An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays his/her own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage. The traditional tests to determine whether a worker is an employee or independent contractor involve the concept of control. The Internal Revenue Service (IRS) developed 20 factors used to determine whether a worker is an independent contractor under the common law. A "yes" answer to any of these questions would be evidence of an employer-employee relationship.

" Does the principal provide instructions to the worker about when, where, and how he or she is to perform the work?

" Does the principal provide training to the worker?

" Are the services provided by the worker integrated into the principal's business operations?

" Must the services be rendered personally by the worker?

" Does the principal hire, supervise and pay assistants to the worker?

" Is there a continuing relationship between the principal and the worker?

" Does the principal set the work hours and schedule?

" Does the worker devote substantially full time to the business of the principal?

" Is the work performed on the principal's premises?

" Is the worker required to perform the services in an order or sequence set by the principal?

" Is the worker required to submit oral or written reports to the principal?

" Is the worker paid by the hour, week, or month?

" Does the principal have the right to discharge the worker at will?

" Can the worker terminate his or her relationship with the principal any time he or she wishes without incurring liability to the principal?

" Does the principal pay the business or traveling expenses of the worker?

A "yes" answer to any of these questions would be evidence of an independent contractor relationship.

" Does the worker furnish significant tools, materials and equipment?

" Does the worker have a significant investment in facilities?

" Can the worker realize a profit or loss as a result of his or her services?

" Does the worker provide services for more than one firm at a time\

" Does the worker make his or her services available to the general public?

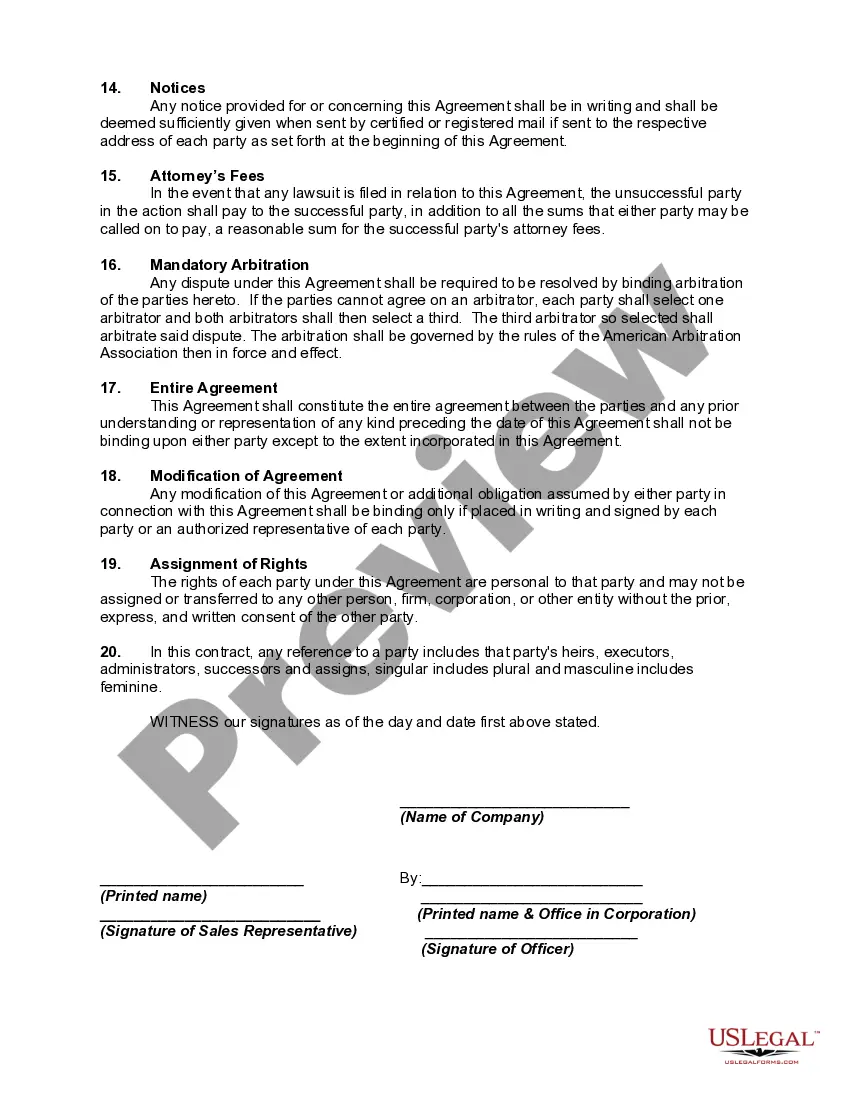

Title: Exploring Chicago Illinois' Contract with Sales Representative as Independent Contractor to Sell Snow Removal Services in Exclusive Territory Keywords: Chicago Illinois, Contract, Sales Representative, Independent Contractor, Snow Removal Services, Exclusive Territory. Introduction: In Chicago, Illinois, the contract with a sales representative as an independent contractor offers a lucrative opportunity to market and sell snow removal services in exclusive territories. This comprehensive guide elaborates on the various types of contracts available for sales representatives seeking to promote and sell snow removal services in Chicago, Illinois. 1. Description of Chicago Snow Removal Services: Chicago experiences harsh winters, making snow removal services an essential aspect of maintaining safety and accessibility. These services include snow plowing, salting, de-icing, sidewalk clearing, and 24/7 emergency response to ensure uninterrupted daily routines for residential, commercial, and municipal areas. 2. What is an Independent Contractor? An independent contractor is an individual or business responsible for offering their services to clients while maintaining autonomy and control over their work. In the context of snow removal services, independent contractors collaborate with snow removal companies on a contractual basis to promote and sell services, leading to revenue generation in exclusive territories. 3. Chicago Illinois Contract Types for Sales Representatives: a) Commission-Based Contract: This contract establishes a commission-based payment model, where sales representatives earn a certain percentage of the sales they generate. This type of contract offers flexibility and incentivizes high-performance, rewarding sales representatives accordingly. b) Fixed Fee Contract: In this contract, the sales representative operates on a fixed fee basis. They receive a predetermined payment for each successful sale made, regardless of the sale value or volume. This structure provides stability and security for the sales representative. c) Exclusive Territory Contract: Exclusive territory contracts allocate specific geographical areas within Chicago to individual sales representatives, ensuring exclusivity and preventing competition within the assigned area. This type of contract empowers sales representatives to focus on customer acquisition and retention within their designated territory. 4. Benefits of Independent Contractor Contracts: a) Flexibility: Independent contractor contracts provide the freedom to create a personalized schedule, allowing sales representatives to manage their time efficiently and balance their personal and professional lives. b) Unlimited Earning Potential: With the ability to earn commissions or fixed fees based on performance, sales representatives have the opportunity to maximize their earnings by expanding their customer base and promoting snow removal services effectively. c) Autonomy: As an independent contractor, sales representatives have the independence to adopt their own sales strategies, set targets, and drive their career growth within the specified contract terms. Conclusion: The Chicago Illinois contract with sales representatives as independent contractors to sell snow removal services in exclusive territories presents an exciting profit-oriented opportunity within a seasonal market. By offering various contract types, sales representatives can leverage their skills and expertise to generate revenue through commission-based or fixed fee contracts. The exclusivity factor further strengthens their sales potential. Take advantage of this thriving sector and capitalize on the snow removal services demand in Chicago's winter landscape.