Salt Lake Utah Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons

Description

How to fill out Letter To Foreclosure Attorney - General Demand To Stop Foreclosure And Reasons?

A document procedure invariably accompanies any legal action you undertake.

Establishing a business, applying for or accepting a job proposal, transferring assets, and numerous other life situations require you to prepare official paperwork that varies from state to state. Hence, having everything organized in one location is exceedingly beneficial.

US Legal Forms is the most comprehensive online repository of current federal and state-specific legal templates.

On this site, you can effortlessly find and acquire a document for any personal or business necessity used in your area, including the Salt Lake Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons.

This is the simplest and most reliable method to acquire legal documents. All the templates provided in our library are professionally prepared and verified for compliance with local laws and regulations. Organize your documentation and manage your legal matters efficiently with US Legal Forms!

- Finding forms on the site is extraordinarily easy.

- If you already have a subscription to our service, Log In to your account, locate the sample using the search bar, and click Download to save it on your device.

- Subsequently, the Salt Lake Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons will be accessible for further use in the My documents tab of your profile.

- If you are engaging with US Legal Forms for the first time, follow this straightforward guide to obtain the Salt Lake Letter to Foreclosure Attorney - General Demand to Stop Foreclosure and Reasons.

- Ensure you have navigated to the correct page with your regional form.

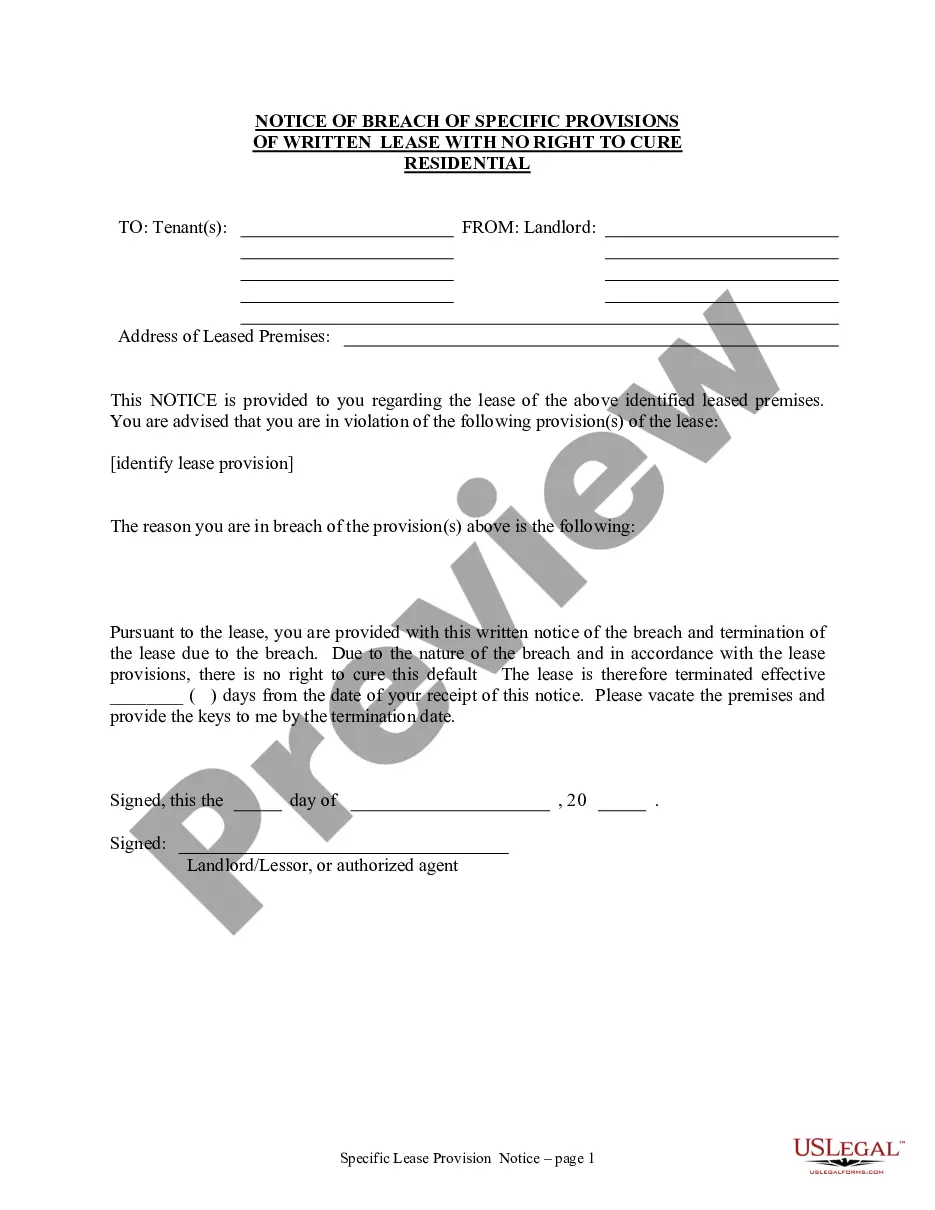

- Utilize the Preview mode (if available) and scroll through the sample.

- Review the description (if any) to confirm the template meets your requirements.

- Search for another document via the search tab if the sample does not suit you.

- Click Buy Now when you identify the required template.

Form popularity

FAQ

Banks will often refuse to foreclose if the HOA dues are sky-high and the property is worth much less than the balance owed on the mortgage. Plus, the banks have to pay for hazard insurance and taxes. In many cases, it's more of a burden than a boon.

Yes, you can refinance a delinquent mortgage as a way to bring a past-due home loan current and avoid foreclosure. The process of refinancing pays off the existing mortgage and replaces it with a new loan, giving borrowers somewhat of a fresh start.

Here are some foreclosure prevention alternatives to consider when you think foreclosure is on the horizon. Reinstate Your Loan.Enter Into a Repayment Plan.Enter Into a Forbearance Agreement.Work Out a Loan Modification.Refinance.File for Chapter 7 or Chapter 13 Bankruptcy.

If no demand was made, then the loan has not yet become due and demandable, and any foreclosure of property used as collateral for the loan would be considered premature.

You can stop a foreclosure in its tracks, at least temporarily, by filing for bankruptcy. Chapter 7 bankruptcy. Filing for Chapter 7 bankruptcy will stall a foreclosure, but only temporarily.

The Most Commonly Used Foreclosure Procedure In the State A foreclosure can be either: judicial (the foreclosing party files a lawsuit, and the case goes through the court system) or. nonjudicial (the foreclosing party follows a set of state-specific, out-of-court procedural steps to foreclose).

Where it is available, foreclosure by power of sale is generally a more expedient way of foreclosing on a property than foreclosure by judicial sale. The majority of states allow this method of foreclosure.

Three of the most common methods of walking away from a mortgage are a short sale, a voluntary foreclosure, and an involuntary foreclosure. A short sale occurs when the borrower sells a property for less than the amount due on the mortgage.

If a foreclosure sale is scheduled to occur in the next day or so, the best way to stop the sale immediately is by filing for bankruptcy. The automatic stay will stop the foreclosure in its tracks. Once you file for bankruptcy, something called an "automatic stay" immediately goes into effect.

A reinstatement is the simplest solution for a foreclosure, however it is often the most difficult. The homeowner simply requests the total amount owed to the mortgage company to date and pays it.