A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept of an estate which has been conveyed to him.

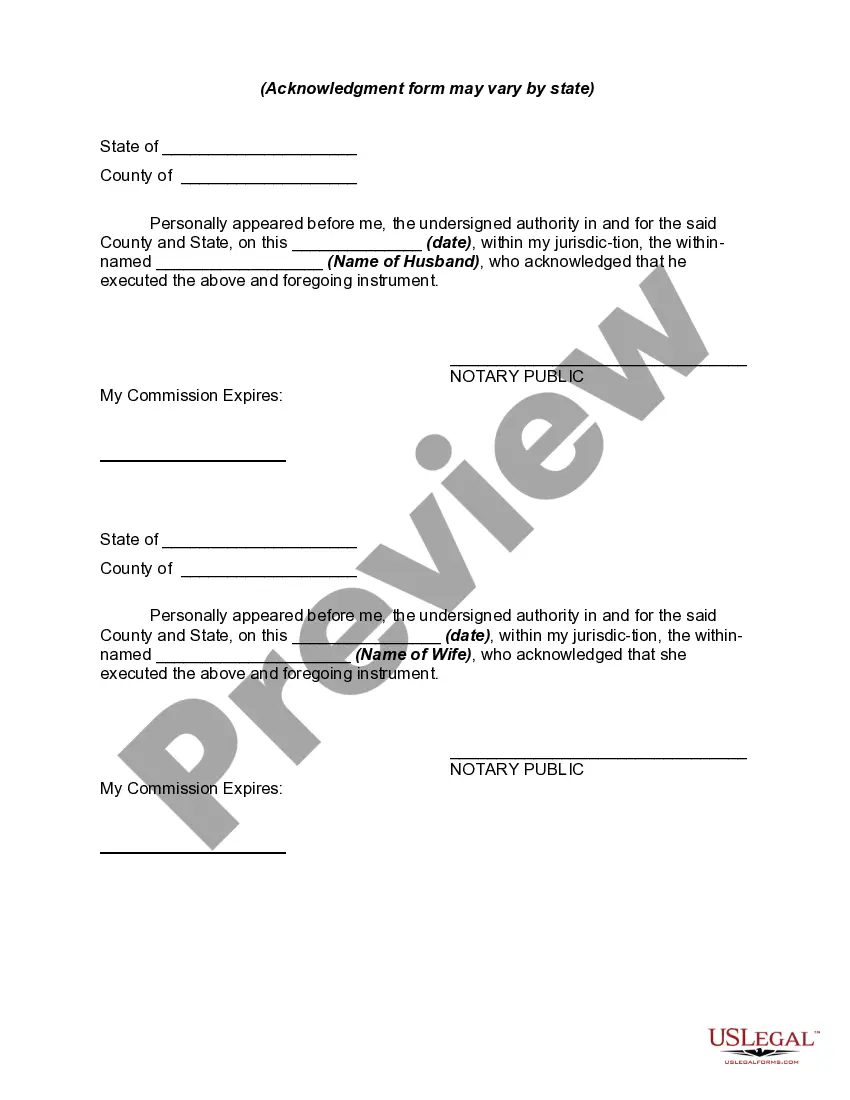

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Chicago Illinois Mutual Disclaimer by Spouses of Interest in Property of Each is a legal document that is used in the state of Illinois to clarify the ownership of property between married couples. This document recognizes that each spouse may have different interests in certain properties and serves to protect their individual rights. The purpose of the Chicago Illinois Mutual Disclaimer is to ensure that each spouse's interest in property is clearly defined and acknowledged in case of divorce, death, or any other situation that may require the disposition of the property. It provides a legal framework for both spouses to declare their separate interests and prevent any future disputes or confusion. The Mutual Disclaimer is especially relevant in situations where one spouse brings property into the marriage, and both parties want to clarify their ownership rights. It can also be used when a couple acquires property during the marriage, but each wants to maintain individual rights over specific assets. The different types of Chicago Illinois Mutual Disclaimer by Spouses of Interest in Property of Each include: 1. Premarital Mutual Disclaimer: This is used when spouses want to establish their separate interests in property before getting married. It helps maintain the remarriage ownership rights of each spouse and can be helpful if the marriage ends in divorce. 2. Post-Marital Mutual Disclaimer: This type of Mutual Disclaimer is used after the couple is married to define their interests in specific properties acquired during the marriage. It is typically used when one spouse wants to protect their separate property rights. 3. Mutual Disclaimer on Specific Asset(s): This variation of the Mutual Disclaimer focuses on individual assets rather than an overarching agreement. It allows spouses to clarify their ownership rights on specific properties, such as a family home, investment property, or valuable possessions like artwork or vehicles. Keywords: Chicago Illinois, Mutual Disclaimer, Spouses of Interest, Property, Ownership, Rights, Legal Document, Married Couples, Divorce, Death, Disposition, Premarital, Post-Marital, Specific Assets.