A Palm Beach Florida Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase is a legal document that outlines the terms and conditions of a business sale between a seller who operates as a sole proprietorship and a buyer who intends to purchase the business assets. This agreement serves as a vital tool to ensure a smooth and legally binding transaction. The Palm Beach Florida Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase typically includes key details such as the names and addresses of the buyer and seller, the purchase price, payment terms, description of the assets being sold, and any warranties or representations made by the seller. There are a few different types of Palm Beach Florida Agreements for Sale of Business — SolProprietorshiphi— - Asset Purchase, each catering to specific scenarios and needs: 1. Standard Asset Purchase Agreement: This agreement covers the sale of the entire business or specific assets owned by the sole proprietorship, such as equipment, inventory, customer lists, intellectual property, lease agreements, and licenses. 2. Bulk Sale Agreement: Often used in Palm Beach Florida for businesses where the buyer is acquiring all the assets as a lump sum, this agreement ensures a clear and orderly transfer of property rights and liabilities while complying with state regulations. 3. Conditional Asset Purchase Agreement: In certain cases, a buyer might require certain conditions to be met before finalizing the purchase. This agreement includes provisions allowing the buyer to back out if these conditions are not fulfilled. 4. Bill of Sale: A Bill of Sale is a simpler document used in Palm Beach Florida for the transfer of specific assets. It typically includes a detailed description of the item being sold, the purchase price, and any warranties. 5. Non-Disclosure Agreement (NDA): In some instances, parties may need to exchange sensitive information during the negotiation process. An NDA ensures confidentiality and prevents the disclosing party from sharing the information with unauthorized parties. When entering into a Palm Beach Florida Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase, it is recommended to seek legal advice to ensure the agreement reflects both parties' intentions and complies with relevant laws and regulations.

Palm Beach Florida Agreement for Sale of Business - Sole Proprietorship - Asset Purchase

