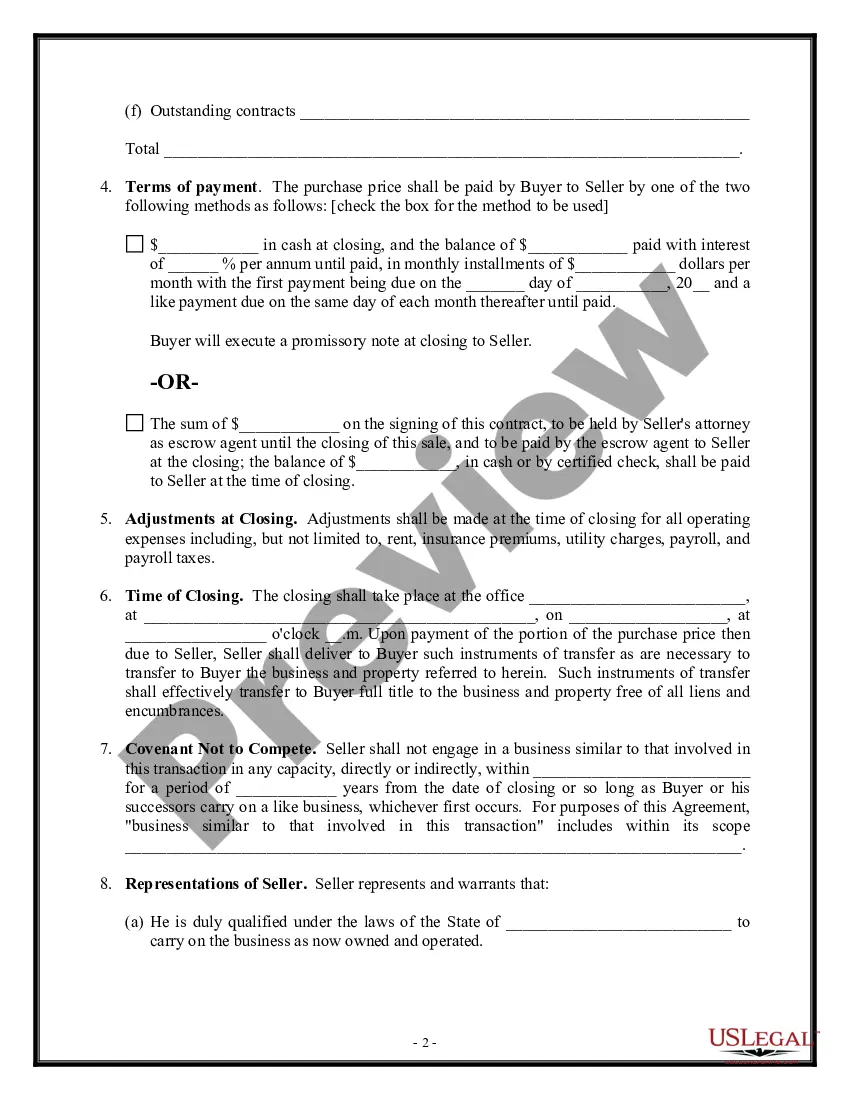

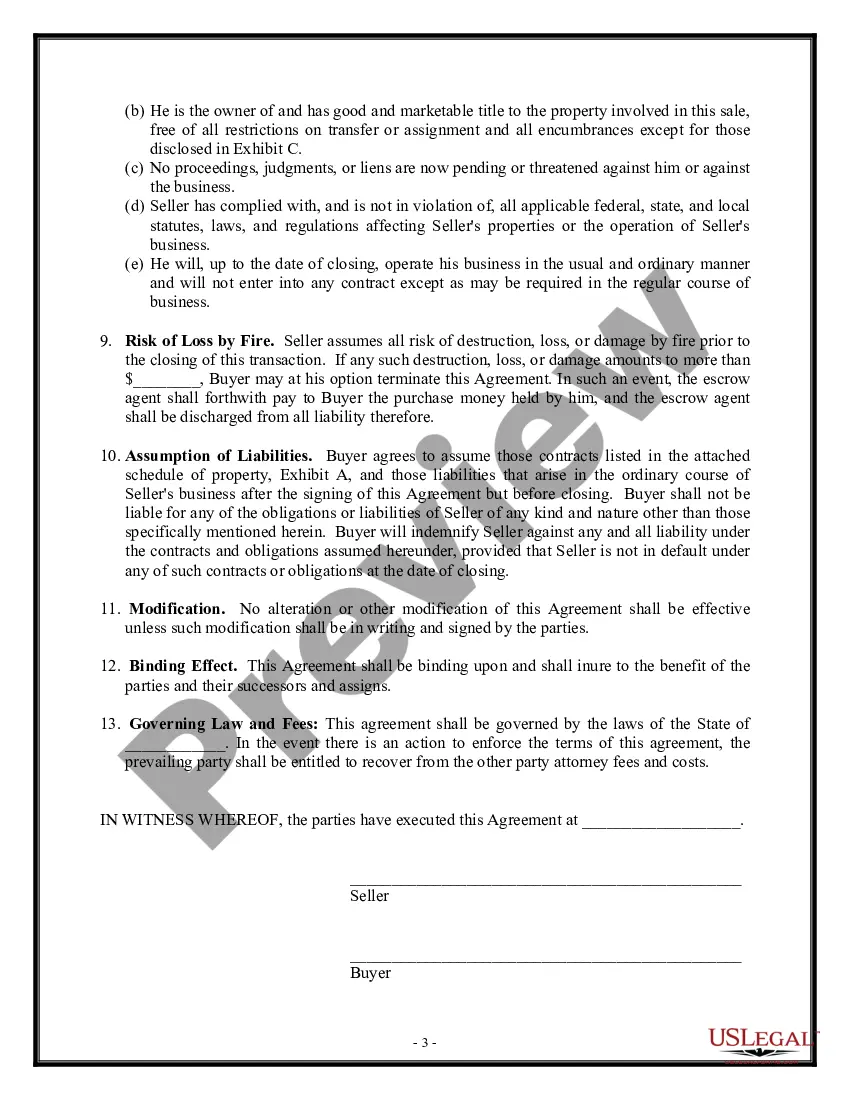

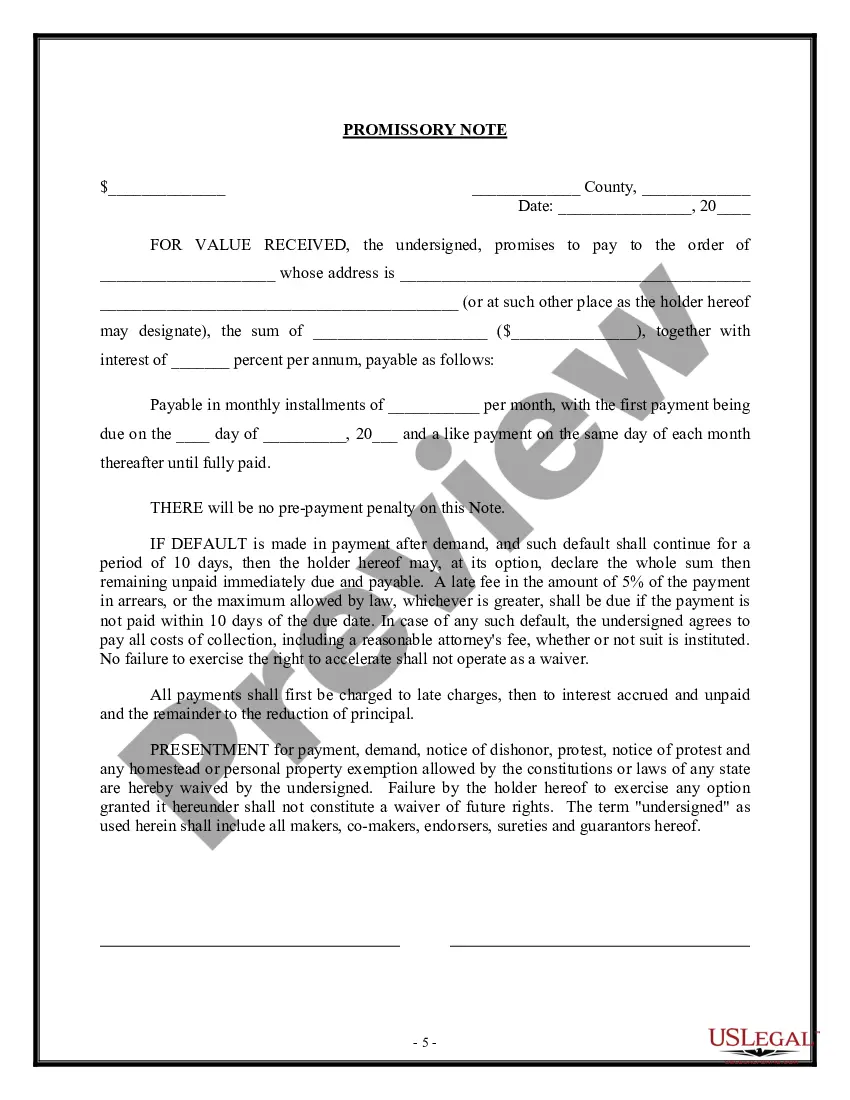

Los Angeles, California Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase is a legal document that outlines the terms and conditions for the transfer of a sole proprietorship business in Los Angeles, California. This agreement, commonly known as an Asset Purchase Agreement (APA), is designed to protect the interests of both the buyer and the seller during the process of buying or selling a business. It covers a wide range of aspects involved in the transaction, ensuring a smooth and fair transfer of assets. This agreement is crucial in an asset purchase scenario, as it allows the buyer to purchase select assets and liabilities of the sole proprietorship business rather than buying the entire business itself. It enables the buyer to assume control over the chosen assets while leaving behind any unwanted liabilities, debts, or legal responsibilities associated with the business. The Los Angeles, California Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase typically includes key provisions such as: 1. Identification of the parties involved: The agreement clearly identifies the buyer and the seller, including their legal names and addresses. 2. Purchase price and payment terms: This section specifies the agreed-upon purchase price for the assets and the terms of payment, which can include lump-sum payments, installment payments, or contingent payments based on future business performance. 3. Assets and liabilities: The agreement specifies the assets being transferred, such as equipment, inventory, intellectual property rights, contracts, licenses, and customer lists. It also outlines any liabilities that the buyer may assume, such as outstanding debts, pending lawsuits, or tax obligations. 