Clark Nevada Equity Share Agreement is a legal contract outlining the terms and conditions associated with the allocation of ownership interest in a company located in Clark County, Nevada. This agreement serves as a framework for individuals or entities wishing to enter into a business venture with shared investment responsibilities, profits, and decision-making powers. The Clark Nevada Equity Share Agreement typically contains the following key components: 1. Parties: This section identifies the parties involved in the agreement, specifically the company seeking investment and the individuals or entities providing the equity share. 2. Equity Share Percentage: The agreement outlines the percentage of ownership interest that each party holds in the company. The equity share percentage is typically determined based on the initial investment amount or any other agreed-upon criteria. 3. Capital Contributions: This section defines the financial investment made by each party. It outlines the initial capital contribution required from each party, any subsequent funding obligations, and the terms of additional investment if needed in the future. 4. Profit and Loss Distribution: The agreement stipulates how the profits and losses of the company will be shared among the equity holders. This may be based on the equity share percentage or subject to other arrangements as agreed upon by the parties. 5. Decision-Making Powers: The agreement outlines the rights and responsibilities of the equity holders concerning company management, decision-making processes, and voting rights. It may specify matters that require unanimous consent or provide special rights to certain parties. 6. Vesting and Transferability: This section defines the terms under which the equity shares can be transferred or sold. It may include restrictions on transferability, such as requiring consent from other equity holders or a right of first refusal. 7. Exit Strategy: The agreement may include provisions related to the potential exit of an equity holder, such as a buyout option, drag-along or tag-along rights, or provisions for an initial public offering (IPO) or sale of the company. There may be variations or different types of Clark Nevada Equity Share Agreements, depending on the specific circumstances or industry. Examples include: 1. Start-up Equity Share Agreement: Specifically designed for new ventures seeking equity investments to fund their operations and growth. 2. Real Estate Equity Share Agreement: Tailored for real estate projects, where investors contribute equity in exchange for a share in the profits generated by the property. 3. Joint Venture Equity Share Agreement: Used when two or more parties collaborate to undertake a specific business project, sharing the costs, risks, and rewards. 4. Private Equity Share Agreement: Commonly used in private equity transactions, where an investor purchases equity in a privately held company, often with the objective of increasing the company's value to achieve a successful exit. In summary, the Clark Nevada Equity Share Agreement serves as a comprehensive legal document governing the allocation of ownership interest between parties involved in a business venture. It defines the rights, obligations, and terms of the equity investment, ensuring a structured and transparent relationship between the equity holders and the company.

Clark Nevada Equity Share Agreement

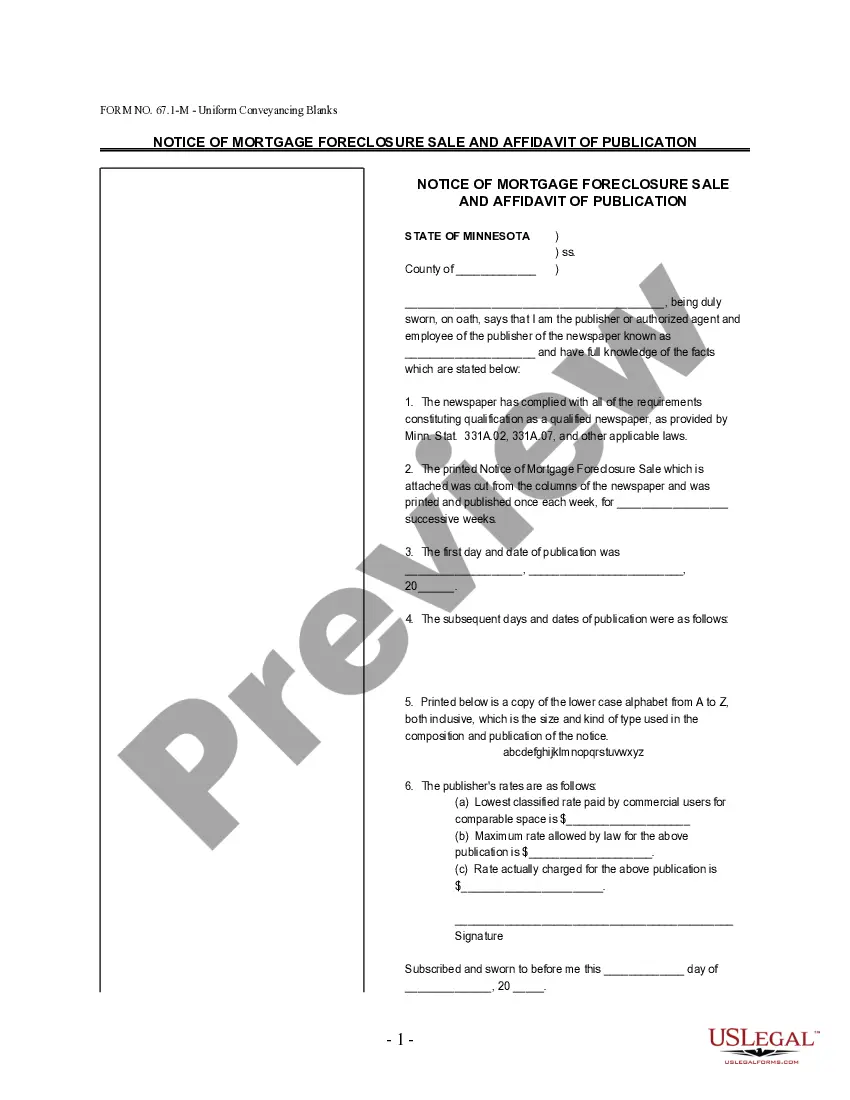

Description

How to fill out Clark Nevada Equity Share Agreement?

Whether you plan to open your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you must prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Clark Equity Share Agreement is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a few more steps to get the Clark Equity Share Agreement. Adhere to the instructions below:

- Make certain the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Clark Equity Share Agreement in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!