The King Washington Security Agreement Regarding Aircraft and Equipment is a legal document that outlines the terms and conditions of a security agreement between a lender and a borrower related to the financing of aircraft and equipment. This agreement serves as a safeguard for the lender, ensuring that in the case of default or non-payment by the borrower, the lender has the right to take possession of and sell the aircraft or equipment to recover the outstanding amount. One type of King Washington Security Agreement Regarding Aircraft and Equipment is a "Chattel Mortgage." This agreement grants the lender a security interest in the aircraft or equipment, making it possible for the lender to assume ownership in the event of default. Another type of agreement is the "Aircraft Security Agreement," which specifically focuses on securing the lender's interest in an aircraft. The document typically includes various essential elements such as a clear description of the aircraft or equipment being financed, identification of the lender and the borrower, the amount of the loan, repayment terms, and any applicable interest rates or fees. It also includes provisions related to default, remedies available to the lender, and guidelines for the release of the security interest upon satisfying the obligations. The King Washington Security Agreement Regarding Aircraft and Equipment generally incorporates references to important legal provisions, such as the Uniform Commercial Code (UCC) and other relevant aviation laws or regulations. By doing so, it ensures compliance with local and federal legislation governing the aircraft and equipment financing industry. Additionally, the agreement may include clauses covering insurance requirements, maintenance and repair stipulations, as well as provisions addressing the transfer or subleasing of the aircraft or equipment. In summary, the King Washington Security Agreement Regarding Aircraft and Equipment establishes a legally binding arrangement between a lender and a borrower to protect the financial interests of the lender in cases where the borrower defaults on repayment. By comprehensively detailing the rights and obligations of both parties, this agreement ensures transparency and clarity, minimizing potential disputes and facilitating a smooth financing process.

King Washington Security Agreement Regarding Aircraft and Equipment

Description

How to fill out King Washington Security Agreement Regarding Aircraft And Equipment?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare official documentation that differs throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any individual or business purpose utilized in your county, including the King Security Agreement Regarding Aircraft and Equipment.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the King Security Agreement Regarding Aircraft and Equipment will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to get the King Security Agreement Regarding Aircraft and Equipment:

- Ensure you have opened the proper page with your regional form.

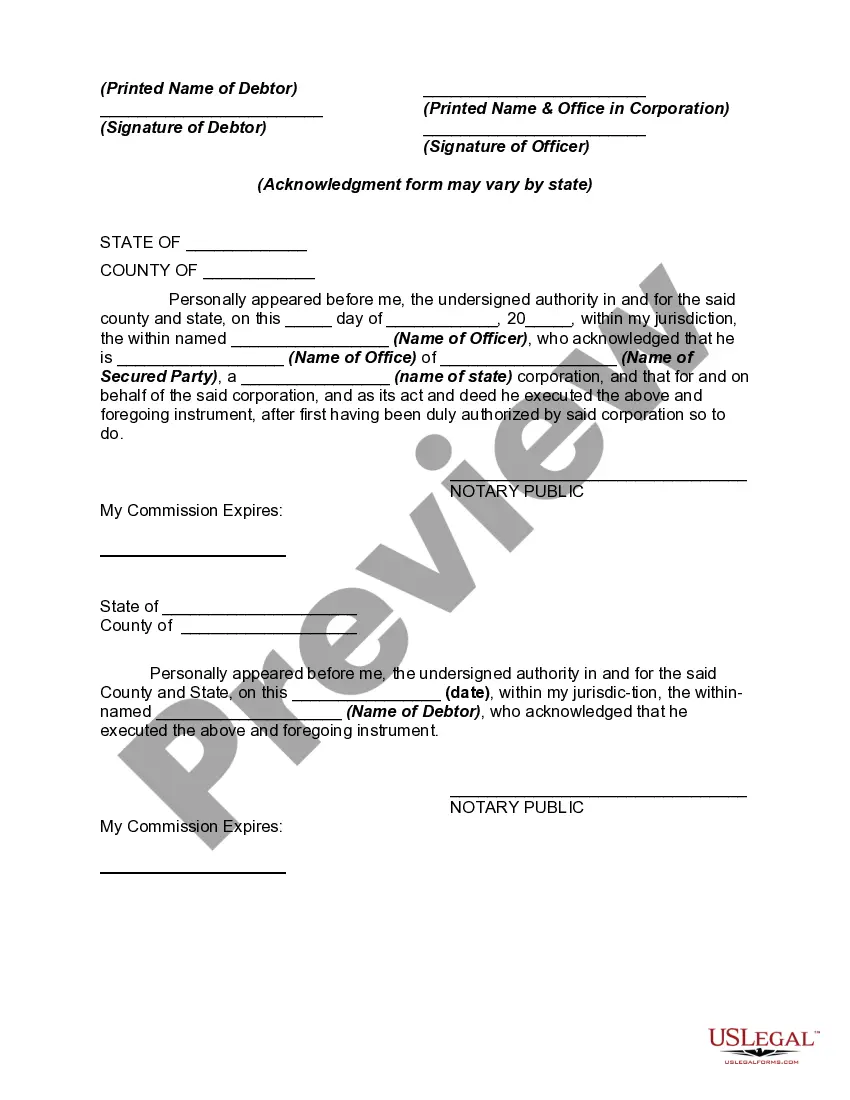

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the King Security Agreement Regarding Aircraft and Equipment on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!