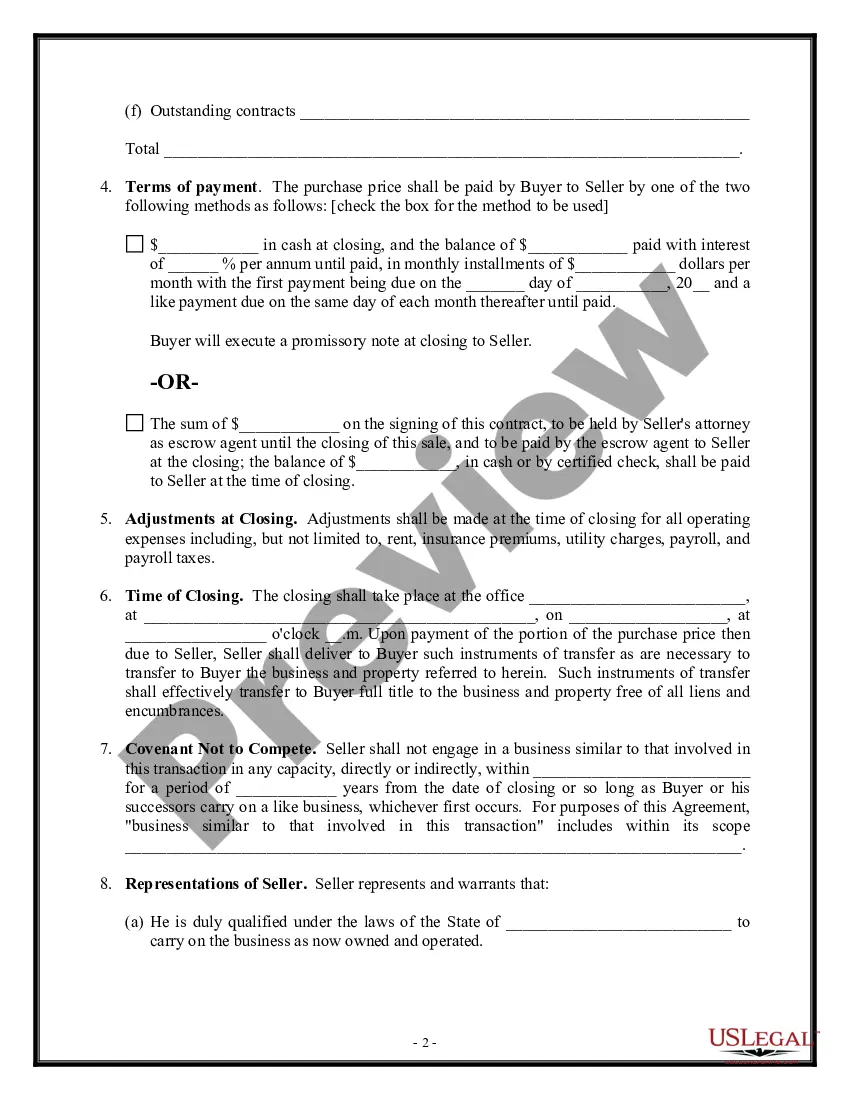

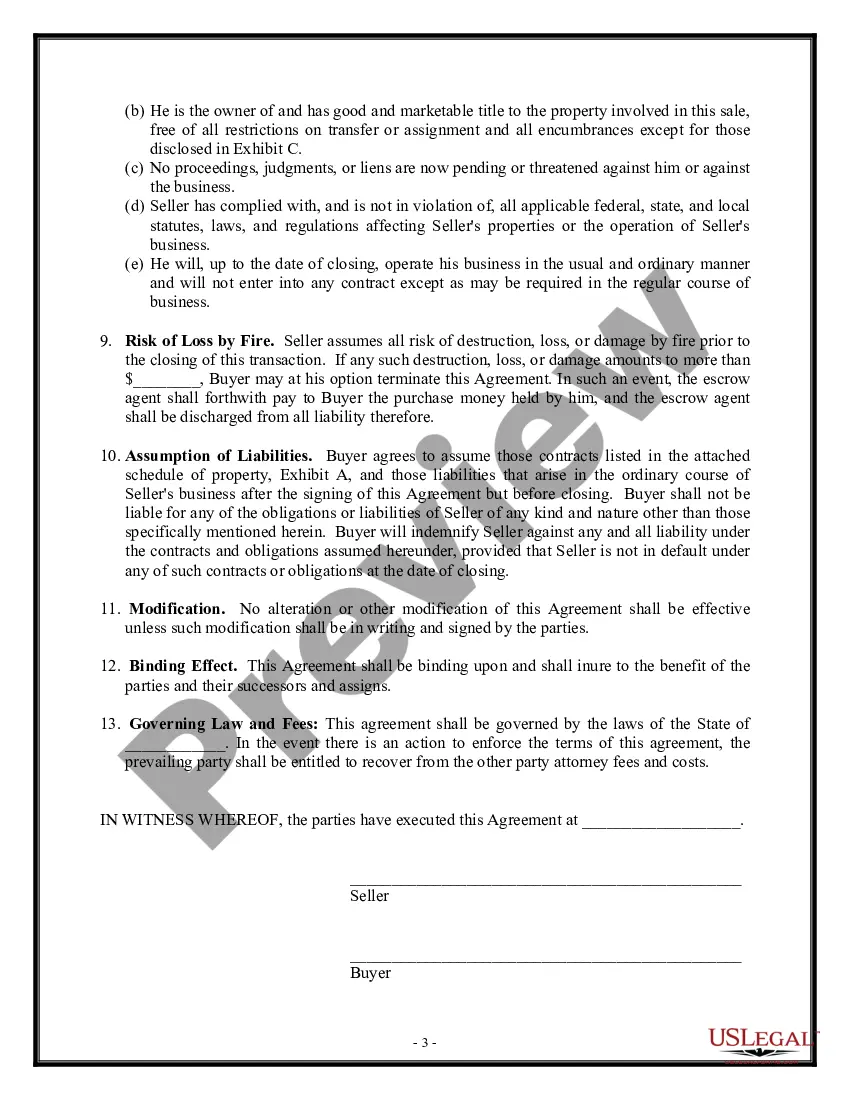

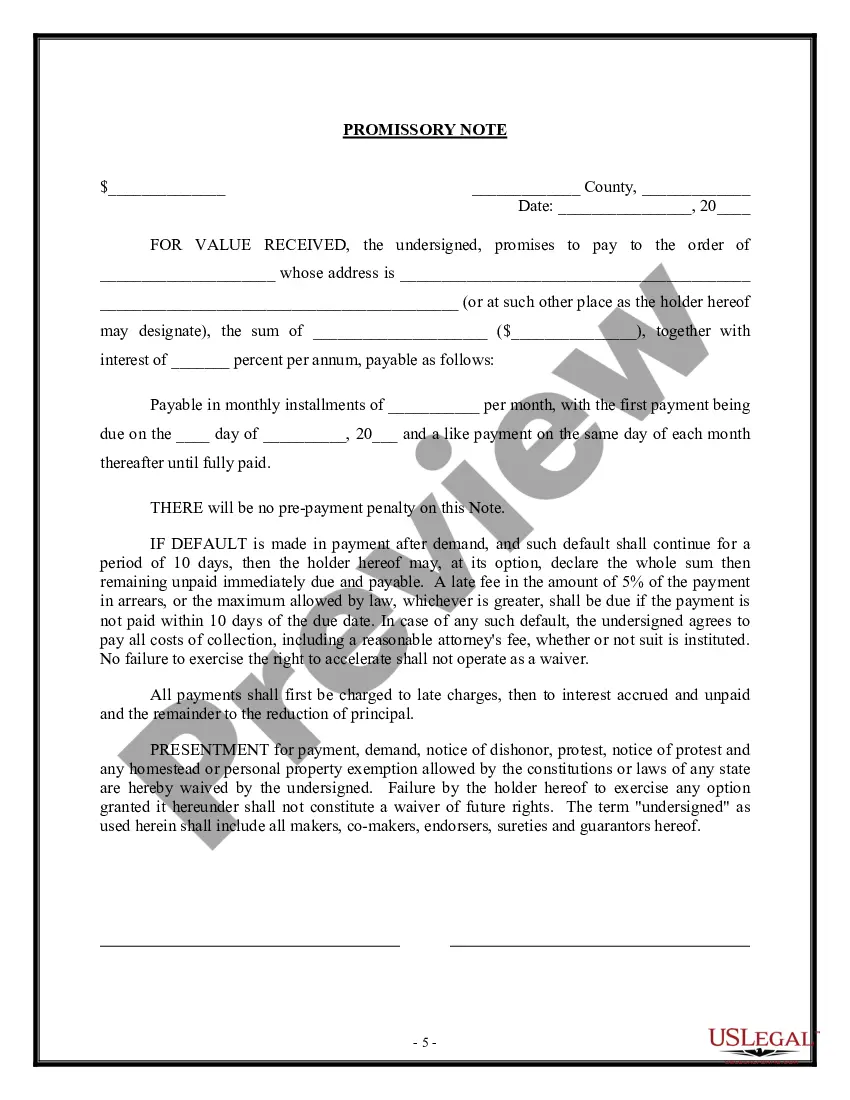

Allegheny Pennsylvania Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase is a legally binding contract used when a business owner, operating as a sole proprietor, intends to sell their business assets to another party. This agreement outlines the terms and conditions under which the sale will take place, safeguarding the interests of both the seller and buyer. The Allegheny Pennsylvania Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase typically includes the following details: 1. Parties Involved: It specifies the names and contact information of the seller (sole proprietor) and the buyer involved in the transaction. 2. Business Assets: This section provides a detailed list of all assets being sold as part of the agreement. It may include physical assets, such as inventory, equipment, machinery, furniture, fixtures, and vehicles. Intellectual property, licenses, permits, and customer lists can also be included. 3. Purchase Price: The agreed-upon purchase price for the business assets is mentioned, along with any specific terms regarding payment, such as a lump sum or installment payments. 4. Due Diligence: The buyer is usually allowed a certain period to conduct due diligence on the business assets to ensure their compliance and satisfactory condition before finalizing the sale. The agreement specifies the duration and scope of due diligence. 