[Your Name] [Your Address] [City, State, Zip] [Email Address] [Phone Number] [Date] [Client’s Name] [Client’s Address] [City, State, Zip] Subject: Disputing Fraudulent Charges on Your Account Dear [Client’s Name], I hope this letter finds you well. I am writing to address a matter of utmost importance concerning your account with [Client’s Bank/Financial Institution]. We have recently detected suspicious activity on your account and believe that you have been a victim of fraudulent charges. Upon thorough review of your account statements, we noticed several transactions that appear to be unauthorized, potentially pointing towards identity theft or fraudulent activities. Our priority is to assist you in rectifying this situation promptly, ensuring your financial security and protecting your interests. To initiate the investigation process, we kindly request that you provide us with the following information: 1. A detailed list of the disputed transactions: Please compile a comprehensive list of all unauthorized charges you have identified on your account. Include specific dates, transaction amounts, and any relevant merchant information, if available. 2. Supporting documentation: If you have any supporting documents such as receipts, account statements, or correspondence related to the fraudulent charges, please include them with your response. These documents will aid our investigation and help expedite the resolution process. 3. Police report and case number (if applicable): If you have filed a police report regarding the identified fraudulent charges, please provide us with a copy of the report along with the case number. This will further strengthen our investigation and assist in pursuing legal action, if necessary. Once we receive the requested information, our dedicated team of financial fraud experts will launch a thorough investigation into your account. We will work diligently with the necessary authorities to resolve this matter swiftly, ensuring that any unauthorized charges are refunded promptly. In the meantime, we advise you to take the following precautions to safeguard your financial well-being: 1. Change your account password: To prevent unauthorized access, change your account password immediately. Ensure that it is complex and not easily guessable, consisting of a combination of uppercase and lowercase letters, numbers, and symbols. 2. Monitor your account regularly: Keep a close eye on your account activity by reviewing your statements and transaction history frequently. Promptly report any suspicious activity to our fraud department. 3. Enable transaction alerts: Take advantage of our banking system's transaction alert feature. This will notify you promptly via email or text message whenever a transaction occurs, allowing you to identify and report any unfamiliar charges immediately. As we progress with our investigation, we assure you that we will keep you informed of any significant developments along the way. Our goal is to restore your account's integrity and mitigate any financial losses you may have incurred due to these fraudulent charges. If you have any additional information or questions regarding this matter, please do not hesitate to contact our fraud department at [Fraud Department Contact Number] or reach out to me personally at [Your Contact Number]. We are committed to providing you with the support you need during this challenging time. Thank you for your attention to this matter. We apologize for any inconvenience caused and assure you of our unwavering commitment to resolving this issue promptly. Sincerely, [Your Name] [Your Title] [Bank/Financial Institution Name]

