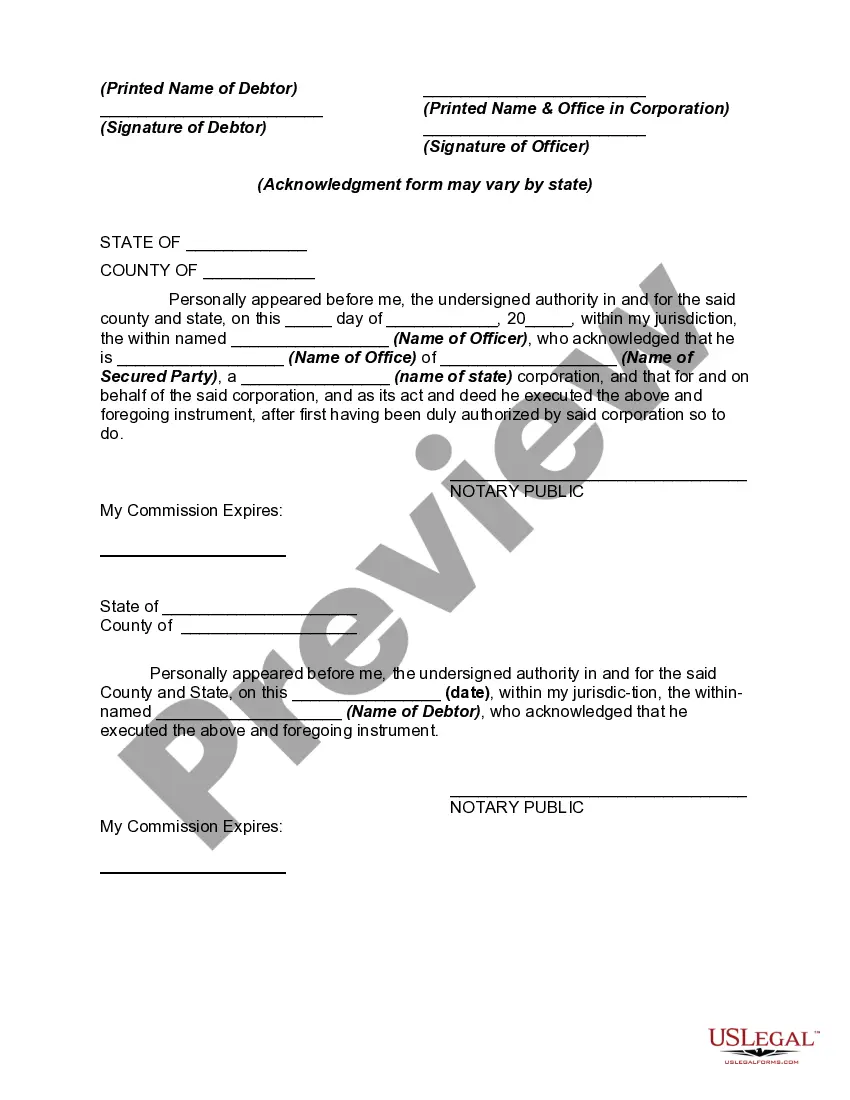

Palm Beach, Florida Security Agreement Regarding Aircraft and Equipment is a legal document that aims to protect the financial interests of lenders or lessors involved in aircraft and equipment transactions. It establishes a set of conditions, rights, and obligations to ensure security and reduce risks. This agreement is crucial for both parties involved to ensure the repayment of debts or obligations and utmost compliance with terms. The Palm Beach, Florida Security Agreement Regarding Aircraft and Equipment may vary in types and specifics based on the context in which it is utilized. Below are a few examples of the different types of agreements relevant to Palm Beach, Florida: 1. Loan Security Agreement: This type of agreement is commonly used when an individual or entity seeks a loan to finance an aircraft or equipment. The lender provides funds, and in return, the borrower grants a security interest in the purchased assets as a guarantee for repayment. 2. Equipment Lease Agreement: In this case, a lessor (owner of the asset) allows a lessee (user) to take possession and use the aircraft or equipment against regular rental payments. The Security Agreement is essential as it secures the lessor's rights in case of default, damage, or other issues specified in the agreement. 3. Purchase Money Security Agreement: When a buyer requires financing to acquire an aircraft or equipment, this agreement is employed. It states the financing terms and grants the lender a security interest in the purchased asset as collateral until the loan is fully repaid. 4. Conditional Sales Agreement: In this scenario, the seller retains ownership until the buyer fulfills all the payment obligations as agreed. The Security Agreement ensures the seller's rights and serves as a lien against the asset until the buyer completes payment. Palm Beach, Florida Security Agreement Regarding Aircraft and Equipment includes essential keywords such as security interest, collateral, lender, borrower, lien, repayment, rights, obligations, financing, possession, rental payments, and agreement specifics. These keywords ensure that the content remains relevant to the topic at hand.

Palm Beach Florida Security Agreement Regarding Aircraft and Equipment

Description

How to fill out Palm Beach Florida Security Agreement Regarding Aircraft And Equipment?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from scratch, including Palm Beach Security Agreement Regarding Aircraft and Equipment, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in various types ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find detailed resources and guides on the website to make any tasks related to paperwork execution simple.

Here's how you can find and download Palm Beach Security Agreement Regarding Aircraft and Equipment.

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the legality of some records.

- Check the related forms or start the search over to find the right file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Palm Beach Security Agreement Regarding Aircraft and Equipment.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Palm Beach Security Agreement Regarding Aircraft and Equipment, log in to your account, and download it. Of course, our platform can’t take the place of a lawyer completely. If you have to deal with an exceptionally complicated situation, we advise getting a lawyer to examine your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Join them today and purchase your state-specific paperwork effortlessly!