5. Liabilities and Indemnification: This section outlines how any outstanding debts, liabilities, or obligations related to the business assets will be handled. The buyer and seller can agree on who will assume these responsibilities and how they will be discharged. 6. Closing and Transfer of Assets: The agreement specifies the date on which the sale will close and when the buyer officially assumes ownership of the purchased assets. It also describes the process of transferring possession and ownership rights. 7. Representations and Warranties: Both parties provide certain assurances relating to the business and assets being sold. These representations and warranties assure the buyer that the information provided by the seller is accurate to the best of their knowledge. 8. Confidentiality and Non-Compete: The agreement may include provisions regarding the protection of confidential information and non-compete clauses to prevent the seller from competing with the buyer within a defined geographic area for a specific period. 9. Governing Law: The agreement specifies that it will be governed by the laws of Allegheny County, Pennsylvania, ensuring that any disputes or legal issues arising from the agreement are addressed within the jurisdiction. Different types of Allegheny Pennsylvania Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase may exist depending on specific circumstances or industries involved. Examples include agreements tailored for retail businesses, professional services, restaurants, manufacturing, or technology firms. These variations may include additional clauses or provisions specific to the industry, customizing the agreement to suit the unique needs of the parties involved.

Allegheny Pennsylvania Agreement for Sale of Business - Sole Proprietorship - Asset Purchase

Description

How to fill out Allegheny Pennsylvania Agreement For Sale Of Business - Sole Proprietorship - Asset Purchase?

Draftwing paperwork, like Allegheny Agreement for Sale of Business - Sole Proprietorship - Asset Purchase, to manage your legal matters is a challenging and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents crafted for various scenarios and life circumstances. We ensure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Allegheny Agreement for Sale of Business - Sole Proprietorship - Asset Purchase template. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before downloading Allegheny Agreement for Sale of Business - Sole Proprietorship - Asset Purchase:

- Make sure that your form is compliant with your state/county since the regulations for creating legal documents may vary from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Allegheny Agreement for Sale of Business - Sole Proprietorship - Asset Purchase isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin using our website and download the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment details.

- Your template is all set. You can try and download it.

It’s an easy task to find and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!