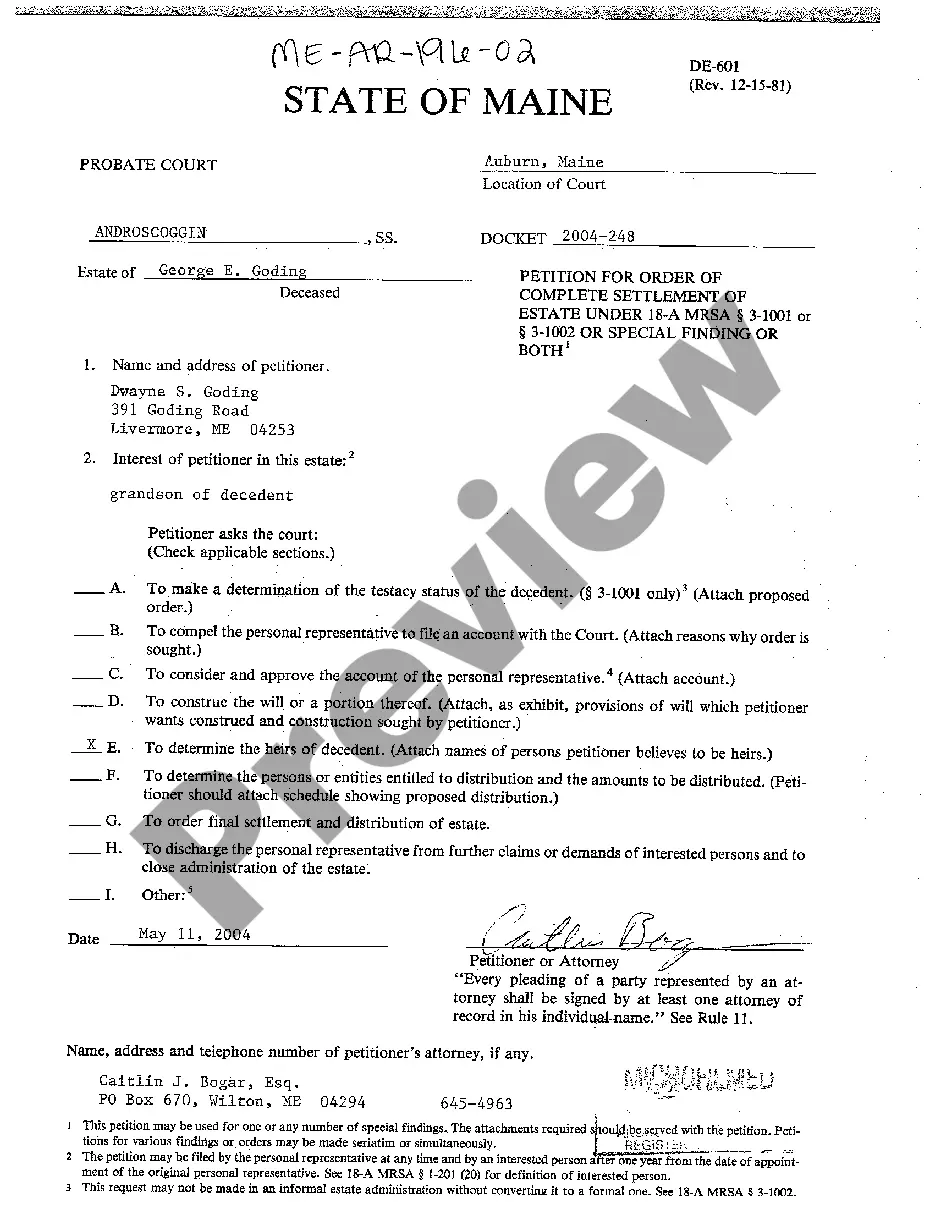

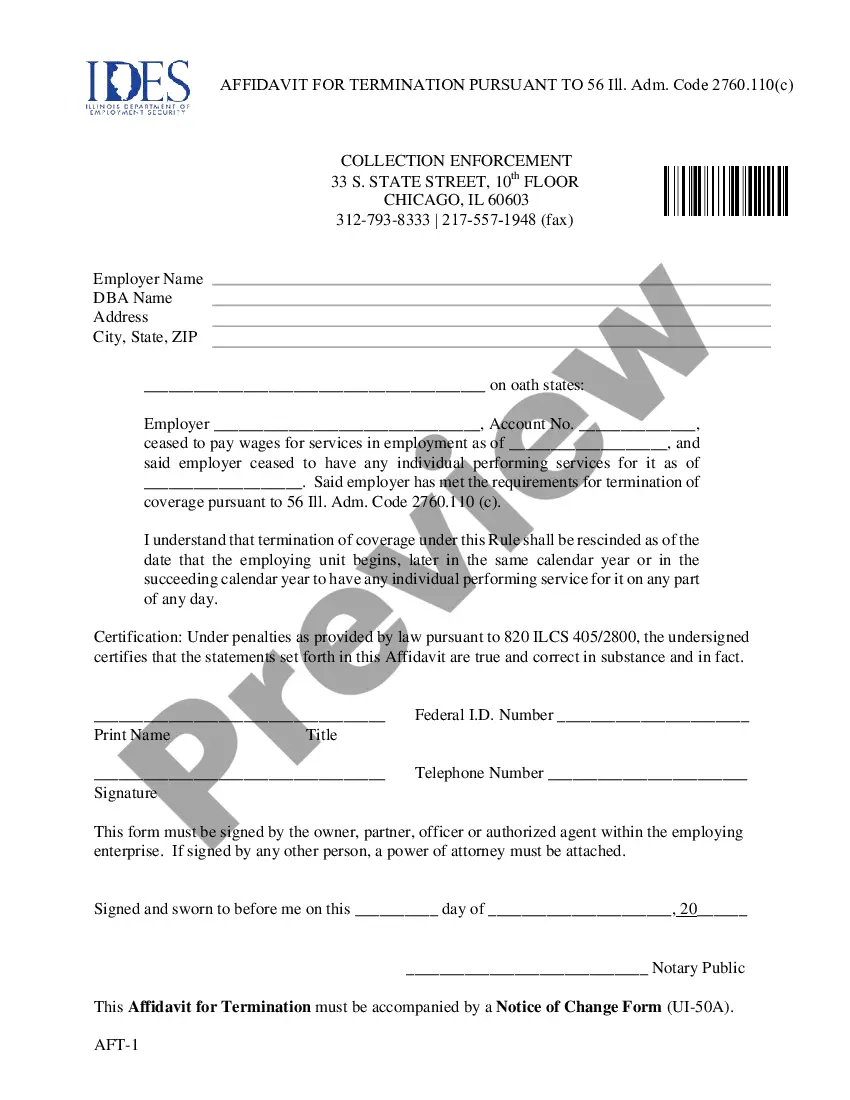

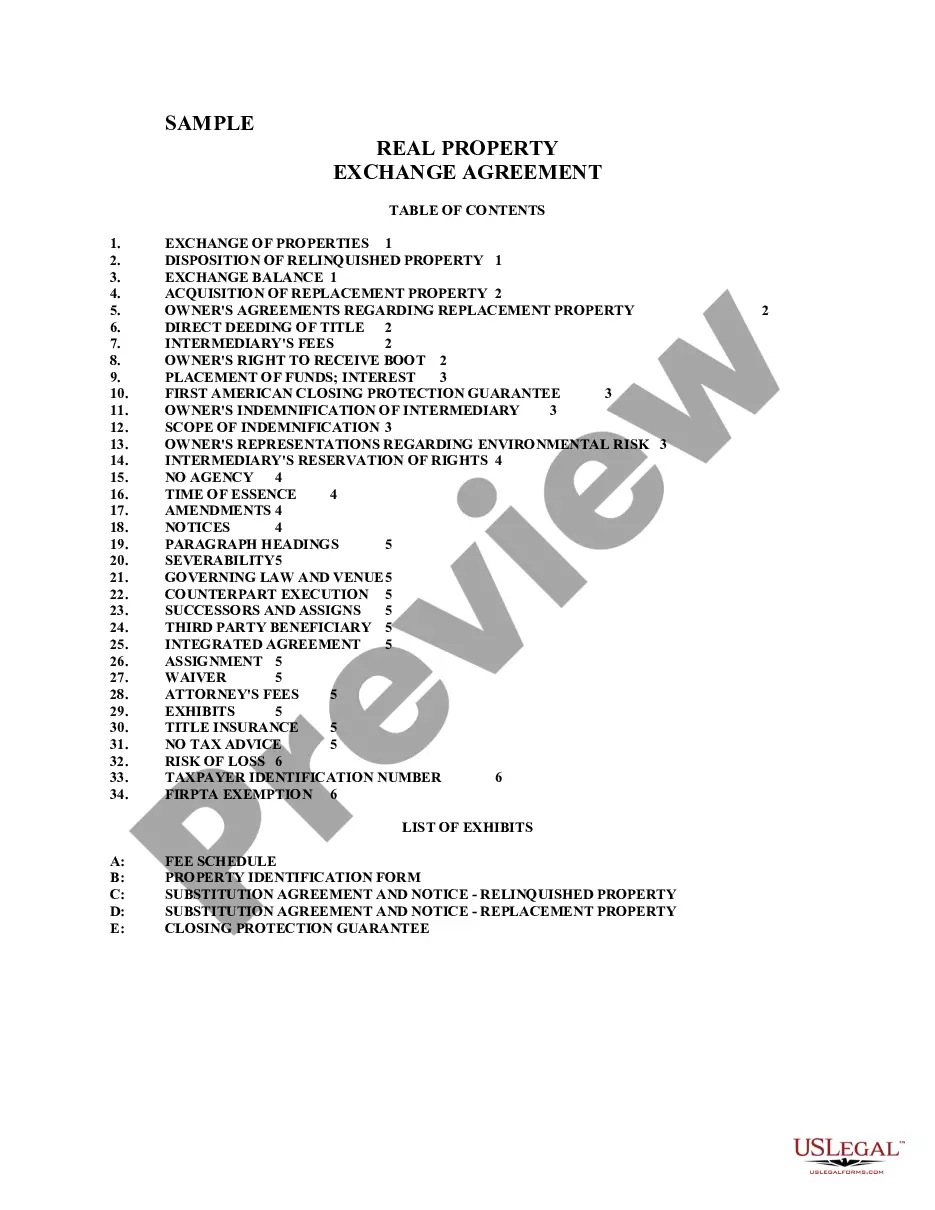

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Queens New York Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse

Description

How to fill out Queens New York Notice Of Non-Responsibility For Debts Or Liabilities Contracted By Spouse?

Whether you plan to start your business, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occasion. All files are grouped by state and area of use, so picking a copy like Queens Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to get the Queens Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse. Follow the instructions below:

- Make sure the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to get the sample once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Queens Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

Can you be responsible for someone else's debt? You are lawfully never responsible for someone else's debt. Whether it's your parent, your partner, or any other person you're associated with, they cannot hold you accountable for money that they borrowed.