Phoenix Arizona Sample Letter for Fraudulent Charges against Client's Account

Description

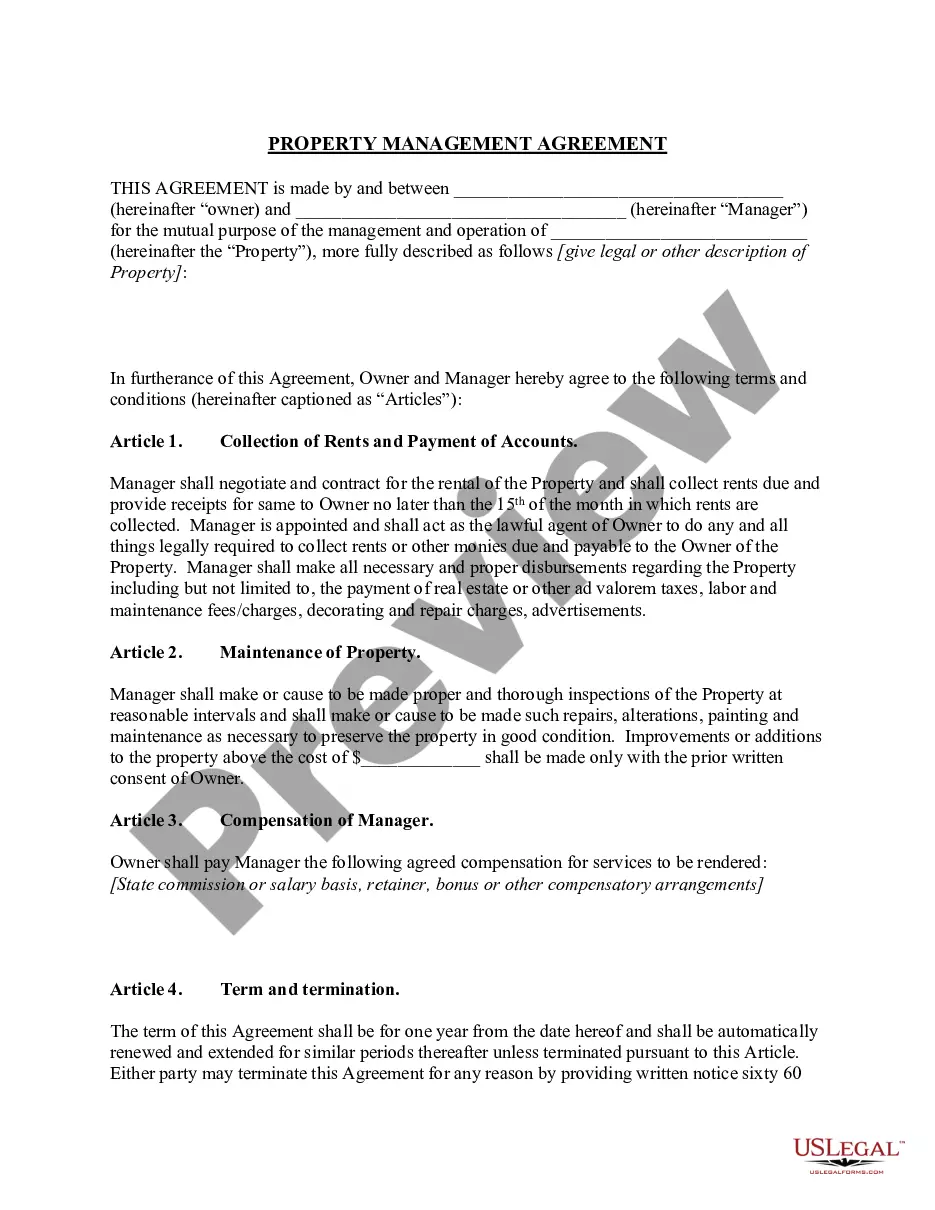

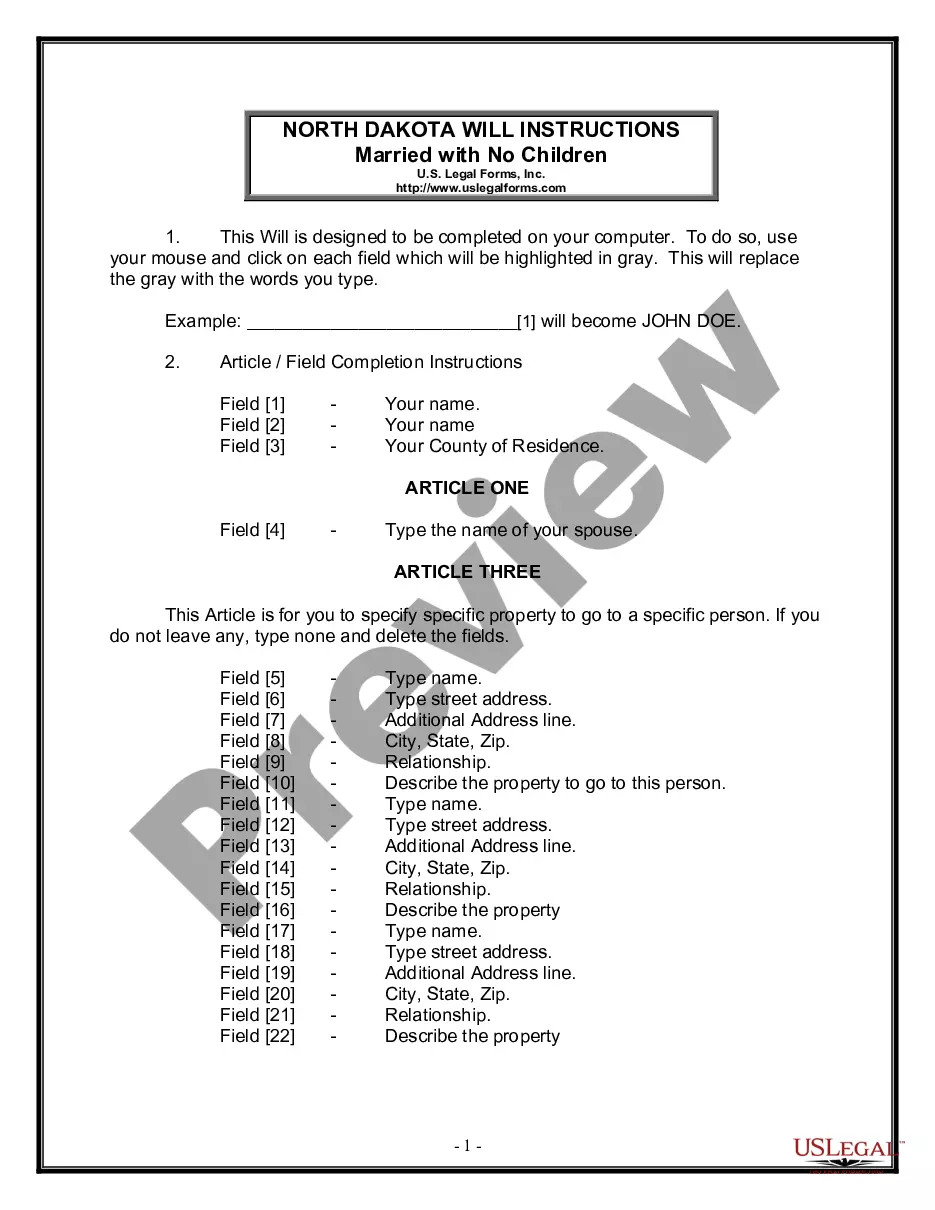

How to fill out Phoenix Arizona Sample Letter For Fraudulent Charges Against Client's Account?

Drafting paperwork for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to draft Phoenix Sample Letter for Fraudulent Charges against Client's Account without expert help.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Phoenix Sample Letter for Fraudulent Charges against Client's Account on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Phoenix Sample Letter for Fraudulent Charges against Client's Account:

- Look through the page you've opened and check if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that suits your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any scenario with just a couple of clicks!

Form popularity

FAQ

I am writing to dispute a charge of $ to my credit or debit card account on date of the charge. The charge is in error because explain the problem briefly. For example, the items weren't delivered, I was overcharged, I returned the items, I did not buy the items, etc..

Most chargebacks are illegitimate, and illegitimate chargebacks can be reversed. In order to achieve this, you'll need to gather compelling evidence that the transaction was valid and authorized. You'll also need to prove that you fulfilled your end of the sales agreement and the cardholder got what they paid for.

There are several reasons you may want to dispute a credit card charge, including fraudulent purchases, billing errors or bad service/service not rendered. Fraudulent charges on your bill can be disputed by calling your credit card issuer or filing a dispute online.