4. Due diligence: This provision allows the buyer to conduct a thorough investigation of the business's books, records, operations, and financial statements before finalizing the purchase. It ensures that the buyer has complete information about the business's financial health and potential risks. 5. Conditions and obligations: The agreement sets forth the conditions that need to be met before the sale can be completed, such as obtaining necessary permits, licenses, or consents. It also outlines the obligations of both parties during the transition period, including cooperation in transferring assets, providing necessary documentation, and maintaining confidentiality. 6. Representations and warranties: This section contains statements made by the seller regarding the accuracy of information provided, the ownership of assets, and the absence of undisclosed liabilities or legal disputes. 7. Indemnification and dispute resolution: The agreement includes provisions for indemnifying either party from losses incurred due to a breach of the agreement. It also outlines the procedures for resolving disputes, such as mediation, arbitration, or litigation. Types of Los Angeles, California Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase: 1. Standard Asset Purchase Agreement: This is a comprehensive agreement covering all aspects of the sale and purchase of assets in a sole proprietorship. 2. Short Form Asset Purchase Agreement: This is a condensed version of the standard agreement, suitable for straightforward transactions with fewer complexities. 3. Stock Purchase Agreement: Although not technically an asset purchase, a stock purchase agreement involves the purchase of all shares of a corporation, which indirectly acquires the assets and liabilities of the sole proprietorship. In summary, the Los Angeles, California Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase is a crucial legal document that ensures a fair and transparent transaction when buying or selling a sole proprietorship business in Los Angeles, California. It protects both parties' interests, outlines the terms of the purchase, and facilitates a smooth transfer of assets while minimizing potential liabilities.

Purchase Agreement Employees

Description

How to fill out Los Angeles California Agreement For Sale Of Business - Sole Proprietorship - Asset Purchase?

Dealing with legal forms is a must in today's world. However, you don't always need to seek qualified assistance to draft some of them from scratch, including Los Angeles Agreement for Sale of Business - Sole Proprietorship - Asset Purchase, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in various categories varying from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching experience less challenging. You can also find detailed resources and tutorials on the website to make any activities related to document completion straightforward.

Here's how you can locate and download Los Angeles Agreement for Sale of Business - Sole Proprietorship - Asset Purchase.

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some documents.

- Examine the similar document templates or start the search over to locate the correct file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment method, and purchase Los Angeles Agreement for Sale of Business - Sole Proprietorship - Asset Purchase.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Los Angeles Agreement for Sale of Business - Sole Proprietorship - Asset Purchase, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney entirely. If you have to deal with an extremely difficult case, we recommend using the services of a lawyer to check your form before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and get your state-specific paperwork with ease!