Collin Texas Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase Collin, Texas has its own specific agreement for the sale of a business as a sole proprietorship, specifically for the purchase of assets. An asset purchase agreement is a legally binding contract between a buyer and a seller outlining the terms and conditions of the sale of a business's assets. In Collin, Texas, there may be different types of agreements for the sale of a business as a sole proprietorship, depending on the specific industry, nature of the business, or other unique circumstances. Some of these types may include: 1. Retail Business Asset Purchase Agreement: This type of agreement is specific to the sale of retail businesses, such as clothing stores, grocery stores, or electronics shops. It will outline the assets being sold, including inventory, equipment, fixtures, and any existing contracts or customer databases. 2. Professional Service Business Asset Purchase Agreement: This type of agreement is tailored for the sale of businesses that offer professional services, such as law firms, medical practices, or consulting agencies. It will focus on transferring client lists, existing contracts, intellectual property rights, and any equipment or supplies essential for rendering the services. 3. Manufacturing Business Asset Purchase Agreement: This agreement type is designed for the sale of businesses involved in manufacturing or production, such as factories, plants, or workshops. It will emphasize the transfer of machinery, equipment, inventory, patents, trademarks, or copyrights associated with the manufacturing process. 4. Restaurant or Food Service Business Asset Purchase Agreement: For businesses in the food industry, including restaurants, cafés, or food trucks, this agreement will concentrate on transferring fixtures, kitchen appliances, inventory, recipes, licenses, and any existing supplier contracts. Regardless of the specific type, a Collin Texas Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase typically includes essential elements such as the purchase price, payment terms, asset description, warranties and representations, non-compete clauses, dispute resolution mechanisms, and other terms specific to the transaction. It is crucial for both the buyer and seller to review and understand the agreement thoroughly before entering into any business transaction. Consulting with legal professionals familiar with Collin, Texas laws is highly recommended ensuring all legal requirements are followed and to protect the interests of both parties involved in the sale.

Collin Texas Agreement for Sale of Business - Sole Proprietorship - Asset Purchase

Description

How to fill out Collin Texas Agreement For Sale Of Business - Sole Proprietorship - Asset Purchase?

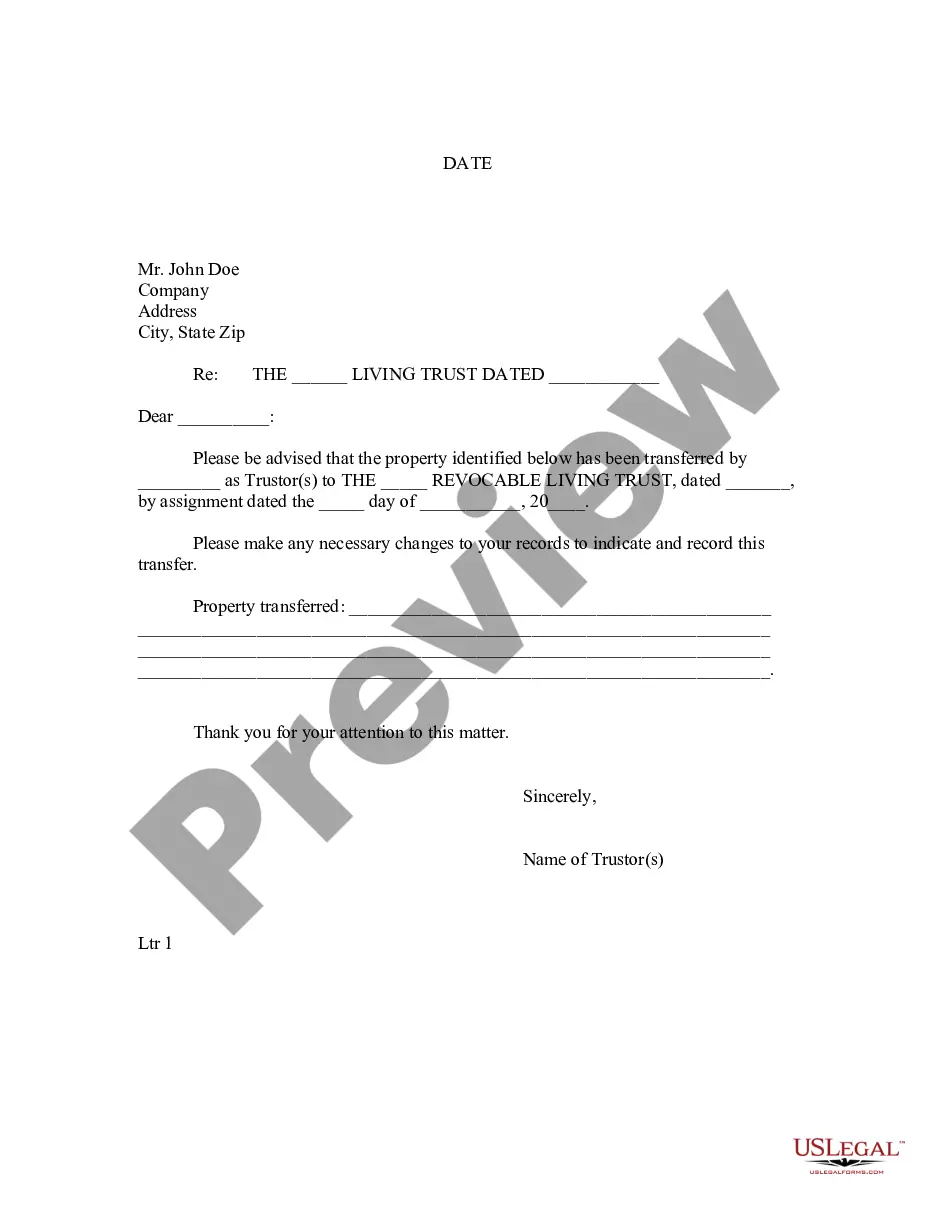

If you need to find a trustworthy legal paperwork supplier to find the Collin Agreement for Sale of Business - Sole Proprietorship - Asset Purchase, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, number of supporting resources, and dedicated support team make it easy to find and execute different paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply type to look for or browse Collin Agreement for Sale of Business - Sole Proprietorship - Asset Purchase, either by a keyword or by the state/county the document is intended for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Collin Agreement for Sale of Business - Sole Proprietorship - Asset Purchase template and take a look at the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately ready for download as soon as the payment is processed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less pricey and more affordable. Set up your first company, arrange your advance care planning, create a real estate contract, or execute the Collin Agreement for Sale of Business - Sole Proprietorship - Asset Purchase - all from the convenience of your sofa.

Sign up for US Legal Forms now!