A San Diego California Equity Share Agreement is a legally binding agreement that outlines the terms and conditions between multiple parties who wish to invest in a project or business venture together. It specifically pertains to the division of equity or ownership interest among the investors. This agreement is commonly used in San Diego, California, as it is a hub for numerous industries, including technology, biotechnology, healthcare, tourism, and more. With its vibrant economy and entrepreneurial ecosystem, San Diego attracts investors who seek opportunities to collaborate and fund potential ventures. The main purpose of a San Diego California Equity Share Agreement is to establish a fair and equitable distribution of ownership rights and responsibilities among the parties involved. It typically includes detailed provisions regarding the contribution of each party, the percentage of equity each party will hold, and the decision-making process within the venture. Different types of San Diego California Equity Share Agreements may include: 1. Start-up Equity Share Agreement: This type of agreement is commonly used when a group of investors wishes to fund a new business or start-up venture in San Diego. It outlines the equity distribution among the founders and investors, along with any vesting schedules or milestones attached to the shares. 2. Real Estate Equity Share Agreement: When multiple parties invest in real estate properties in San Diego, a real estate equity share agreement is utilized. This agreement specifies the division of ownership and profit-sharing arrangements among the investors, ensuring transparency and accountability throughout the investment process. 3. Joint Venture Equity Share Agreement: In cases where multiple parties collaborate on a specific project or venture, a joint venture equity share agreement is employed. This agreement outlines the responsibilities, contributions, and equity distribution among the participants, ensuring a fair partnership and risk-sharing arrangement. 4. Angel Investor Equity Share Agreement: When angel investors provide financial support to start-ups or early-stage companies in San Diego, an angel investor equity share agreement is established. This agreement safeguards the investor's rights, outlines the equity stake, and potentially includes provisions for exit strategies or future funding rounds. In conclusion, a San Diego California Equity Share Agreement is a crucial legal document that facilitates fair and transparent investment collaborations in various industries within San Diego. The different types of agreements mentioned above allow parties to establish clear guidelines and protect their interests when investing in start-ups, real estate, joint ventures, or through angel investments.

San Diego California Equity Share Agreement

Description

How to fill out San Diego California Equity Share Agreement?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the San Diego Equity Share Agreement, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case accumulated all in one place. Consequently, if you need the recent version of the San Diego Equity Share Agreement, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the San Diego Equity Share Agreement:

- Look through the page and verify there is a sample for your area.

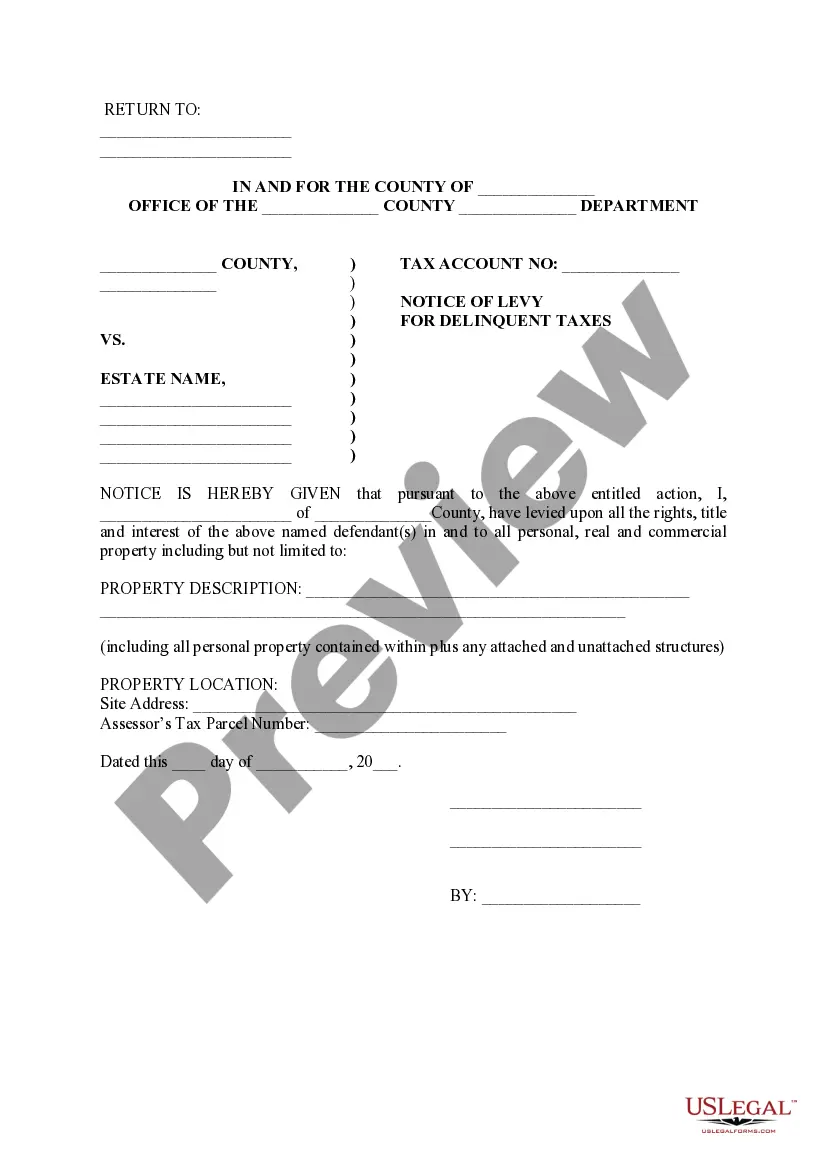

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your San Diego Equity Share Agreement and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!