Until a conveyance, lease, or instrument executed for security purposes which may be recorded under ??? 44107(a)(1) or (2) has been filed with the FAA, it is valid only against the parties to the instrument and individuals and entities who have actual knowledge of the instrument. Therefore, the interests of the parties to a transaction, including purchasers, lessor, lessees and secured parties, are not perfected until the instruments creating those interests have been filed with the FAA.

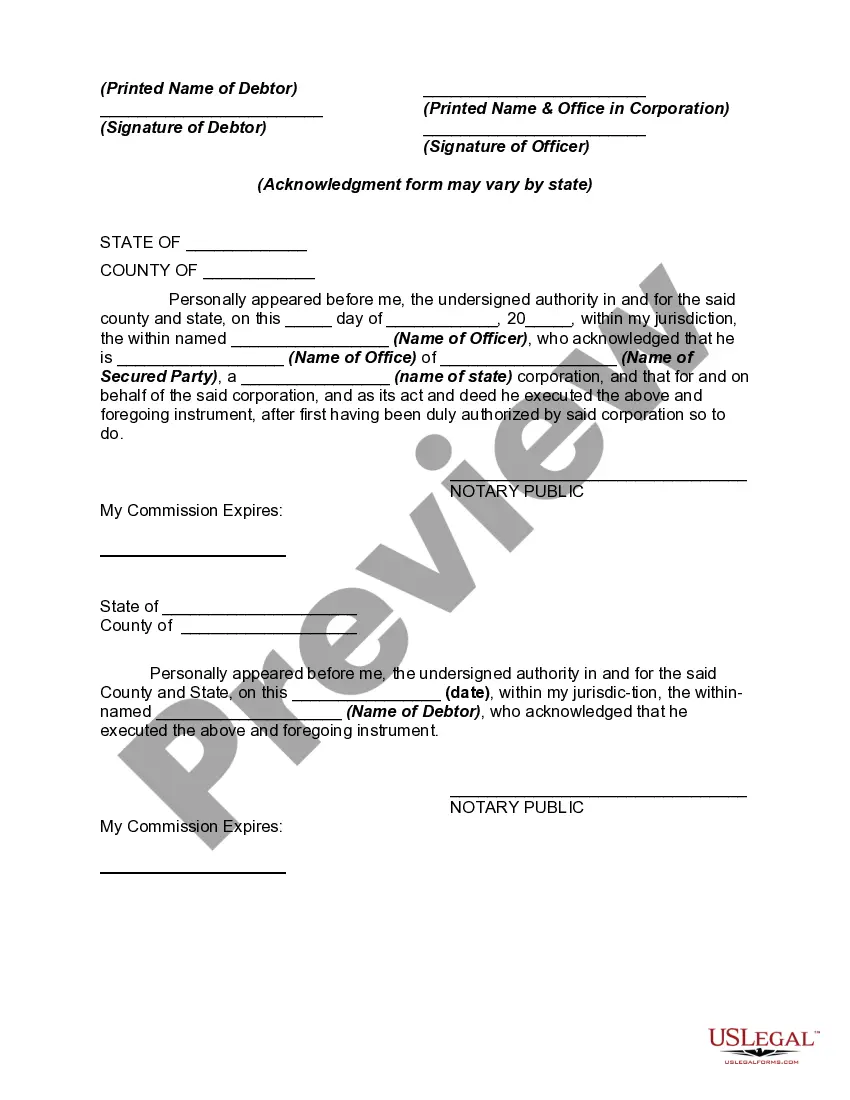

The Nassau New York Security Agreement Regarding Aircraft and Equipment is a legal document that outlines the terms and conditions for securing aircraft and related equipment in Nassau, New York. This agreement is crucial for establishing a comprehensive framework that protects the interests of parties involved in aircraft financing or leasing transactions. This agreement ensures that lenders or lessors have a right to seize and sell the aircraft and equipment in case of default by the borrower or lessee. It provides a legal mechanism to mitigate risks associated with such transactions and maintain the security of the investment. Some relevant keywords associated with the Nassau New York Security Agreement Regarding Aircraft and Equipment include: 1. Aircraft financing: This refers to the process of securing funds for the purchase or lease of an aircraft. The security agreement provides lenders with assurance that their investment is adequately protected. 2. Equipment leasing: The agreement may also cover the leasing of equipment directly related to aircraft operations, such as engines, avionics, or ground support equipment. Lenders or lessors want to ensure their rights in case of non-payment or breaches of the lease agreement. 3. Collateral: The agreement identifies the aircraft and associated equipment as collateral, meaning that they serve as security for the loan or lease. This enables the lender or lessor to claim ownership or sell the collateral to recover their investment. 4. Default: The agreement specifies the conditions under which a borrower or lessee is considered in default, such as failure to make payments or violation of certain terms mentioned in the agreement. In case of default, the lender or lessor can enforce their rights and remedies outlined in the agreement. 5. Enforceability: The agreement ensures that the terms and conditions are legally binding, allowing the lender or lessor to take necessary legal actions to ensure compliance by the borrower or lessee. In addition to the general Nassau New York Security Agreement Regarding Aircraft and Equipment, there may be different types, such as: 1. Mortgage Agreement: This type of security agreement involves the creation of a mortgage on the aircraft, granting the lender a lien on the aircraft as collateral. The lender holds the mortgage until the loan is repaid, ensuring their priority interest in the aircraft. 2. Conditional Sales Agreement: This agreement allows the borrower to gain possession or use of the aircraft while making installment payments. However, the borrower does not gain full ownership until the final payment is made, and the lender retains a security interest in the aircraft until then. 3. Chattel Mortgage: This agreement involves the creation of a security interest in personal property, such as aircraft equipment. The lender holds the right to seize and sell the equipment in case of default, providing them with security. The Nassau New York Security Agreement Regarding Aircraft and Equipment, along with its various types, plays a crucial role in safeguarding the interests of lenders and lessors in Nassau, New York, providing a legal framework to ensure the security of aircraft financing and leasing transactions.