All debts incurred during the marriage, even if accrued by only one of the spouses, are typically considered marital debt in New York. Marital debt can include credit card debt, mortgages, car loans, medical bills, debt from the pursuit of advanced degrees, and more.

When someone dies with an unpaid debt, it's generally paid with the money or property left in the estate. If your spouse dies, you're generally not responsible for their debt, unless it's a shared debt, or you are responsible under state law.

In common law states, debt taken on after marriage is usually treated as being separate and belonging only to the spouse who incurred them. The exception are those debts that are in the spouse's name only but benefit both partners.

If you signed up for a joint credit card before getting married, then both spouses would be responsible for that debt. But the act of getting married doesn't cause you to inherit debt signing up for a joint account is what makes the debt your responsibility.

Debts you and your spouse incurred before marriage remain your own individual obligationsbut you'll share responsibility for debts you take on together after the wedding.

Most states follow the same rules derived from common law for determining when one spouse may be liable for the debts of the other. Generally, one is only liable for their spouse's debts if the obligation is in both names. This is true both if one is a joint account holder or just a co-signer.

The bottom line. You are generally not responsible for your spouse's credit card debt unless you are a co-signor for the card or it is a joint account. However, state laws vary and divorce or the death of your spouse could also impact your liability for this debt.

In community property states, you are not responsible for most of your spouse's debt incurred before marriage. However, the IRS says debt taken on by either spouse after the wedding is automatically a shared debt. Even if your spouse opens up a line of credit in their name only, you could still be liable for that debt.

Key Takeaways: Debts are usually the responsibility of the person who incurs them. One spouse can be held financially liable for the other spouse's debts, in community property states.