Most chargebacks are illegitimate, and illegitimate chargebacks can be reversed. In order to achieve this, you'll need to gather compelling evidence that the transaction was valid and authorized. You'll also need to prove that you fulfilled your end of the sales agreement and the cardholder got what they paid for.

Can I dispute a credit card charge I willingly paid for? You should never dispute a credit card charge you willingly paid for. Not only is doing so unethical, but you won't be able to keep the initial credit you receive if you don't deserve it.

I have not made any transactions where in such charges is due. There were no such charges ever in my account. Hence I presume that it is an inadvertent error from your side. I request you to kindly verify and rectify the error by re-crediting the amount to the account.

The Federal Trade Commission (FTC) states that you have the right to dispute charges based on the following: Charges that list the wrong date or amount. Charges for goods and services you didn't accept or that weren't delivered as agreed. Math errors. Failure to post payments and other credits, like returns.

Bank investigators will usually start with the transaction data and look for likely indicators of fraud. Time stamps, location data, IP addresses, and other elements can be used to prove whether or not the cardholder was involved in the transaction.

Ask your bank where to send the letter and what the requirements are in your situation. Include your name, account number, contact information, and details about the transaction, such as the date, amount, and source (the merchant or biller name, for example). Finally, explain why the transaction is not accurate.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.