's performance. These reports provide the individual with a broad understanding of the trust's operations without revealing specific investment details. 5. Successor Trustee: A provision may be included to designate a successor trustee in case the originally appointed trustee is unable or unwilling to continue their duties. This provision ensures the continuity of the trust's management. Different types of Dallas Texas Blind Trust Agreements for Private Individuals may include specialized variations tailored to the individual's specific needs or circumstances, such as: — Business Blind Trust: Designed for business owners or executives looking to separate their personal financial interests from their business affairs. This trust allows them to maintain objectivity in decision-making while protecting their privacy. — Political Blind Trust: Commonly used by politicians or public officials, this trust ensures their financial assets are managed independently to avoid any conflicts of interest. It is particularly relevant when public officials want to avoid potential influence on their decision-making processes due to their personal financial interests. — Estate Planning Blind Trust: Individuals who wish to protect their assets and maintain privacy during estate planning can opt for this type of trust. It allows for the orderly transfer of assets to designated beneficiaries while minimizing estate taxes and ensuring confidentiality. In conclusion, a Dallas Texas Blind Trust Agreement for Private Individual offers a method for individuals to manage their assets privately, preserve anonymity, and prevent conflicts of interest. These agreements can be customized to cater to various needs, including business-related, political, or estate planning purposes, ensuring that the individual's financial affairs remain confidential and uncompromised.A Dallas Texas Blind Trust Agreement for Private Individual, as opposed to the government, is a legal document that allows individuals to create a trust to manage their assets and investments while ensuring their financial affairs remain confidential. This type of agreement is particularly relevant for high-profile individuals, business owners, or anyone seeking privacy in their financial matters. The purpose of a Dallas Texas Blind Trust Agreement for Private Individual is to remove any conflict of interest that could arise when the individual has a significant financial stake in certain businesses or industries. By transferring their assets to a blind trust, the individual relinquishes control and knowledge of their investments, allowing an independent trustee to manage them on their behalf. Key components of a Dallas Texas Blind Trust Agreement for Private Individual include: 1. Confidentiality: The agreement ensures utmost privacy and confidentiality in the management of the individual's assets, shielded from public scrutiny. This is crucial for private individuals who want to maintain anonymity and avoid potential conflicts of interest. 2. Trustee Selection: The individual appoints a trustee who will oversee the blind trust's operations. It is important to select a trustee who is reliable, experienced, and independent, ensuring they act in the best interest of the beneficiary. 3. Investment Authority: The agreement outlines the trustee's investment authority, including which assets can be acquired, sold, or held within the trust. The trustee makes these decisions prudently and without direct input from the individual to prevent any bias or knowledge that may influence investment choices. 4. Reporting Requirements: The agreement defines the trustee's reporting obligations, ensuring regular updates and transparency on the trust's performance. These reports provide the individual with a broad understanding of the trust's operations without revealing specific investment details. 5. Successor Trustee: A provision may be included to designate a successor trustee in case the originally appointed trustee is unable or unwilling to continue their duties. This provision ensures the continuity of the trust's management. Different types of Dallas Texas Blind Trust Agreements for Private Individuals may include specialized variations tailored to the individual's specific needs or circumstances, such as: — Business Blind Trust: Designed for business owners or executives looking to separate their personal financial interests from their business affairs. This trust allows them to maintain objectivity in decision-making while protecting their privacy. — Political Blind Trust: Commonly used by politicians or public officials, this trust ensures their financial assets are managed independently to avoid any conflicts of interest. It is particularly relevant when public officials want to avoid potential influence on their decision-making processes due to their personal financial interests. — Estate Planning Blind Trust: Individuals who wish to protect their assets and maintain privacy during estate planning can opt for this type of trust. It allows for the orderly transfer of assets to designated beneficiaries while minimizing estate taxes and ensuring confidentiality. In conclusion, a Dallas Texas Blind Trust Agreement for Private Individual offers a method for individuals to manage their assets privately, preserve anonymity, and prevent conflicts of interest. These agreements can be customized to cater to various needs, including business-related, political, or estate planning purposes, ensuring that the individual's financial affairs remain confidential and uncompromised.