Dear [Foreclosure Attorney's Name], I hope this letter finds you well. I am writing to discuss a matter pertaining to fair debt collection practices in relation to a foreclosure case in Phoenix, Arizona. Specifically, I want to address the failure on the part of the collection agency or lender to adequately provide notice of the foreclosure process. Phoenix, Arizona is a vibrant and dynamic city known for its stunning desert landscapes, thriving economy, and cultural attractions. As the capital and largest city of Arizona, Phoenix is home to a sizable population that relies on various financial services, including mortgage loans to achieve homeownership. In recent months, I have become aware of certain deficiencies in the fair debt collection practices employed during the foreclosure process initiated against my property in Phoenix. Despite being obligated to provide proper notice under both federal and state laws, it appears that the collection agency or lender responsible for overseeing the foreclosure failed to provide adequate notification, depriving me of the opportunity to address the situation before it escalated. According to the Fair Debt Collection Practices Act (FD CPA), debt collectors are legally required to provide debtors with certain information and notices regarding their outstanding debt and any subsequent legal actions, such as foreclosure. Similarly, Arizona state laws mandate specific notice requirements in foreclosure proceedings to ensure fairness and transparency. The failure to adhere to these regulations not only violates my rights as a debtor but also undermines the principles of fair debt collection. I believe it is crucial to highlight the various types of Phoenix Arizona Letter to Foreclosure Attorney — Fair DebCollectionio— - Failure to Provide Notice that may be relevant to this situation: 1. Initial Notice of Default: This letter should have been sent to inform me of the default on my mortgage loan, providing a clear explanation of the arrears, the amount of time given to cure the default, and any necessary contact information or instructions. 2. Notice of Intent to Foreclose: Once the initial notice of default has been sent, a subsequent notice is typically required to inform the debtor about the intent to pursue foreclosure if the default remains unresolved. This notice should have outlined the pending foreclosure action and provided a reasonable timeframe for corrective action. 3. Notice of Foreclosure Sale: In the event that the foreclosure process proceeded, a notice of foreclosure sale should have been served, specifying the date, time, and location of the sale. Additionally, it should have provided information on how the debtor could exercise their right to cure, if applicable. Considering the lack of proper notice and the potential violation of fair debt collection practices, I kindly request that you review this matter with utmost diligence and competence. I am eager to rectify this situation in a mutually satisfactory manner, ensuring that both the rights of the creditor and my rights as a debtor are protected. I kindly request timely communication to discuss the available options, potential remedies, and any relevant documentation required to address this issue effectively. As a responsible debtor, I am committed to fulfilling my obligations, provided that I am accorded the necessary rights and legal protection in the foreclosure process. Thank you for your attention to this matter, and I look forward to resolving this issue amicably. Sincerely, [Your Name] [Your Contact Information]

Phoenix Arizona Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice

Description

How to fill out Phoenix Arizona Letter To Foreclosure Attorney - Fair Debt Collection - Failure To Provide Notice?

If you need to find a trustworthy legal form provider to obtain the Phoenix Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice, consider US Legal Forms. Whether you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can search from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of learning resources, and dedicated support team make it simple to get and execute various documents.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply type to search or browse Phoenix Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice, either by a keyword or by the state/county the document is created for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

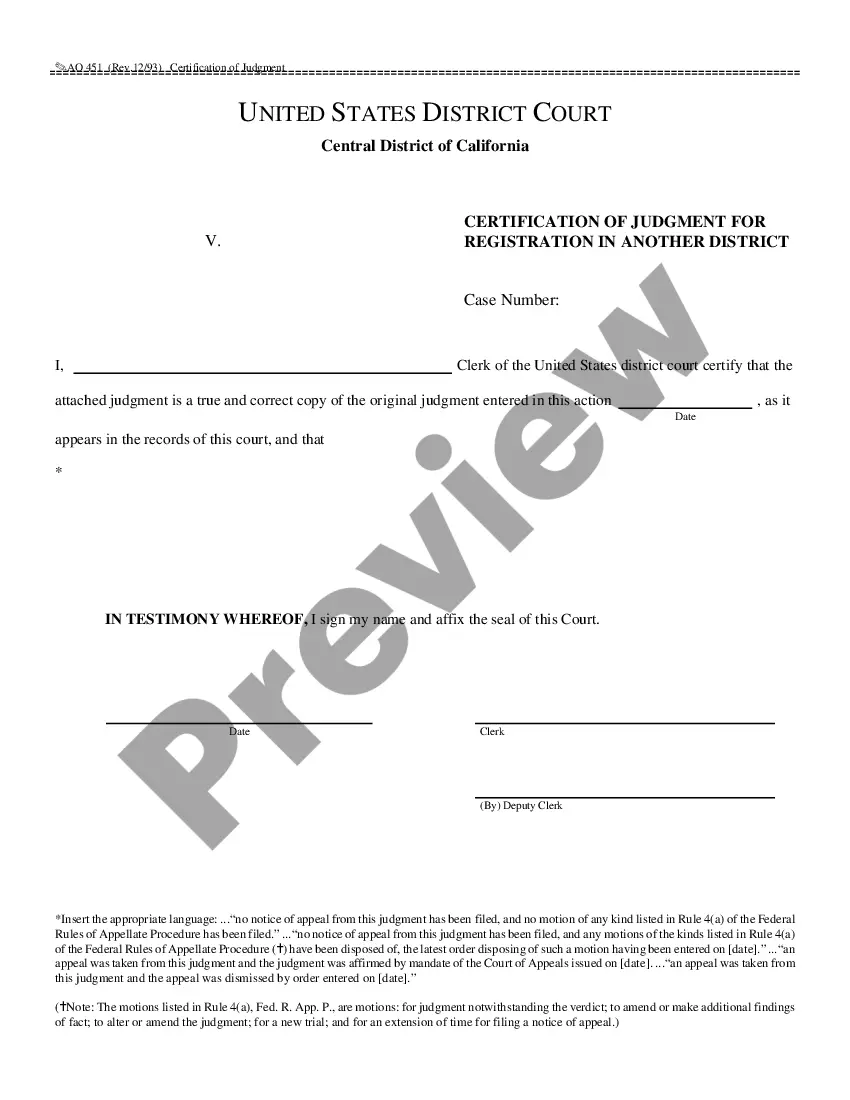

Don't have an account? It's effortless to start! Simply locate the Phoenix Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Register an account and select a subscription option. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less pricey and more affordable. Create your first business, organize your advance care planning, create a real estate agreement, or complete the Phoenix Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice - all from the comfort of your home.

Sign up for US Legal Forms now!