Dallas Texas Equity Share Agreement, also known as a profit-sharing agreement, is a legally binding contract established between two or more parties to outline the terms and conditions of sharing ownership or equity in a business or property in the Dallas, Texas region. This agreement governs the distribution of profits, losses, and responsibilities among the parties involved. One type of Dallas Texas Equity Share Agreement is the Real Estate Equity Share Agreement. This agreement is commonly used in the Dallas real estate market, where investors pool their resources to jointly purchase and own a property. The agreement specifies the percentage of equity each party possesses, their respective financial contributions, and the allocation of profits or losses arising from the property's rental income, capital appreciation, or venture sale. Another type of Dallas Texas Equity Share Agreement is the Startup Equity Share Agreement. It is prevalent in the vibrant startup scene of the region, where founders, investors, and employees agree on the distribution of ownership and profits in a fledgling company. This agreement typically outlines the equity percentages held by each party, vesting schedules for employee shares, and the conditions for exercising stock options or warrants. The Dallas Texas Equity Share Agreement includes essential provisions such as the purpose and scope of the agreement, the initial equity split, the rights and responsibilities of each party, restrictions on transferring or selling equity, dispute resolution mechanisms, and exit strategies. It ensures a fair and transparent framework for all parties involved to avoid conflicts and maintain a harmonious business relationship. When drafting a Dallas Texas Equity Share Agreement, it is crucial to consult with a qualified attorney specializing in business or real estate law. These professionals can help navigate the specific legal requirements in Dallas and ensure the agreement aligns with the Texas State laws and regulations. They can also assist in customizing the agreement to suit the unique needs and goals of the parties involved. In summary, a Dallas Texas Equity Share Agreement serves as a powerful tool for establishing clear guidelines and expectations when sharing ownership or equity in businesses or properties located in the Dallas region. Whether it is a real estate venture or a startup, this agreement helps to safeguard the rights and interests of all parties involved, promoting a secure and prosperous business environment.

Dallas Texas Equity Share Agreement

Description

How to fill out Dallas Texas Equity Share Agreement?

Preparing paperwork for the business or individual needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to generate Dallas Equity Share Agreement without expert help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Dallas Equity Share Agreement by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Dallas Equity Share Agreement:

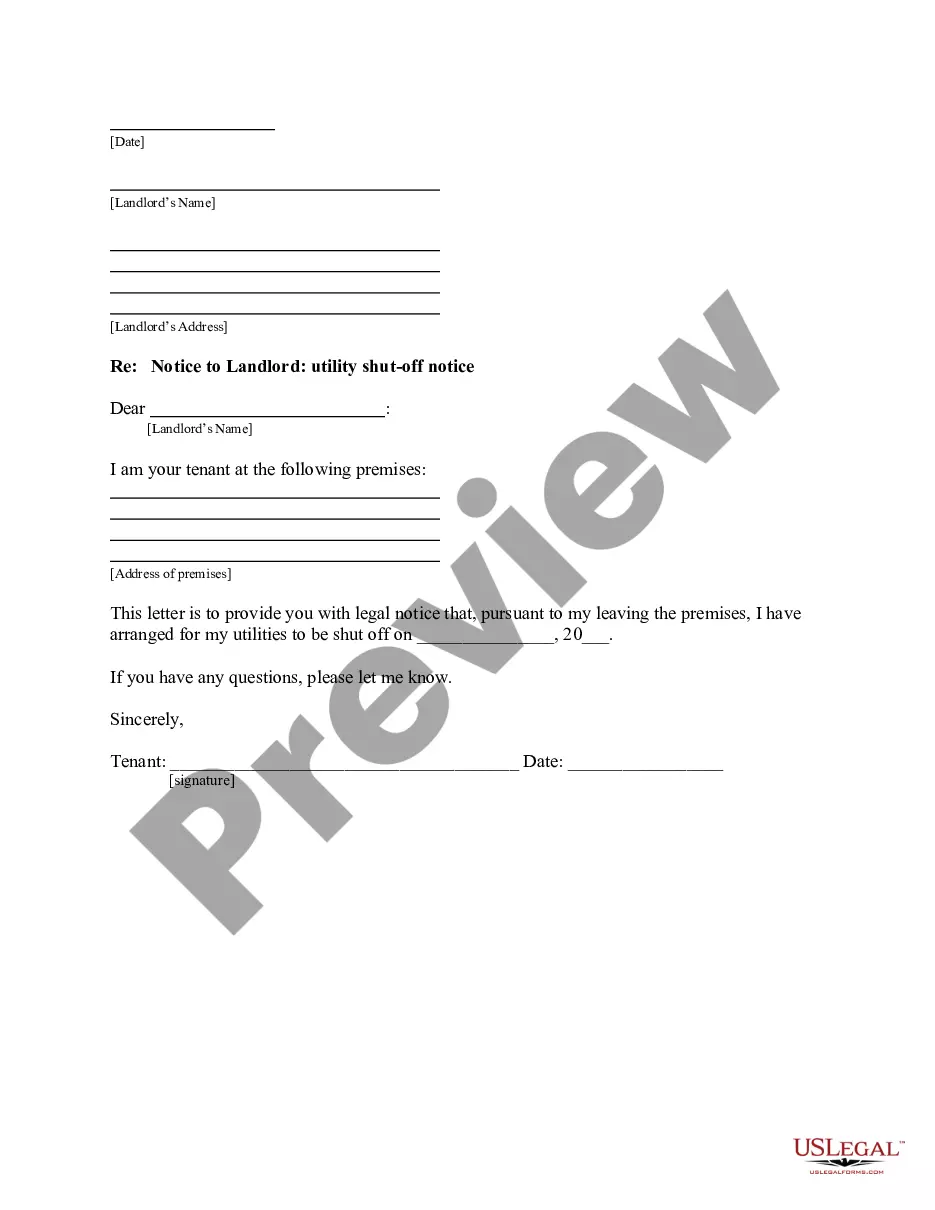

- Look through the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any situation with just a few clicks!