Description

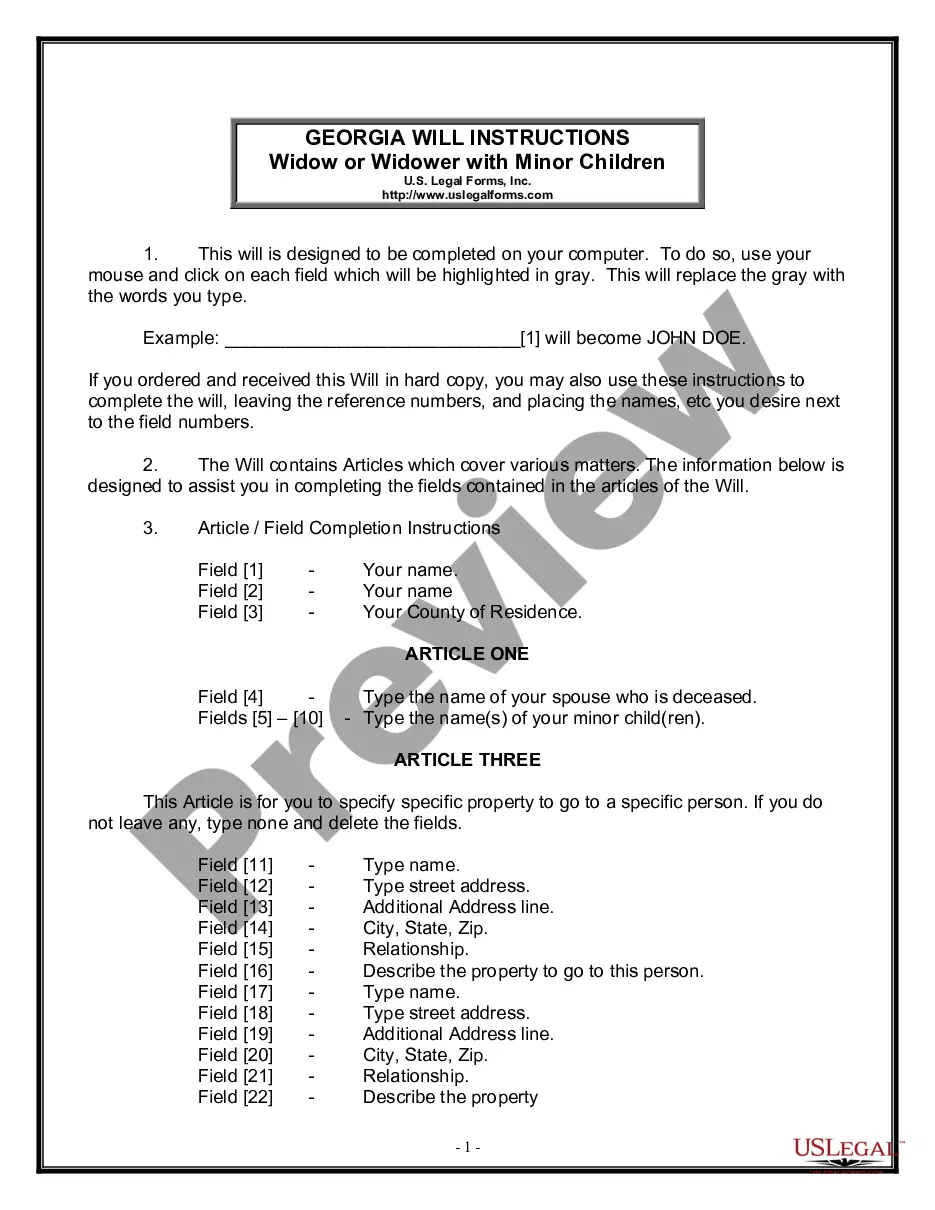

How to fill out Palm Beach Florida Agreement For Sale Of Business - Sole Proprietorship - Asset Purchase?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official documentation that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Palm Beach Agreement for Sale of Business - Sole Proprietorship - Asset Purchase.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Palm Beach Agreement for Sale of Business - Sole Proprietorship - Asset Purchase will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to obtain the Palm Beach Agreement for Sale of Business - Sole Proprietorship - Asset Purchase:

- Make sure you have opened the right page with your regional form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Palm Beach Agreement for Sale of Business - Sole Proprietorship - Asset Purchase on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

In an asset sale, sellers are subject to potentially higher taxes than in a stock sale. While intangible assets, such as goodwill, are taxed at capital gains rates, other hard assets may be taxed at higher ordinary income tax rates. Currently, federal capital gains rates are around 20%, while state rates vary.

Business Asset Purchase Agreement (APA): What You MUST Know! Preamble and Recitals. Identifying the Parties Involved. Purchase Price and Payment Terms. Representations and Warranties of the Buyer and Seller. Conditions to Closing and other Obligations of the Parties. Termination Provisions. Miscellaneous Terms.

Generally, the buyer will draft very broad language when describing the transferred assets, such as all assets used in the business, including2026 Therefore, it's up to you, as the seller, to carve out assets that should not be transferred.

The difference between an asset sale and a share sale The transaction is between the company and the buyer of the business assets. The seller retains ownership of the company structure. In a share sale, the buyer purchases shares in the company, rather than just the assets.

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

How to Write a Business Purchase Agreement? Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

Any purchase agreement should include at least the following information: The identity of the buyer and seller. A description of the property being purchased. The purchase price. The terms as to how and when payment is to be made. The terms as to how, when, and where the goods will be delivered to the purchaser.

The buyer's solicitor will prepare and draft the sale contract, no matter whether it is an Asset Purchase Agreement or an SPA, this is because the contract will provide for a number of warranties (and possibly indemnities) but it will also govern who the purchase will be carried out, the purchase price to be paid,

The following considerations should be included in a Letter of Intent: Value exchanged for the asset purchase. Anticipated timeline for negotiations and deal structuring. Escrow account requirements if any. Exclusivity to the buyer. Scope of key warranties and guarantees. Prohibited buyer and seller activities.

Content of a Business Purchase Agreement The financial terms of the transfer, such as the purchase price, and the time and manner of payment; this may involve an initial deposit, with either a lump sum payment of the balance at closing or installment payments if the seller is financing the sale.